Poverty

Utah Economic Benchmarking Project 2022: Utah vs Texas

New Economic Benchmarking Report Finds Utah Ahead of Texas in Most Key Metrics of Economic Opportunity and Standard of Living

Salt Lake City, August 31, 2022 - Voices for Utah Children released today the fifth in its series of economic benchmarking reports that evaluate how the Utah economy is experienced by median- and lower-income families by benchmarking Utah against another state. This year's report, authored by Taylor Throne and Matthew Weinstein with support from intern Bryce Fairbanks from the University of Utah Department of Economics, compares Utah to Texas. While the Economic Opportunity benchmarks come out nearly even, with Utah ahead in 11 and Texas ahead in 8, in the Standard of Living category Utah predominates in 20 categories and Texas in just two.

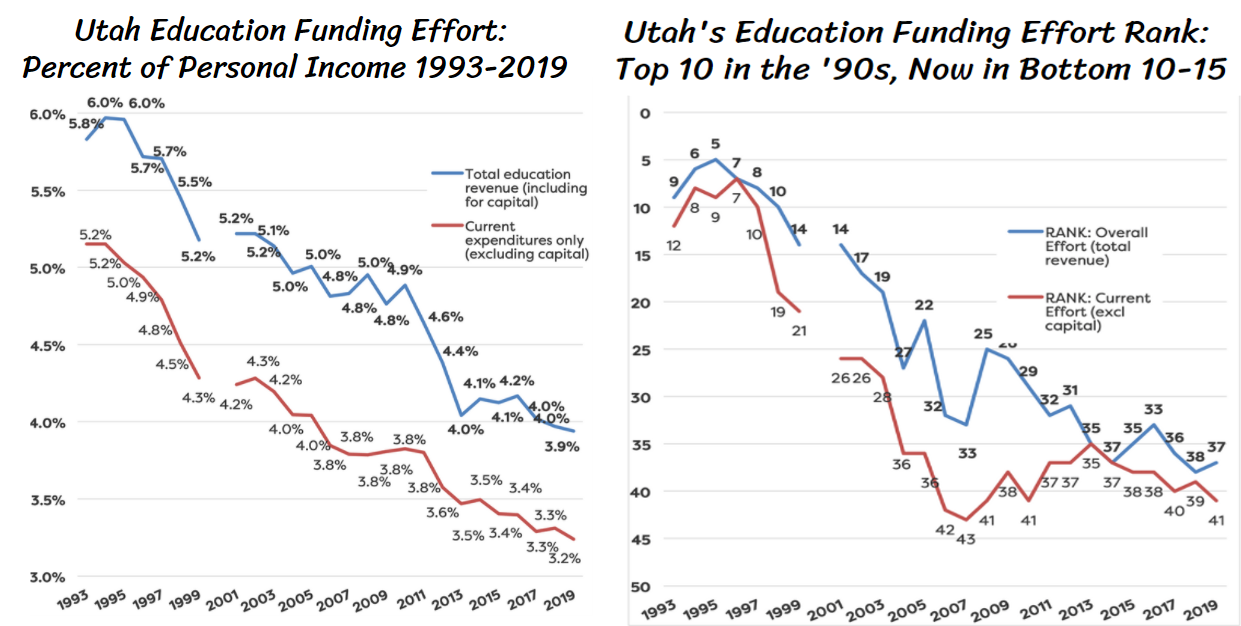

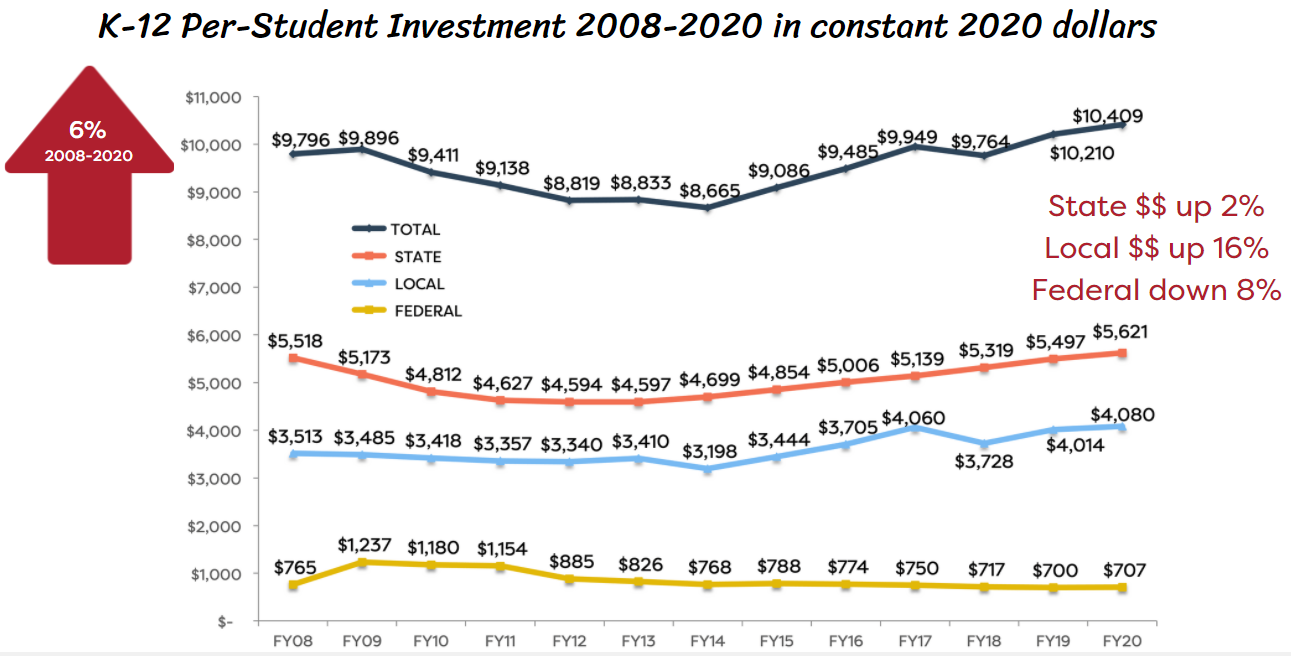

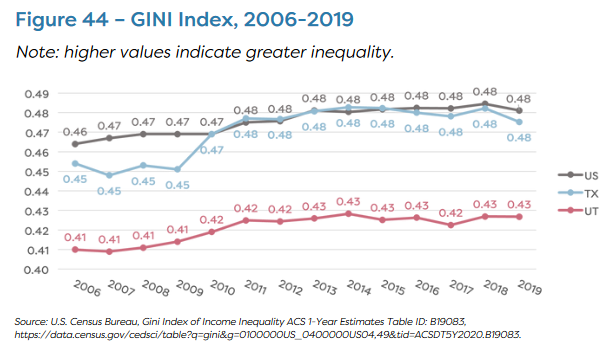

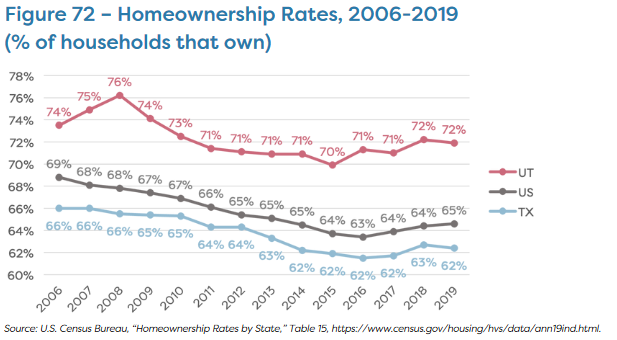

Voices for Utah Children's Economic Analyst Taylor Throne commented, "It seems clear that Texas has more to learn from Utah than vice versa. In terms of economic opportunity, Utah outperforms Texas for our labor force participation rate and our low unemployment rate (see page 13 of the report). In education, while both states are in the bottom 10 for investment, Utah claims much better 4th and 8th grade math and reading scores. At the university level, Utah invests more and enjoys stronger educational attainment levels (though our younger generation has lost the lead over the nation enjoyed by our older generations.) (See page 17.) Utah ranks 1st in the nation for our low level of income inequality, while Texas ranks 38th. We also stand out for intergenerational mobility and rank #1 for education funding fairness while Texas ranks 34th (see page 21). In the second part of the report where we measure standard of living. Utah is the clear winner in most measures. Utah enjoys much lower rates of poverty and uninsured children (though both states rank at the bottom for insuring Hispanic/Latino children) (see page 25).The most recent Kids Count overall ranking has Utah 4th and Texas 45th (see page 29). Utah also has shorter commutes, higher homeownership rates, and more volunteerism and voter participation (see page 33)."

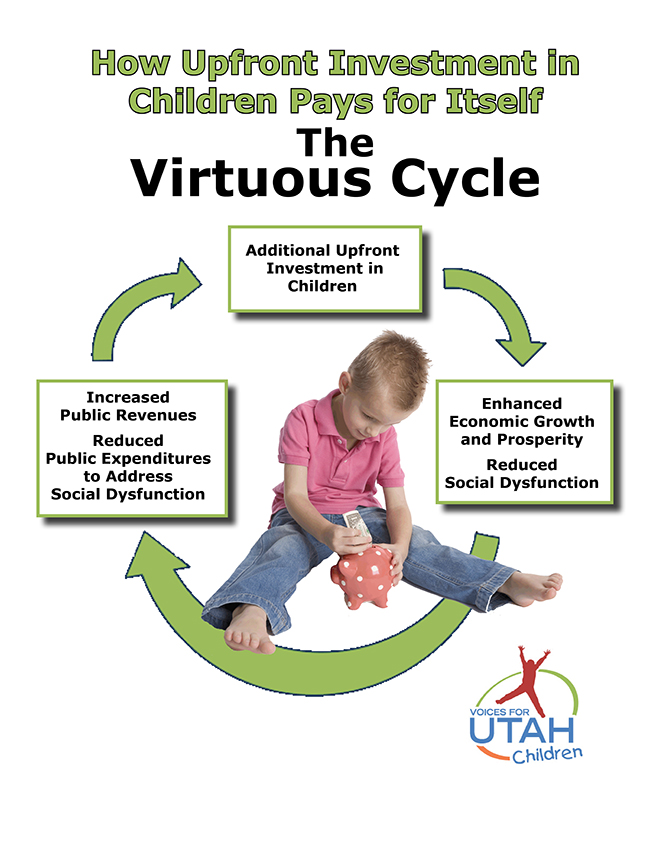

Voices for Utah Children's State Priorities Partnership Director Matthew Weinstein commented, "The main takeaways from this report and the others in the series are that Utah's economic successes put us in a position to make the new upfront investments we need to make now -- in education, public health, poverty prevention, and closing racial/ethnic gaps -- so that we can achieve our true potential and follow in the footsteps of states like Colorado and Minnesota that have become high-wage states and achieved a higher standard of living, and do it in such a way that all our children can have a better future."

The report release presentation took place online and can be viewed at https://fb.watch/ffuSPZ09MR/. The presenters included both Taylor Throne and Matthew Weinstein as well as a special guest, Brandon Dew, President of Central Utah Labor Council.

Utah's Top Economic Advantages: Hard Work & Strong Families Allow Utah to Enjoy High Household Incomes and Low Poverty

Can Texas Learn Any Lessons from Utah?

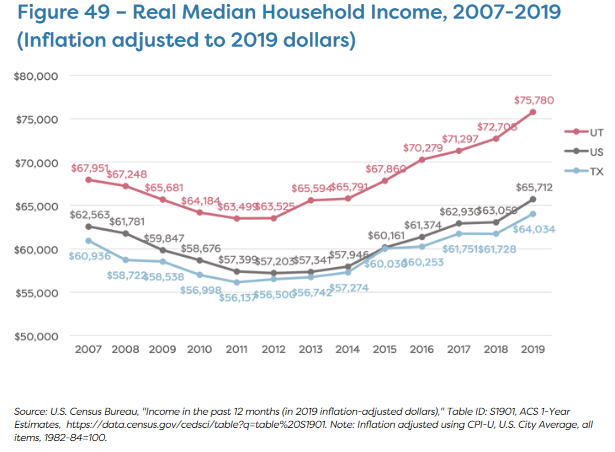

Utah enjoys a higher real median household income than Texas, ranking #11 nationally, although past inequities have left a legacy of barriers causing significant gaps between the median wage of different racial and ethnic groups. Utah's higher incomes are due largely to our high labor force participation rates and our preponderance of two-worker (often two-parent) households.

