Education

A Rough Legislative Session for Utah Kids (Again)

The 2024 Utah Legislative Session ended at midnight on Friday, March 1. For the Voices for Utah Children team, this session included supporting a lot of community engagement, working hard to protect the programs that protect Utah kids, and trying not to get distracted by outlandish efforts to "solve" problems that don't actually exist in Utah.

As usual, there were many, many missed opportunities for state leaders to improve the lives of Utah kids. Nonetheless, we managed to pull off some great victories - as always, in partnership with many supportive community members, our great partner organizations and supportive public servants.

We hosted six different public engagement events at the Capitol over seven weeks. Working closely with our community partners, we stopped some truly terrible legislation that literally threatened the lives of Utah kids who rely on Medicaid and CHIP. Thanks to many supportive child care professionals and working parents, we kept Utah's child care crisis in the media spotlight throughout the session.

For a deeper dive into our efforts in various policy areas, as well as a recap of what happened to the many different bills we were tracking, check out the virtual booklet below!

The Governor’s 2024 Budget: Hits and Misses for Utah Families

Governor Cox unveiled his budget last week, and the general direction of the budget is positive. Voices for Utah Children is interested in some specific components of the budget that directly impact Utah children and their families:

Public Education

$854 million increase, including a 5% jump in per-pupil funding and $55 million for rural schools

This is a much-needed investment in public education. We support the focus on rural schools and are anxious to see the details as they emerge. Public education consistently polls as a top priority for Utahns of all political parties and backgrounds.

Support for Utah Families

$4.7 million to expand Utah’s child tax credit and $5 million for accessible child care

We appreciate the fact that the Governor has begun to address the urgent needs of Utah families with young children. However, both allocations fall far short of the amount required to truly support and elevate these young families’ current needs. A truly impactful child tax credit would require an investment of at least $130 million, and the benefits in reducing child poverty in Utah would be substantial. Our recent report on child care in Utah clearly illustrates the need for bold action to support families in the workforce, who are struggling with the cost and unavailability of child care. The Governor’s $5M project will help very few Utah families and does not address the true need.

Housing

$128 million for homeless shelters and $30 million for deeply affordable housing

We support the Governor in his effort to better support the homeless residents of our state. We encourage a greater focus on expanding support for homeless children specifically. Early care and education opportunities for young children as well as more supportive programs for their parents and caregivers are critical to helping families find stable housing and better future opportunities. Investing in deeply affordable housing will help many Utah families.

Behavioral/Mental Health

$8 million for behavioral and mental health

This is not enough to address the current mental health needs of Utahns – in particular, those of our children and the folks tasked with raising them. We need more mental health professionals and greater access to services. We know this is a major concern for the Governor and we encourage increased strategic investment in this area.

It is also important to acknowledge and applaud some items the Governor wisely left out of his proposed budget:

No Proposed Tax Cuts

Utahns want to see more invested in our children while they are young, to prevent greater challenges later in life. It is our children who suffer most, when politicians toss our tax dollars away on polices that mostly benefit the wealthiest 1% of Utah households.

No Proposed Funding for Vouchers

Public funds should not be redirected to private entities. Utah needs an annual audit of the current program, to assess who is benefitting from school vouchers. In other states, the results are not good – vouchers are looking more and more like a tax break for wealthy families.

Bold Investments Needed for Utah's Children

Governor Cox's budget focuses on increasing funding for education, families, and affordable housing.

These are all areas where we believe bold investment is needed. We support the Governor in addressing these issues, but cannot overlook how this budget falls short in the face of the ongoing struggles faced by Utah families with children.

We encourage our Legislature to use the Governor’s budget as a roadmap and increase the allocations to the amount needed.

Our 2024 Legislative Agenda

At Voices for Utah Children, we always start with this guiding question: "Is it good for all kids?" That remains our north star at the outset of the 2024 legislative session, and is reflected in our top legislative priorities.

So, what’s good for all kids in 2024?

A Healthy Start!

A healthy start in life ensures a child's immediate well-being while laying a foundation for future success. We are steadfast in our commitment to championing policies that prioritize every child's physical, mental, and emotional well-being. Central to this commitment is our focus on improving Utah’s popular Medicaid and CHIP programs, which are pivotal in the lives of many Utah children and families.

This legislative session, a healthy start for kids looks like:

- Empowering Expectant Mothers: We support a proposal from Rep. Ray Ward (R-Bountiful) to increase access to health coverage for low-income and immigrant mothers-to-be.

- Increasing Access to Health Care: We support bills that aim to improve access to the vital healthcare services children and parents need, especially for those on Medicaid and CHIP.

- Protecting Health Coverage: We oppose any effort to defund, and exclude deserving children from, the Medicaid and CHIP programs that help thousands of Utah kids every year.

Early Learning and Care Opportunities!

The formative years of a child's life lay the foundation for their future, shaping their cognitive abilities, socio-emotional skills, and passion for learning. We will support efforts to increase access to home visiting programs and paid family leave, but ensuring consistent, quality, and affordable child care is our top priority.

This legislative session, early learning and care opportunities for kids looks like:

- Bolstering Access to Quality Child Care: We support the efforts of both Rep. Andrew Stoddard (D-Sandy) and Rep. Ashlee Matthews (D-Kearns) to extend the successful Office of Child Care stabilization grant program that has supported licensed child care programs statewide.

- Investing in High-Quality Preschool: We support an anticipated legislative proposal to streamline Utah’s existing high-quality school-readiness program and to make it available to more preschoolers statewide.

- Recruiting and Retaining Child Care Professionals: We support Rep. Matthews’ proposal to expand access to the Child Care Assistance Program for anyone working in the child care sector.

- Building New Child Care Businesses: We also support Rep. Matthews’ proposal to continue funding for work to develop and support new child care programs in rural, urban, and suburban areas.

To view a more comprehensive list of our 2024 early care and learning legislative priorities, click here.

Economic Stability for Families with Children!

Economic stability forms the bedrock of thriving families and vibrant communities. To ensure that young families in Utah have the support they need to afford basic necessities, we will advocate for increasing families’ access to Utah's earned income and child tax credits.

This legislative session, economic stability for families looks like:

- A Little Extra Help in the Early Years: We support HB 153, Rep. Susan Pulsipher’s (R-South Jordan) bill to expand Utah’s new Child Tax Credit, (currently only for children ages 1 to 3), to apply to children between 1 and 5 years of age. We also strongly recommend helping even more Utah families with young children by making the tax credit available for families with any child between birth and 5, and expanding it to include the thousands of lower- and moderate-income families who are currently excluded.

- Credit for Working Families with Kids: We support HB 149, Rep. Marsha Judkins’ (R-Provo) bill to expand Utah’s Earned Income Tax Credit so that more lower- and middle-income families with children can benefit.

Justice for Youth!

We want to ensure that all youth, including those who come into contact with the juvenile justice system, have access to interventions and supports that work for them and for their families. We are dedicated to advancing policies and recommendations that contribute to a more fair and equitable juvenile justice system for all Utah youth.

This legislative session, justice for youth looks like:

- Prioritizing School Safety: We are monitoring bills from Rep. Wilcox (R-Ogden) and the School Safety Task Force, including: HB 14, “School Threat Penalty Amendments” and HB 84, “School Safety Amendments.” We remain hopeful that these efforts will support a secure learning environment for all students, without contributing further to the School-to-Prison Pipeline.

Be an Advocate!

As we chart the path forward, one thing remains abundantly clear: the well-being, growth, and future of Utah's children rely on the decisions we make today. Each legislative session presents an opportunity—a chance to reaffirm our commitment, reevaluate our priorities, and reimagine a brighter, more inclusive future for all.

