Health

71,000 Utah Kids Still Without Health Insurance… Why?

This Legislative Session, we have heard a lot of thoughtful, important discussion around children’s access to health coverage and care, including needed mental health care. Health insurance helps children connect with affordable care, yet thousands of Utah children are not enrolling in coverage. Utah has the highest rate of kids currently eligible for health insurance, but not enrolled.

Following the Session, Voices for Utah Children will be releasing an in-depth “State of Children’s Care” report that reviews kids’ coverage and care across the state. Here’s a preview look at some reasons why Utah kids are still uninsured…

- Uninsured Parents= kids more likely to be uninsured: Thousands of parents have been left without have health insurance for too long. On April 1st, parents with incomes between 60-100% of the federal poverty level will be able to enroll in Medicaid coverage. After the passage of Proposition 3 and then Senate Bill 96, there is a lot of confusion among parents around what affordable health care options are still available and the new requirements to getting care. It’s important that up-to-date information is provided to families, so that eligible parents can begin enrolling on April 1st. Research shows that covering parents helps kids.

- Keeping kids covered after they enroll: Once kids get enrolled, we need to help them stay covered. Kids can lose coverage because of administrative error, a small change in parents’ income or an employer’s failure to return requested information on behalf of the parent.

- Misinformation and lack of outreach: Many families are confused about what types of affordable options are available to them. Unfortunately, statewide there is a significant lack of outreach funding to help families learn about options and dispel confusion.

- Fear: The federal administration has contributed to a climate of fear that is causing many immigrant families to not enroll, or dis-enroll, their children from Medicaid or CHIP, for fear of reprisal. The majority of children with immigrant parents are eligible for coverage but are not enrolling. We need to counter this climate of fear, create a welcoming environment for new Americans and fight the misinformation of using public benefits.

- Coverage disparities: Utah has one of the highest rates of uninsured Latino/Hispanic children. Alongside fighting the climate of fear for immigrant families, we must also continue to outreach to communities and support families who may not enroll alone.

Unfortunately, as we reported last year, the rate of uninsured Utah children is trending in the wrong direction. For the first time in almost ten years, we saw a troubling rise in the number of uninsured children in our state. Voices for Utah Children is currently working to increase coverage and care for all children with our 100% Kids Coverage Campaign. Let’s work together to help all Utah kids get the coverage and care they need to be healthy and thrive.

Recently Senate Bill 96 was signed into law by Governor Herbert. Here’s our recap of what’s in SB 96 and the next steps for Utah kids and families’ coverage

Where do we go from here?

The Governor and Legislature have said they are committed to an enrollment date on April 1st, which was also included in Proposition 3. Individuals and parents up to 100% federal poverty level (FPL) will have an important opportunity to enroll beginning on April 1st. We will work to make sure those newly eligible know that they can get coverage. Thousands of Utahns are counting on getting the care they need as soon as possible.

But as we work toward enrolling those newly eligible now, we will not rest until all Utahns get coverage and care without barriers, red-tape, without risk of losing coverage or benefits.

To that end, we will be opposing Utah’s SB 96 waiver applications to the federal government. It is now up to the federal government to approve Utah’s proposed harmful work reporting requirements, caps and coverage restrictions included in SB 96, which will be imposed on newly eligibile individuals and parents.

It is critical that we make sure the federal government hears Utah’s opposition to these harmful waivers. Utahns voted for full Medicaid expansion without caps or lock-outs, added requirements or red-tape. (For more detail on what’s in SB 96, keep reading!)

A Closer Look at How SB 96 Differs from Proposition 3

“Partial expansion” instead of full expansion:

SB 96 rolls back voter-approved full Medicaid expansion. Instead of expanding Medicaid coverage to those up to 138% of the FPL, SB 96 only expands to those up to 100% FPL. Currently, no state has been allowed to do a so-called partial expansion. If approved, partial expansions have serious consequences for individuals and states, as this Kaiser Family Foundation brief explains.

Enrollment caps and work reporting requirements:

SB 96 imposes added barriers, caps and requirements on Medicaid coverage, if approved by the federal government. Newly eligible parents and individuals will be subject to work reporting requirements. In states that have passed work reporting requirements already, there is no evidence that they’ve done anything to incentivize work. On the contrary, studies from states that have implemented a clean expansion saw that Medicaid coverage made it easier for people to find work, maintain a job and increase their earning potential. SB 96 also includes an enrollment cap and potential lock-out periods for certain individuals, which could leave some with long periods of uninsurance.

Higher costs and higher risks:

SB 96 will immediately cost more than Proposition 3, gambling on federal approval for waivers that will increase Utah’s future financial risks. SB 96 proposes to use a funding mechanism called a Medicaid per capita cap. A per capita cap changes Medicaid financing from being a shared state-federal partnership, to a fixed amount. If states spend more than their capped amount, it could lead to potential benefit reductions or narrowed eligibility requirements. If Utah is allowed to move forward with per capita caps, this could lead to cuts in benefits or fewer people covered in the future.

