Education

#InvestInUtahKids: An Agenda for Utah's New Governor and Legislature

Salt Lake City - Voices for Utah Children released publicly today (January 6, 2021) "#InvestInUtahKids: An Agenda for Utah's New Governor and Legislature," the first major publication of our new #InvestInUtahKids initiative.

Utah begins a new era in this first week of January, with the swearing in of a new Governor and Lt. Governor and a new Legislature. The arrival of 2021 marks the first time in over a decade that the state has seen this kind of leadership transition. Last month Voices for Utah Children began sharing with the Governor-elect and his transition teams the new publication, and on Wednesday morning Voices will share it with the public as well.

The new publication raises concerns about the growing gaps among Utah's different racial, ethnic, and economic groups and lays out the most urgent and effective policies to close those gaps and help all Utah children achieve their full potential in the years to come in five policy areas:

- Early education

- K-12 education

- Healthcare

- Juvenile justice

- Immigrant family justice

The report, which was initially created in December and distributed to the incoming Governor and his transition teams, closes with a discussion of how to pay for the proposed #InvestInUtahKids policy agenda. The pdf of the report can be downloaded here.

Amendment G Passed. Now What Happens?

With Amendment G winning 54% of the vote this month, many of our partners and supporters have been asking us: What’s going to happen next?

What changes will result from this Constitutional amendment going into effect January 1, 2021, along with the legislation triggered by it (HB 357)?

The short answer is, “Probably not a lot, at least not immediately, but possibly quite a bit over the long term.”

As a result of the passage of Amendment G, the Utah Constitution Article XIII, Section 5, paragraph 5 changes from

“All revenue from taxes on intangible property or from a tax on income shall be used to support the systems of public education and higher education as defined in Article X, Section 2.”

to the following:

“All revenue from taxes on intangible property or from a tax on income shall be used:

(a) to support the systems of public education and higher education as defined in Article X, Section 2; and

(b) to support children and to support individuals with a disability.”

The state’s budget leaders sought this change because they expect the long-term trend to continue of Utah’s higher education budget shifting from the General Fund (which is financed mainly by the sales tax) to the Education Fund (which is financed mainly by the income tax). This shift has made it possible to make more of the General Fund available for social and healthcare services. But once higher ed has shifted completely out of the General Fund, something expected to happen in the coming years, then budget writers will no longer have a mechanism to free up additional funds to meet the state’s obligations for healthcare and social services. This concern is what drove the decision to place on the ballot a Constitutional amendment to allow budget writers to begin to shift additional items (services for children and for Utahns with disabilities) out of the General Fund and have them financed by the income tax.

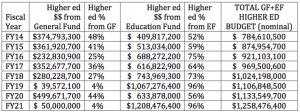

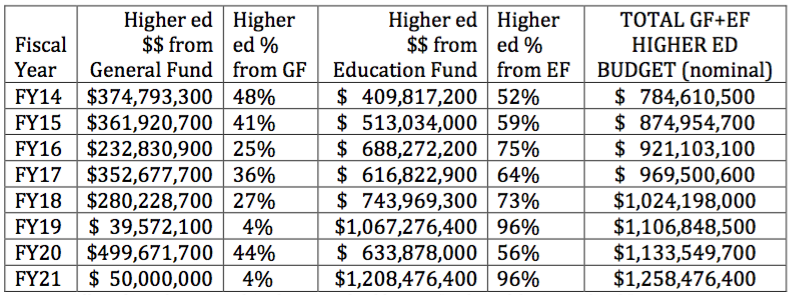

In the FY21 budget passed by the Legislature in March and then adjusted in June (the FY21 budget year runs from July 1, 2020 through June 30, 2021), just 4% of the higher education budget came from the General Fund and the remaining 96% from the Education Fund. The chart below shows how the higher education budget has been divided between the two funds in recent fiscal years:

Source: Office of Legislative Fiscal Analyst annual publication “Budget of the State of Utah” at https://le.utah.gov/asp/lfa/lfareports.asp?src=LFAAR

While the trend has not been a straight line, the general direction has been to shift the higher education budget out of the General Fund and into the Education Fund. And, indeed, two of the last three budgets have seen 96% of the higher education budget come out of the Education Fund.

This trend has also been facilitated by the fact that income tax revenue has been growing faster than sales tax revenue.

Assuming these trends continue, we can expect to see the FY22 and future year budgets begin to make gradually increasing use of income tax revenue to finance social and healthcare services for children and Utahns with disabilities, two items that until now were only funded from sales tax revenue (through the General Fund).

What will be the impact of Amendment G on education funding?

As part of the political deal that produced Amendment G, the Legislature passed HB 357, with implementation contingent on voter approval of Amendment G. HB 357 contains three main provisions intended to provide education advocates with compensation for losing the Constitutional earmark of the income tax for education:

- It requires that “when preparing the Public Education Base Budget, the Office of the Legislative Fiscal Analyst shall include appropriations to the Minimum School Program from the Uniform School Fund… in an amount that is greater than or equal to:

(a) the ongoing appropriations to the Minimum School Program in the current fiscal year; and

(b) … enrollment growth and inflation estimates…”

This is intended to avoid what happened in the Great Recession a decade ago, when annual appropriations were not sufficient to keep up with inflation and enrollment growth, and it took almost a decade to restore real per-student education appropriations.