Even though Texas has a larger GDP per capita and ranks ahead of Utah for business climate, Utah has a higher share of people working and fewer people looking and unable to find work. Utah ranks 1st in the nation for income equality by the GINI Index, 1st for K-12 funding equity, and has fewer people living below the poverty line.

Utah is the clear winner by most standard of living measures. The most recent Kids Count overall ranking has Utah 4th and Texas 45th. Utah also has shorter commutes, higher homeownership rates, and more volunteerism and voter participation. Utah also has a much fairer tax system. Texas applies one of the highest tax rates in the nation (6th highest) to households with the lowest incomes and applies one of the lowest tax rates (9th lowest) to households with the highest income. This is because Texas has no personal or corporate income tax to offset the regressivity of their major revenue sources: sales, excise, and property taxes. As a result, Texas is one of the highest-tax states in the nation for lower-income residents, and one of the lowest-tax states for the wealthy.

Can Utah Learn Any Lessons from Texas?

Texas leads in early childhood education for pre-k and full-day kindergarten participation. Texas also has a much smaller gender wage gap than Utah, which ranks as one of the worst states for gender equality. When disaggregated by race and ethnicity, Texas has a smaller gender wage gap than Utah for every race and ethnicity except Latino and Native Hawaiian and Pacific Islander women.

Policy Implications

Strengthening the Labor Force

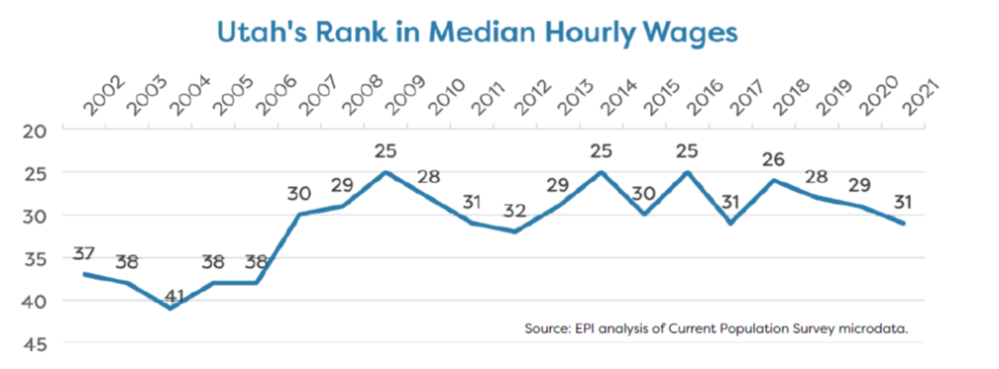

Utah and Texas are both far below the national average for median (50th percentile) and 10th percentile hourly wages, likely due to the fact that both are among the 20 states that never raised their minimum wages above the 2009 federal minimum of just $7.25 (now at its lowest level since 1956), and both states are among the 27 that discourage union membership through “right-to-work” laws.

Addressing the Legacy of and Present Barriers Causing Racial & Ethnic Gaps

Racial and ethnic gaps are evident in almost every outcome where race and ethnicity are disaggregated, such as high school graduation rates, wages, gender pay gaps, poverty rates, and uninsured rates. It is important to note that these gaps were caused by social, economic, and political structures and policies that have perpetuated racial inequality, elaborated in our report. Such policies have had very serious consequences for people of color, especially children of color. And as in the rest of the nation, the COVID-19 pandemic has exacerbated these hardships. Addressing these gaps through investments in early childhood and K-12 education, specifically where there is a high concentration of children of color (which includes many communities along the Wasatch Front, including Ogden, Salt Lake City, South Salt Lake, West Valley City, Midvale, and Provo) would likely increase educational attainment, wages, and standard of living overall and would therefore contribute to reducing racial and ethnic gaps in the future.

Restoring Education Funding Effort

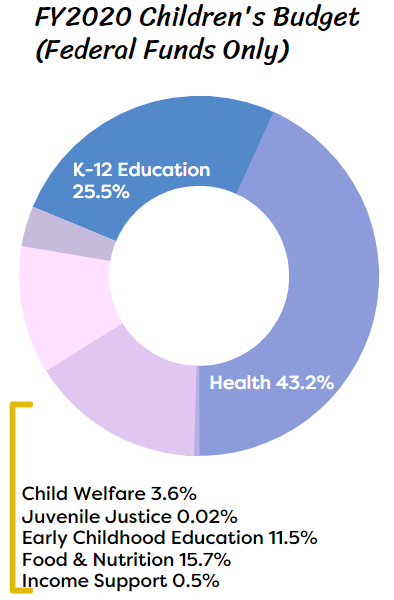

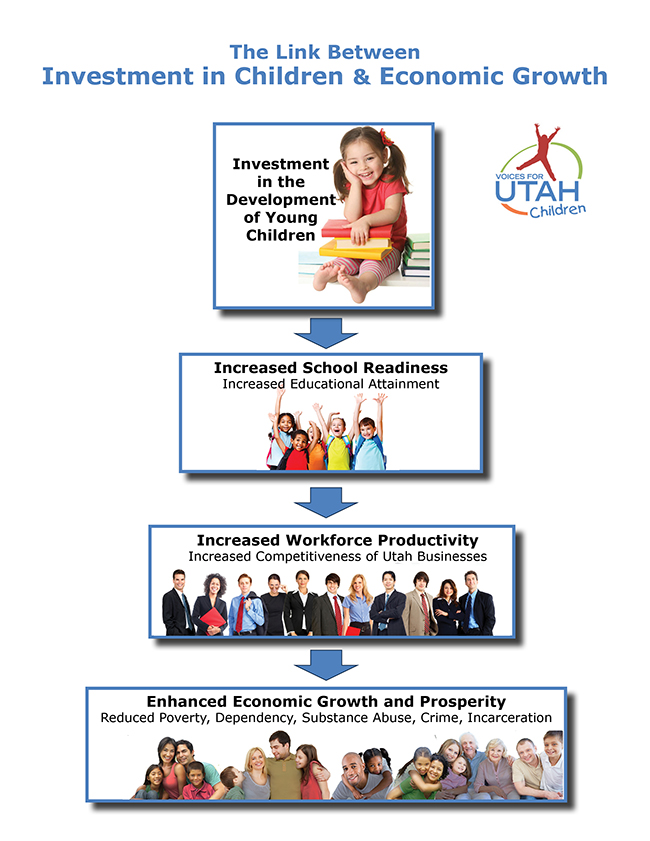

The link between education and income is well-established. States with higher education levels generally have higher levels of worker productivity, wages, and incomes. Voices for Utah Children has demonstrated elsewhere that Utah’s education funding effort has fallen from top 10 in the nation in the 1990s to the bottom 10 states today. While Utah “does more with less” in education compared to other states, will we be able to continue to advance without addressing the underfunding in our public education system? Utah has racial/ethnic educational outcome gaps which are larger than the national average, our pupil-to-teacher ratio is 3rd worst in the nation at 23:1 vs the national average of 16:1, and teacher pay has also fallen by 2% over the past 50 years, while teacher salaries nationally have increased 7%.

At the college level, Utah historically was always ahead of the national average for attainment of bachelor’s degrees and above. But Census data show Utah’s lead shrinking relative to the nation with each successive generation, to the point now that Utah millennials (ages 25-34) have fallen behind their peers nationally, despite relatively generous state support and low tuition levels. In addition, for young adults who do not seek to complete a college degree, apprenticeships and other skilled training programs or ensuring state contracts pay the prevailing local wage are two policies that have proven their value for achieving higher wages.

Can Utah Become a High-Wage State?

Utah has gone from being a low-wage state a generation ago to middle-wage status today, a considerable accomplishment. One question Utah leaders may now wish to consider is, is that good enough? Should we declare, “Mission Accomplished”? Or is Utah in a position, like Colorado and Minnesota before us, to become, over time, a high-wage state and set our sights on taking the necessary steps today to achieve that goal over the years and decades to come?

Similarly, how do we include those earning the lowest wages in the gains Utah has made and will potentially make in the future? Utah is not even a half percentage point lower than the national share of workers earning poverty-level wages and lags behind the nation’s 10th percentile wage, ranking 33rd. Even as the state with the lowest income inequality ranking in the nation, Utah suffers from a tremendous gap between low-income workers and the rest of the income scale.

The main lesson that emerges from the Working Families Benchmarking Project reports comparing Utah to Colorado, Minnesota, Idaho, Arizona and now Texas is the following: Higher levels of educational attainment translate into higher hourly wages, higher family incomes, and an overall higher standard of living. The challenge for policymakers is to determine the right combination of public investments in education, infrastructure, public health, and other critical needs that will enable Utah to continue our progress and achieve not just steady growth in the quantity of jobs, but also a rising standard of living that includes moderate- and lower-income working families from all of Utah’s increasingly diverse communities.

The 41-page report is available for download here.

MEDIA COVERAGE OF THE BENCHMARKING PROJECT:

The Spectrum: https://www.thespectrum.com/story/news/2022/09/02/report-compares-utah-texas-economy-standard-living-homes-jobs/7970912001/

KSL News Radio: https://kslnewsradio.com/1974565/new-report-ranks-utah-above-texas-in-aspects-of-economic-opportunity-and-standard-of-living/

Salt Lake Tribune: https://www.sltrib.com/opinion/commentary/2022/09/15/matthew-weinstein-taylor-throne/

2021 Utah Kids Count Data Book Release

Kids Count Utah: A Data Book on the Measures of Child Well-Being in Utah, 2021 is the first glance at the effects of the COVID-19 pandemic on Utah’s children. Please click on the button below for the full report.

2021 UTAH KIDS COUNT DATA BOOK

Children under the age of 18 make up a third of the state’s population. Not surprisingly, Utah children and their families faced additional challenges as a result of living through a global pandemic.

Unfortunately, over 10 percent of Utah children are experiencing poverty. Additionally, since 2019 Utah saw an increase of over 4,000 additional children considered to be in Intergenerational Poverty (IGP). More children caught in a cycle of IGP is concerning as it could mean that their own children may continue that same cycle if their economic situation does not improve.

Providing a quality education to children during the pandemic continues to be a challenge. The most recent data shows that student proficiency assessment results decreased over the past year. And data also shows that many children are not receiving the mental health treatment they need. A new data indicator shared in the 2021 data book looked at access to mental health. The data collected from the National Survey of Children’s Health shows that approximately 60% of three- to 17-year-olds struggling with mental health are not receiving treatment.

Voices for Utah Children hopes that the yearly KIDS COUNT data book project and the publication of Measuring of Child Well-Being in Utah continues to be a valuable resource that can provide guidance to both policymakers and the general public on how to improve the lives and futures of Utah children.