Waiver requests and federal approval= an opportunity for advocacy and opposing harmful barriers to coverage:

In order to put SB 96’s caps and restrictions into place, Utah must submit waiver proposals to the federal government for approval. We will work to oppose the waivers and prevent federal approval. If the federal government does not approve Utah’s different waiver requests, then full Medicaid expansion should go into effect in July 2020, as stipulated in SB 96.

Also included in SB 96’s waiver proposals are measures that could help adults experiencing homelessness access housing and continuous care. While we believe the broader provisions of SB 96 are harmful, we applaud the Legislature and Governor for these efforts to leverage Medicaid funding in innovative ways.

We hope that going forward we can continue to work toward effective solutions to help vulnerable Utahns get care, without adding barriers, cuts or restrictions to coverage.

Medicaid Expansion in Utah: Get the Facts so Kids & Families Can Get the Coverage they Need

Q: Is there enough money for Utah to expand Medicaid? I keep hearing that the ballot initiative didn’t provide enough money to cover all the costs. Isn’t that why voters chose to increase the sales tax?

A: All fiscal estimates show that Utah has enough money to implement expansion for the first few years, if not longer. A lot of the fiscal impact statements beyond the first years include predictions, different interpretations, and what-if scenarios about the new law.

Bottom line: Utah has the money to implement expansion now; it’s already in the process of doing so and we shouldn’t slow down. The sales tax increase that Utah voters supported will ensure there is enough money in the state budget for Utahns to enroll in Medicaid. State agencies are working diligently to implement the law on April 1, as Utah voters approved it. Utah families cannot afford to derail those efforts with costly and burdensome proposals that do nothing more than take our eye off the ball and delay meeting the needs of those who have no other way to afford health care coverage.

Q: But, really? I hear that other states end up spending a lot more than they expected on Medicaid.

A: There have been numerous, peer-reviewed studies looking at the experiences of other states that have expanded Medicaid, including this Brookings Institute report: Do states regret expanding Medicaid? [The short answer is no]

Medicaid expansion is an economic win for states because of the federal dollars that will be returned. But also because of the many budget offsets that come with Medicaid expansion. States that have expanded Medicaid have consistently found that expansion is a net saver. However, Utah’s current fiscal estimates for Proposition 3 do not appear to include all of the anticipated cost savings and offsets we’ve seen in other states.

Bottom line: The national evidence and data show that the cost to expand for states is minimal, while the overall economic and public health gains are high. Any effort to change Utah’s plan is just a delay tactic that will cost more money and more time and prevent people from getting the health care they need and deserve. Utah must keep moving forward now.

Q: So, could the Legislature pass a different Medicaid expansion plan, through a waiver? What does this mean?

A: The proposals legislators are considering would require additional federal approval, through a federal waiver. (Proposition 3 does not require a waiver.) In theory, these plans could cover everyone in the coverage gap. The hitch is that the federal government has to approve such a plan, and there is no public indication or evidence that they would do so, or that any such plans would be fiscally prudent for Utah to implement. What’s more, the Legislature’s plan would require public comment periods, and will be subject to legal challenges, further delaying Utahn’s coverage, not to mention increasing its costs.

In addition, many of the Legislature’s proposed changes to Proposition 3 would include other provisions that put up additional barriers to health care enrollment and amount to radical restructuring of the Medicaid program here in Utah and nationally. These changes make it harder for Utahns to get care and are likely to be challenged in courts, piling on more unnecessary costs and delays.

Bottom line: If the Legislature passes a different Medicaid expansion plan, it will mean more barriers to coverage, increased administrative costs, and lengthy- if not indefinite- delays. Utah already has a smart, fiscally sound, plan to give families across the state access to the health coverage they need. The state agencies will continue to work to implement that plan as voters intended so enrollment can begin April 1. Let’s focus on getting people the health care they need and deserve instead of increasing bureaucracy, red tape and risks that help no one.

Over 40 Organizations Sign on to Letter in Support of Full Medicaid Expansion, as Utah Voters Decided

Utah Decided: Implement Full Medicaid Expansion without Delay

On November 6, 2018, Utah voters took an historic step, voting to expand Medicaid to adults and families across Utah through Proposition 3. We call upon our Legislature and Governor Herbert to ensure that full Medicaid expansion is implemented by the April 1st deadline, without any delays or restrictions to care. Proposition 3 will help thousands of Utahns access affordable health insurance and was carefully crafted by healthcare and policy experts to ensure it would deliver on its promises. As Utah voters, healthcare consumers, providers and stakeholders, we stand by the following principles as full Medicaid expansion moves forward in our state.