- It requires that 15% of education revenue growth go into a new “Public Education Economic Stabilization Restricted Account” to be saved for recessions until it reaches 11% of the full Uniform School Fund. This is intended to build up a new reserve fund of about $400 million to finance the first commitment mentioned above, the commitment that education funding will always increase by enough to cover enrollment growth and inflation, even in times of recession. This new annual 15% savings requirement will mean smaller education funding increases in good times and larger ones in bad times, in effect smoothing out the annual changes in education funding. It does not change the overall amount available for education budgets over the full course of each economic cycle.

- HB 357 allows local districts to reallocate capital funds to cover operating expenses in recession years. This is something that was allowed on a one-time basis in the Great Recession a decade ago. Now it will be allowed in any year when the Legislature makes use of the new Public Education Economic Stabilization Restricted Account.

What impact will Amendment G and HB 357 have on funding for social and healthcare services for children?

On the positive side, budget writers will now have increased flexibility to use income tax revenues that are now going to education for social and healthcare services for children and Utahns with disabilities. On the negative side, there are no new revenue streams and no rolling back of past tax breaks, and HB 357 does promise an increased commitment to education in recession years (presumably including the current one), so that seems to imply that there will be less available for everything other than education, at least in the short term.

What impact will this have in the coming year?

This depends on how much revenue there is. Will there be enough new education revenue to cover inflation and enrollment growth? And if not, how will the state budget cover that commitment supposedly contained in HB 357 since the new Public Education Economic Stabilization Restricted Account does not yet have any money in it? The Legislature may face the same difficult choices as in the last recession a decade ago between funding enrollment growth and inflation in the education budget or funding life-saving social and healthcare services. And if they choose to keep their promise to fund enrollment growth and inflation in the education budget in the absence of sufficient education revenues, then that commitment will come at the expense of other areas of the state budget, such as social and healthcare services for children.

One wild card here is the question of how the calculations will be impacted by the unprecedented drop in student enrollment that was reported this fall. Student enrollment had been projected to grow by 7,000; instead it fell by over 2,000. This drop is probably a temporary blip due to the impacts of the COVID-19 pandemic. But the Legislature may see it as an opportunity to go with a low-ball estimate of enrollment for FY22 when it meets to pass that year’s budget this coming winter. Doing so would certainly make it easier to keep its commitment to fund enrollment growth and inflation even in the current downturn.

What impact will this new arrangement have in the longer term?

On the negative side, the fact that Amendment G and HB 357 provide for no new revenue streams to roll back any of what now amounts to $2.4 billion every year in tax breaks enacted since 1995 (18% of public revenues) does not bode well for education, for social and healthcare services for Utahns in need, or for any of the many areas of state responsibility that suffer from chronic revenue shortages because of these revenue losses.

On the positive side, the promise made by the state’s leaders to always at least fund inflation and enrollment growth could potentially lead to an increased commitment of existing state resources to education than might have otherwise taken place. If that happens, and since the need for resources in other areas is not going to change, there is the possibility that members of the state’s budget leadership might move closer to public opinion, which has expressed consistent -- and growing -- willingness to pay more to achieve improvements in areas of state responsibility like education, transportation, and air quality, as evidenced by the results of the following public opinion surveys this year:

If that happens, then we will be able to say that Amendment G led to positive changes in state fiscal policy for the benefit of all of Utah’s children. But if not, then we may well be in for many years of budget writers using their newfound flexibility to grant substantial increases to one area of the budget one year and another the next, making different areas of the budget compete with each other to be that year’s “favored child,” but leaving none better off in the long run.

THIS PAPER IS ALSO DOWNLOADABLE AS A PDF HERE.

WE ALSO PRESENTED THIS PAPER AS A SLIDESHOW ON A FACEBOOK LIVE EVENT: https://www.facebook.com/watch/live/?v=380455343223086&ref=watch_permalink