Together we can continue to make Utah a place where every child's potential is realized, their dreams are nurtured, and their voices are heard.

Below are some ways you can get involved this session.

Stay Informed with our Bill Tracker

Stay informed about important legislation we are watching and reach out to your local representatives to let them know how you feel about legislation that is important to you. We make it easy for you to subscribe and watch bills that you are most concerned about.

Join us for Legislative Session Days on the Hill

Join us at the Capitol, where we offer attendees the opportunity to engage in the legislative process on a specific issue area (health and/or child care). You'll have the chance to attend bill hearings, lobby your legislators, connect with fellow community advocates, and watch House and Senate floor debates. Click the button below for the dates/times of our meetings and to RSVP.

Celebrate Utah's Immigrant Community

In collaboration with our partners at UT With All Immigrants, the Center for Economic Opportunity and Belonging, and I Stand with Immigrants, we are organizing Immigrant Day on the Hill. Join us to discover ways to engage in Utah's civic life. Enjoy food, explore resource tables, participate in interactive activities, and entertainment. Everyone is invited to attend this free event!

Event Details: February 13, 2024, 3:30pm-5:30pm at the Capitol Rotunda, 350 State St, Salt Lake City, UT 84103

Utah Children's Budget 2023

The care for the children in our state and communities can be measured by our public investment in our smallest humans. From the fiscal year 2008 to 2022, Voices for Utah Children divided all state programs concerning children into seven categories, without regard to their location within the structure of state government to quantify the level of public funding and identify trends. The seven categories are:

- K-12 Education

- Health

- Food & Nutrition

- Early Childhood Education

- Child Welfare

- Juvenile Justice

- Income Support

An appendix of our tables, sources, methodology and description of programs can be found here.

How Much We Spend

The interactive circle chart below compares how much we spend by category, program, and source of funding, just use the filter and click the category to zoom in.

-

K-12 Education makes up 92% of the state-funded portion of the Children’s Budget, while the federal-funded portion is more diversified across categories.

Spending Trends

We compare the budget to FY2008 because that was a peak year in the economic cycle before The Great Recession and all figures have been adjusted for inflation, so they are comparable across time.

- From FY2008 to FY2022, total public investment in children increased by 43%, growing much faster than Utah’s public-school enrollment (district & charter schools) by 26%, or the child population ages 0-17 by 13% from 2008-2021.

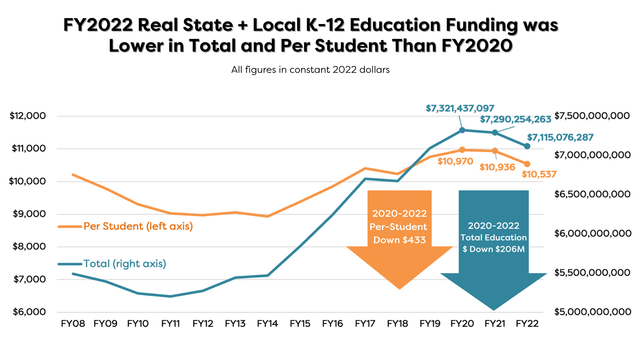

The federal share of the Children's Budget has fluctuated between 18-26% but had its biggest increase at the beginning of the Great Recession and the Covid-19 Pandemic. This is also when state funding for the Children's Budget has declined, for example real state & local K-12 education funding fell by $206 million since FY2020, the largest two-year decline since the Great Recession in 2008-2010. Several years after the Great Recession the federal share of the Children’s Budget decreased and the state share started to increase again, something that will hopefully happen again as pandemic relief funding rolls back.

Funding Sources: Federal vs. State

When the categories are disaggregated by source of funding, Food & Nutrition, Income Support, Health, and Early Childhood Education programs are mainly funded by federal sources, and Child Welfare, K-12 Education, and Juvenile Justice programs are funded mainly by state sources. And since Amendment G passed and allowed the income tax to be used to fund programs for children (in addition to K-12 and some Early Childhood Education & Nutrition Programs), the Child Welfare, Juvenile Justice, and Health categories are funded primarily by the income tax. In FY2022, 98% of Juvenile Justice, 100% of Child Welfare, and 88% of Health categories of the state funded Children's Budget were funded by the income tax totaling to $475 M.

When examining the state-funded portion of the budget since FY2008 each category has a different story.

- Juvenile Justice programs declined the most in dollar amount, $32.9 M or 28% mainly due to a reduction in correctional facility and rural programs and it also had an increase in early intervention services which advocates consider to be a goal of juvenile justice reform.

- Child Welfare programs declined by 16% or $21.8 M, mainly from the Service Delivery program which funds caseworkers to deliver child welfare, youth, and domestic violence services.

- Income Support declined 49% or $2.1 M and appears to be more cyclical, rising and falling with the Great Recession. Interestingly, the TANF grant is a mix of state and federal funds, and only a small amount goes to Income Support or cash assistance.[i]

- Food & Nutrition increased by 56% or $19.7 M due to an increase in liquor & wine tax revenues which supports the school lunch program.

- Early Childhood Education had the largest percentage increase of 109% or $42.0 M mainly from the Upstart program but increasing in every program except Child Care Assistance.

- Health has increased by 80% or $139.3 M from the Medicaid and CHIP program but also had a 58% or $12.4 M decrease in Maternal & Child Health.

- The category that has increased the most in dollar amount is K-12 Education.

K-12 Education Funding

State and local sourced funding for K-12 education increased by $1.6 billion in constant 2022 dollars from FY2008 to FY2022, but per-pupil spending only increased from $10,212 to $10,537 per student. This means that even though more is being spent in total dollars, it barely covers the increase in students during the same time.

In 1948, 100% of the income tax was allocated to public education, an increase from 75% when it was originally imposed in 1931. It was expanded in 1996 to include higher education, in 2021 to include non-education services for children and people with a disability, and may be expanded again depending on a 2024 ballot measure placed by the Utah Legislature.

