Poverty

Our 2024 Legislative Agenda

At Voices for Utah Children, we always start with this guiding question: "Is it good for all kids?" That remains our north star at the outset of the 2024 legislative session, and is reflected in our top legislative priorities.

So, what’s good for all kids in 2024?

A Healthy Start!

A healthy start in life ensures a child's immediate well-being while laying a foundation for future success. We are steadfast in our commitment to championing policies that prioritize every child's physical, mental, and emotional well-being. Central to this commitment is our focus on improving Utah’s popular Medicaid and CHIP programs, which are pivotal in the lives of many Utah children and families.

This legislative session, a healthy start for kids looks like:

- Empowering Expectant Mothers: We support a proposal from Rep. Ray Ward (R-Bountiful) to increase access to health coverage for low-income and immigrant mothers-to-be.

- Increasing Access to Health Care: We support bills that aim to improve access to the vital healthcare services children and parents need, especially for those on Medicaid and CHIP.

- Protecting Health Coverage: We oppose any effort to defund, and exclude deserving children from, the Medicaid and CHIP programs that help thousands of Utah kids every year.

Early Learning and Care Opportunities!

The formative years of a child's life lay the foundation for their future, shaping their cognitive abilities, socio-emotional skills, and passion for learning. We will support efforts to increase access to home visiting programs and paid family leave, but ensuring consistent, quality, and affordable child care is our top priority.

This legislative session, early learning and care opportunities for kids looks like:

- Bolstering Access to Quality Child Care: We support the efforts of both Rep. Andrew Stoddard (D-Sandy) and Rep. Ashlee Matthews (D-Kearns) to extend the successful Office of Child Care stabilization grant program that has supported licensed child care programs statewide.

- Investing in High-Quality Preschool: We support an anticipated legislative proposal to streamline Utah’s existing high-quality school-readiness program and to make it available to more preschoolers statewide.

- Recruiting and Retaining Child Care Professionals: We support Rep. Matthews’ proposal to expand access to the Child Care Assistance Program for anyone working in the child care sector.

- Building New Child Care Businesses: We also support Rep. Matthews’ proposal to continue funding for work to develop and support new child care programs in rural, urban, and suburban areas.

To view a more comprehensive list of our 2024 early care and learning legislative priorities, click here.

Economic Stability for Families with Children!

Economic stability forms the bedrock of thriving families and vibrant communities. To ensure that young families in Utah have the support they need to afford basic necessities, we will advocate for increasing families’ access to Utah's earned income and child tax credits.

This legislative session, economic stability for families looks like:

- A Little Extra Help in the Early Years: We support HB 153, Rep. Susan Pulsipher’s (R-South Jordan) bill to expand Utah’s new Child Tax Credit, (currently only for children ages 1 to 3), to apply to children between 1 and 5 years of age. We also strongly recommend helping even more Utah families with young children by making the tax credit available for families with any child between birth and 5, and expanding it to include the thousands of lower- and moderate-income families who are currently excluded.

- Credit for Working Families with Kids: We support HB 149, Rep. Marsha Judkins’ (R-Provo) bill to expand Utah’s Earned Income Tax Credit so that more lower- and middle-income families with children can benefit.

Justice for Youth!

We want to ensure that all youth, including those who come into contact with the juvenile justice system, have access to interventions and supports that work for them and for their families. We are dedicated to advancing policies and recommendations that contribute to a more fair and equitable juvenile justice system for all Utah youth.

This legislative session, justice for youth looks like:

- Prioritizing School Safety: We are monitoring bills from Rep. Wilcox (R-Ogden) and the School Safety Task Force, including: HB 14, “School Threat Penalty Amendments” and HB 84, “School Safety Amendments.” We remain hopeful that these efforts will support a secure learning environment for all students, without contributing further to the School-to-Prison Pipeline.

Be an Advocate!

As we chart the path forward, one thing remains abundantly clear: the well-being, growth, and future of Utah's children rely on the decisions we make today. Each legislative session presents an opportunity—a chance to reaffirm our commitment, reevaluate our priorities, and reimagine a brighter, more inclusive future for all.