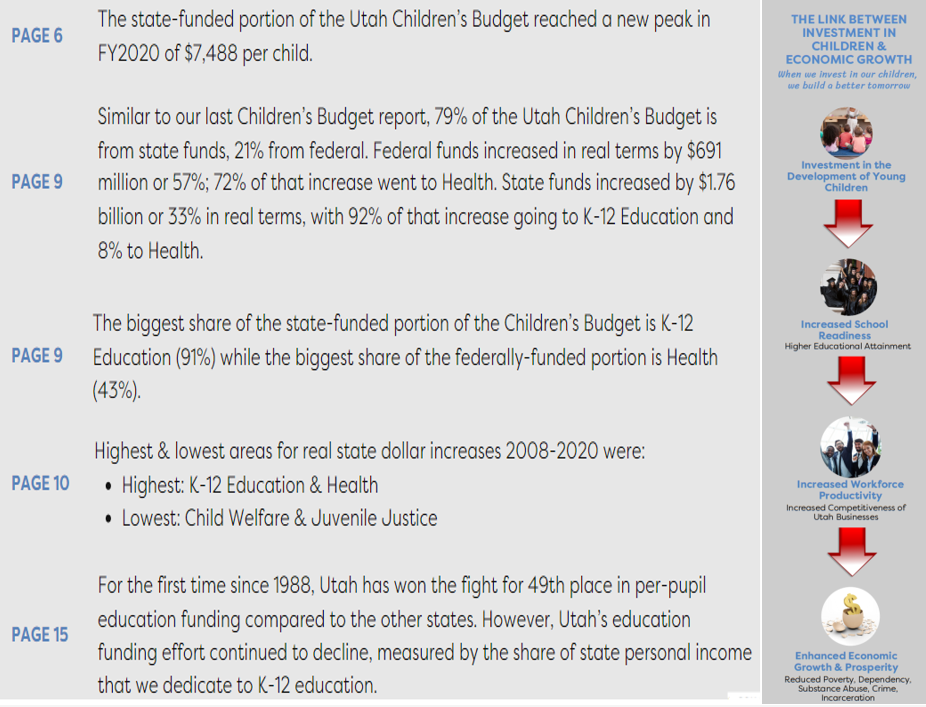

Utah Children's Budget Report 2021

Children’s Budget Report Finds Utah Is Spending More On Children Than Ever Before, But Education Funding Effort Is At A Record Low

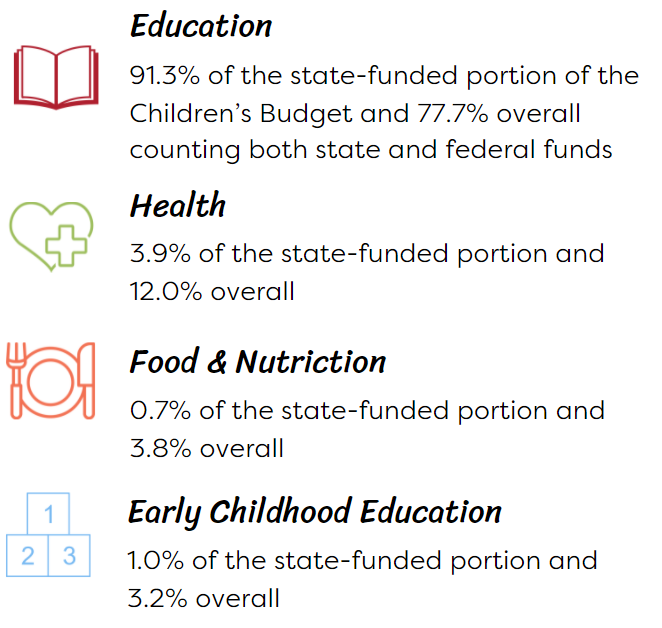

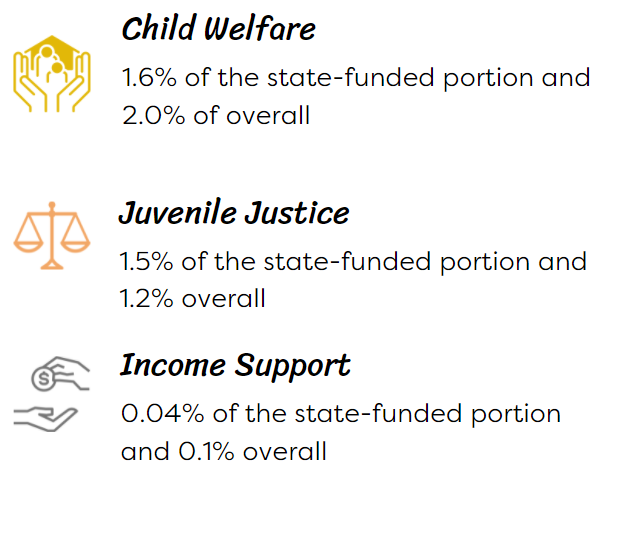

Salt Lake City, December 9, 2021 - Voices for Utah Children, the state’s leading children’s policy advocacy organization, released its biennial Children's Budget Report. The report, published every other year, measures how much (before and after inflation) the state invests every year in Utah’s children by dividing all state programs concerning children (which add up to about half of the overall state budget) into seven categories, without regard to their location within the structure of state government. The seven categories are as follows, in descending order by dollar value (adding state and federal funds together):

Public investment in children should be understood as a central component of Utah’s economic development strategy. Examining how much Utah invests in children can help the state evaluate whether it is maximizing the potential of our future workforce through our investment in human capital.

This is especially important given the rapid demographic changes taking place in our state. The 2020 Census found that 30% of Utahns under 18 are members of a racial or ethnic minority (almost one-third of our future workforce), compared to just 24% in 2010. The investments we make today in reducing racial and ethnic gaps among Utah’s children will enable the state to thrive and prosper for generations to come

Report highlights are as follows

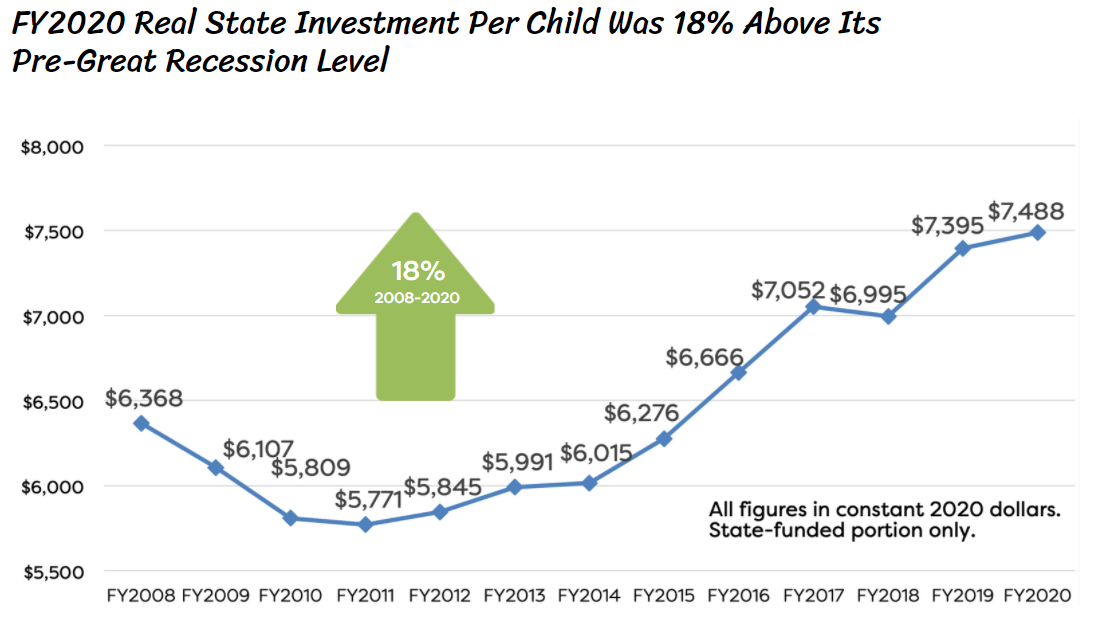

Good News: Utah is investing more in the next generation now than ever before, both overall and on a per-child basis

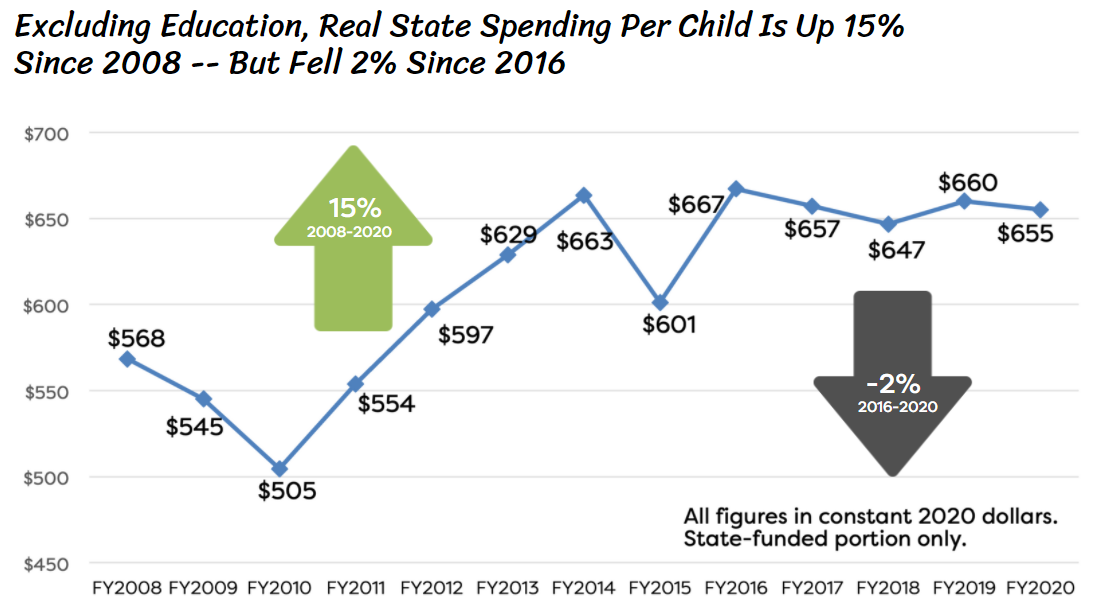

Not-so-good News: The non-K-12 Education portion of the Children’s Budget peaked on a per-child basis in FY 2016 and has fallen since then by 2%

Bad News: Utah’s education funding effort continues to fall to record low levels

Additional Trends: Changes in Funding by Source

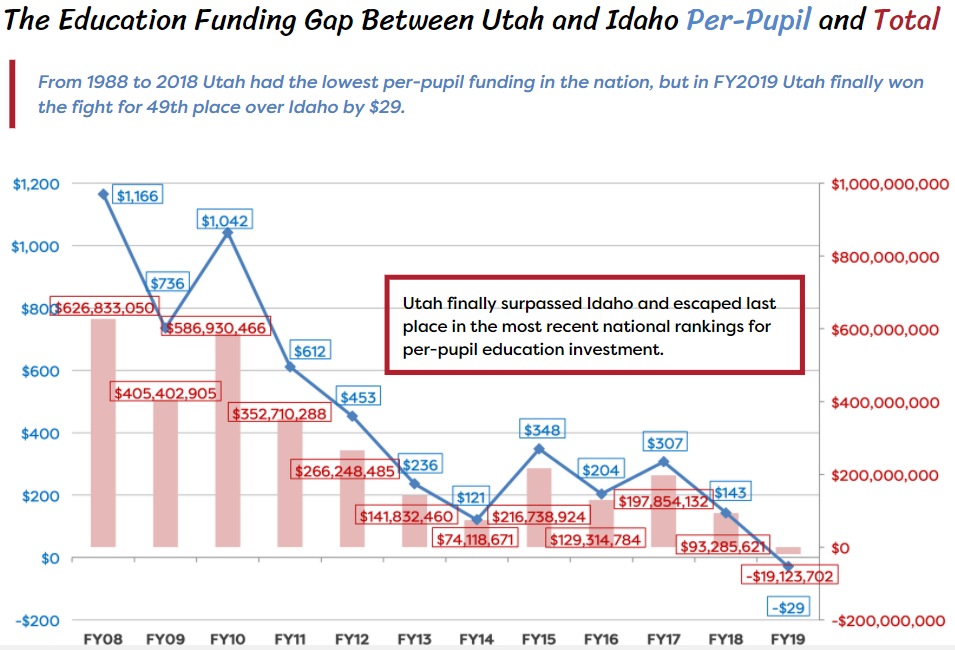

Trends in Education Funding: UT beat ID for 49th place, still far behind US overall

MEDIA COVERAGE OF THE CHILDREN'S BUDGET REPORT:

Facebook Live Event presenting the 2021 Children's Budget Report, major findings and summaries of all the categories of funding that impact children in Utah. https://fb.watch/9O05ECPAHi/

Invest in Utah's Future, Not Tax Cuts

BROAD COALITION CALLS FOR INVESTMENT IN UTAH’S FUTURE, NOT TAX CUTS, DOCUMENTS $5.2 BILLION IN URGENT UNMET NEEDS

Salt Lake City – On Monday, November 8, 2021 on the steps of the Utah Capitol, a broad and diverse coalition of advocates for the poor, for disabled Utahns, for education, health care, clean air, and a variety of other popular Utah priorities held a press conference calling on the Utah Legislature to avoid cutting taxes until it has developed a comprehensive plan to address Utahns’ top concerns by investing in Utah’s future.

Following nearly two years of the COVID-19 pandemic, Utah is fortunate to have achieved a more rapid economic recovery than nearly every other state. Utah has also received billions in federal assistance that have padded state revenues – but only temporarily. It is expected that the Governor and Legislature will have at least $2.5 billion in new revenues to appropriate in the 2022 General Session of the Utah Legislature.