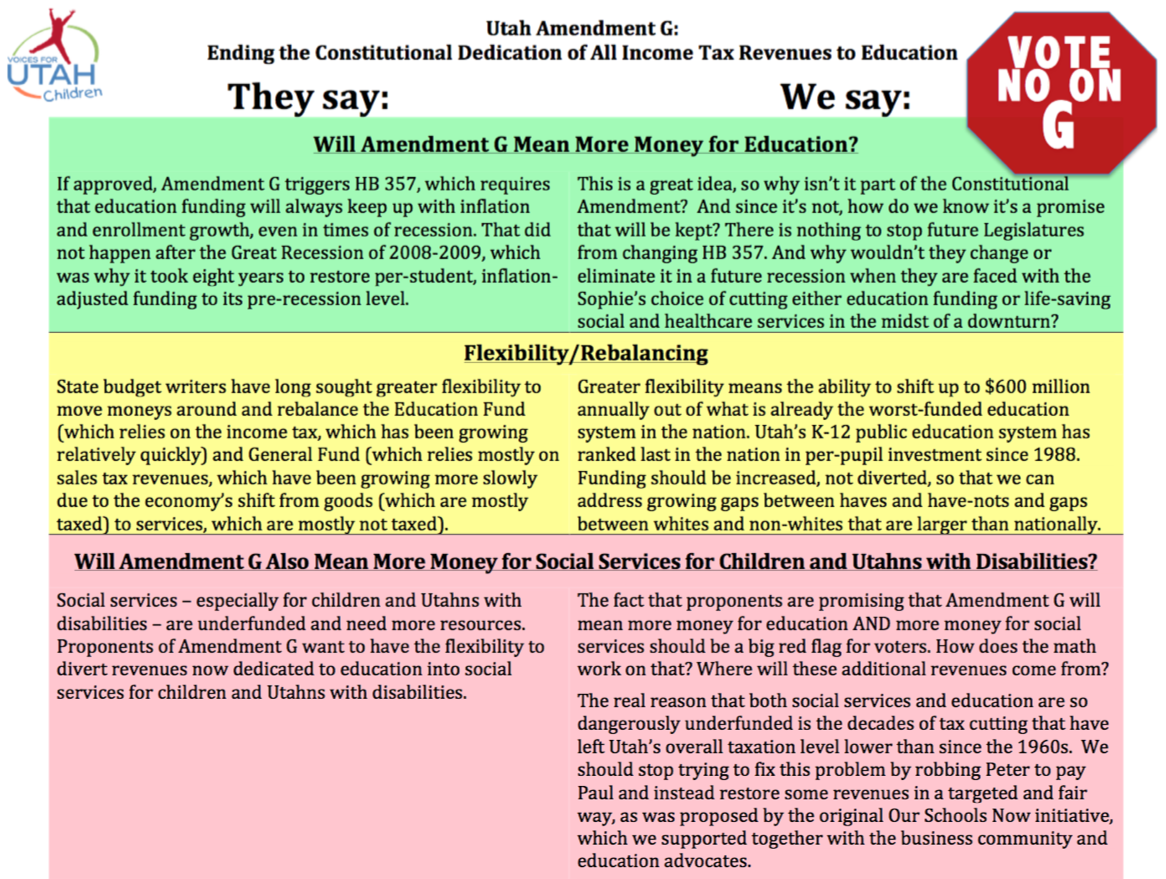

The state's leading child research and advocacy organization Voices for Utah Children announced its opposition to Constitutional Amendment G in an online press conference today (Monday, October 5, 2020).

Constitutional Amendment G is the proposal to amend the Utah State Constitution to end the Constitutional earmark of all income tax revenues for education. Since 1946 Utah has dedicated 100% of income tax revenues to education, initially defined only as K-12 education and, since 1996, including also higher education. The State Legislature voted in March to place on the ballot the question of also allowing these funds to be used for other purposes -- specifically for programs for children and for Utahns with disabilities.