Utah Decided: Full Medicaid Expansion is Fiscally Responsible

Utah voters approved a small sales tax on non-food items to fund Medicaid expansion. Numerous reports and analyses confirm that this tax increase provides enough funding to implement Medicaid expansion immediately and in a fiscally responsible manner. By expanding Medicaid, Utah will bring home federal dollars that have been set aside for our state. In addition, expanding Medicaid will create new jobs and grow the Utah economy. The hypothetical concerns raised about increasing long-term state costs will need to be monitored as the full economic picture becomes clear; however, these can be addressed and resolved in the future without delaying implementation or fundamentally changing the law.

Utah Decided: Full Medicaid Expansion Promotes Work

Medicaid expansion will help thousands of hard-working, low-wage Utahns get the health coverage they need to improve their lives. People cannot work if they are not healthy. Once the full Medicaid expansion goes into effect, we will have a more seamless public health insurance system that no longer disincentives work by creating an eligibility cliff for individuals and parents. We support helping all Utahns find stable and productive work. Medicaid work requirements will increase government bureaucracy and add to the cost of administering the Medicaid program, but, as has been shown in states where work requirements have already been put into place, will do nothing to help unemployed Utahns find work.

Utah Decided: Full Medicaid Expansion Drives Healthcare Innovation

Medicaid expansion will allow Utah to reduce healthcare costs through improved access to primary and preventive care for all and strengthen our behavioral and physical healthcare systems by reducing uncompensated care. Many states are already delivering better-coordinated behavioral health and primary care services as a result of expansion. Utah has a strong history of healthcare innovation and, with expansion, Utah can continue to develop more efficient ways to provide services, find collaborative solutions for our state’s opioid crisis, improve the quality of care provided, and find better ways to address social determinants of health. Full Medicaid expansion will facilitate improvements to our healthcare sector that support growth and innovation.

Utah Decided: Full Medicaid Expansion Supports Strong Families

Medicaid coverage improves access to needed care for parents and children. When parents have health insurance, children are more likely to also be insured. Health insurance coverage strengthens families’ financial security and helps families avoid medical debt. Families with access to affordable health coverage are more likely to get the care they need to reach their full potential and thrive, and parents have the peace of mind they need to provide for their family.

We, the undersigned organizations, respectfully ask that our leaders implement Proposition 3 as it was written, making only essential technical changes. Voters did not choose to add restrictions or caps that will only delay implementation. For the health and well-being of all Utah residents, we must fully expand Medicaid on April 1st so Utahns can get the care they need to work, take care of their families and succeed.

Sincerely,

|

AARP Utah |

|

Action Utah |

|

American Academy of Pediatrics, Utah Chapter |

|

American Heart Association |

|

Association for Utah Community Health |

|

Bear Lake Community Health Center |

|

Better Utah |

|

Catholic Community Services of Utah |

|

Catholic Diocese of Salt Lake City |

|

Coalition of Religious Communities (CORC) |

|

Comunidades Unidas |

|

Crossroads Urban Center |

|

Denials Management |

|

Disability Law Center |

|

Doctors for America |

|

Epilepsy Foundation Utah |

|

Equality Utah |

|

Family Healthcare |

|

FourPoints Health |

|

International Rescue Committee |

|

League of Women Voters of Utah |

|

Legislative Coalition for People with Disabilities |

|

Manufactured Housing Action |

|

Midtown Community Health Center |

|

NAMI Utah |

|

The Children's Center |

|

The Haven |

|

The People’s Health Clinic |

|

United Way of Salt Lake |

|

Utah Academy of Family Physicians |

|

Utah Chapter of the American Society of Addiction Medicine (UTSAM) |

|

Utah Citizens' Counsel |

|

Utah Democratic Healthcare Caucus |

|

Utah Health Policy Project |

|

Utah Housing Coalition |

|

Utah Nurse Practitioners |

|

Utah Nurses Association |

|

Utah Partners for Health |

|

Utah Statewide Independent Living Council |

|

Utah Support Advocates for Recovery Awareness (USARA) |

|

Utahns Against Hunger |

|

Voices for Utah Children |

|

YWCA Utah |

Response to Govenor's Budget Recommendations FY2020

On December 6, 2018, Governor Herbert released his budget recommendations for the next fiscal year (2020). The budget is based on a consensus forecast developed by the Governor’s Office of Management and Budget, the Office of the Legislative Fiscal Analyst and the Utah State Tax Commission.

In summary, the budget recommendations reflect an estimated $1 billion in surplus revenue due to Utah’s booming economy; a $200 million tax cut and a call to modernize Utah’s tax system. The budget’s theme is Growth and Quality of Life and presents budget recommendations covering the following key areas: Quality of Life, Qualified Workforce, and Tax Modernization.