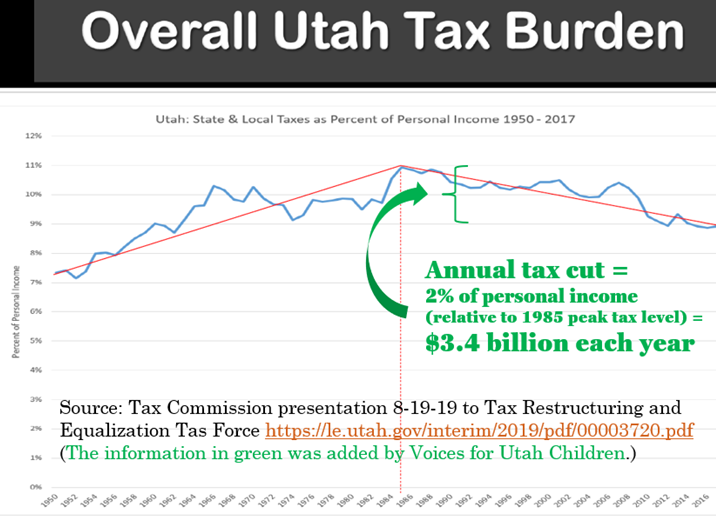

This has led some to say that Utah is “swimming in money” and should cut the state income tax rate from 4.95 to 4.5%, a tax break of $600 million (that mostly benefits upper income families rather than Utahns in need). This tax break would be over and above the roughly $3.5 billion that the Legislature has already cut from annual revenues in recent decades (seehttps://le.utah.gov/interim/2021/pdf/00003683.pdf slide #3).

In response, today the Invest in Utah’s Future coalition presented a list of urgent unmet needs amounting to $5.2 billion, more than double the amount of the expected new revenues.

The advocates also pointed out that, according to recent reports from the Utah State Tax Commission and the Utah Foundation, taxes in Utah are the lowest that they have been in decades, following repeated rounds of tax cutting. “We understand that tax cuts are popular, but we’ve reached the point where we must ask ourselves: Are we, as the current generation of Utahns, meeting our responsibility, as earlier generations did, to set aside sufficient resources every year to invest in our children, in our future, in the foundations of the next generation’s prosperity and quality of life?” said Matthew Weinstein of Voices for Utah Children.

Speakers also referenced the recent public opinion survey by the Deseret News and Hinckley Institute that found that only 27% of Utahns support tax cutting over investing in Utah’s future, consistent with other polls done in recent years by the same organizations as well as by Envision Utah and the Utah Foundation.

Here is the list of urgent unmet needs that Utah has not been able to address due to the state’s chronic revenue shortages, adding up to a total of $5.2 billion:

| Budget Area | Amount | Details | Contacts |

| K-12: Reduce class sizes from 29 to 15 |

$1.1 billion ($612m K-6 only) |

Reduce class sizes/improve student/teacher ratio below the current Utah average of 29 (vs national average of 24) to optimum class size of 15. (Source: UEA) |

Utah Education Association Director of Policy and Research Jay Blain |

| K-12: Paraeducators | $312 million |

Expand paraeducators to all Utah elementary classrooms. (Source: UEA) |

|

|

K-12: Increase school counselors |

$130 million |

Increase school counselors per student to the national standard optimum of 1:250. Utah’s current ratio is 1:648, compared to the national average of 1:455. (Source: UEA) |

|

| K-12: school psychologists, social workers and special ed teachers | $285 million |

Increase student access to school psychologists, social workers and special ed teachers. (Source: UEA) Current and optimal ratios are: School psychologists: Now 1:1950/Optimal 1:500 Social workers: Now 1:3000/Optimal 1:250 Special ed teachers: Now 1:35/Optimal 1:25 |

|

| K-12 Education: reduce teacher attrition and shortages | $500-600 million | Envision Utah estimates that we need to invest an additional $500-600 million each year just to reduce teacher turnover, where we rank among the worst in the nation. Our leaders’ unwillingness to solve our education underinvestment problem is why the majority-minority gaps in Utah’s high school graduation rates are worse than nationally and our younger generation of adults (age 25-34) have fallen behind their counterparts nationally for educational attainment at the college level (BA/BS+). | |

| K-12 School Nurses | $84.4 million |

The Utah Department of Health annual report “Nursing Services in Utah Public Schools 2020-21” found that it would cost $84.4m to hire an additional 844 nurses so as to have one nurse in every public school building. There are currently only 224 nurse FTEs in Utah’s public schools, a ratio of 1 nurse for every 2,617 students. One nurse in every building would improve that ratio to 1:623, which would still be worse than the national average. Sources: www.utahschoolnurses.org/, www.nasn.org, www.sltrib.com/opinion/commentary/2021/10/01/diane-nicoll-utah-schools/ |

Dr. Jennifer Brinton, MD, President, American Academy of Pediatrics – Utah and Dr. William Cosgrove, Past-President - |

|

K-12: Homeless Students |

$105.8 million |

HUD vouchers do not cover students and their families who are homeless under McKinney Vento Dept. of Education definition. For the 2019-2020 school year, Utah had a little over 13,500 K-12 homeless students. Some of them are duplicates as students move from one district to another. Also the same household has multiple children. If we assume we have:

Source: Utah Housing Coalition |

Utah Housing Coalition Advocacy & Outreach Coordinator Francisca Blanc – |

| Full Day Kindergarten |

$52.5 million |

Voices for Utah Children estimates that it will cost $52.5 million to make full-day Kindergarten available to all Utah families who would choose to opt in to it. | Voices for Utah Children Sr. Policy Analyst Anna Thomas and Pastor Brigette Weier, Our Saviour’s Lutheran Church |

| Pre-K and Child Care |

$1 billion |

Well over $1 billion is one estimate for a much needed comprehensive system of early childhood care and education (pre-k) in Utah. | |

| Afterschool Programs |

$3.6 million |

Utah’s 303 afterschool programs serve 43,000 kids but still leave 99,000 unsupervised every day after school. During this past year’s 21st Century Community Learning Center grant competition in Utah, $1,062,816 was available and there was $4.6 million in requests, indicating a $3.6 million funding gap. (Source: Utah Afterschool Network) | Utah Afterschool Network Director Ben Trentelman – |

| Health Insurance: Children | $5 million | It would cost Utah about $5 million to pay for SB158 to remove barriers to health insurance coverage so that all Utah kids can access health insurance, including 12-month continuous eligibility. Utah currently ranks last in the nation for covering the one-in-six Utah kids who are Latinx and in the bottom 5 states for all children. Source: Voices for Utah Children | Voices for Utah Children Deputy Director Jessie Mandle |

|

Health Insurance: New parents |

$5 million | Extending Post-Partum Medicaid Coverage for new parents up to one year (now just 60 days) Source: Voices for Utah Children | |

| Mental Health & Substance Use Disorder Treatment | Uncertain |

Utah ranks last in the nation for mental health treatment access, according to a 2019 report from the Gardner Policy Institute. A 2020 report from the Legislative Auditor General found that Utah’s Justice Reinvestment Initiative had failed to achieve its goal to reduce recidivism -- and actually saw recidivism rise -- in part because “both the availability and the quality of the drug addiction and mental health treatment are still inadequate.” (page 51) Stakeholders identify the highest priority items as: housing and workforce capacity. There is a need to expand student enrollment slots in universities for MSWs (Masters in Social Work), MFTs (Marriage & Family Therapists) and MHCs (Mental Health Counselors), and to provide scholarships at these institutions to attract students. |

|

| Disability Services | $30 million |

The DSPD disability services waiting list has doubled in the last decade from 1,953 people with disabilities in 2010 to 3,911 in 2020. The FY20 $1 million one-time appropriation made it possible to provide services to 143 people from the waiting list, implying that it could cost $30 million to eliminate the waiting list entirely. |

Legislative Coalition for People with Disabilities – Jan Ferre |

|

Rural Utah Economic Development |

Uncertain | Rural Utahns should not feel that they need to abandon their home communities and add to the growth pressures along the Wasatch Front in order to provide for their families. Rural economic development would benefit all Utahns and reduce disparities between the Wasatch Front and other areas of the state. | Community Action Partnership of Utah - Stefanie Jones and Clint Cottam – |

| Transportation Access | $300 million |

Increase access to employment and educational opportunities for more people, especially lower-income communities. Provide additional transit connections, including extended evening and weekend service. Establish more ‘active transportation‘ (bike and pedestrian) connections to increase equity of access. Source: Wasatch Front Regional Council |

|

| Left Behind Workers and Families | $154 million |

Last year’s report “Left Out: Adding Up the Cost of Excluding Undocumented Utahns from State and Federal COVID-19 Relief” showed how undocumented Utahns and their families (comprising 39,000 households with over 100,000 individuals) work hard and pay taxes but were excluded from $154 million of federal COVID and unemployment relief. |

Comunidades Unidas – Brianna Puga – |

| Sexual and Domestic Violence | $85 million |

Our economy incurs steep economic costs as a result of sexual and domestic violence. The Center for Disease Control estimates that over a lifetime the costs for a female survivor are $103,762 and for a male survivor $23,414. These include medical costs, loss of employment or interruption of paid work, criminal justice system costs, among others. The Utah Domestic Violence Coalition 2017 Needs Assessment identified insufficient funding for shelters, affordable housing, child care, legal representation, and mental health and substance abuse treatment services as major obstacles to protecting women from domestic violence. In the 2021 Utah Legislative Session, fourteen private non-profit domestic violence service providers submitted an appropriations request of $3.4 million in ongoing state funds. However, only $1.7 million was funded through federal TANF funds. No ongoing state funds were approved. Unfortunately, only two domestic violence service providers were able to accept and utilize the TANF funds. The remaining twelve domestic violence service providers were unable to accept those funds because TANF eligibility requirements conflict with Violence Against Women Act (VAWA) confidentiality provisions. The actual cost to meet the needs of Utahns experiencing sexual and domestic violence is much higher than is reflected in the 2021 appropriations request and has been estimated to total $85 million. (Source: Utah Domestic Violence Coalition, Utah Coalition Against Sexual Assault, Restoring Ancestral Winds) |

Gabriella Archuleta, Director of Public Policy, YWCA Utah and Yolanda Francisco-Nez, Executive Director of Restoring Ancestral Winds |

| Housing | $415 million |

Funding to build affordable housing state-wide for people earning less than 50% AMI. In Salt Lake County alone, the current need is $1 billion. Affordable housing units fall 41,266 units short of meeting the need for the 64,797 households earning less than $24,600. Among extremely low-income renter households, 71% pay more than 50% of their income for housing, which is considered a severe housing burden. For more information on the current and ongoing needs visit https://endutahhomelessness.org/wp-content/uploads/2021/06/HousingNow-Deck-12.pdf |

|

| Homeless Services | $55 million | Case manager positions have been underfunded for the past several years and most do not make a living wage. The homeless resource centers in Salt Lake County also maintain a perpetual gap in state funding of at least $3 million per year. In 2019, homeless service providers across the state sought $41 million in funding for ongoing programs, including case management. At that time, the state provided $12 million. The following year, the state provided $9 million. Covering even the basic needs of providers would be a huge step forward in our efforts to reduce homelessness across the state. | |

| Housing for Seniors |

$30 million/ year for 10 years |

If we don’t fund preservation of affordable housing for seniors we will lose valuable units. A very general estimate would be $50,000 per unit for perhaps 5,000 units. This equates to $250 million in rehab costs. What is more realistic is subsidizing 5,000 at say $500 per month or $30 million per year which would allow these projects to Borrow the money for rehab. Over 10 years the total is $300 million but the state would pay this over 10 years. The $250 million up front to rehab the units would likely keep them going for 10 years, then more rehab would be required. https://www.utahhousing.org/preserving-senior-affordable-housing-report.html https://nyuds.maps.arcgis.com/apps/webappviewer/index.html?id=b8318f874017488ea9bdd51a296e59ef for senior housing report |

Utah Housing Coalition Director Tara Rollins |

| Air Quality | $100 million | In 2018 Gov. Gary Herbert proposed $100 million for clean air initiatives but the Legislature did not fully fund this goal.