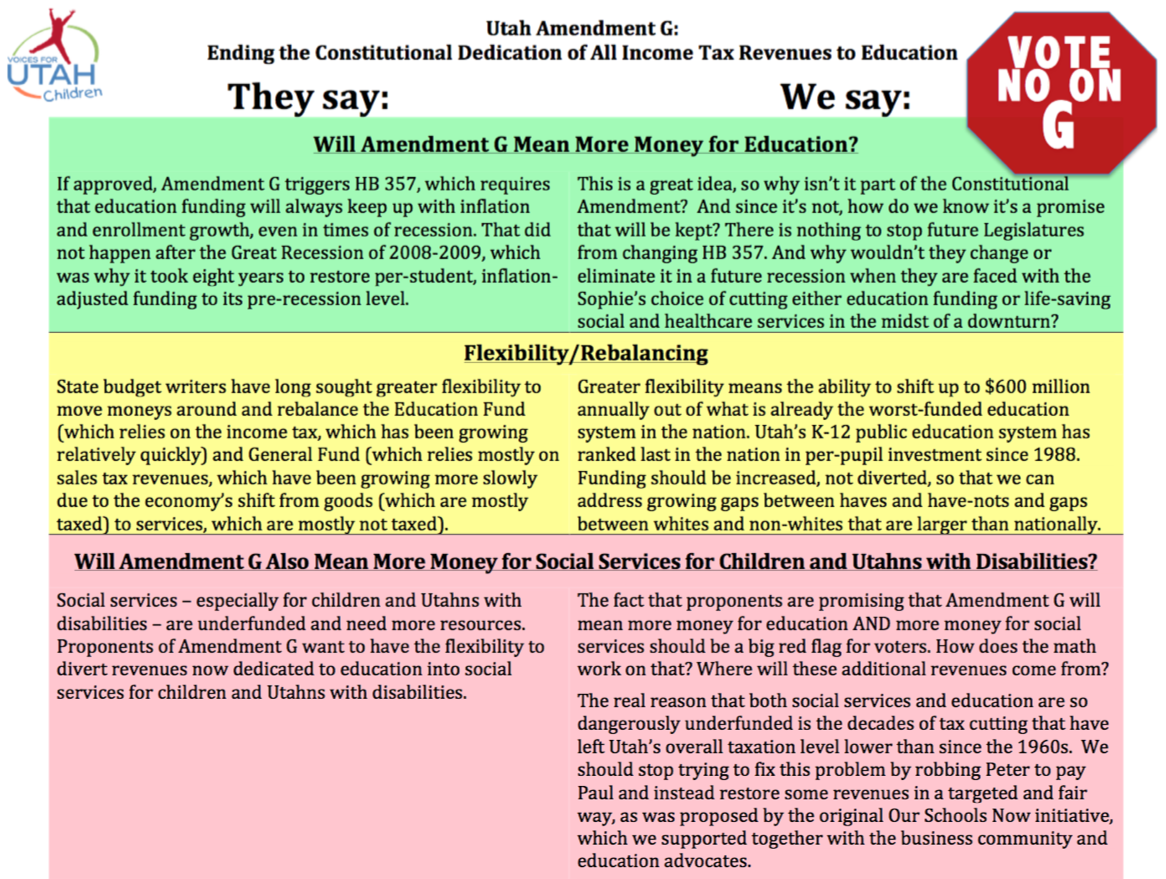

The arguments made by proponents and opponents are summarized in an online document prepared by the state election administrators in the Lt Governor's office. According to that document, "the state spends about $600 million annually of non-income tax money on programs for children and programs that benefit people with a disability."

Voices for Utah Children CEO Maurice "Moe" Hickey explained the organization's decision to oppose the Amendment: "We believe that the proposed Amendment not only won’t solve Utah’s state budget woes, it is likely to delay the real fiscal policy changes that are needed. Over the past decade we have been continuously ranked last in the country for per pupil spending. This is a caused by our growth in number of students, combined with a lowered tax burden in the past decade. A major question we have to ask is “if the current Constitutional earmark has failed to help Utah invest more in education, how will getting rid of it improve matters?” The unfortunate reality is that getting rid of the Constitutional earmark of income tax for education does nothing to solve the real problem, which is the fact that nearly every area of state responsibility where children are impacted – education, social services, public health, and many others – is dangerously underfunded."

Health Policy Analyst Ciriac Alvarez Valle said, "Utah has one of the highest rates of uninsured children in the country at 8% or 82,000 children, and we have an even higher rate of uninsured Latino children at almost 20%. It is alarming that even during this pandemic, children and families are going without health insurance. There are so many ways to reverse this negative trend that began in 2016. Some of the solutions include investing in our kid’s healthcare. By investing in outreach and enrollment efforts especially those that are culturally and linguistically appropriate for our communities of color, we can ensure they are being reached. We also have to invest in policies that keep kids covered all year round and ensures they have no gaps in coverage. and lastly, we have to invest in covering all children regardless of their immigration status. By doing these things we can ensure that kids have a foundation for their long term health and needs. It's vital that we keep children’s health at the forefront of this issue, knowing that kids can only come to school ready to learn if they are able to get the resources they need to be healthy."

Health Policy Analyst Jessie Mandle added, "All kids need to have care and coverage in order to succeed in school. We are no strangers to the funding challenges and the many competing demands of social services funding. Without greater clarity, more detail, and planning, we are left to ask, are we simply moving the funding of children’s health services into another pool, competing with education funding, instead of prioritizing and investing in both critical areas? Sufficient funding for critical children’s services including school nurse, home visiting and early intervention, and school-based preventive care remains a challenge for our state. We have made important strides in recent years for children’s health, recognizing that kids cannot be optimal learners without optimal health. Let’s keep investing, keep moving forward together so that kids can get the education, health and wraparound services they need."

Education Policy Analyst Anna Thomas: "We often hear that UT is dead last in the nation in per pupil funding. We have also heard from such leaders as Envision Utah that millions of dollars are needed to avert an urgent and growing teacher shortage. What we talk about less is the fact that these typical conservative calculations of our state’s underfunding of education don’t include the amount the state should be paying for the full-day kindergarten programming most Utah families want, nor does it include the tens of millions our state has never bothered to spend on preschool programs to ensure all Utah children can start school with the same opportunities to succeed. Utah currently masks this underfunding with dollars from various federal programs, but this federal funding is not equitably available to meet the needs of all Utah children who deserve these critical early interventions. The state also increasingly relies on local communities to make up the difference through growing local tax burdens - which creates an impossible situation for some of our rural school districts, where local property tax will never be able to properly fund early interventions like preschool and full-day kindergarten along with everything else they are responsible for. Our lack of investment in early education is something we pay for, much less efficiently and much less wisely, later down the road, when children drop out of school, experience mental and physical health issues, and get pulled into bad decisions and misconduct. If kids aren’t able to hit certain learning benchmarks in literacy and math by third grade, their struggles in school - and often by extension outside of school - multiply. We should be investing as much as possible in our children to help ensure they have real access to future success - and can contribute to our state's future success. You don’t have to be a math whiz - third grade math is probably plenty - to see that the general arithmetic of Amendment G, and the attendant promises of somehow more investment in everything that helps kids - just doesn’t add up. We have multiple unmet early education investment obligations right now. Beyond that, we have many more needs, for children and for people with disabilities, that we must be sensitive to as a state especially during a global pandemic. How we will ensure we are investing responsibly in our children and our future, by having MORE expenses come out of the same pot of money - which the legislature tells us every year is too small to help all the Utah families we advocate for - is still very unclear to me. Until that math is made transparent to the public, we have to judge Amendment G to be, at best, half-baked in its current incarnation."