Voices for Utah Children works to make Utah a place where all children thrive. While reviewing the Governor’s recommendations we asked one simple, important question: "Is it good for kids?" If it’s good for kids that means Utah’s families can fully participate in the economy and support their children. That means parents are able to ensure their children reach their full potential and grow up ready to contribute to Utah’s thriving communities.

Continuing the Governor’s theme of Growth and Quality of Life, Voices staff have reviewed the budget and make the following observations:

1. Quality of Life

Funding for Medicaid Expansion Implementation

In November, Utahns expressed their clear support for Medicaid expansion and chose to extend health insurance to 150,000 new individuals. Utah voters elected to expand Medicaid to individuals and parents, without work requirements or caps. Voters even chose a small sales tax increase to support affordable health coverage. The Governor recognizes this historic step forward for Utahns in his budget recommendations and allocates funds for expansion implementation by April 1, 2019. The policy brief accompanying the budget also explores different scenarios and “what ifs” about the provider and consumer safeguards included in the ballot initiative; however, none of these questions preclude expansion from rolling out April 1st. It is paramount that individuals and parents in the coverage gap be able to enroll in coverage as soon as possible, without any added delays or restrictions, and we thank the Governor for supporting expansion funds in the budget.

Proposition 3 did not include any additional work requirements or barriers to care, as the Governor’s budget and policy brief also notes. Our new state law does not stipulate that Medicaid enrollees meet a work requirement as a condition to health coverage. We support exploring future programs that help connect Medicaid beneficiaries with job resources, training, or helps facilitate community engagement. However, we should not rush into changes and any work support program should not preclude someone from receiving coverage. As we have seen in other states, the complexities and confusion around reporting a work requirement often result in individuals unnecessarily losing coverage- even though they are working (See Arkansas’ recent experience). We support programs that help individuals be healthy and work; but people cannot work if they are not healthy.

Funding for Children’s Health Coverage

The Governor’s budget includes important funding recommendations to ensure that Utah children are covered, as demonstrated through Medicaid consensus figures. The Governor’s recommendations are particularly timely as recent data show an alarming increase in the number of uninsured children in Utah. In fact, Utah was one of only nine states to experience an increase in our child uninsured rate. We thank the Governor for extending a welcome mat to ensure that more children can receive health insurance. Going forward, there are additional steps we hope the Governor will support, so that more children do not lose health coverage: it is critical to ensure children can avoid unnecessary insurance loss or disruptions, by implementing a policy of 12-month continuous eligibility in Medicaid; in addition, Utah must counter the ‘chilling effect’ in health coverage due to federal policies targeting immigrant communities. We thank the Governor for his previous efforts encouraging qualifying parents to sign their children up for Children’s Health Insurance Program (CHIP). It is especially critical now that the Governor continue to create a welcoming, safe environment for Utah families to obtain affordable health coverage.

E-Cigarette Taxes

The Governor recommends a sales-tax increase on e-cigarettes. As the Governor notes, e-cigarette use is on the rise and can have a significant, harmful impact on the health of our youth. We are encouraged that the Governor recommends taxing e-cigarette and related paraphernalia like traditional tobacco products. This is an important step to keeping our kids healthy. National research shows e-cigarette use can be highest among some of our most marginalized youth, including LGBTQI, gender non-conforming and transgender youth. We hope that, in addition, state agencies will also ensure that 1) we are collecting state-level data to better understand impacted kids here in Utah and 2) we are providing the right kinds of care and services, so all kids feel affirmed, loved and supported.

Integrating Physical and Behavioral Health

We applaud the Governor for addressing Utah’s bifurcated healthcare system where different entities are responsible for physical and behavioral health services. The policy brief accompanying the budget discusses efforts to better integrate these systems. We hope that these efforts will also incorporate the behavioral health care needs of specific populations including children and new mothers. The behavioral health care needs of these populations are often overlooked and under-resourced. For example, women suffering from perinatal mood disorders - commonly called “maternal depression”- often have trouble finding treatment and care. Going forward, new efforts to better integrate services should make sure kids and parents can get the unique behavioral health care they need early on, before a condition escalates.

Jessie Mandle, Senior Health Policy Analyst

School Safety

When it comes to spending on “school safety,” the Governor’s budget has given us cause for concern. Governor Herbert appears to support the recommendations of the “School Safety Advisory Committee,” a group which has drawn criticism for its lack of representation and for conducting its business outside the public view.

In November of this year, this Committee presented a $194 million bill titled “School and Student Safety Amendments,” which designated $164 million for schools to upgrade their physical facilities with student safety in mind. In his budget, Governor Herbert includes $66 million in “flexible” funding for this same purpose. We have no problem with funding for schools to modernize and improve their infrastructure, as many schools are in need of basic maintenance anyway. Why not build in new safety features while modernizing facilities?