Together we can continue to make Utah a place where every child's potential is realized, their dreams are nurtured, and their voices are heard.

Below are some ways you can get involved this session.

Stay Informed with our Bill Tracker

Stay informed about important legislation we are watching and reach out to your local representatives to let them know how you feel about legislation that is important to you. We make it easy for you to subscribe and watch bills that you are most concerned about.

Join us for Legislative Session Days on the Hill

Join us at the Capitol, where we offer attendees the opportunity to engage in the legislative process on a specific issue area (health and/or child care). You'll have the chance to attend bill hearings, lobby your legislators, connect with fellow community advocates, and watch House and Senate floor debates. Click the button below for the dates/times of our meetings and to RSVP.

Celebrate Utah's Immigrant Community

In collaboration with our partners at UT With All Immigrants, the Center for Economic Opportunity and Belonging, and I Stand with Immigrants, we are organizing Immigrant Day on the Hill. Join us to discover ways to engage in Utah's civic life. Enjoy food, explore resource tables, participate in interactive activities, and entertainment. Everyone is invited to attend this free event!

Event Details: February 13, 2024, 3:30pm-5:30pm at the Capitol Rotunda, 350 State St, Salt Lake City, UT 84103

Making Utah Taxes Fair for All Families

Most of us don't enjoy paying taxes. We do it, though, because pooling our money together through taxes makes it possible for us to have roads, schools, libraries and parks, fire fighters and law enforcement, and so many more public goods that none of us could afford on our own.

Tax policy (the ways we choose to collect taxes) impacts everyone, and often in many different ways. You may have very recently paid sales tax on your groceries, gas tax at the pump, property taxes on your home or through your rent, and of course, income tax on the money you earn.

From state to state, tax policy is unique; no two states collect taxes the same way. Tax policy also changes a lot over time. Different types of taxes affect people differently, depending on whether they have higher or lower incomes.

Some tax policies and structures promote fairness and equity. Other approaches to taxes contribute to social inequality. When tax policies burden lower-income people more than very wealthy people, who can more easily afford to pay higher taxes, we consider that unfair. Sometimes those kinds of tax policies are called "regressive."

States with the most unfair tax structures typically have:

- have no or little income tax,

- have no refundable tax credits, and

- rely on high sales and excise* taxes.

How Fair is Utah's Tax Structure?

Analysis by the Institute on Taxation and Economic Policy (ITEP) shows that in Utah, low- and middle-income families pay more of their income in taxes than the wealthiest households.