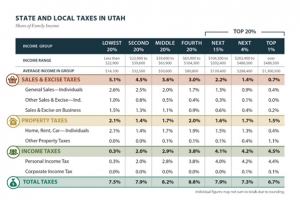

Fiscal Policy Analyst Matthew Weinstein shared information from the Tax Commission (see slide #8) showing that Utah's overall level of taxation is now at its lowest level in 50 years relative to Utahns' incomes, following multiple rounds of tax cutting. He also shared recent survey data from the Utah Foundation showing that three-fourths of Utahns oppose cutting taxes further and are ready and willing to contribute more if necessary to help solve the state's current challenges in areas like education, air quality, and transportation. He also contrasted the public's understanding that there's no "free lunch" with the unrealistic election-year promises made by our political leadership -- more money for both education and social services if the public votes for Amendment G -- even though Amendment G does nothing to reverse any past tax cuts and address the state's chronic revenue shortages.

The organization shared a one-page summary of the arguments (available here in pdf format) for and against the proposed Constitutional Amendment:

Voices for Utah Children has also published a full five-page position paper that is available in pdf format.

This press conference was broadcast live at

Media coverage:

The state's leading child research and advocacy organization Voices for Utah Children announced its opposition to Constitutional Amendment G in an online press conference today (Monday, October 5, 2020).

Constitutional Amendment G is the proposal to amend the Utah State Constitution to end the Constitutional earmark of all income tax revenues for education. Since 1946 Utah has dedicated 100% of income tax revenues to education, initially defined only as K-12 education and, since 1996, including also higher education. The State Legislature voted in March to place on the ballot the question of also allowing these funds to be used for other purposes -- specifically for programs for children and for Utahns with disabilities.

The arguments made by proponents and opponents are summarized in an online document prepared by the state election administrators in the Lt Governor's office. According to that document, "the state spends about $600 million annually of non-income tax money on programs for children and programs that benefit people with a disability."

Voices for Utah Children CEO Maurice "Moe" Hickey explained the organization's decision to oppose the Amendment: "We believe that the proposed Amendment not only won’t solve Utah’s state budget woes, it is likely to delay the real fiscal policy changes that are needed. Over the past decade we have been continuously ranked last in the country for per pupil spending. This is a caused by our growth in number of students, combined with a lowered tax burden in the past decade. A major question we have to ask is “if the current Constitutional earmark has failed to help Utah invest more in education, how will getting rid of it improve matters?” The unfortunate reality is that getting rid of the Constitutional earmark of income tax for education does nothing to solve the real problem, which is the fact that nearly every area of state responsibility where children are impacted – education, social services, public health, and many others – is dangerously underfunded."

Health Policy Analyst Ciriac Alvarez Valle said, "Utah has one of the highest rates of uninsured children in the country at 8% or 82,000 children, and we have an even higher rate of uninsured Latino children at almost 20%. It is alarming that even during this pandemic, children and families are going without health insurance. There are so many ways to reverse this negative trend that began in 2016. Some of the solutions include investing in our kid’s healthcare. By investing in outreach and enrollment efforts especially those that are culturally and linguistically appropriate for our communities of color, we can ensure they are being reached. We also have to invest in policies that keep kids covered all year round and ensures they have no gaps in coverage. and lastly, we have to invest in covering all children regardless of their immigration status. By doing these things we can ensure that kids have a foundation for their long term health and needs. It's vital that we keep children’s health at the forefront of this issue, knowing that kids can only come to school ready to learn if they are able to get the resources they need to be healthy."

Health Policy Analyst Jessie Mandle added, "All kids need to have care and coverage in order to succeed in school. We are no strangers to the funding challenges and the many competing demands of social services funding. Without greater clarity, more detail, and planning, we are left to ask, are we simply moving the funding of children’s health services into another pool, competing with education funding, instead of prioritizing and investing in both critical areas? Sufficient funding for critical children’s services including school nurse, home visiting and early intervention, and school-based preventive care remains a challenge for our state. We have made important strides in recent years for children’s health, recognizing that kids cannot be optimal learners without optimal health. Let’s keep investing, keep moving forward together so that kids can get the education, health and wraparound services they need."

Education Policy Analyst Anna Thomas: "We often hear that UT is dead last in the nation in per pupil funding. We have also heard from such leaders as Envision Utah that millions of dollars are needed to avert an urgent and growing teacher shortage. What we talk about less is the fact that these typical conservative calculations of our state’s underfunding of education don’t include the amount the state should be paying for the full-day kindergarten programming most Utah families want, nor does it include the tens of millions our state has never bothered to spend on preschool programs to ensure all Utah children can start school with the same opportunities to succeed. Utah currently masks this underfunding with dollars from various federal programs, but this federal funding is not equitably available to meet the needs of all Utah children who deserve these critical early interventions. The state also increasingly relies on local communities to make up the difference through growing local tax burdens - which creates an impossible situation for some of our rural school districts, where local property tax will never be able to properly fund early interventions like preschool and full-day kindergarten along with everything else they are responsible for. Our lack of investment in early education is something we pay for, much less efficiently and much less wisely, later down the road, when children drop out of school, experience mental and physical health issues, and get pulled into bad decisions and misconduct. If kids aren’t able to hit certain learning benchmarks in literacy and math by third grade, their struggles in school - and often by extension outside of school - multiply. We should be investing as much as possible in our children to help ensure they have real access to future success - and can contribute to our state's future success. You don’t have to be a math whiz - third grade math is probably plenty - to see that the general arithmetic of Amendment G, and the attendant promises of somehow more investment in everything that helps kids - just doesn’t add up. We have multiple unmet early education investment obligations right now. Beyond that, we have many more needs, for children and for people with disabilities, that we must be sensitive to as a state especially during a global pandemic. How we will ensure we are investing responsibly in our children and our future, by having MORE expenses come out of the same pot of money - which the legislature tells us every year is too small to help all the Utah families we advocate for - is still very unclear to me. Until that math is made transparent to the public, we have to judge Amendment G to be, at best, half-baked in its current incarnation."