We appreciate that the Governor has set aside $31.7 million in his budget for a “school counseling program,” which appears to reflect a similar $30 million ask from the School Safety Advisory Committee during November interim. We applaud Governor Herbert for explicitly saying that this funding should be used for counselors. Mental health professionals, social workers, counselors and other professionals are critical for building a safe and positive school climate. Investing in prevention when it comes to bullying, violence and suicide makes more sense than trying to deal with the aftermath of these ongoing challenges.

Our concern about school safety funding arises from what is not said in the Governor’s budget, but which exists in the proposed legislation from the School Safety Advisory Committee: a mandate for each school in the state to form “Threat Assessment and Student Support Teams” that are authorized to respond to “significantly disruptive behavior” from students – whatever that may mean.

This approach, which is loosely based on a specific protocol that has yielded good results in other states, could jeopardize the recent juvenile justice reforms that received a great deal of well-deserved attention and praise in the Governor’s budget document. Utah’s impressive juvenile justice reforms have included a focus on using restorative, rather than punitive, practices in schools. This approach decreases the number of youth who are referred to court for very low-level offenses (such as truancy and smoking), incurring high costs to taxpayers and negative outcomes for the youth themselves. We are very concerned that the legislation recommended by the School Safety Advisory Committee does not align with these important reforms. We all want our kids to be safe at school, but not every proposed solution creates actual safety, and some approaches actually make some groups of students less safe. Voices for Utah Children will have much more to say on this subject as we move closer to the 2019 Legislative Session.

Anna Thomas, Senior Policy Analyst

2. Quality Workforce

Education

We at Voices, are particularly happy about the recommendations for sustained and improved funding of public education. Education is the key to future career success for so many Utah kids – and our teachers are key to education. That’s why we are so pleased with the Governor’s support for boosting teacher pay. When teachers do well, students do well.

We scoured the Governor’s budget for any mention of investment in early education with no luck. We’re not panicking yet. The Governor’s Education Road Map, released a year ago this month, included an entire section of recommendations related to early learning. We expect to see more investment in this area as current state-funded early education programs become better aligned and coordinated.

Child Care

We couldn’t help but notice the absence of any mention of state investment in – or even attention to – the pressing child care needs of Utah’s workers and students. We agree with Governor Herbert that “Utah must invest in its people to achieve long-term success,” and that “a dynamic economy requires a skilled and education population.”

Having the right skills and the willingness to work isn’t enough to make our workforce successful, though. More Utah workers than ever before are now also parents. They can’t be expected to engage productively in our thriving economy unless they have access to affordable, accessible child care. The state currently does a good job of managing federal dollars that help to subsidize child care costs for working parents but invests very few state tax dollars for this purpose. The Governor’s proposed budget would do little to change this.

The irony is, Utah doesn’t just need to fill “high-paying jobs” with “highly skilled” workers. We need many more individuals who are willing to work jobs that don’t pay well enough relative to their importance to our economic development. These critical jobs are in the early care and education sector. Currently, the Utahns who provide child care to working parents all over the state, barely make enough to keep their own families out of poverty.

One easy way the Governor could bolster state investment in child care, would be to provide sufficient funding for subsidized childcare while parents are attending college. The Governor’s budget rightly emphasizes the importance of higher education in creating opportunity to otherwise “at-risk” families. However, lack of affordable child care keeps many parents – moms, especially – from going back to school to enhance their earning potential. If Utah is serious about investing in the workforce, the Governor’s budget should prioritize investment in college-based child care centers such as the Wee Care Center at Utah Valley University and the Sorenson Legacy Foundation Child & Family Development Center at Southern Utah University.

Anna Thomas, Senior Policy Analyst

anna@utahchildren.org

3. Tax Modernization

Utah’s economic structure is moving from goods based to service based. Most purchased goods generate a sales tax. Some services are taxed, but many others enjoy a sales tax exemption or a reduced tax rate. The following table illustrates a few examples.

| State Sales Tax Bases: Consumer Goods & Services as of 7/1/18 | |

| Groceries | Alternate Rate |

| Clothing | Taxable |

| Prescription Medication | Exempt |

| Non-Prescription Medication | Taxable |

| Gasoline | Exempt |

| Legal | Exempt |

| Financial | Exempt |

| Accounting | Exempt |

| Medical | Exempt |

| Landscaping | Exempt |

| Repair | Taxable |

| Real Estate Services | Exempt |

| Parking | Exempt |

| Dry Cleaning | Taxable |

| Fitness | Taxable |

| Barber | Exempt |

| Veterinary | Exempt |

| Tax Foundation 2019 State Business Tax Climate Index | |

| https://files.taxfoundation.org/20180925174436/2019-State-Business-Tax-Climate-Index.pdf | |

| https://tax.utah.gov/sales/food-rate | |

| Utah grocery sales tax is 3%, a higher rate is charged if food items are mixed or combined by seller and/or heated by seller, or utensils are provided. | |

The increase in services as an engine for economic growth is not generating enough tax revenue to keep pace with the rising cost to build and maintain Utah’s infrastructure and provide services which support communities and keep the economy humming. As Utah moves to a service based economy, transactions generating sales tax have declined from about 70% (in the 1980s) to 40%. As a percent of income, 95% of Utah’s families pay more in sales and other local taxes than the top 5% of higher income families.