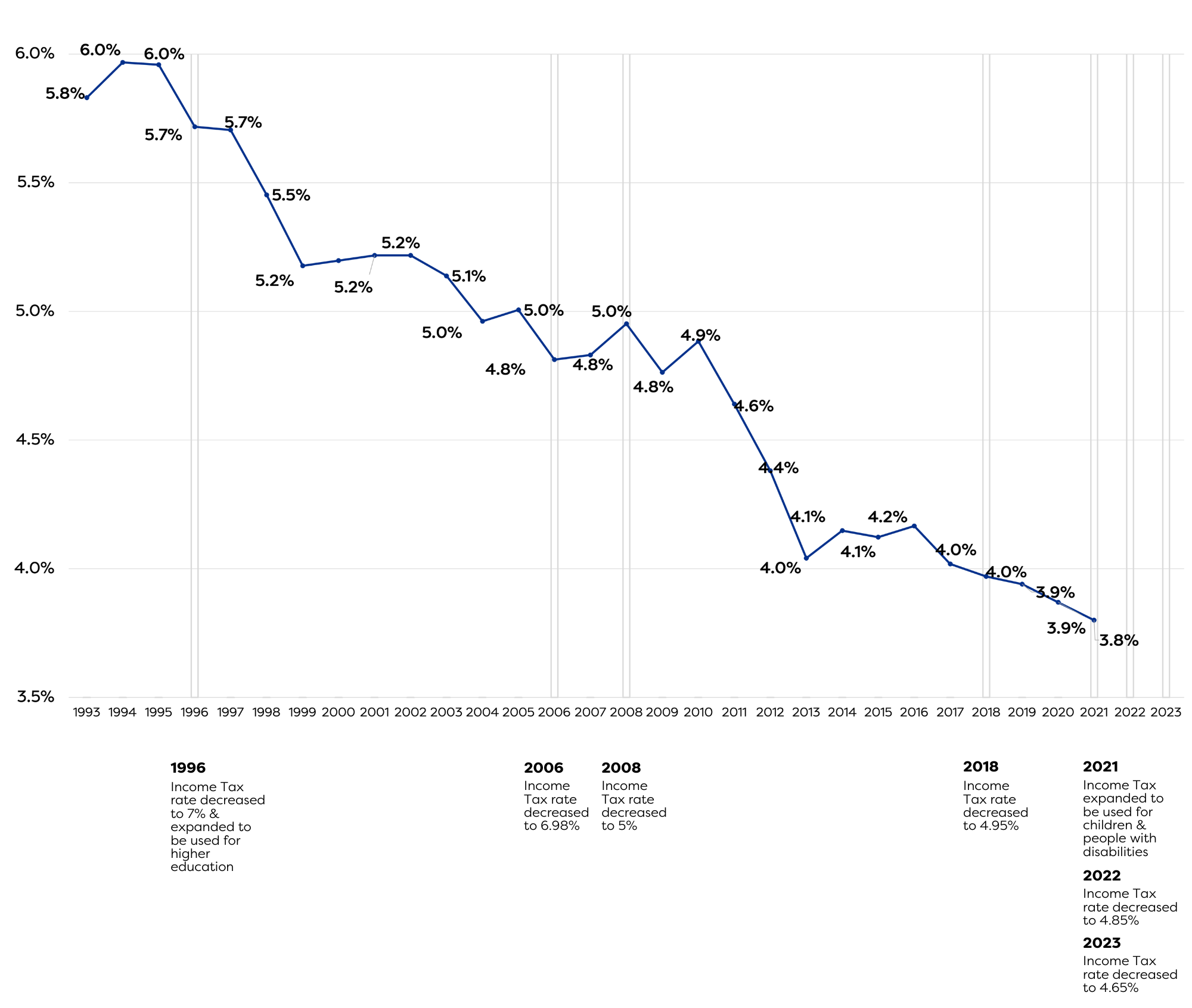

The income tax rate has been reduced in 1996, 2006, 2008, 2018, 2022, and 2023. The graphs below illustrate a timeline of these changes and Utah’s total elementary and secondary public schools (district & charter) funding effort (including capital) as a percentage of personal income and rank compared to other states.

Unfortunately, the result is a downward trajectory and likely explains our second to last place in per-pupil funding in the country.[ii]

Utah's Education Funding Effort as a Percent of Personal Income

According to the fiscal notes, the last two bills that reduced the Income Tax rate in 2022 and 2023 estimated a loss of $1.3 billion in the Income Tax Fund from FY2022-2025 with more ongoing.[iii]

State & Local Funded Portion of K-12 Education

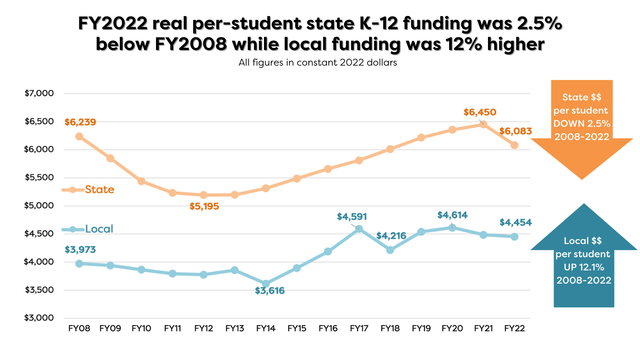

Another result of these changes has been shifts in the funding source for K-12 education. From the fiscal year 2008 to 2022, the federal-funded portion increased by 74% and the state-funded portion declined by 3%.

Meanwhile, Local sources have increased by 12%, possibly to meet the needs of their communities while state-funded sources decline and putting greater pressure on sources like the property tax which is more regressive than the income tax because it takes a greater toll on low-and middle-income families.

Rank of Utah's Education Funding Effort Compared to Other States

We Need to Prioritize Children in the Budget

While Utah doesn’t have the most kids than any other state, we do have the highest share of kids in our population. And we as a community are entrusted to make sure they are cared for, safe, and have the tools they need to achieve their aspirations. As the Utah Legislature drafts, holds hearings on, debates, and passes the Utah state budget we hope they prioritize our most vulnerable and precious group, Utah’s children.

[i] https://www.cbpp.org/sites/default/files/atoms/files/tanf_spending_ut.pdf

[ii] https://www.census.gov/programs-surveys/school-finances.html

[iii] https://le.utah.gov/~2022/bills/static/SB0059.html, https://le.utah.gov/~2023/bills/static/HB0054.html These fiscal notes show the loss from the income tax fund but they are not disaggregated by changes from the income tax rate or tax credit portion of the bills.

Utah’s family demographics have changed. 53% of Utah families have all available parents in the workforce, making child care a necessity. These days, most Utah families need two incomes to maintain financial stability. But Utah’s licensed child care system struggles to meet the demand. Licensed child care program capacity is only sufficient to serve about 36% of all children under six whose parents are working.

To provide a comprehensive picture of Utah's current child care crisis, this report produced by Voices for Utah Children examines the availability of licensed child care across the state, and in each individual county. By conducting a detailed analysis of both the demand and supply of child care services, the report aims to provide policymakers and the public with a clear understanding of the urgent need for child care reform.

Download a copy of the report here.

County-Level Data

Child Care Access Data Fact Sheets by County are also available on our Utah Care for Kids website. Look up child care access in your county today!

Statewide Data

Children Potentially in Need of Care |

|

| All Children Under 6 Years Old | 289,240 |

| Children Under 6 Years Potentially in Need of Care | 154,229 |

| Rate of Children Under 6 with Potential Child Care Needs | 53% |

Licensed Child Care Programming |

|

| Home-based Child Care Programs | 940 |

| Center-based Child Care Programs | 427 |

| Total Licensed Slots | 54,804 |

| Percent of Child Care Need Met | 36% |

Cost of Care for Families |

|

| Average Annual Cost Home-based Child Care for Infant/Toddler | $8,267 |

| Average Annual Cost Center-based Child Care for Infant/Toddler | $11,232 |

| Average Annual Cost Home-based Child Care for Preschool-Aged Child | $7,311 |

| Average Annual Cost Center-based Child Care for Preschool-Aged Child | $8,487 |

| Number of Children Eligible for Subsidies | 81,805 |

| Number of Children Receiving Subsidies | 11,665 |

| Rate of Eligible Children Receiving Subsidies | 14% |

Child Care Workforce Compensation |

|

| Median Hourly Wage for Child Care Professionals | $12.87 |

| Median Annual Salary for Child Care Professionals | $26,770 |

Takeaways

There is insufficient licensed child care in Utah to meet the needs of working families.

There are more than 154,000 children under the age of six living in Utah with all available parents in the workforce. But, there are only 54,804 licensed child care spots in 1,367 programs statewide. Licensed child care program capacity is only sufficient to serve about 36% of all children under six whose parents are working. That means the working families of nearly two-thirds of Utah’s youngest children must rely on alternate arrangements (such as utilizing family members, hiring or sharing a nanny, alternating parent work schedules, using unlicensed child care providers, or some combination of these).

The high cost of child care makes it even less accessible to low- and middle-income families, and rural families struggle most.

Affordability remains a significant hurdle with child care costs often consuming a substantial portion of a family’s income. The U.S. Department of Health and Human Services defines affordable child care as care that costs no more than 7% of a family's income. In Utah, the average annual cost of care for two children under the age of six (one infant, one preschool-aged child is $16,890, taking up about 17% of family’s income. For a family in rural Grand County, the cost of that care is actually higher at $17,339, consuming 41% of their income. The lack of dramatic differences in child care prices from county to county is an illustration of how little flexibility providers have to reduce tuition costs for parents, even in areas of the state where family incomes clearly can’t keep up.