Fiscal Policy Analyst Matthew Weinstein shared information from the Tax Commission (see slide #8) showing that Utah's overall level of taxation is now at its lowest level in 50 years relative to Utahns' incomes, following multiple rounds of tax cutting. He also shared recent survey data from the Utah Foundation showing that three-fourths of Utahns oppose cutting taxes further and are ready and willing to contribute more if necessary to help solve the state's current challenges in areas like education, air quality, and transportation. He contrasted the public's understanding that there's no "free lunch" with the unrealistic election-year promises made by our political leadership -- more money for both education and social services if the public votes for Amendment G -- even though Amendment G does nothing to reverse any past tax breaks and address the state's chronic revenue shortages.

The organization shared a one-page summary of the arguments for and against the proposed Constitutional Amendment:

The organization also published a full five-page position paper that is available in pdf format.

Early Learning and Care

Early childhood education is one of the best ways to invest in future success for Utah kids and, by extension, our entire state!

For every dollar we spend on positive interventions for children under six, we can save between $7 and $10 in later years (through reduced reliance on government benefits, lower utilization of special education and fewer instances of criminal justice involvement).

When we invest in early learning opportunities for children, regardless of their family background, we are ensuring positive outcomes for Utah overall. These outcomes include an educated workforce, empowered parents, economic prosperity and safer communities.

Early education can be a bridge to opportunity for low-income children, in particular. High quality pre-school and child care help all children start school ready to learn and succeed resulting in: higher academic achievement, increased graduation rates and enhanced future self-sufficiency.

That is why, at Voices for Utah Children, we promote targeted investments in early childhood care and education, woven together into an efficient, effective early learning system in Utah that supports and empowers families.

Whether Utah’s littlest kids spend their days at home with their parents, in formal child care, in private or public pre-school or with family and friends, they all deserve as much attention and support as our community can provide them!

Publications

Mapping Care for Kids: A County-Level Look at Utah’s Crisis in Licensed Child Care

This report highlights Utah's current child care crisis, examining the availability of licensed child care across the state, and in each individual county. By conducting a detailed analysis of both the demand and supply of child care services, the report aims to provide policymakers and the public with a clear understanding of the urgent need for child care reform.

Current Initiatives

Care for Kids

Care for Kids is a project of Voices for Utah Children, with the goal of educating policymakers and the general public about Utah's child care system, and the serious problems it faces. Care for Kids is meant to be a resource for those who are serious about creating real solutions that help Utah families get the child care they need. Click below to visit the Care for Kids website.

Utah Full-Day Kindergarten Now

The Utah Full-Day Kindergarten Now! Coalition is a joint project of several community organizations and associations. The Coalition has the support and involvement of staff from the Utah State Board of Education, as well as administrators and educators working in Utah's Local Education Agencies (LEAs). Our purpose is to advocate for full state funding for optional full-day kindergarten programs that serve all interested and willing families.

Click below to learn more about efforts to expand optional Full-Day Kindergarten across our state.

For years, advocates (like me) have avoided mentioning the fact – at least, in the presence of legislators – that Utah families rely on school not just for education, but also for reliable and high quality child care.

Similarly, until very recently, many Utah policymakers were ignorant of the fact that child care – especially for infants, toddlers and pre-school aged children – is possibly the most critical education Utah families will ever invest in.

COVID-19 has made all this denial of reality much more difficult.

Right now, education administrators throughout the state are wondering how they could manage to implement a “staggered schedule” in their schools, when doing so would mean that teachers with school-aged children would require paid child care for half the workweek.

Parents working from home are realizing how much personal attention and educational interaction their children are able to receive in child care settings while they are working. Perhaps initially thrilled to save money on child care expenses, they are gaining renewed (perhaps desperate) appreciation for the intense, valuable work performed by their child care providers.

Families throughout the state are struggling with a diminished roster of summer camps, summer programs and summers schools. They are wondering how they are going to manage the cost of additional hours of child care that may be necessary in the fall, depending on how individual school districts choose to “re-open” their schools.

Utah families and educators are all re-learning, under great pandemic-driven duress, something that has been the truth for decades: school is child care, and child care is school.

In Utah, about 47% of all kids under age six, who are living with both parents, have both of those parents in the workforce.* Among kids between 6 and 17, who are living with both parents, that number jumps to 57%.* That increase represents a lot of Utah parents, going back to work, as soon as their young kids are able to attend kindergarten.

More than 54,000 children under the age of six live with only one parent.* For 83% of those young children, the single parent they live with is in the workforce.* Among kids between 6 and 17, who are living with only one parent, that number jumps to 98%.* Again, that increase represents a lot of Utah parents, going back to work, as soon as their young kids are able to head off to public school.