Source: https://itep.org/whopays/

This is not the first time the Governor has called for a tax overhaul. Removing a few exemptions is a commonsense way to broaden the tax base. It is time for special interests to do their part to boost revenues needed to pay for investments which support Utah’s Growth and Quality of Life.

Revenue Earmarks

Earmarks are revenue assigned to fund specific government projects, services or programs. For example, gas taxes are earmarked for transportation needs while a portion of tobacco taxes are designated to fund antismoking initiatives. The recent voter approved Prop 3 calls for a sales tax increase earmarked to expand Medicaid access.

The Governor wants to reform the state’s earmark policy. He notes that 48% of new sales tax revenue growth is earmarked in FY2020 and further argues that earmarks are not transparent and do not allow policy makers to prioritize the state’s most pressing needs. He proposes that some earmarks be replaced by user fees.

The online dictionary defines fee as “a payment made to a professional person or to a professional or public body in exchange for advice or services.” A tax is “a compulsory contribution to state revenue, levied by the government on workers' income and business profits or added to the cost of some goods, services, and transactions.” Whether it’s a tax or fee, broadening the tax base must be done fairly, equitably and shared by all.

Patrice Schell Scott, State Priorities Partnership Fellow

What’s in a name? The woodwork vs. welcome mat effect for kids

Voices for Utah Children is dedicated to increasing coverage and care for all Utah kids. With this comes the responsibility to rethink how our language can be more welcoming and inclusive. When referring to children who are eligible-but-unenrolled in public health insurance, but who may now enroll as a result of Medicaid expansion, the term “woodwork” or the “woodwork enrollment” is often used. This term suggests “to come or crawl out of the woodwork” according to the Oxford dictionary, and can have a derogatory connation. We believe a better phrase is the term the “welcome mat effect.” More children having access to health care is better for our state and allows children to be healthy and better able to reach their full potential. We are excited to welcome more children to these programs, especially as eligible but uninsured children obtain coverage thanks to Medicaid expansion for their parents.

Learn more here.

The Latest Census Data Health Insurance Findings...

U.S. Progress in Reducing the Rate of Uninsured Kids Stalls in 2017; Utah’s progress in reducing its overall uninsured rate halts too

Medicaid expansion is (still) the most effective way to move forward

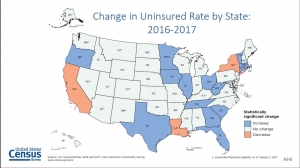

Between 2016 and 2017, the U.S. uninsured rate for children remained flat at 5.4%, according to new Census data released today, after years of historic declines in the U.S. child uninsured rate.

Utah’s total uninsured rate, for adults and children, remained stagnant as well. Utah saw a slight increase from 8.8% in 2016 to 9.2% in 2017 (although data are not statistically significant). In previous years, Utah has seen a steady decline in its overall uninsured rate.

The gap in uninsured rates between states that expanded Medicaid, and states that have not, has grown in four straight years. If the uninsured rate had fallen in non-Medicaid expansion states at the same rate as it did in expansion states, another 4.5 million uninsured Americans would have had coverage last year.

In addition, Census data show continued disparities in coverage. In 2017, U.S. children in poverty had an uninsured rate of 7.8%, compared to 4.9% of children not in poverty. Among different racial and ethnic groups, Hispanic/ Latino children have the highest rate of uninsurance at a national average of 7.2%, compared to 4.3% among White children. (We'll have additional Utah-specific child uninsurance data available soon!)

Over the last several years, the U.S. and Utah have made significant progress reducing the rate of uninsured children. It is discouraging to see progress stall. Health coverage gives kids and families a healthy foundation and future. We will continue to work for all Utah kids and families to get insured and stay insured!

