Tax cuts over the past decade have reduced Utah tax rates—and revenues—to a multi-decade low. As a result, the state budget is failing to meet urgent priorities, such as lifting Utah out of last place for per pupil K-12 education funding. Today, social service providers and advocates for Utah’s most vulnerable populations announced the results of their analysis of the five major tax reform proposals that have been discussed during the 2017 Utah Legislative Session.

Recently, Utah legislative leadership announced a revenue-neutral proposal to restore the full sales tax on food and reduce the overall sales tax rates. Utah residents are losers under this scenario because 97% of the sales tax increase on food is borne by Utah residents while only 77% of the rate reduction benefits Utah residents. This proposal shifts the tax burden away from out-of-state visitors and replaces their contributions with revenue generated from Utah residents. Moreover, because it is revenue-neutral, it does not restore the revenue needed to address Utah’s urgent needs.

Recently, Utah legislative leadership announced a revenue-neutral proposal to restore the full sales tax on food and reduce the overall sales tax rates. Utah residents are losers under this scenario because 97% of the sales tax increase on food is borne by Utah residents while only 77% of the rate reduction benefits Utah residents. This proposal shifts the tax burden away from out-of-state visitors and replaces their contributions with revenue generated from Utah residents. Moreover, because it is revenue-neutral, it does not restore the revenue needed to address Utah’s urgent needs.

Proposals to raise the sales tax on food or the gasoline tax disproportionately shift the tax burden to Utah’s low-income populations. Utah’s middle class is also disproportionately affected by food and gas taxes, as well as by proposals to eliminate personal exemptions.

The fairest and most equitable proposal has been suggested by the advocacy group, Our Schools Now. They propose raising the income tax rate from 5% to 5.875%. This proposal does not place an undue burden on low-income or middle income Utahns and would restore enough revenue to address the state’s unmet needs.

The fairest and most equitable proposal has been suggested by the advocacy group, Our Schools Now. They propose raising the income tax rate from 5% to 5.875%. This proposal does not place an undue burden on low-income or middle income Utahns and would restore enough revenue to address the state’s unmet needs.

The social service providers and advocates have written an open letter to Utah lawmakers expressing their hope that legislators will consider the needs of vulnerable populations as they grapple with this difficult challenge. The letter is available here:

Open Letter to the Utah Legislature: Tax Reform and Utah’s Most Vulnerable Populations

The analysis is summarized in these two posters:

![]() Comparing the Leading 2017 Revenue Proposals

Comparing the Leading 2017 Revenue Proposals

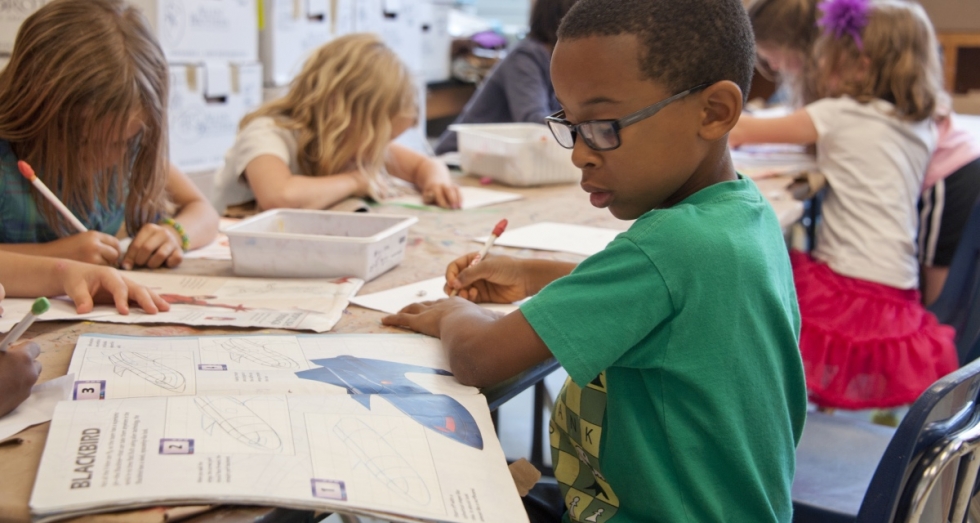

Image Credit: Amanda Mills, Centers for Disease Control and Prevention

For 30 years now, Voices for Utah Children has called on our state, federal and local leaders to put children’s needs first. But the work is not done. The children of 30 years ago now have children of their own. Too many of these children are growing up in poverty, without access to healthcare or quality educational opportunities.

How can you be involved?

Make a tax-deductible donation to Voices for Utah Children—or join our Network with a monthly donation of $20 or more. Network membership includes complimentary admission to Network events with food, socializing, and opportunity to meet child advocacy experts. And don't forget to join our listserv to stay informed!

We look forward to the future of Voices for Utah Children and we hope you will be a part of our next 30 years.

Special thanks to American Express, our "Making a Difference All Year Long" sponsor.