The Wasatch Front ranks as the 11th worst air quality in the nation for ozone and 7th worst for short-term particle pollution. Investments should align with the principles in Kem C. Gardner Policy Institute Road Map, and have fallen short in previous years. |

|

| Air Quality in Schools |

$35 million |

Funding for air purifiers in every classroom in Utah, which would reduce the risks both from COVID and from Utah’s air pollution and could be expected to result in improved school performance, even more than standard interventions such as reducing class size by 30%, or “high dose” tutoring. (Source: Utah Physicians for a Healthy Environment) | UPHE Director Jonny Vasic - |

| Air Quality: Promote Transit | $60 million | Funding for UTA to eliminate fares entirely on all UTA conveyances as has been done already in dozens of cities to varying degrees, including in the SLC Free Fare Zone. (Source: Steve Erickson fiscal estimate, https://freepublictransport.info/city/ ) | Steve Erickson - |

| Hunger | Uncertain | It is clear that the state needs to do more in providing funding and other resources to help support local community food pantries. Earlier this year, Utahns Against Hunger conducted a community food pantry survey and found that in 2020, a quarter of pantry respondents had a funding gap, with 15% of respondents having a gap of $10,000 or more. | Utahns Against Hunger – Gina Cornia – and Alex Cragun |

| Utah EITC |

$100 million |

Utah should become the 31st state to offer a 20% state match to this highly popular federal tax break. This refundable tax cut targeted to low- and moderate-income working families has been proven to reduce poverty by drawing lower-skilled persons into the workforce, moving them toward independence and self-sufficiency. Most of this tax cut goes to the lowest income fifth of Utahns, those earning under $28,000, and the rest goes to the second fifth of the income scale, those earning under $50,000. | Voices for Utah Children – Matthew Weinstein – |

| Eliminate the sales tax on unprepared food | $130 million |

The food tax is the most regressive tax. One-third of it is paid by the lowest-income half of Utah households, who earn less than a sixth of all Utah income. According to the U.S. Department of Agriculture’s Economic Research Service, low-income families pay 36% of their income on food while higher-income families spend only 8%. This is why 37 states do not charge any sales tax on food. |

Rev Libby Hunter, Cathedral Church of St. Mark, speaking on behalf of the Coalition of Religious Communities (Bill Tibbitts – ) |

| About those water project boondoggles… | Federal rules permit the use of ARPA funds for water infrastructure projects, but Utah would save billions of dollars and millions of gallons by investing in conservation first to reduce usage in one of the most water-wasteful states in the nation. Those ARPA dollars would be better used addressing the urgent unmet human needs of our fellow Utahns. | Utah Rivers Council – Zach Frankel – and Lindsey Hutchison | |

| Racial Equity, Diversity, and Inclusion |

Our public fiscal policies – how we generate and expend public investment dollars – have a direct impact on whether we are widening or narrowing the gaps between different groups in Utah. The new Utah Compact on Racial Equity, Diversity, and Inclusion must be more than just words on a page. https://slchamber.com/public-policy/utah-compact/ |

Angel Castillo, Ogden NAACP | |

TOTAL |

$5.177 billion – more than double the amount of “surplus” revenue that the Legislature expects to have |

||

Live recording of the Invest in Utah's Future press conference 11/8/21: https://fb.watch/99bpgYEAqp/

Printable version of this document is here.

Media coverage is posted at KSL and Deseret News and Fox-13.

ONE PAGERS ABOUT THE VARIOUS UNMET NEEDS:

- K-12 education: UEA data infographic and UEA 2022 budget priorities

- K-12 school nurses info from American Academy of Pediatrics - Utah Chapter

- Rural Utah economic development from CAP-Utah and additional information from Governor's Office of Economic Opportunity

- Disability services information from annual report of the Utah Division for Services to People with Disabilities

- Air quality: Classroom air purifiers from Utah Physicians for a Healthy Environment

- Air quality and low-income transportation access: Free Fare UTA one-pager from Crossroads Urban Center

- Sexual and domestic violence one-pager from YWCA-Utah

- Sales tax on food op-ed from Deseret News

- Income tax rate cut vs Utah EITC one-page summary

The High Price of Lower Taxes

Legislative leaders have said that 2021 should be “the year of the tax cut.” Numerous public opinion surveys show that Utahns disagree. This may come as a surprise to policymakers, who have been in the habit of handing out tax break after tax break for decades.

But there seems to be an increasing public awareness that Utah is now paying a price for decades of tax cutting that have left us with the lowest overall tax level in 50 years relative to Utah personal income.

UTAH'S URGENT UNMET NEEDS

We all like being able to pay less in taxes. But there is a growing understanding that tax cuts are leaving us unable to address the long list of urgent unmet needs in education, infrastructure, social services, air quality, public health, and many other areas that affect our standard of living and quality of life. All of these issues will shape the Utah that our children will one day inherit.

Outlined below are some examples of the urgent unmet needs in Utah.

Early Care and Education

Amount |

Unmet Need |

| $500-600 Million/Year |

Envision Utah estimates that we need to invest an additional $500-600 million each year just to reduce teacher turnover, where we rank among the worst in the nation. Our leaders’ unwillingness to solve our education underinvestment problem is why our high school graduation rate is below the national average (after adjusting for demographics) and our younger generation of adults (age 25-34) have fallen behind their counterparts nationally for educational attainment at the college level (BA/BS+). |

| $52.5 Million/Year | Voices for Utah Children estimates that it will cost $52.5 million to make full-day Kindergarten available to all Utah families who would choose to opt in to it. |

| $1 Billion | Well over $1 billion is one estimate for a much needed comprehensive system of early childhood care and education (pre-k) in Utah. |

Health

Amount |

Unmet Need |

| $59 Million/Year |

It would cost Utah about $59 million each year to cover all of our 82,000 uninsured children. The longstanding preference for tax cuts over covering all kids is why we rank last in the nation for covering the one-in-six Utah kids who are Latinx and why the state as a whole ranks in the bottom 10 nationally for uninsured children. |

Human Services

Area |

Unmet Need |

| Mental Health & Substance Abuse Treatment |

Utah ranks last in the nation for mental health treatment access, according to a 2019 report from the Gardner Policy Institute. A 2020 report from the Legislative Auditor General found that Utah’s Justice Reinvestment Initiative had failed to achieve its goal to reduce recidivism -- and actually saw recidivism rise -- in part because “both the availability and the quality of the drug addiction and mental health treatment are still inadequate.” (pg 51) |

| Disability Services |

The DSPD disability services waiting list has doubled in the last decade from 1,953 people with disabilities in 2010 to 3,911 in 2020. The FY20 $1 million one-time appropriation made it possible to provide services to 143 people from the waiting list. |

| Domestic Violence | The Utah Domestic Violence Coalition 2017 Needs Assessment identified insufficient funding for shelters, affordable housing, child care, legal representation, and mental health and substance abuse treatment services as major obstacles to protecting women from domestic violence. |

| Seniors |

The official poverty measure undercounts senior poverty by about a third because it does not consider the impact of out-of-pocket medical expenses. A 2018 study found that seniors spent $5,503 per person on out-of-pocket medical expenses in 2013, making up 41% of their Social Security income. (For most seniors, Social Security is the majority of their income, and it makes up 90% or more of income for 21% of married couples and about 45% of unmarried seniors.) |

Infrastructure, Environment, and Housing

Area |

Unmet Need |

| Infrastructure |

The American Society of Civil Engineers gives Utah a C+ grade for infrastructure in its December 2020 report. The Utah Transportation Coalition has identified a funding shortfall of nearly $8 billion over the next two decades. |

| Air Quality | The Wasatch Front ranks as the 11th worst air quality in the nation for ozone and 7th worst for short-term particle pollution |

| Housing |

Affordable housing units fall 41,266 units short of meeting the need for the 64,797 households earning less than $24,600. Among extremely low-income renter households, 71% pay more than 50% of their income for housing, which is considered a severe housing burden. The FY21 affordable housing appropriation request for $35 million from Sen. Anderegg, which was already just a small step in the right direction, was reduced to just $5 million. |

WHY TAX CUTS ARE A BIG DEAL

Some legislators have said to us, "What's the big deal with $100 million of tax cuts out of a $22 billion budget?".

The big deal is that we’ve been cutting, on average, about $100 million every single year for the last 25 years.

Voices for Utah Children’s research has found that tax cuts from the last 25 years has left us short $2.4 billion each year, amounting to an 18% cut to public revenues.

One could even call us a “slow-motion Kansas” because in 2012 they cut taxes overnight by 15%, leading to an economic slump and political backlash that saw the Republican legislature reverse the cuts in 2017 and the public elect a Democratic governor in 2018.

But here in Utah, we’re like the proverbial frog in the pot of water heating on the stove. The devastating impacts of these revenue reductions have been slow and incremental, so we’ve come to accept as normal a state of affairs that Kansans quickly reversed.

Instead of figuring out the fairest way to restore some of those lost revenues so we can address our most urgent challenges, Utah’s political leadership continues to pass new tax cuts every year, generally skewed toward the top of the income scale.

For example, Voices for Utah Children analyzed two of the tax cuts proposed this year and found that they excluded lower-income Utahns completely and mostly went to the highest-income households – even though their supporters said publicly that they are intended to help low- and middle-income Utahns.

Public opinion surveys conducted last year by the Deseret News and Hinckley Institute, by the Utah Foundation, and by Envision Utah all found a strong popular preference for public investment over tax cuts.

Same thing with surveys this month by the Deseret News-Hinckley Institute and by Voices for Utah Children.

Breaking old habits can be hard. As is often the case, the public appears to be ahead of our political leaders. But let's hope that they too will eventually come to appreciate the wisdom of their constituents, who are increasingly aware of the high price Utah is paying for lower taxes.

Utah has been fortunate in weathering the current recession. This gives us a unique opportunity to be able to make smart long-term investments at a time when other states are cutting budgets. As a State we need to take advantage of this situation and invest in Utah kids, not tax cuts.

THIS OP-ED APPEARED IN THE SALT LAKE TRIBUNE ON MARCH 1, 2021

#InvestInUtahKids: An Agenda for Utah's New Governor and Legislature

Salt Lake City - Voices for Utah Children released publicly today (January 6, 2021) "#InvestInUtahKids: An Agenda for Utah's New Governor and Legislature," the first major publication of our new #InvestInUtahKids initiative.

Utah begins a new era in this first week of January, with the swearing in of a new Governor and Lt. Governor and a new Legislature. The arrival of 2021 marks the first time in over a decade that the state has seen this kind of leadership transition. Last month Voices for Utah Children began sharing with the Governor-elect and his transition teams the new publication, and on Wednesday morning Voices will share it with the public as well.

The new publication raises concerns about the growing gaps among Utah's different racial, ethnic, and economic groups and lays out the most urgent and effective policies to close those gaps and help all Utah children achieve their full potential in the years to come in five policy areas:

- Early education

- K-12 education

- Healthcare

- Juvenile justice

- Immigrant family justice

The report, which was initially created in December and distributed to the incoming Governor and his transition teams, closes with a discussion of how to pay for the proposed #InvestInUtahKids policy agenda. The pdf of the report can be downloaded here.