Medicaid expansion is the most effective way to help more children, parents and individuals enroll in health insurance programs, so we can continue to make progress toward helping all Utahns receive affordable health care. #YesonProposition3

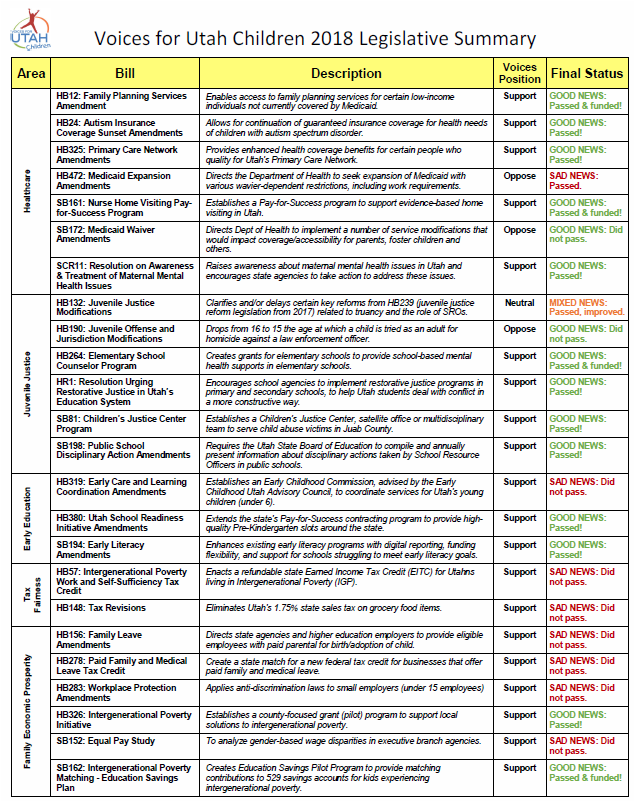

2018 Utah Legislative Update

The 2018 Legislative Session is over. Voices for Utah Children worked tirelessly to advocate for Utah’s children and families, and we had some great wins and some painful losses. Nonetheless, Utah children and families are in a better place now than they were in January.

Health

WIN: HB12 Family Planning Services Amendments (Rep. Ward)

- This legislation was championed by a number of Voices allies (YWCA, Utah Women’s Coalition, ACLU, and Planned Parenthood) to provide family planning services to low-income individuals through Medicaid

WIN: HB325 Primary Care Network Amendments (Rep. Eliason)

- This bill will direct the Department of Health to get a waiver to expand current PCN services for adults receiving coverage from the state.

DEFEATED: SB48 Medicaid Waiting Period Amendments (Sen. Christensen)

- This legislation would have re-imposed a five-year waiting period on legal immigrant children before they could enroll in health coverage. Our advocacy work helped ensure this bill never got heard

DEFEATED: SB 172 Medicaid Waiver (Sen. Hemmert)

- This bill would have done away with Medicaid’s children’s health benefit and EPSDT. This would have caused 2,600 parents and former foster youth to lose their health coverage. Voices defeated it in the House Health and Human Services Committee and again in the House Revenue and Taxation Committee.

LOSS: Keeping Kids Covered – 12-month continuous eligibility on Medicaid

- Rep. Ward appropriation requested wasn’t prioritized high enough to receive funding this year.

LOSS: Dental hygiene check-ups for kids in public education settings

- Dental Code for use by dental professionals providing hygiene check-ups for kids in public education settings - did not get prioritized high enough to be funded for this year - but we’ve strengthened our relationship with a huge association of highly motivated dental hygienists!

LOSS: HB472 Medicaid Expansion Revisions (Rep. Spendlove)

- HB472 seeks a waiver, that is highly unlikely Utah will receive from the Trump Administration. This waiver would provide Medicaid benefits to eligible individuals below 95% of the federal poverty level.

The Utah Decides Ballot Initiative is now our last hope to get Medicaid expansion done in 2018.

Early Childhood

LOSS - HB319 Early Care and Learning Coordination Amendments (Rep. Chavez-Houck)

- A priority bill to form an Early Childhood Commission for better governance and coordination among agencies offering services to Utah’s youngest kids (0 to 5).

WIN - HB380 Utah School Readiness Initiative Amendments – (Rep. Last)

- With a close collaboration with United Way of Salt Lake, this bill will continue the school readiness program, Pay-for-Success. Since 2014 this has provided thousands of at-risk kids in Salt Lake county with high-quality pre-school.

WIN - SCR11 Concurrent Resolution on Awareness and Treatment of Maternal Depression and Anxiety (Sen. Zehnder)

- With the efforts of the Maternal Mental Health Coalition, this resolution energized and inspired story-sharing and education on maternal mental health.

WIN: SB161 Nurse Home Visiting Pay-for-Success Program (Sen. Escamilla)

- This legislation will fully fund the Nurse Family Partnership by putting it forward as a Pay-for-Success Program.