How costs play out for a typical four-person family with one infant/toddler and one preschool-aged child |

|

| Median Four-Person Family Household Income | $100,752 |

| Average Annual Cost of Toddler/Infant Care | $9,193 |

| Average Annual Cost of Preschool-Aged Care | $7,678 |

| Considered "Affordable" Child Care for this Family | $7,053 |

| Average Amount this Family Will Spend on Child Care | $16,871 |

| Percent of Income this Family Will Spend on Child Care | 17% |

Licensed child care is insufficient in every county in Utah, though the level of unmet need varies from place to place.

Summit County emerges as the county with the highest percentage of child care need met (54%), followed by Carbon, (48%) Sevier (45%), Grand (45%), Salt Lake (45%), and Iron Counties (41%). All other counties have less than 40% of child care need met with licensed program capacity, and multiple rural counties (Daggett, Piute, Rich, and Wayne) have no licensed child care available at all.

With substantial public investment, Utah’s child care system has grown 31% since the start of the COVID pandemic.

Through various federal funding streams, nearly $600 million has worked to grow Utah’s child care capacity from approximately 42,000 licensed slots in March 2020 to over 54,000 in August 2023. In contrast to many other states, Utah has managed to increase its licensed child care capacity - despite substantial pandemic disruptions - through stabilization grants paid directly to existing providers for wage supplementation, startup support for new programs, and a one-time worker bonus of $2,000 per child care professional. These financial investments both expanded the enrollment capacities of existing programs as well as recruited new providers into the sector. However, with the ending of this funding in October 2023, Utah risks jeopardizing this incredible progress.

Recommendations

1. Commit to Public Investment in Child Care

Utah’s child care crisis requires public investment. Funding is needed to bridge the gap between what families can afford and the true cost of care. While businesses can contribute, their capacity to address this crisis is limited. There is no sufficient source of investment to address child care’s market failure aside from public funding. Child care should be valued in the same ways as the public education system, ensuring equal access and opportunities for all children. Currently, the burden of expensive early education falls largely on Utah families, with minimal public support, even though most brain development occurs before age six.

2. Help Parents Afford the Care They Want

Utah’s current child care system doesn’t promote parent choice. Child care affordability and accessibility severely limit family choice when it comes to child care, forcing decisions based on cost or access, rather than preference. This also impacts family planning and career choices. Parents are forced to make difficult choices, such as changing jobs, adjusting school and work schedules, or choosing suboptimal child care situations. To address these issues, policymakers should consider improving the child care subsidy program, expanding the child tax credit, and finding ways to help alleviate the financial burden on Utah families.

3. Support the Critical Work of Child Care Professionals

Child care professionals face significant financial challenges. Low wages and a lack of benefits, including healthcare and retirement, have made the profession unsustainable, leading to high rates of turnover each year. Since Utah’s current child care system only meets 36% of the state's need, Utah must invest in the early child care profession to attract and retain a robust workforce. To support child care providers, policymakers should consider measures including state funding of Child Care Stabilization Grants, wage supplement programs, eliminating barriers to licensure, and increasing access to employment benefits.

For questions or inquiries regarding this report, please contact Voices staff members:

It’s Official: Access to Licensed Child Care Statewide is Really Bad (and Getting Worse)

We know that Utah’s child care crisis is bad, and is going to get worse. New data helps illustrate exactly how bad the situation is, in each county across the state.

Next week Voices for Utah Children will release a report titled, “Mapping Care for Kids: A County-Level Look at Utah’s Crisis in Licensed Child Care.” The report includes more detailed county-level analysis and data highlighting the inaccessibility of care and financial challenges faced by families and child care professionals. In addition, the report includes policy recommendations for Utah leaders to help resolve this crisis.

The full report will be available the week of October 23rd, but as a teaser, this blog highlights some key findings from the report.

There is insufficient licensed child care in Utah to meet the needs of working families.

Licensed child care program capacity is only sufficient to serve about 36% of all children under six whose parents are working. Parents face shortages in every county statewide, with rural families struggling most.

The high cost of child care makes it even less accessible to low- and middle-income families, and rural families struggle most.

The average annual cost of care for two children under the age of six (one infant/toddler, one preschool-aged child) for a Utah family costs about 17% of a 4-person family’s income. Cost varies little between rural and urban counties, but on average household median incomes are lower in rural areas. In Grand County, with the state’s lowest median annual income at $42,654, the cost of care for a family of four would comprise about 41% of a family’s income.

Child care providers receive insufficient compensation, and have few incentives to stay in the field.

Child care providers typically earn low wages and very limited benefits. The median hourly wage for child care professionals in Utah is just $12.87 per hour ($26,770/year), less than they could make as professional dog walkers. The poverty rate among child care providers in Utah is 23.1%, more than 8 times higher than that of K-8 teachers.

With substantial public investment, Utah’s licensed child care capacity has grown significantly since the start of the COVID-19 pandemic.

Thanks to federal funding streams totaling nearly $600 million, licensed child care capacity in Utah has grown by approximately 31% since March 2020. This growth is due primarily to child care stabilization grants made directly to licensed child care providers; those grants recently were reduced by 75%. Utah has been identified as one of six states that could see half or more of all licensed child care programs statewide close with the end of the stabilization grants.

Licensed child care is insufficient in every county in Utah, though the level of unmet need varies from place to place.

How does child care access and affordability compare in each county?

Our full report, “Mapping Care for Kids: A County-Level Look at Utah’s Crisis in Licensed Child Care” will be released the week of October 23rd. For questions about the report, this blog, or sources and methodology, please contact Jenna Williams at . For more information on efforts to improve Utah’s child care system or learn about the child care advocacy network, visit utahchildren.org/issues/early-childhood-education and utahcareforkids.org.

Full Steam Ahead for Full-Day Kindergarten in Utah!

Congratulations, Utah parents and educators! Together, we did it. Funding for optional full-day kindergarten is now a reality for schools statewide.

The Utah Legislature passed HB477, "Full Day Kindergarten Amendments," sponsored by Rep. Robert Spendlove (R-Sandy). This bill establishes the same flexible, stable funding stream for full-day kindergarten as currently exists for all other grades of public school, first through twelfth. Last week, Governor Spencer Cox signed this historic bill into law!

(Click here to jump to our four-minute explainer video, which is also included at the bottom of this page)

Does this mean that next school year, every family in Utah will have the opportunity to enroll their kindergartner in a full-day program in their neighborhood school? Unfortunately, no. It DOES mean that the number of families who will have access to full-day kindergarten will increase dramatically - we estimate between 60% and 65% of kindergarteners will be able to enroll in an optional full-day program during the 2023-24 school year. This is is a huge leap from fewer than 25% just five years ago!

The passage of HB477 means that next school year (2023-24), every district and charter elementary school will have the opportunity to offer optional full-day kindergarten, using this new state funding stream.

In order to offer more full-day kindergarten, schools must have more classroom space, more teachers, and more equipment like tables and chairs. Some school districts and charter schools have spent the last several years making plans to overcome these challenges, and will be ready to offer optional full-day kindergarten to most, if not all, of their local families in the coming school year.

Some elementary schools are not quite ready to take advantage of this opportunity. These schools will need some time to overcome the challenges of: 1) limited classroom space; 2) recruiting new teachers; 3) purchasing new materials and equipment; 4) busing adjustments; and other practical issues. This is true particularly in some of our large, suburban school districts, such as Jordan, Davis and Alpine. Other small- and mid-size districts face some of these issues, as well.