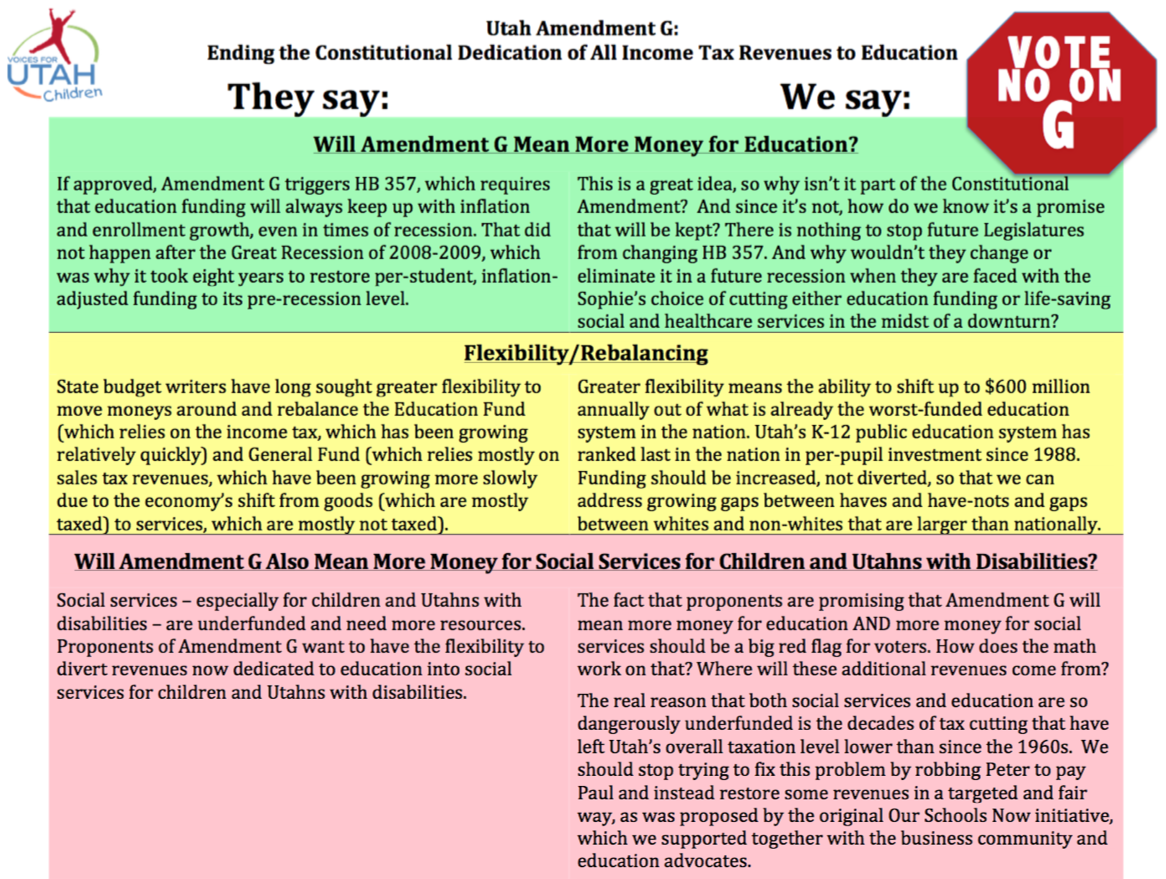

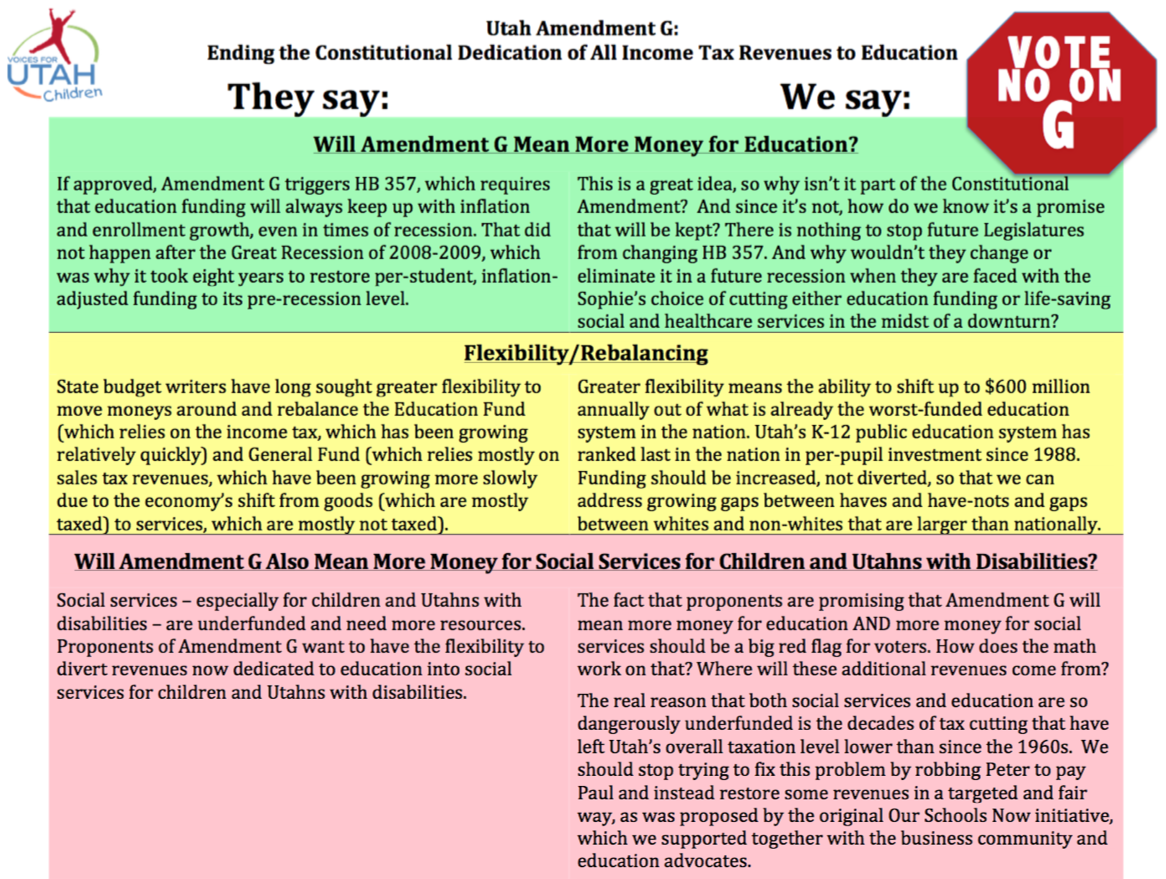

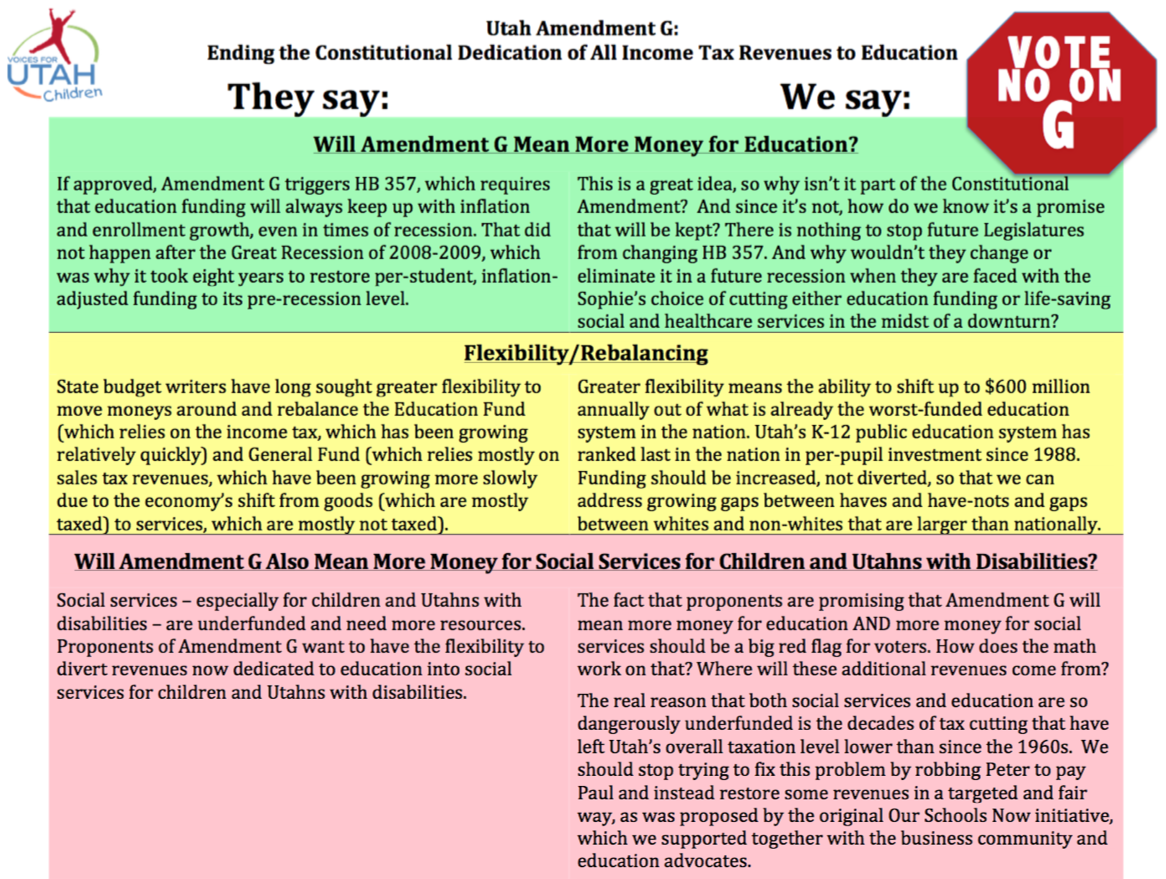

The state's leading child research and advocacy organization Voices for Utah Children announced its opposition to Constitutional Amendment G in an online press conference today (Monday, October 5, 2020).

Constitutional Amendment G is the proposal to amend the Utah State Constitution to end the Constitutional earmark of all income tax revenues for education. Since 1946 Utah has dedicated 100% of income tax revenues to education, initially defined only as K-12 education and, since 1996, including also higher education. The State Legislature voted in March to place on the ballot the question of also allowing these funds to be used for other purposes -- specifically for programs for children and for Utahns with disabilities.

The arguments made by proponents and opponents are summarized in an online document prepared by the state election administrators in the Lt Governor's office. According to that document, "the state spends about $600 million annually of non-income tax money on programs for children and programs that benefit people with a disability."

Voices for Utah Children CEO Maurice "Moe" Hickey explained the organization's decision to oppose the Amendment: "We believe that the proposed Amendment not only won’t solve Utah’s state budget woes, it is likely to delay the real fiscal policy changes that are needed. Over the past decade we have been continuously ranked last in the country for per pupil spending. This is a caused by our growth in number of students, combined with a lowered tax burden in the past decade. A major question we have to ask is “if the current Constitutional earmark has failed to help Utah invest more in education, how will getting rid of it improve matters?” The unfortunate reality is that getting rid of the Constitutional earmark of income tax for education does nothing to solve the real problem, which is the fact that nearly every area of state responsibility where children are impacted – education, social services, public health, and many others – is dangerously underfunded."

Health Policy Analyst Ciriac Alvarez Valle said, "Utah has one of the highest rates of uninsured children in the country at 8% or 82,000 children, and we have an even higher rate of uninsured Latino children at almost 20%. It is alarming that even during this pandemic, children and families are going without health insurance. There are so many ways to reverse this negative trend that began in 2016. Some of the solutions include investing in our kid’s healthcare. By investing in outreach and enrollment efforts especially those that are culturally and linguistically appropriate for our communities of color, we can ensure they are being reached. We also have to invest in policies that keep kids covered all year round and ensures they have no gaps in coverage. and lastly, we have to invest in covering all children regardless of their immigration status. By doing these things we can ensure that kids have a foundation for their long term health and needs. It's vital that we keep children’s health at the forefront of this issue, knowing that kids can only come to school ready to learn if they are able to get the resources they need to be healthy."

Health Policy Analyst Jessie Mandle added, "All kids need to have care and coverage in order to succeed in school. We are no strangers to the funding challenges and the many competing demands of social services funding. Without greater clarity, more detail, and planning, we are left to ask, are we simply moving the funding of children’s health services into another pool, competing with education funding, instead of prioritizing and investing in both critical areas? Sufficient funding for critical children’s services including school nurse, home visiting and early intervention, and school-based preventive care remains a challenge for our state. We have made important strides in recent years for children’s health, recognizing that kids cannot be optimal learners without optimal health. Let’s keep investing, keep moving forward together so that kids can get the education, health and wraparound services they need."

Education Policy Analyst Anna Thomas: "We often hear that UT is dead last in the nation in per pupil funding. We have also heard from such leaders as Envision Utah that millions of dollars are needed to avert an urgent and growing teacher shortage. What we talk about less is the fact that these typical conservative calculations of our state’s underfunding of education don’t include the amount the state should be paying for the full-day kindergarten programming most Utah families want, nor does it include the tens of millions our state has never bothered to spend on preschool programs to ensure all Utah children can start school with the same opportunities to succeed. Utah currently masks this underfunding with dollars from various federal programs, but this federal funding is not equitably available to meet the needs of all Utah children who deserve these critical early interventions. The state also increasingly relies on local communities to make up the difference through growing local tax burdens - which creates an impossible situation for some of our rural school districts, where local property tax will never be able to properly fund early interventions like preschool and full-day kindergarten along with everything else they are responsible for. Our lack of investment in early education is something we pay for, much less efficiently and much less wisely, later down the road, when children drop out of school, experience mental and physical health issues, and get pulled into bad decisions and misconduct. If kids aren’t able to hit certain learning benchmarks in literacy and math by third grade, their struggles in school - and often by extension outside of school - multiply. We should be investing as much as possible in our children to help ensure they have real access to future success - and can contribute to our state's future success. You don’t have to be a math whiz - third grade math is probably plenty - to see that the general arithmetic of Amendment G, and the attendant promises of somehow more investment in everything that helps kids - just doesn’t add up. We have multiple unmet early education investment obligations right now. Beyond that, we have many more needs, for children and for people with disabilities, that we must be sensitive to as a state especially during a global pandemic. How we will ensure we are investing responsibly in our children and our future, by having MORE expenses come out of the same pot of money - which the legislature tells us every year is too small to help all the Utah families we advocate for - is still very unclear to me. Until that math is made transparent to the public, we have to judge Amendment G to be, at best, half-baked in its current incarnation."