The vast majority of Utah parents appreciate that for six or seven hours a day, five days a week, for around 36 weeks out of the year, they are able to put their children in the care of trained professionals, in a relatively safe environment, at little or no cost to their family.

Their children are being educated in all manner of subjects, and they are learning to socialize with other children from different families and backgrounds. They also are under the watchful eye of educators acting “in loco parentis,” a common law principle that empowers educators to take on some of the functions and responsibilities of a parent during school hours and activities.

This all-encompassing educational and social experience is provided to Utah families largely for free – by law – because primary education is regarded generally as a public good. Ensuring that all people receive a basic level of education, regardless of their ability to pay for it otherwise, is good for all of us. Public education advances important goals like equal opportunity, work force preparation and an educated populace.

Most Utah parents feel comfortable reading, writing, doing basic math, socializing with other people, finding (some) foreign countries on a map, and playing sports. But, as the pandemic lockdown has reminded so many, not all Utah parents feel qualified to be primarily responsible for teaching their children how to do all those things. No wonder fewer than 5% of school-aged children in Utah are homeschooled.**

It just so happens that public education also provides hundreds of hours of free, high-quality child care to Utah families while accomplishing those important societal goals. School is many things, and yes, it is also child care.

The more we learn about the incredible amount of brain development that occurs in early childhood, the stranger it seems that we, as a society, are still unwilling to acknowledge the reverse: child care is many things, and yes, it is also school.

Many Utah policymakers and elected officials still insist that “child care is a family issue” that should be left up to families to figure out. Families with young children are expected to either care for their children all day, or find someone else to do it for them. Under this model, all the inconvenience, confusion and cost associated with child care fall on individual families.

But our demographics show that this approach is painfully outdated.

Nearly 54% of all Utah children under age six live in a household with all available parents working. The parents of those children are not in a position to fulfill all the responsibilities of teaching, socializing, reading and playing with their children. Those families need the support of child care professionals who, in addition to providing a safe and caring environment for children while their parents are working, are also teaching, socializing, reading and playing with those children.

Unlike public school, however, there is an enormous cost associated with this invaluable service. Subsidies are only available to those Utah families making the least amount of money, while almost all Utah families (of any income level) struggle to afford the cost of child care for infants, toddlers, and preschool-aged children.

Most families can’t homeschool their school-aged children, because they work outside the home (or inside the home for many due to COVID19). Most families also can’t pay for private school, because they don’t make enough money from their work outside the home. Luckily, public school is available for all those families.

Most families can’t stay home to care for and teach their infant, toddler and pre-school aged children, because they work outside the home. Yet, we still expect them to pay for child care, even when they don’t make enough money from their work outside the home to afford the early care and education their children deserve.

We need to stop tip-toeing around the fact that Utah families rely on school not just for education, but for safe and highly-effective child care. We need to embrace it. At the same time, we need to embrace the reverse truth: that safe, high-quality childcare is also the equivalent of “school” for young children.

Safe, effective, high-quality care and education for Utah children of all ages is a public good. Treating child care and public education as part of the same important system of learning and development will create enormous benefit for these children, and, by extension, the rest of the state.

* Figures from the 2018 American Community Survey, accessed at data.census.gov.

** Calculated from data made available by the Utah State Board of Education on homeschooled children and public school enrollment in the 2015-16 school year (the most recent data reported on the USBE website at https://www.schools.utah.gov/data/reports?mid=1424&tid=4).

Special thanks to Erin Jemison, formerly of YWCA Utah and now with Community Resources for Justice's Crime & Justice Institute, for contributions to this post.

Poverty Advocates Tax Reform Letter

Utah Poverty Advocates Call for Fairer Taxes and Restoration of Public Revenues

Salt Lake City - Today (September 26, 2019) at the Utah State Capitol, a group of two dozen non-profit organizations that provide services to and advocate on behalf of Utah's low- and moderate-income population released a letter to the Tax Restructuring and Equalization Task Force. The letter calls on the Task Force to consider the impact on low-income Utahns as they consider tax changes that could, in the worst case scenario, make Utah's tax structure more regressive and less able to generate the revenues needed to make critically important investments in education, public health, infrastructure, poverty prevention, and other foundations of Utah's future prosperity and success.

The text of the letter and the list of signatories appears below (and is accessible as ![]() a pdf at this link):

a pdf at this link):

Open Letter to the Tax Restructuring and Equalization Task Force (TRETF)

Tax Reforms for Low- and Moderate-Income Utahns

September 2019

Dear Senators, Representatives, and Other Members of the TRETF:

We, the undersigned organizations that work with and advocate for low- and moderate-income Utahns, urge you to consider the impact on the most vulnerable Utahns of any tax policy changes that you propose this year.

We urge you to address the two major challenges facing our tax structure as it impacts lower-income Utahns:

1) Utah’s current system of taxation is regressive, in the sense that it requires lower-income Utahns to pay a higher share of their incomes to state and local government than it asks of the highest-income Utahns, even though about 100,000 lower-income Utah households are forced into – or deeper into – poverty by their tax burden every year.

This regressivity could be addressed with tax policy changes including the following:

- A Utah Earned Income Tax Credit (EITC) to allow the working poor to keep more of what they earn.

- Remove the sales tax entirely from food, as 34 other states have done.

- Remove the state income tax on Social Security benefits for low- and moderate-income seniors; Utah is one of only 13 states that tax these benefits.