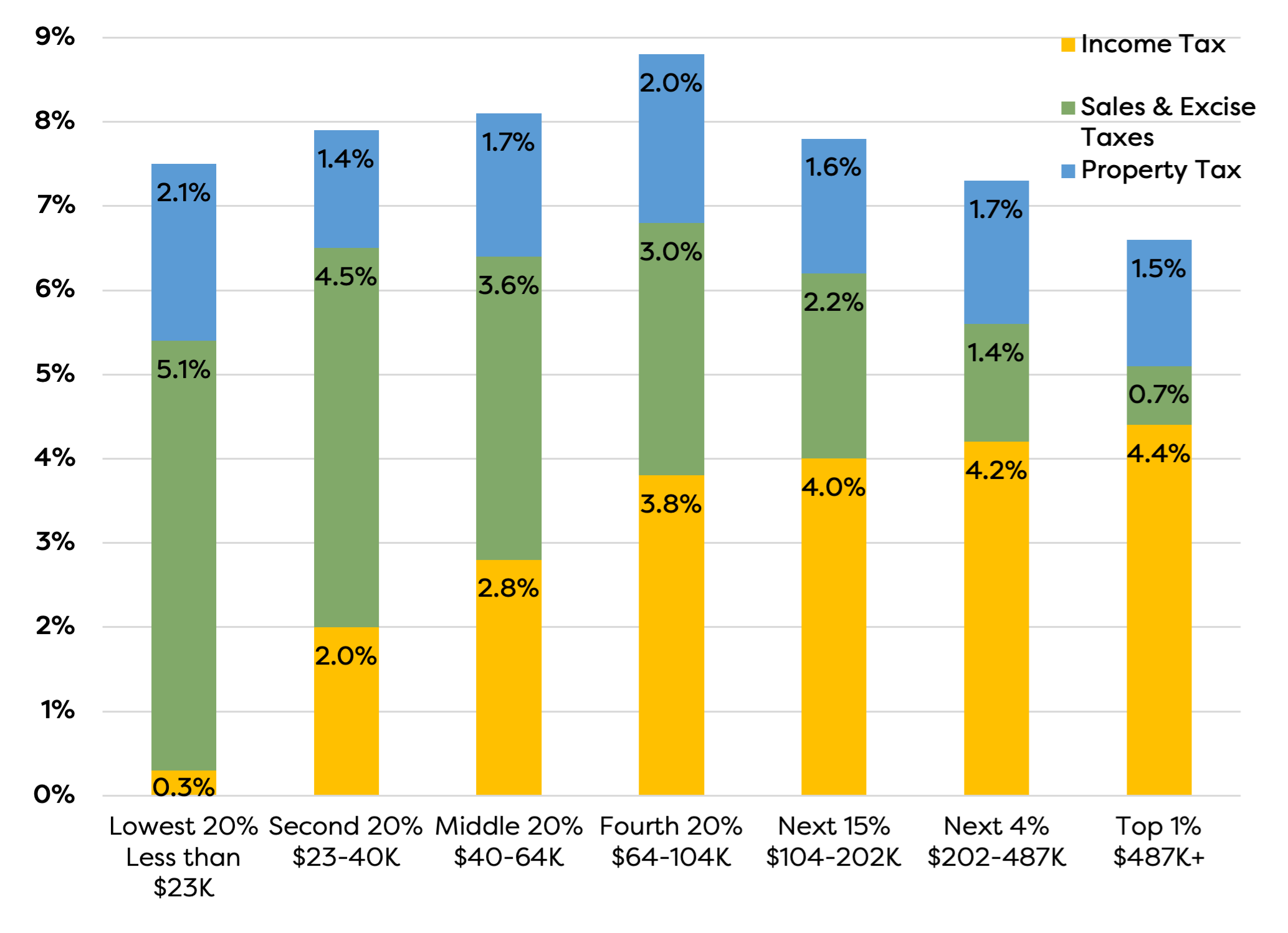

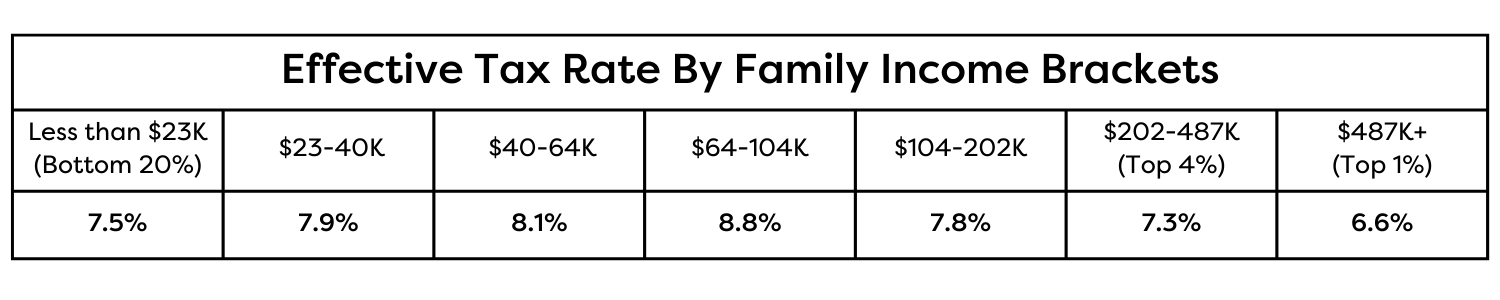

We judge Utah's tax fairness holistically, by looking at all the taxes that are paid by families at different income levels. This is the "effective tax rate," or the share of overall household income a family spends on income, sales/excise and property taxes in a year. The table below shows the effective tax rate of Utah households, depending on how much income they earn each year.