We estimate that it will take between three and five years before all Utah families have the opportunity to enroll their child in a full-day kindergarten program. Based on the popularity of newly expanded full-day programs in different parts of the state, we expect to see more than 90% of parents opt for full-day kindergarten for their children when it becomes available to them.

The best way to find out whether your local elementary will be offering optional full-day kindergarten during the 2023-24 school year is to contact the current principal of that school (or the director, in case of charter schools) and ask them directly! Not only will this help you to plan for your family's schooling schedules, but it will help our local education leaders assess how much community interest exists for more optional full-day kindergarten.

In case you were worried, the new law preserves parents' right to enroll their child in a half-day program, and does not make kindergarten mandatory. There is nothing in the law that tells districts and charters how much optional full-day kindergarten they must offer to their communities, or how soon they have to do so. HB477 was created to be as flexible as possible, allowing local communities to decide the right mix of half- and full-day programming for them.

Thanks to all the hard work of education leaders, insistent parents and committed community advocates, we have finally accomplished state funding for optional full-day kindergarten in Utah! We especially appreciate the commitment of the United Way of Salt Lake and the Utah PTA, our core partners in the Utah Full-Day Kindergarten Now Coalition.

Of course, this would not have happened without the support and leadership of State Superintendent Sydnee Dickson, Sara Wiebke, Christine Elegante and other superhero staff at the Utah State Board of Education. We owe a lot to our bill sponsor, Rep. Spendlove, and the other legislative champions like Senator Ann Millner who have been key to this effort in the past (former Reps. Lowry Snow and Steve Waldrip, we are looking at you!).

Utah Education Funding: Legislative Leadership vs The Data

At two large pre-legislative events in the second week of January, hundreds of attendees heard Utah's Senate President proudly assert that Utah was the only state that increased education funding during the pandemic.

Every year, especially around the end of every legislative session, Utah's political leaders proclaim that they are putting record amounts of funding into education.

Unfortunately, these claims are contradicted by the data published by the Utah State Board of Education in its Superintendent's Annual Report.

Real FY21 and FY22 State + Local Education Funding Did Not Rise -- It Fell

These data are from the USBE Superintendent's Annual Reports, adjusted for inflation using the standard CPI-U inflation index from the federal Bureau of Labor Statistics. They show that Utah's real (inflation-adjusted) state + local education funding fell in both FY21 and FY22, both in total and on a per-student basis. (During those two fiscal years, the Utah Legislature passed over $300 million in income tax cuts.)

State Education Funding Has Fallen While Local Education Funding Has Risen

We have heard legislative leaders assert every year that they have appropriated record amounts for education. We have also sometimes heard them say that local education funding (from property taxes) has not kept up, and that is the reason that overall education funding is inadequate to reduce Utah's largest-in-the-nation class sizes or address our high rates of new teacher turnover. Yet the data from USBE show two trends that contradict these claims, as illustrated in the chart above:

- Real per-student state education funding was 2.5% lower in 2022 than in 2008 (the peak year for education funding before the Great Recession).

- Real per-student local education funding was 12% higher in 2022 than in 2008.

It is also worth noting, in this context, that permanently cutting the state income tax rate, as the Legislature has done in recent years and is considering doing once again this year, tends to put additional pressure on local property taxes to make up the difference for schools. The income tax and the property tax are the two main sources of funding for education. If policymakers intentionally and repeatedly undermine one of them, that inevitably creates pressure to increase the other (or allow it to increase naturally, as has happened the last two years with property taxes as home values have shot up).

Can We Have Record Education Funding and Record Tax Cuts?

Legislative leaders have used their incorrect claims that Utah increased education funding during the pandemic to bolster their case that Utah can have it all -- record high levels of education funding and record tax cuts. But USBE data reveal that, in fact, we cannot have it all, that tradeoffs exist, and that hard choices must be made. If we have record tax cuts, we likely will not have record levels of education funding. If we want to strengthen education finance for the long-term betterment of our children and our state, we ought to consider what we are giving up when we give in to the tax cut temptation.

One Final Comment: Inputs vs Outcomes

Needless to say, this entire discussion concerns only inputs to, not outcomes of, our K-12 public education system. But, as one superintendent wisely observed over a decade ago, "We cannot have the best school system in the country and be the lowest in the country in funding. We can't be first if we're always last."

While there is little doubt that Utah does more with less in our public schools better than probably any other state, there are several key educational outcome measures that most concern Voices for Utah Children:

- Our high school graduation rates are no higher than or below national averages for nearly every racial and ethnic category.

- Our high school graduation rate gaps between haves and have-nots and between majority and minority groups are larger than nationally.

- Our rate of college degrees, an area where Utah's older generations outpaced the nation, has fallen behind the nation's among our younger generation, the Millennial generation, based on Census data for Utahns age 25-34.

Closing these gaps and regaining our once enviable lead will require substantial new investments at every step in the pipeline, from expanding pre-K and full-day kindergarten options to reducing class sizes and new teacher turnover in our elementary, middle, and high schools, to ensuring that more of our sons and daughters finish what they start at our public colleges and universities.

Note: The charts in this blog post are from Voices for Utah Children's forthcoming "Children's Budget Report 2023" that will be published in February 2023.

Both graphs are available for download here.

Methodology and Location of Data

Utah’s education funding rises each year, but so does the student population. And prices rise due to inflation, which has been worse the last year than in 40 years. So how can we judge whether education funding is really going up, as our political leaders always claim? There is one metric considered to be the gold standard for this purpose: inflation-adjusted per-student spending. To calculate this metric, you need three pieces of data. The locations of these items are detailed below:

1. State, Local, and Federal Education Spending

Source: Utah State Board of Education Superintendent’s Annual Report at www.schools.utah.gov/superintendentannualreport

Direct Document Link: Statewide Total: Revenue and Expenditures by Fund, June 30, 2022 https://www.schools.utah.gov/file/674392fc-3946-4ba2-ba19-da7f024f3fe5

Comments: In the charts above, we used the state and local education spending data

2. K-12 Student Population

Source: Utah State Board of Education Superintendent’s Annual Report at www.schools.utah.gov/superintendentannualreport

Direct Document Link: Fall Enrollment by Grade Level and Demographics, October 1, School Year 2022-2023 https://www.schools.utah.gov/file/5c8e2fac-55dc-4f0a-bf6a-6889133e4ffe

Comments: Be sure to use the fall enrollment data from the fall of the year you are analyzing. For example, for FY/SY22, use October 2021 enrollment data.

3. Inflation Index CPI-U

Source: US Bureau of Labor Statisticshttps://www.bls.gov/data/home.htm

Direct Document Link: All Urban Consumers (Current Series) (Consumer Price Index - CPI) https://data.bls.gov/cgi-bin/surveymost?cu U.S. city average, All items - CUUR0000SA0....then use “Annual Averages”

Google Sheet with all collected data, sources & formulas

https://docs.google.com/spreadsheets/d/1fTy8wKHY6Di33eRLTcM7Ce1B5Caw10sb/edit#gid=534909710

Invest in Utah's Future Coalition: $5.6b of unmet needs should be prioritized over tax cuts

BROAD COALITION CALLS FOR INVESTMENT IN UTAH’S FUTURE RATHER THAN TAX CUTS, DOCUMENTS $5.6 BILLION IN URGENT UNMET NEEDS

Salt Lake City – On Monday, January 23, 2023 at the Utah State Capitol, a broad and diverse coalition of advocates for the poor, for disabled Utahns, for education, health care, clean air, the Great Salt Lake, transportation investment, and a variety of other popular Utah priorities held a press conference calling on the Utah Legislature to prioritize addressing Utah’s long and growing list of unmet needs over permanent tax cuts that undermine our long-term capacity to invest in Utah’s future.