Juvenile Justice

WIN: HR1 House Resolution Urging Restorative Justice in Utah’s Education System – (Rep. Sandra Hollins)

- Resolution to encourage the use of restorative justice practices in Utah schools

NOT A WIN BUT NOT A LOSS: HB132 Juvenile Justice Modifications (Rep. Snow)

- Updates to last year’s big juvenile justice reform effort - we fought hard with our allies (ACLU, Libertas Institute, YWCA, Racially Just Utah) to keep the changes to a minimum. This bill gives school a limited amount of time to update their programs to comply with HB239 from 2017.

WIN: SB198 – Public School Disciplinary Action Amendments (Sen. Anderegg)

- This legislation requires the Board of Education to produce an annual report looking at law enforcement and disciplinary action in schools. This data will be helpful as we work to reduce racial disparities in school discipline and work to build a system that produces better outcomes for all kids.

Tax and Budget

NOT QUITE A WIN BUT OH SO CLOSE: HB57 Utah Intergenerational Poverty Work and Self-sufficiency Tax Credit (Rep. Westwood/Sen. Vickers)

- This bill would have created a $6 million Earned Income Tax Credit (EITC) for 25,000 working families identified as being in the Intergenerational Poverty (IGP) cohort by the state Department of Workforce Services. These families, which pay tens of millions of dollars in state and local taxes every year, would have been able to keep more of what they earn with a tax credit averaging $240 (and up to $600 maximum). This legislation received unanimous support in both House and Senate committees, passed the House, and received a 22-4 vote on 2nd reading in the Senate. But on the final day of the session, leadership decided to leave it out of the final tax package.

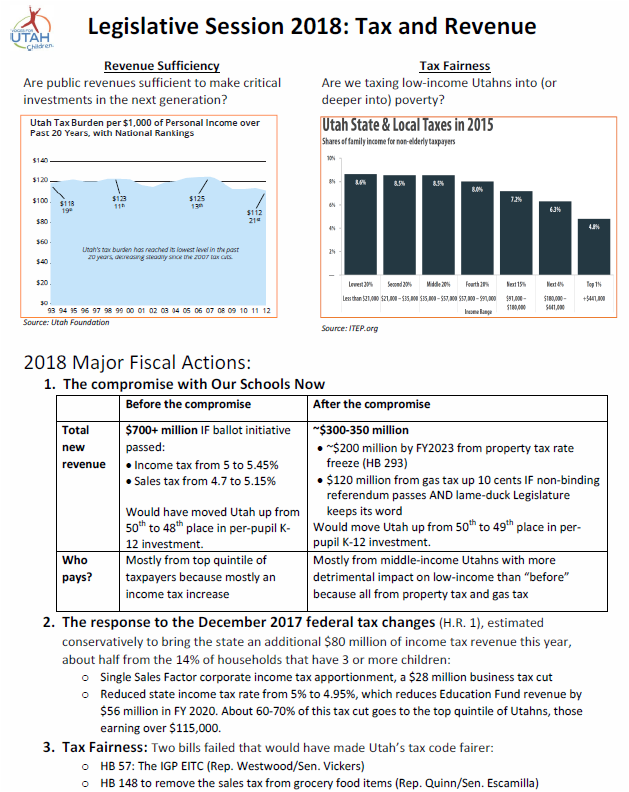

NOT QUITE A WIN BUT COULD HAVE BEEN A LOSS --SCHOOL FUNDING

- The most notable fiscal outcome of the 2018 Legislative Session was a deal between legislative leadership and education funding advocates. The compromise deal included two big choices:

- Investing up to about $350 million in new education funding dollars – which should move Utah up one position in the national rankings for per-pupil K-12 funding, from 50th place to 49th if it is fully implemented.

- Shifting who pays these new dollars in a way that unfortunately more negatively impacts poor and middle class families. The Our Schools Now initiative proposal that was set aside in favor of this compromise would have raised over $700 million mostly from an income tax increase paid by the top 20% of Utahn (those who earn over $115,000). The compromise shifted these funds to come from more regressive gas and property tax increases.

LOSS: HB 148: House Bill 148 Tax Revisions- Sales Tax on Food (Rep. Quinn)

- Sought to eliminate the state sales tax on grocery food items (currently 1.75%) and make up for the $88 million in lost revenue by slightly increasing the general state sales tax rate from 4.7 to 4.92%. One underappreciated benefit of this tax change would have been to shift 20% of the $88 million, or $17.6 million, off of state residents and onto tourists and out-of-state residents who purchase Utah exports. The bill passed the House but was killed by the Senate Revenue and Taxation Committee.

WIN: Two Significant Intergenerational Poverty (IGP) bills

- HB 326 Intergenerational Poverty Initiative (Rep. Redd) establishes a one-time $1 million grant program for local IGP initiatives.

- SB 162 Intergenerational Poverty Matching – Education Savings Plan (Sen. Vickers) establishes a $100,000 matching grant program for IGP families that invest in a Utah Educational Savings Plan for their children's post-secondary education.