In Utah, 20% of families make less than $23,000 per year. These families pay approximately 7.5% of their total income in state and local taxes. By comparison, the top 1% of Utah families - which are earning more than $487,000 per year - pay an effective tax rate of only 6.6%.

But the Utah families who pay the most in taxes are those in the middle. Middle-income households (making between $40,000 and $104,000 per year) have an effective income tax rate from 8.1% to 8.8% - the highest effective tax rate of all income levels.

Towards Fairness: Tax Credits that Actually Work for Working Families

Towards Fairness: Tax Credits that Actually Work for Working Families

One way to make our state tax structure more fair is through carefully constructed income tax credits. When tax credits cut out families that pay less in income tax - like our non-refundable Earned Income and Child Tax Credits - then the families who are struggling most, benefit the least. Some legislators argue that families who don't pay as much income tax don't "deserve" to fully benefit from tax credits. But those families clearly pay more in overall taxes than any other income group.

Babies don't pay any taxes - but the households they live in do. Working families with young children deserve a tax system that supports them as they care for and raise the future leaders of our state. Having a fair tax structure in Utah means making sure children, and the households they are living in, have enough money to afford the things they need.

Learn How Better Income Tax Credits Help Families

Glossary

Effective Tax Rate: the share of income a family spends on taxes. This is calculated by dividing the amount families pay in taxes by their annual household income.

* Excise Tax: a tax directly levied on certain goods by a state, such as fuel, liquor, or cell phone plans. They are paid by the merchant before the goods can be sold and passed to the consumer through higher prices before the sales tax is added.

Nonrefundable Tax Credit: reduces the taxes owed - allows a taxpayer to only receive a reduction of their tax liability until it reaches zero.

Refundable Tax Credit: allows a taxpayer to receive a refund if the credit they receive is greater than their tax liability.

Tax Credit: a dollar-for-dollar amount that a taxpayer claims on their tax return to reduce the income tax they owe. You can use this to reduce your tax bill and potentially increase your refund amount.

Tax Liability: the amount of taxes owed by a taxpayer to the government before taking into account allowable tax credits.

Tax Policy: policies that determine how we to collect taxes.

Take Action on EITC Awareness Day

January 26th is Earned Income Tax Credit (EITC) Awareness Day! The EITC is a vital tool in reducing child poverty, and improving the long-term outcomes for children across our state.

Some tax policies - like the EITC - promote fairness and equity. Others make social inequality worse - we call those policies “regressive;” Regressive policies disproportionately hurt lower-income individuals while disproportionately benefiting rich people. That simply isn’t fair.