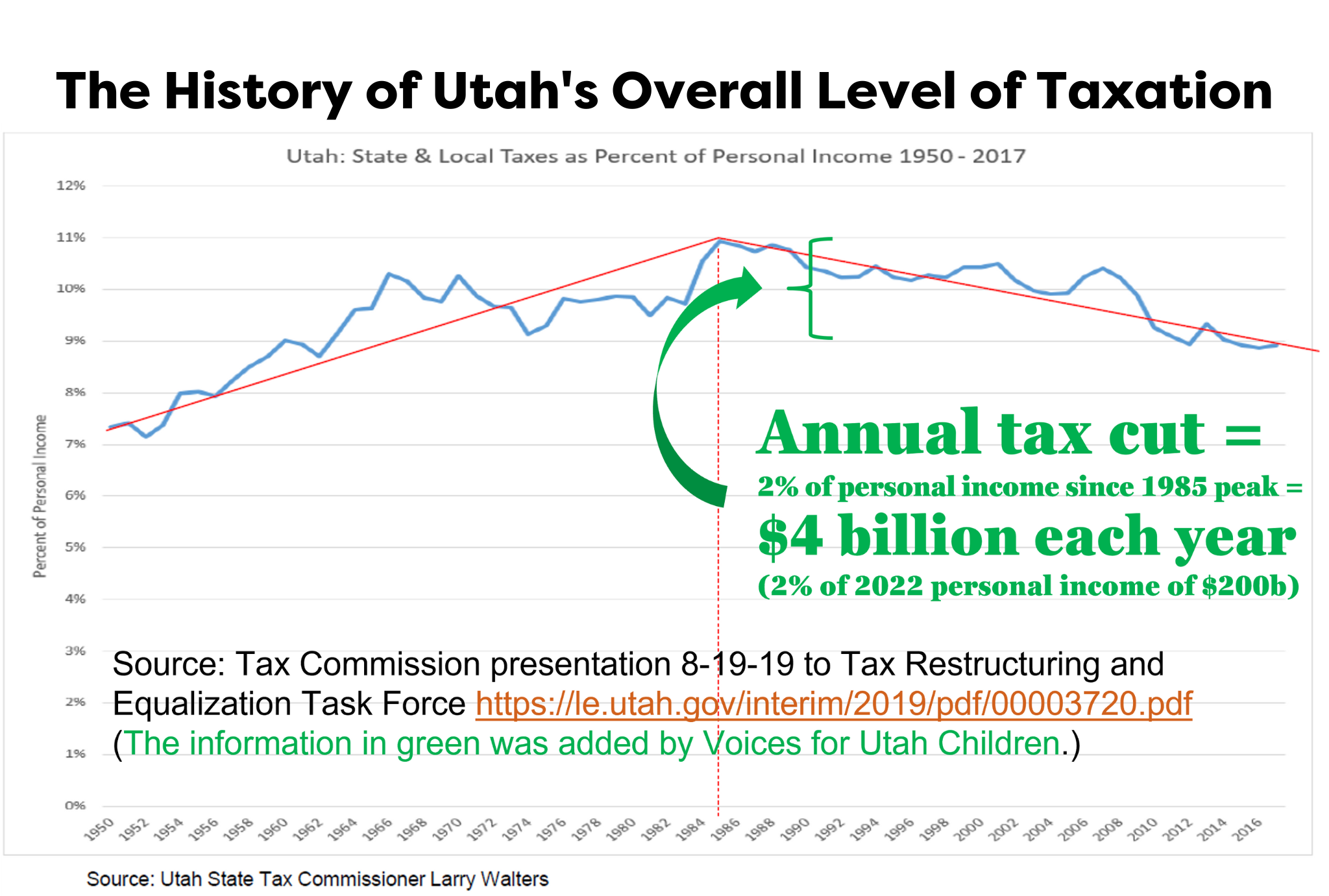

Utah’s strong economy and rapid recovery from the pandemic, combined with the ongoing impact of federal spending, have generated unexpected state revenues amounting to a reported $3.3 billion available for FY2024. These revenues put Utah in a position to address chronic revenue shortages that have plagued numerous areas of state responsibility. Instead, state leaders have proposed roughly half a billion dollars in permanent tax cuts, tilted unfairly toward the high end of the income scale, as well as additional hundreds of billions in one-time tax breaks.

These new proposed permanent tax cuts would be over and above the roughly $4 billion that the Legislature has already cut from annual revenues in recent decades, leaving Utah’s taxes at their lowest level in half a century, relative to incomes.

In response, today the Invest in Utah’s Future coalition presented a list of urgent unmet needs amounting to $5.6 billion, over $2 billion more than the amount of the “surplus” revenues.

The advocates also pointed out that, according to data from the Utah State Tax Commission and the Utah Foundation, taxes in Utah are the lowest that they have been in decades, following repeated rounds of tax cutting. “Of course we all like paying lower taxes, but at a certain point we have to ask ourselves: Is it possible to have too much of a good thing? Are we, as the current generation of Utahns, meeting our responsibility, as earlier generations did, to set aside sufficient resources every year to invest in our children, in our future, in the foundations of the next generation’s prosperity and quality of life?” said Matthew Weinstein of Voices for Utah Children.

Speakers also referenced public opinion surveys by the Deseret News and Hinckley Institute that found that only 25% of Utahns support tax cutting over investing in Utah’s future, consistent with other polls done in recent years by the same organizations as well as by Envision Utah and the Utah Foundation.

Here is the list of urgent unmet needs that Utah has not been able to address due to the state’s chronic revenue shortages:

| Budget Area | Amount | Details | Contacts |

| K-12: Reduce class sizes from 29 to 15 | $1.1 billion ($612m K-6 only) |

Reduce class sizes/improve student/teacher ratio below the current Utah average of 29 (vs national average of 24) to optimum class size of 15. |

Utah Education Association Director of Policy and Research Jay Blain |

| K-12: Paraeducators | $312 million |

Expand paraeducators to all Utah elementary classrooms. |

Utah Education Association Director of Policy and Research Jay Blain |

| K-12: Increase school counselors | $130 million | Increase school counselors per student to the national standard optimum of 1:250. Utah’s current ratio is 1:648, compared to the national average of 1:455. | Utah Education Association Director of Policy and Research Jay Blain |

| K-12: school psychologists, social workers and special ed teachers | $285 million | Increase student access to school psychologists, social workers and special ed teachers.

Current and optimal ratios are: School psychologists: Now 1:1950/Optimal 1:500 Social workers: Now 1:3000/Optimal 1:250 Special ed teachers: Now 1:35/Optimal 1:25 |

Utah Education Association Director of Policy and Research Jay Blain |

| K-12 Education: reduce teacher attrition and shortages | $500-600 million | Envision Utah estimates that we need to invest an additional $500-600 million each year just to reduce teacher turnover, where we rank among the worst in the nation. Our leaders’ unwillingness to solve our education underinvestment problem is why the majority-minority gaps in Utah’s high school graduation rates are worse than nationally and our younger generation of adults (age 25-34) have fallen behind their counterparts nationally for educational attainment at the college level (BA/BS+). | |

| K-12 School Nurses | $78.5 million | The Utah Dept of Health annual report “Nursing Services in Utah Public Schools 2021-22” found that it would cost $78.5m to hire an additional 785 nurses so as to have one nurse in every public school building. There are currently only 261 nurse FTEs in Utah’s public schools, a ratio of 1 nurse for every 2,583 students. One nurse in every building would improve that ratio to 1:644, which would still be worse than the national average. https://heal.health.utah.gov/wp-content/uploads/2022/08/2022-Nursing-services-in-Utah-Public-schools-8-22-22-ADA.pdf |