Fiscal Policy Analyst Matthew Weinstein shared information from the Tax Commission (see slide #8) showing that Utah's overall level of taxation is now at its lowest level in 50 years relative to Utahns' incomes, following multiple rounds of tax cutting. He also shared recent survey data from the Utah Foundation showing that three-fourths of Utahns oppose cutting taxes further and are ready and willing to contribute more if necessary to help solve the state's current challenges in areas like education, air quality, and transportation. He also contrasted the public's understanding that there's no "free lunch" with the unrealistic election-year promises made by our political leadership -- more money for both education and social services if the public votes for Amendment G -- even though Amendment G does nothing to reverse any past tax cuts and address the state's chronic revenue shortages.

The organization shared a one-page summary of the arguments (available here in pdf format) for and against the proposed Constitutional Amendment:

Voices for Utah Children has also published a full five-page position paper that is available in pdf format.

This press conference was broadcast live at

Media coverage:

The state's leading child research and advocacy organization Voices for Utah Children announced its opposition to Constitutional Amendment G in an online press conference today (Monday, October 5, 2020).

Constitutional Amendment G is the proposal to amend the Utah State Constitution to end the Constitutional earmark of all income tax revenues for education. Since 1946 Utah has dedicated 100% of income tax revenues to education, initially defined only as K-12 education and, since 1996, including also higher education. The State Legislature voted in March to place on the ballot the question of also allowing these funds to be used for other purposes -- specifically for programs for children and for Utahns with disabilities.

The arguments made by proponents and opponents are summarized in an online document prepared by the state election administrators in the Lt Governor's office. According to that document, "the state spends about $600 million annually of non-income tax money on programs for children and programs that benefit people with a disability."

Voices for Utah Children CEO Maurice "Moe" Hickey explained the organization's decision to oppose the Amendment: "We believe that the proposed Amendment not only won’t solve Utah’s state budget woes, it is likely to delay the real fiscal policy changes that are needed. Over the past decade we have been continuously ranked last in the country for per pupil spending. This is a caused by our growth in number of students, combined with a lowered tax burden in the past decade. A major question we have to ask is “if the current Constitutional earmark has failed to help Utah invest more in education, how will getting rid of it improve matters?” The unfortunate reality is that getting rid of the Constitutional earmark of income tax for education does nothing to solve the real problem, which is the fact that nearly every area of state responsibility where children are impacted – education, social services, public health, and many others – is dangerously underfunded."

Health Policy Analyst Ciriac Alvarez Valle said, "Utah has one of the highest rates of uninsured children in the country at 8% or 82,000 children, and we have an even higher rate of uninsured Latino children at almost 20%. It is alarming that even during this pandemic, children and families are going without health insurance. There are so many ways to reverse this negative trend that began in 2016. Some of the solutions include investing in our kid’s healthcare. By investing in outreach and enrollment efforts especially those that are culturally and linguistically appropriate for our communities of color, we can ensure they are being reached. We also have to invest in policies that keep kids covered all year round and ensures they have no gaps in coverage. and lastly, we have to invest in covering all children regardless of their immigration status. By doing these things we can ensure that kids have a foundation for their long term health and needs. It's vital that we keep children’s health at the forefront of this issue, knowing that kids can only come to school ready to learn if they are able to get the resources they need to be healthy."

Health Policy Analyst Jessie Mandle added, "All kids need to have care and coverage in order to succeed in school. We are no strangers to the funding challenges and the many competing demands of social services funding. Without greater clarity, more detail, and planning, we are left to ask, are we simply moving the funding of children’s health services into another pool, competing with education funding, instead of prioritizing and investing in both critical areas? Sufficient funding for critical children’s services including school nurse, home visiting and early intervention, and school-based preventive care remains a challenge for our state. We have made important strides in recent years for children’s health, recognizing that kids cannot be optimal learners without optimal health. Let’s keep investing, keep moving forward together so that kids can get the education, health and wraparound services they need."

Education Policy Analyst Anna Thomas: "We often hear that UT is dead last in the nation in per pupil funding. We have also heard from such leaders as Envision Utah that millions of dollars are needed to avert an urgent and growing teacher shortage. What we talk about less is the fact that these typical conservative calculations of our state’s underfunding of education don’t include the amount the state should be paying for the full-day kindergarten programming most Utah families want, nor does it include the tens of millions our state has never bothered to spend on preschool programs to ensure all Utah children can start school with the same opportunities to succeed. Utah currently masks this underfunding with dollars from various federal programs, but this federal funding is not equitably available to meet the needs of all Utah children who deserve these critical early interventions. The state also increasingly relies on local communities to make up the difference through growing local tax burdens - which creates an impossible situation for some of our rural school districts, where local property tax will never be able to properly fund early interventions like preschool and full-day kindergarten along with everything else they are responsible for. Our lack of investment in early education is something we pay for, much less efficiently and much less wisely, later down the road, when children drop out of school, experience mental and physical health issues, and get pulled into bad decisions and misconduct. If kids aren’t able to hit certain learning benchmarks in literacy and math by third grade, their struggles in school - and often by extension outside of school - multiply. We should be investing as much as possible in our children to help ensure they have real access to future success - and can contribute to our state's future success. You don’t have to be a math whiz - third grade math is probably plenty - to see that the general arithmetic of Amendment G, and the attendant promises of somehow more investment in everything that helps kids - just doesn’t add up. We have multiple unmet early education investment obligations right now. Beyond that, we have many more needs, for children and for people with disabilities, that we must be sensitive to as a state especially during a global pandemic. How we will ensure we are investing responsibly in our children and our future, by having MORE expenses come out of the same pot of money - which the legislature tells us every year is too small to help all the Utah families we advocate for - is still very unclear to me. Until that math is made transparent to the public, we have to judge Amendment G to be, at best, half-baked in its current incarnation."

Fiscal Policy Analyst Matthew Weinstein shared information from the Tax Commission (see slide #8) showing that Utah's overall level of taxation is now at its lowest level in 50 years relative to Utahns' incomes, following multiple rounds of tax cutting. He also shared recent survey data from the Utah Foundation showing that three-fourths of Utahns oppose cutting taxes further and are ready and willing to contribute more if necessary to help solve the state's current challenges in areas like education, air quality, and transportation. He contrasted the public's understanding that there's no "free lunch" with the unrealistic election-year promises made by our political leadership -- more money for both education and social services if the public votes for Amendment G -- even though Amendment G does nothing to reverse any past tax breaks and address the state's chronic revenue shortages.

The organization shared a one-page summary of the arguments for and against the proposed Constitutional Amendment:

The organization also published a full five-page position paper that is available in pdf format.

Family Economic Success

Economic Growth, Taxes, and Investments in Families and Children

Taxes: Every year, Utah's taxes (income, sales, gas, and property taxes) generate revenues that government then expends in ways that profoundly affect families and communities. The fiscal choices Utah makes — such as whether to invest in Utah's future or give in to the temptation to cut taxes below their current overall low level — will make a critical difference in the lives of the next generation of Utahns. If we make the best choices, we can help foster opportunity for all our children and lay the foundations for Utah's future growth and prosperity.

Recently the Utah State Tax Commission and the Utah Foundation both published research showing that taxes in Utah are the lowest that they have been in 30-50 years, following repeated rounds of tax cutting. Tax cutting is thought to be popular, especially in election years, but is it always wise? At some point we need to ask ourselves a difficult question: Is the current generation of Utahns doing our part, as earlier generations did, to set aside sufficient resources every year to invest in our children, in our future, in the foundations of our children's prosperity and quality of life? And more immediately and specifically, given the Coronavirus Recession's expected impacts on the Utah state budget, should we reconsider the 2018 election-year decision to reduce our income tax rate from 5% to 4.95%, a $50 million tax cut that mostly benefitted high-income households?

The supposed popularity of tax cutting has been called into question by 2020 polling data. For example, during the 2020 legislative session, the Deseret News found that only 10% of Utahns thought that the expected Education Fund surplus should be used for tax cuts rather than enhanced education investment. And the Utah Foundation found similar results in their election issue survey -- less than one-quarter of Utahns support tax cuts that erode the state's ability to deliver the services Utahns need, while "74% of Utahns were willing to increase their taxes for a specific benefit" (either education, transportation, or air quality).

Voices for Utah Children's fiscal policy program works to ensure that we invest sufficient resources to ensure that our kids get world-class education and health care as well as special support for children most in need.

At the same time, we also work to ensure that public revenues are generated in ways that are fair. No family should be taxed into poverty as the price of educating their children. Currently, while we've moved in a better direction over the past 25 years, Utah does tax about 100,000 families into or deeper into poverty every year. In addition, the lowest-income Utahns pay a higher overall tax rate (7.5%) than those with the highest incomes (who pay 6.7% of their incomes in state and local taxes). That's one of the reasons why Voices for Utah Children supports making Utah the 30th state in the nation with our own Earned Income Tax Credit (EITC), starting with Utahns working their way out of intergenerational poverty.

Economic Performance: Voices for Utah Children examines and reports on Utah's economic performance from the perspective of how low- and moderate-income Utahns experience the economy -- some examples appear in the links below:

Why Utah Should Invest In Our Future, Not Tax Cuts

Why Should Utah Become the 30th State with Our Own Earned Income Tax Credit (EITC)?

The History of Tax Incidence in Utah 1995-2018

Inequality in Utah Compared to Other States and the Nation

Utah Working Families Economic Performance Benchmarking Project: Utah vs. Idaho

We work to equip lawmakers, journalists, advocacy organizations, other nonprofit service providers and the public with unassailable information that will help children get a quality education, help families get medical care, and help working people get the support they need to build a better life for their children.

2020 Election Guide to Issues Affecting Children

2020 Election Issues Guide

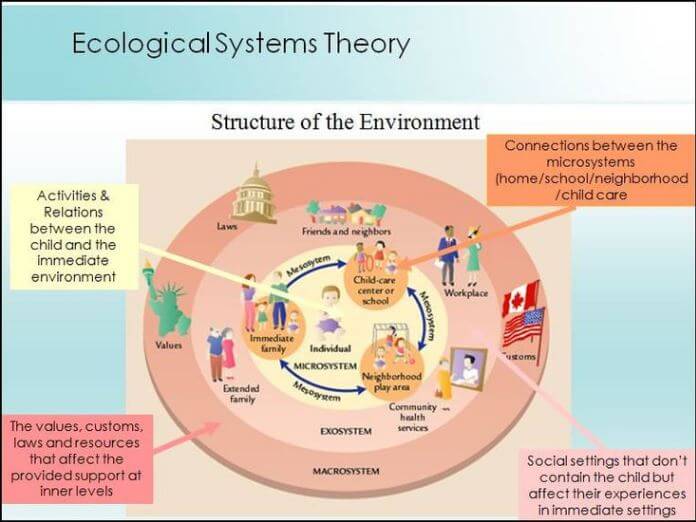

American psychologist Urie Bronfenbrenner formulated the Ecological Systems Theory to explain how the inherent qualities of children and their environments interact to influence how they grow and develop.

American psychologist Urie Bronfenbrenner formulated the Ecological Systems Theory to explain how the inherent qualities of children and their environments interact to influence how they grow and develop.

As Utah grapples with the effects of the coronavirus and COVID-19, this election year challenges us all to think bigger, broader, and longer-term. What lessons must we learn from the public health emergency? What has worked and has not in the actions already taken by state and local authorities? What weaknesses in Utah's economic and social structures were exposed by the pandemic that demand increased attention by Utah's next governor and legislators? What challenges can we now see that we should have addressed years ago to improve our resilience and ability to adapt to emergency circumstances?