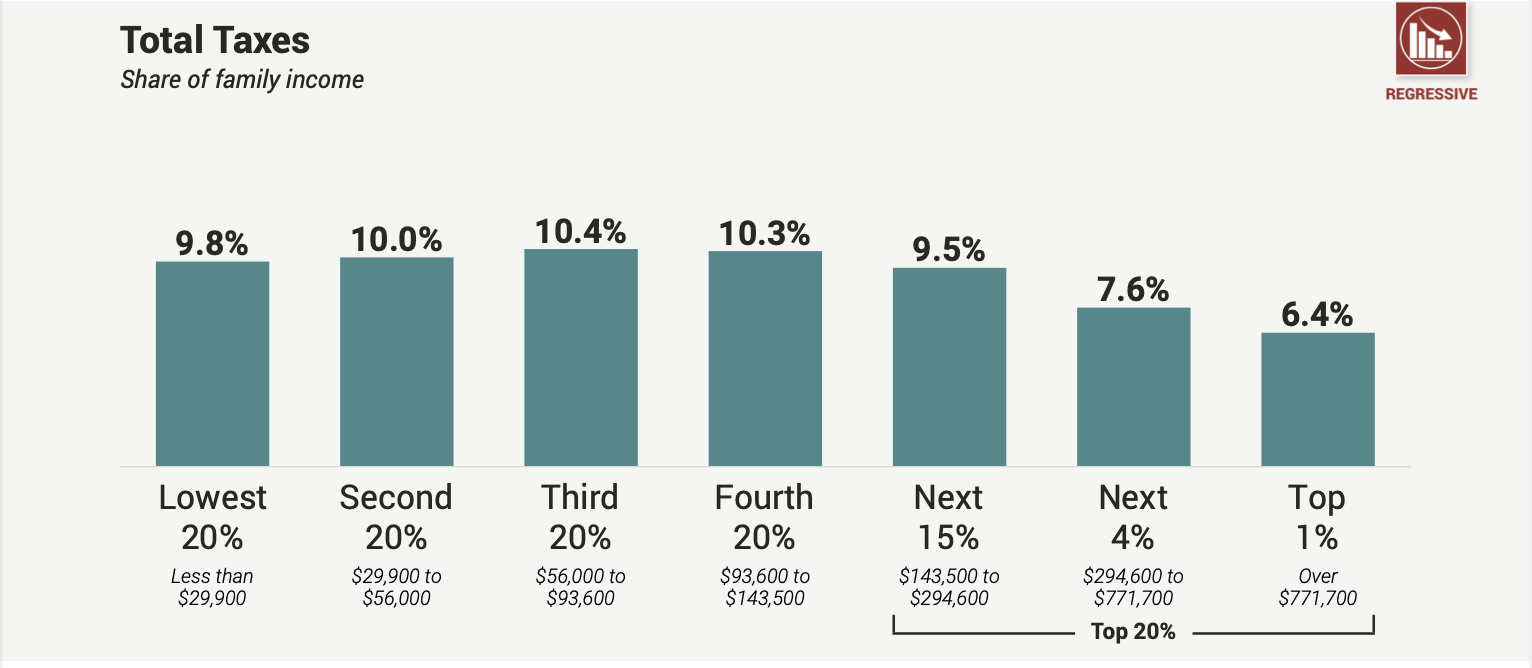

Utah was ranked 29 out of 50 states (plus the District of Columbia) in a recently released report from the Institute of Taxation and Economic Policy (ITEP) —-ITEP uses a “tax inequality index” to measure the effects of each state’s tax system on income inequality. Data from ITEP shows that lower and middle-income households pay a larger portion of their income in taxes overall, when compared to wealthier households. Middle-class families pay the highest effective tax rate (income tax, sales tax, other taxes and fees), while the wealthiest 1% of Utah households pay the least of all (see table below).

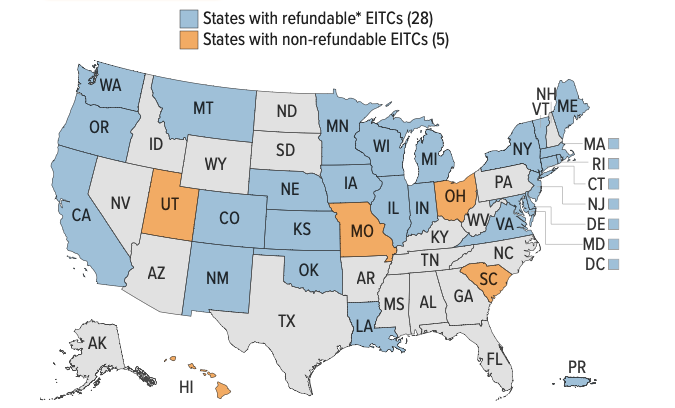

Thirty-one states and the District of Columbia have a state Earned Income Tax Credit (EITC). Utah is one of only five states that excludes the poorest working families from benefiting from their state EITC, by making their EITC non-refundable. By contrast, many states have taken steps to ensure that their state EITC includes as many low- and middle-income families as possible. In 2024, Utah legislators will have a chance to help more Utah families, too - by making our state EITC refundable.

Support HB 149: Make Utah's EITC Refundable!

This year, Representative Marsha Judkins (R-Provo) is championing HB149, which would transform Utah’s EITC into a refundable credit. This bold change will help many more families to afford essential necessities for their children's well-being, such as food, clothing and medical care.

On this EITC Awareness Day, let's make some noise! Reach out to your state legislators, remind them why this policy is impactful for families and children, and help us advocate for a more fair and equitable tax system.

To learn more about the Earned Income Tax Credit, see here.