Dr. William Cosgrove, Past-President, American Academy of Pediatrics – Utah |

| Full Day Kindergarten | $70 million | Gov. Cox is proposing $70 million in the FY24 budget to make full-day Kindergarten available to all Utah families who would choose to opt in to it. | Voices for Utah Children Anna Thomas |

| Child Care | $236 million |

$236 million is needed to continue stabilizing the child care industry as federal funds are depleted. This funding will allow for the continuation of child care stabilization grants, retention incentives for early childhood professionals, the coverage of licensing-related fees in order to lessen the barriers to expanding, maintaining, and opening new child care programs, and regional child care outreach grants for rural and urban child care deserts. Source: www.utahcareforkids.org/get-involved/2023-legislation |

|

| Pre-K and Child Care | $1 billion | Well over $1 billion is one estimate for a much needed comprehensive system of early childhood care and education (pre-k) in Utah. | |

| Afterschool Programs | $3.6 million | Utah’s 303 afterschool programs serve 43,000 kids but still leave 99,000 unsupervised every day after school. During the 2021 “21st Century Community Learning Center” grant competition in Utah, $1,062,816 was available and there was $4.6 million in requests, indicating a $3.6 million funding gap. | Utah Afterschool Network Director Ben Trentelman |

| Health Insurance: Children: Cover All Kids | $5 million | It would cost Utah about $5 million to remove barriers to health insurance coverage so that all Utah kids can access health insurance. Utah currently ranks last in the nation for covering the one-in-six Utah kids who are Latinx and in the bottom 5 states for all children. Source: Voices for Utah Children and www.100percentkids.health | Voices for Utah Children Ciriac Alvarez Valle |

|

Health Insurance: New parents |

$10 million |

HB 84 would cost $3m to extend post-partum Medicaid coverage for new parents from the current 60 days to one year. HB 85 would cost $7m to extend Medicaid coverage to pregnant women with household incomes up to 200% of poverty level. |

Voices for Utah Children Ciriac Alvarez Valle |

| Mental Health & Substance Use Disorder Treatment | Uncertain |

Utah ranks last in the nation for mental health treatment access, according to a 2019 report from the Gardner Policy Institute. A 2020 report from the Legislative Auditor General found that Utah’s Justice Reinvestment Initiative had failed to achieve its goal to reduce recidivism -- and actually saw recidivism rise -- in part because “both the availability and the quality of the drug addiction and mental health treatment are still inadequate.” (pg 51) Amounts not determined to address large gaps in workforce capacity, but two bills this year are: HB 66: $11m for additional Mobile Crisis Outreach Teams and 2 additional Receiving Centers in rural parts of Utah HB 248: $5m for additional Assertive Community Treatment Teams |

|

| Disability Services | $31 million |

The DSPD disability services waiting list has more than doubled in the last decade from 1,825 people with disabilities in 2011 to 4,427 in 2021. The FY20 $1 million one-time appropriation made it possible to provide services to 143 people from the waiting list, implying that it could cost $31 million to eliminate the waiting list entirely. In the 2022 session, the Legislature added $6 million in ongoing and $3 million in one-time money to shorten the disabilities waiting list. This year, Rep. Ward is sponsoring HB 242 to dedicate additional base budget funding to reduce the waitlist by 200 people each year. |

Legislative Coalition for People with Disabilities – Jan Ferre |

| Rural Utah Economic Development | $20 million | Rural Utahns should not feel that they need to abandon their home communities and add to the growth pressures along the Wasatch Front in order to provide for their families. Rural economic development would benefit all Utahns and reduce disparities between the Wasatch Front and other areas of the state. $20 million was one estimate for funding for economic development projects like the San Rafael Energy Research Center (Emery County) and renewable energy projects around Beaver County, both serving areas where primary jobs such as Smithfield Foods have left recently, and renewable energy projects have the potential to stabilize county economies. | Community Action Partnership of Utah - Stefanie Jones and Clint Cottam – |

| Reduce/Eliminate Benefits Cliffs | Uncertain | The existing benefits cliffs in many public anti-poverty programs – where public assistance disappears suddenly rather than phasing out gradually when someone gets a raise or takes a new, higher-paying job – act as an unintended obstacle to the efforts of low-income people to work their way out of poverty. | Circles Salt Lake – Kelli Parker |

| Sexual and Domestic Violence Victim Services |

$310 million OR $68 million |

Our economy incurs steep economic costs as a result of sexual and domestic violence. The Center for Disease Control estimates that over a lifetime the costs for a female survivor are $103,762 and for a male survivor $23,414. These include medical costs, loss of employment or interruption of paid work, criminal justice system costs, among others. A coalition of victim service providers and state agencies estimates the annual funding needed as $310 million ongoing to meet standard of care for all victims of domestic and sexual violence OR $68 million ongoing to fund the most basic level of services at only the current level of demand for services. |

Erin Jemison, Director of Public Policy, Utah Domestic Violence Coalition (UDVC) |

| Housing | $346 million per year for 10 years |

Among extremely low-income renter households, 71% pay more than 50% of their income for housing, which is considered a severe housing burden. $346 million per year of state funding over the next decade will make it possible to build affordable housing statewide for people earning less than 50% AMI, based on a state cost share of $80,000 per unit, and Utah is short 43,253 units. For more information on the current and ongoing needs visit https://nlihc.org/gap/state/ut |

Utah Housing Coalition Tara Rollins |

| Housing for Seniors | $67.5 million |

$37.5 million a year for 10 years will fund rehabilitation of 500 units per year at a cost of $75,000 per unit. If we don’t fund preservation of affordable housing for seniors we will lose valuable units. $30 million per year will make available rental gap funding of $500 per month for 5,000 units so that seniors can afford to stay in their rented units. https://www.utahhousing.org/preserving-senior-affordable-housing-report.html https://nyuds.maps.arcgis.com/apps/webappviewer/index.html?id=b8318f874017488ea9bdd51a296e59ef for senior housing report |

Utah Housing Coalition Director Tara Rollins |

| Homeless Services | $154 million |

$100m in one-time funds to produce 2,000 units of deeply affordable housing $19m ongoing for tax credits and housing trust fund $5m to the housing trust fund to produce 1,000 new units of affordable housing over the next 10 years $30m one-time for projects to eliminate unsheltered homelessness for families with children: The total number of people needing emergency shelter services in Utah increased by 14% in 2022. For families with children the increase was 33%. This is why, for the first time in over 20 years, families with children were turned away from the family shelter in Midvale during the months of September, October and November of last year because there were not enough beds to meet the need. $30 million would help purchase a motel to convert into a second family shelter and purchase land that can be dedicated to produce mixed income housing developments that include permanent supportive housing for families with children headed by parents with disabling conditions that have been homeless for six or more months. |

|

| Air Quality in Schools | $5 million | Funding to continue the successful implementation of this year’s federally-funded program placing air purifiers in every classroom in Utah, which will reduce the risks both from COVID and from Utah’s air pollution and is expected to result in improved school performance, even more than standard interventions such as reducing class size by 30%, or “high dose” tutoring. (Source: Utah Physicians for a Healthy Environment) | UPHE Director Jonny Vasic - |