While it is certainly true that the direct health effects of the coronavirus impact older adults the most, it is Utah's children who may bear the most lasting scars. Unable to attend school in person, relying on their parents or guardians to be their "home teachers" in a new sense, we already know that tens of thousands of Utah's children will fall behind in ways that will be difficult to make up. The decisions that our new governor and legislators make in the years to come will determine whether and how much our social and economic gaps expand as a result.

The public offices on the ballot in November include:

- Governor and Lt. Governor

- Half of the State Senate

- The entire Utah House of Representatives

Our elected officials play a central role in determining whether all Utah's children have the opportunity to achieve their potential. Will they have access to healthcare and education? Will their families enjoy the economic stability they need to thrive? These are all questions that will be answered by Utah's next governor and legislature.

Voices for Utah Children is providing this Election Issues Guide so that candidates for elected office can better understand the challenges facing Utah's children. We are also seeking to encourage public awareness and dialogue about the needs of children during this year's campaigns so that our new governor and legislature will begin their terms of office prepared to enact effective policies to protect their youngest constituents.

We have divided this Election Issues Guide into five sections:

Tax & Budget/Economic Performance

The Election Issues Guide can also be downloaded as a ![]() 15-page pdf at this link for easier printing.

15-page pdf at this link for easier printing.

Supported by the Annie E. Casey Foundation, our KIDS COUNT® work aims to provide Utah’s legislators, public officials and child advocates with reliable data, policy recommendations and other tools needed to advance the kinds of sound policies that benefit children and families across the state.

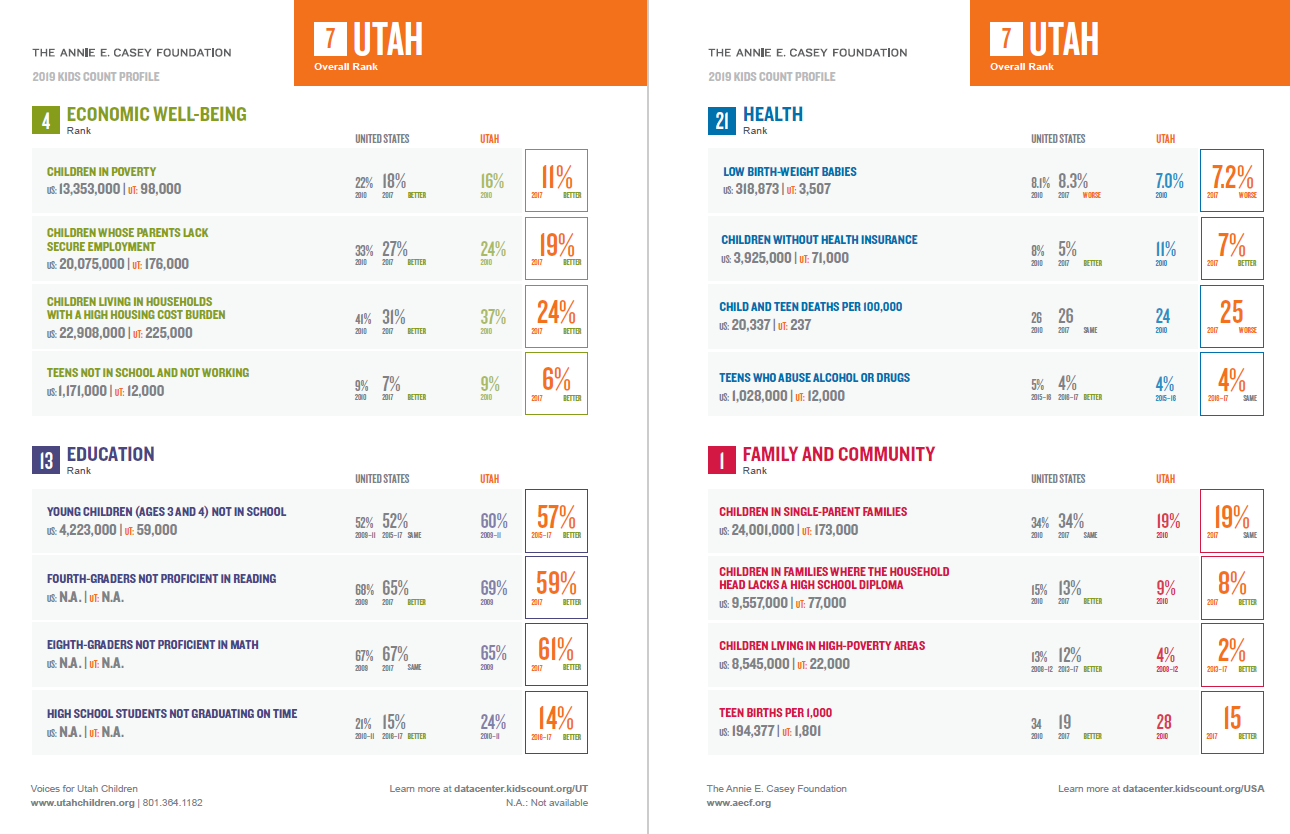

In 2019, Utah held on to its ranking among the top ten in the annual Annie E. Casey Foundation KIDS COUNT® Data Book report, coming in at 7th highest in the nation. We especially shined in the subcategory of "Family and Community," where we ranked #1 thanks to our highest-in-the-nation share of two-parent families and low share of children growing up in high-poverty neighborhoods. We also ranked 4th highest in the subcategory of "Economic Well-Being" thanks to our relatively low share of children in poverty.

But we failed to make the top ten in the other two subcategories in the KIDS COUNT® rankings, due to the fact that public policy has fallen short in precisely those two areas: education and health care. We barely outperformed the nation for high school graduation (and fell behind after adjusting for demographics). And we fell behind in the share of children with health insurance, especially among Utah's Latino children, who suffer from the highest uninsured rate in the nation.

All the KIDS COUNT® ranking details are viewable on the chart and links below.

Terry Haven

Deputy Director

Voices for Utah Children

More Information:

Measures of Well-Being in Utah, 2019

Talking Kids Tour 2019 - A Supplement to the 2019 Utah KIDS COUNT Data Book

Every Utah child deserves the opportunity to reach their full potential, no matter where their family comes from or where they live in our state. No family should be denied care or afraid to seek the care they need. We must ensure that all Utah parents and kids have affordable health coverage and care. That is why Voices for Utah Children spearheads the 100% Kids Coverage Campaign, so that all children in Utah have insurance. Together we can promote healthy communities where all Utah families thrive.

All Utah children, families, and communities should have access to:

Pre-natal care and insurance, including mental health support for caregivers;

Pre-natal care and insurance, including mental health support for caregivers;- Continuous, comprehensive health coverage and care for all Utah kids;

- Healthy communities and environments, including access to healthy food, clean drinking water and clean air.

To learn more about the 100% Kids Coverage Campaign visit: https://utahchildren.org/issues/100-kids-covered

Contact Jessie Mandle or Ciriac Alvarez Valle

More Information:

What Does the Coronavirus Mean for Families’ Access to Health Care?

New Report Finds Number of Uninsured Latino Children in Utah on the Rise

Voices for Utah Children Opposes New Trump Administration Medicaid Block Grant Guidance

Voices for Utah Children opposes Trump Administration Public Charge Rule

Voices for Utah Children celebrates Utah Medicaid Expansion

Voices for Utah Children believes in a youth-centered juvenile justice system that meets the needs of the children involved in it, while producing positive outcomes for Utah families and protecting community safety. We are committed to the belief that children should be nurtured, educated and given an equitable chance at success in life. That means allowing young people to make mistakes, learn from them, develop accountability to themselves and their communities, and work through their own unique challenges as they prepare for their lives as adults.

Voices for Utah Children advocates for juvenile justice system that is fair, effective and equitable. Such a system creates positive outcomes for different children, using evidence-based and culturally-competent programs, that meets the needs of children from a variety of socioeconomic backgrounds, races, ethnicities, physical and mental abilities, religious paths and belief systems, and sexual orientations and gender identities. We'll know that Utah has a fair, effective and equitable system when the youth themselves, their families and their communities, believe that the system is working in their best interest. In addition, we will see existing disparities between children of different races - in terms of contact with the system, the seriousness of dispositions, and the barriers to exiting the system quickly - disappear.

While we actively engage in policy analysis and advocacy directed at the policymakers who are able to remore structural barriers to youth success, we also work to empower advocates and community members alike, arming people with information that allows them to advocate for the young people in their lives who may be system-involved or at risk for system involvement.

More Information:

April 6, 2020 COVID-19 Update on Utah's Juvenile Justice System in: English, Spanish

April 27, 2020 COVID-19 Update on Utah's Juvenle Justice System in: English, Spanish (Part 1 & Part 2)

Good News for Juvenile Justice Reformers, from the 2019 Legislative Session

Report: Utah children face barriers to accessing defense attorneys

Let's End Racial Disparities in Utah's Juvenile Justice System

Anna Thomas, MPA

Anna Thomas, MPA

Senior Policy Analyst

Voices for Utah Children

The early years in a child’s life are critically important in terms of social, emotional and cognitive development. All children deserve to start their lives with a real chance to succeed and be happy later in life, but not all children have access to the things that set them up for that kind of future. We believe that when the wellbeing of young children is at the center of public policy and community investment, our entire state does better.

That is why Voices for Utah Children focuses on promoting targeted investments in early childhood care and education, structured to meet the unique needs (and build on the unique strengths) of Utah's many diverse communities. We believe it is possible to build an early childhood system in Utah that supports families with young children by making sure they have access to affordable and appropriate options for their children’s early care and learning—whether children spend their days at home, in formal child care, at public school, or in the care of trusted family and friends.

Anna Thomas, MPA

Senior Policy Analyst

Voices for Utah Children

More Information:

There’s No “Re-Opening” Utah Without More Child Care

National Orgs Call for Emergency Child Care Sector Relief

Three Things Utah Can Do to Ensure Right-Sized Access to Full-Day Kindergarten

Kinship Care Families Need Our Support

Tax & Budget/Economic Performance

Tax and Budget: Every year, Utah's taxes (income, sales, gas, and property taxes) generate revenues that government then expends in ways that profoundly affect families and communities. The fiscal choices Utah makes — such as whether to invest in Utah's future or give in to the temptation to cut taxes below their current overall low level — will make a critical difference in the lives of the next generation of Utahns. If we make the best choices, we can help foster opportunity for all our children and lay the foundations for Utah's future growth and prosperity.

Last year the Utah State Tax Commission and the Utah Foundation both published research showing that taxes in Utah are the lowest that they have been in 30-50 years, following repeated rounds of tax cutting. Tax cutting is undoubtedly popular, especially in election years, but is it always wise? At some point we need to ask ourselves a difficult question: Is the current generation of Utahns doing our part, as earlier generations did, to set aside sufficient resources every year to invest in our children, in our future, in the foundations of tomorrow’s prosperity and quality of life? And more immediately and specifically, given the Coronavirus Recession's expected impacts on the Utah state budget, should we reconsider the 2018 election-year decision to reduce our income tax rate from 5% to 4.95%, a $50 million tax cut that mostly benefitted high-income households?

Voices for Utah Children's fiscal policy program works to ensure that we invest sufficient resources to ensure that our kids get world-class education and health care as well as special support for children most in need.

At the same time, we also work to ensure that public revenues are generated in ways that are fair. No family should be taxed into poverty as the price of educating their children. Currently, while we've moved in a better direction over the past 25 years, Utah does tax about 100,000 families into or deeper into poverty every year. In addition, the lowest-income Utahns pay a higher overall tax rate (7.5%) than those with the highest incomes (who pay 6.7% of their incomes in state and local taxes). That's one of the reasons why Voices for Utah Children supports making Utah the 30th state in the nation with our own Earned Income Tax Credit (EITC), starting with Utahns working their way out of intergenerational poverty.

Economic Performance: Voices for Utah Children examines and reports on Utah's economic performance from the perspective of how low- and moderate-income Utahns experience the economy -- some examples appear in the links below.

Matthew Weinstein, MPP

State Priorities Partnership Director

Voices for Utah Children

More Information:

Why Utah Should Invest In Our Future, Not Tax Cuts

Why Should Utah Become the 30th State with Our Own Earned Income Tax Credit (EITC)?

The History of Tax Incidence in Utah 1995-2018

Inequality in Utah Compared to Other States and the Nation

Utah Working Families Economic Performance Benchmarking Project: Utah vs. Idaho