| Air Quality: Promote Transit | $25.5 million |

The Utah Transit Authority (UTA) experienced an increase in ridership during Free Fare February in 2022. Tens of thousands of riders, including many new to public transit, enjoyed the services, and stress on our transportation system and environment was lessened. Governor Cox’s Budget Recommendations for FY24 includes a $25 million, one-year pilot for statewide zero-fare transit. This pilot would include the state’s three transit systems that are not currently zero-fare: Cedar Area Transportation System, SunTran, and the Utah Transit Authority. The governor also recommends $500,000 for a zero fare transit study to analyze the impacts of the pilot. During Free Fare February, 87% of entities that subsidize UTA fares for their users continued paying subsidies to help enable the zero fare period. The Governor’s proposal calls on UTA fare subsidy partners to continue paying subsidies for their users during this one-year pilot period to cover $13.1 million in additional costs. This pilot will provide Utah families price relief to help offset the burden of gasoline prices, gasoline tax indexing, and inflation, while also allowing researchers to analyze factors related to permanent decisions about zero fare transit |

|

| Improve UTA transit service | $175.6 million |

$10.9m to match UTA projections to fully supplement free fares for a year. (In all, UTA projected $35.9 in fare revenue for 2023) $3.5 million to address UTA’s driver shortage ($20/hr*2,080 hours*60 operators + 40% for benefits, taxes, etc.) $30,000 to match CATS (Cedar City’s transit system) to fully supplement free fares for a year based on budget projections. $136,000 to match SunTran (St. George’s transit system) to fully supplement free fares for a year based on budget projections. $159 million to clear UTA’s debt to free UTA to expand and improve service. $2 million to fund a matching grant from the federal government to study the feasibility of a passenger rail route connecting Boise to Las Vegas via Salt Lake and points in between. |

Curtis Haring, Utah Transit Riders Union |

| Hunger | $1 million | It is clear that the state needs to do more in providing funding and other resources to help support local community food pantries. | Utahns Against Hunger – Gina Cornia – |

| Utah EITC | $57 million | Last year Utah became the 31st state with our own Earned Income Tax Credit, but we're one of the few who make it non-refundable, even though over 85% of the value of the federal EITC -- and the key to its poverty-reducing and workforce-enhancing power -- is its refundability. In 2022 under Gov. Youngkin, Virginia made their state EITC refundable. ITEP analysis shows 71% goes to the lowest-earning quintile and nearly all to the lower-income half of Utahns. | Voices for Utah Children – Matthew Weinstein – |

| Gov. Cox’s proposed refundable tax credit | $54 million | Utah's Taxpayer Tax Credit shields most low-income workers from the income tax, which is a good thing because it makes our overall tax system less regressive. Now Gov. Cox is proposing to make it even better by making up to $250 of this credit refundable. | Drew Cooper, United Today Stronger Tomorrow |

| Eliminate the sales tax on unprepared food | $200 million | The food tax is the most regressive tax. One-third of it is paid by the lowest-income half of Utah households, who earn less than a sixth of all Utah income. According to the U.S. Department of Agriculture’s Economic Research Service, low-income families pay 36% of their income on food while higher-income families spend only 8%. This is why 37 states do not charge any sales tax on food. | Drew Cooper, United Today Stronger Tomorrow |

| Save the Great Salt Lake | $333 million | Gov. Cox is proposing $133m in new resources to save the Great Salt Lake and $200 million to help reduce water waste in agriculture. Source: www.sltrib.com/news/2022/12/30/dear-legislature-heres-2023/ | Utah Rivers Council –Matt Berry |

| Racial Equity, Diversity, and Inclusion as it relates to undocumented Utahns | Our public fiscal policies – how we generate and expend public investment dollars – have a direct impact on whether we are widening or narrowing the gaps between different groups in Utah. The Utah Compact on Racial Equity, Diversity, and Inclusion must be more than just words on a page. slchamber.com/public-policy/utah-compact In particular, Utah is home to 95,000 undocumented men, women, and children. They work hard and pay taxes and need and deserve access to the same public services as every other Utahn. | Comunidades Unidas – Brianna Puga – | |

| The economic case against tax cuts | Tax cuts are usually enacted to provide additional stimulus to the economy. Given our very low unemployment rate, along with ongoing inflationary pressures, now is not really the right time for new economic stimulus. The future is uncertain – some economists expect we may face a recession in the coming year, though there’s a wide variety of opinions about the likely timing and severity of such a possible event. Additional tax cuts right now won’t do much to affect that. However, investing now in the many unmet needs we face, particularly in the areas of water and climate, education, child-care, and the many other needs listed here this morning, will put us in a better position to thrive whatever the coming years bring us in terms of economic conditions. | Univ. of Utah Economics Prof. Thomas Maloney PhD | |

TOTAL |

|

$5.6 billion – over $2b more than the amount of "surplus" revenue for FY2024 |

The press conference was broadcast live on Facebook: https://fb.watch/ieyT_0Zi14/?mibextid=RUbZ1f

Media coverage:

- KJZZ: Local organizations oppose statewide tax cuts, call for investments in Utah's future instead

- Deseret News: Time to invest more in education, housing, water and other areas, group says

- KUTV-2: Local organizers oppose tax cuts, call for investments in Utah's future instead

- KSL: Don't cut taxes, advocacy groups urge Utah lawmakers. Here's why.

- UtahPolicy.com

Additional one-pagers distributed by some of the coalition members:

- Circles Salt Lake: Background about Circles and one-pager about benefits cliffs

- Transit: Utah Transit Riders Union info and one-pager about free-fare transit

- Community Action Partnership of Utah one-pager about rural Utah's needs

- Child care one-pager from UtahCareforKids.org

- Housing affordability one-pager from Utah Housing Coalition

Digital Media Policies & Kids: The need for more thoughtful approaches to solutions

By Sariah Villalon (Voices Policy Intern)

We live in a digital world where social media has become integral to our society. It has broadened our communication, allowing us to connect and share information with anyone around the world. It has helped bring awareness to many issues and achievements within our society. But let's face it, unintended risks and consequences come with every innovation. One of them is its effect on our mental health, especially our young people's mental health.

Over the years, there has been an increase in depression, anxiety, and suicide among the youth, especially among girls. Social media may influence these mental health problems through social comparison, cyberbullying, and exposure to other toxic content (Nesi, 2020).

Governor Spencer Cox recently addressed the relationship between social media on the mental health of our youth and how we could improve the mental health of our youth in Utah. Some of his recommendations are the following:

- Hold social media companies accountable by providing tools for parents to safeguard their children,

- Implement a cell phone-free environment in schools to reduce distraction for students.

- Encourage parents to set an example for their children by spending quality social time with one another without social media use.

- Educate their children on what is appropriate to say on these platforms.

- Monitor their children's social media use by using different tools.

- Have an honest conversation about social media

There are multiple good points that the governor pointed out. We agree that social media companies need to be held accountable for the algorithm and design of their apps that provide a toxic environment for their users. A couple of legislative efforts have been created to hold social media responsible. But is it enough?

We do not see so much urgency from these big techs. Even if they get fined, they could pay everything off quickly. It also puts too much burden on the parents to monitor and safeguard their children. We also have to be honest that we cannot blame everything on these companies. So, what can we do?

We need to hold these social media companies responsible by making them contribute to funding social media education for the youth. Organizations such as Digital Respons-Ability train parents, students, and educators on digital citizenship.

We cannot escape the digital world, and it will only progress from here on. We need to teach our youth how to use the technology and social media they have properly. Removing phones during school time will not solve our problems. By educating the youth, they can be better equipped to make informed decisions for their lives and improve their learning.

Another is research on the effect of social media on youth mental health. As we know, mental health is multi-faceted. We cannot just say that one factor causes mental health problems. We need more longitudinal studies on its effects to counter better or mitigate its adverse effects.

More importantly, let's talk more openly about our mental health. Let us educate ourselves and share our experiences with our children so they can also be aware of their well-being. Give them the resources to improve or manage their mental health. When children are more knowledgeable, it can increase their chances of knowing when and where to get the help they might need.

Learn more on how we can help through this video. You can also download this infographic on Youth Mental Health & Digital Media for more information.