- Restore the income tax rate to 5% or increase it above that level. (Because the majority of all Utah income is earned by the top quintile of taxpayers, and because the Utah income tax more closely matches Utah’s income distribution than any other tax, most of such an income tax rate increase would be paid by the top-earning 20% of Utahns, while most lower-income Utahns are shielded from income tax rate increases.)

- Disclose and evaluate the effectiveness of tax expenditures (revenue lost to the taxing system because of tax deductions, exemptions, credits, and exclusions); Utah’s lack of transparency in this area of taxation earned us a C grade from the Volcker Alliance, a leading evaluator of state budgetary practices founded by former Federal Reserve chairman Paul Volcker.

2) For decades, Utah’s overall level of taxation relative to the state’s economy has been dropping, as illustrated in the chart below from the Utah State Tax Commission:

The unfortunate result is that we are left with a tax structure that fails to generate sufficient revenues to allow our state and local governmental entities to properly meet their responsibilities and fulfill their appropriate role in a number of critical areas, including the following:

- Education: Utah ranks last nationally for our per-pupil investment in K-12 education. Particular areas of weakness include:

-

- · Teacher turnover rates are higher than the national average. One study found the majority of new teachers leave within seven years.

- · Pre-K: Utah ranks 36th for our percent of lower-income 3- and 4-year-olds attending pre-school, private or public. We are also 1 of only 7 states not to have statewide public preschool programs. (The state offers only small-scale programs in a limited number of local school districts.) Yet we know from multiple research sources that every dollar invested in high-quality day care and preschools produces at least a $7 return on that investment in future years.

- · Kindergarten: Only a third of Utah kids participate in full-day kindergarten, less than half the national average, because local school districts can’t afford to offer it. Voices for Utah Children estimates that it would cost at least $75 million to offer full-day K to all Utah kids (not including potential capital costs).

- · According to the January 2019 report of the Utah Afterschool Network, the need for after-school programs exceeds the supply many times over, leaving tens of thousands of children completely unsupervised, meaning they are less likely to do their homework and more likely to engage in unsafe activities.

In addition to these input measures, Utah is also lagging behind in terms of several significant educational outcome measures:

-

- · Our high school graduation rates are lower than national averages for nearly every racial and ethnic category, including our two largest, Whites and Latinos.

- · Among Millennials (ages 25-34), our percent of college graduates (BA/BS or higher) lags behind national trends overall and among women.

Moreover, Utah is in the midst of a demographic transformation that is enriching our state immeasurably but also resulting in majority-minority gaps at a scale that is unprecedented in our history. For example, in our education system:

-

- · Our gap between White and Latino high school graduation rates is larger than the national gap.

- · Education Week recently reported that Utah ranks in the worst 10 states for our growing educational achievement gap between haves and have-nots.

- · We are beginning to see concentrations of minority poverty that threaten to give rise to the type of segregation and socio-economic isolation that are common in other parts of the country but that Utah has largely avoided until now.

B. Infrastructure: Utah’s investment has fallen behind by billions of dollars. This is another area where the Volcker Alliance ranked Utah in the worst nine states for failing to track and disclose to the public the dollar value of deferred infrastructure replacement costs. In addition. Internet infrastructure is lacking in some rural counties, limiting their integration into Utah’s fast-growing economy.

C. Mental Health and Drug Treatment: Utah was recently ranked last in the nation for our inability to meet the mental health needs of our communities, according to a recent report from the Kem C. Gardner Policy Institute. Underfunding of drug treatment and mental health services costs taxpayers more in the long run as prison recidivism rates rise because the needed services are not available. Estimates are that Utah meets only 15% of the need for these vital, life-saving services.

D. Affordable housing units fall 41,266 units short of meeting the need for the 64,797 households earning less than $24,600, yet the annual $2.2 million state allocation to the Olene Walker Housing Loan Fund has not changed in over two decades, despite inflation of over 60%. Among extremely low-income renter households, 71% pay more than 50% of their income for housing, which is considered a severe housing burden. This year, the Olene Walker Housing Loan Fund used up most of its annual $14 million budget at its very first meeting of the fiscal year (made up of both state and federal funds).

E. Health care: Our rates of uninsured children are higher than national averages – and rising – especially among the one-in-six of our children who are Latino. In Utah 35,000 or 5% of White children are uninsured (national rank = 36th place), compared to 31,000 or 18% of Latino children (rank = 46th = last place in 2017).

F. Disability services: The 2018 annual report from the Utah Department of Human Services’ Division of Services for People with Disabilities reports that the wait list for disability services grew to a record level of 3,000 individuals last year and that the average time on the wait list is 5.7 years.

G. Seniors: The official poverty measure undercounts senior poverty because it does not consider the impact of out-of-pocket medical expenses. A 2018 study found that seniors spent $5,503 per person on out-of-pocket medical expenses in 2013, making up 41% of their Social Security income. (For most seniors, Social Security is the majority of their income, and it makes up 90% or more of income for 21% of married couples and about 45% of unmarried seniors.)

H. Domestic Violence: Although Utah's overall homicide rate is significantly lower than the national average, domestic-violence-related homicides constitute over 40% of Utah's adult homicides compared to 30% nationally. Several thousand women continue to be turned away annually from crisis shelters because of lack of capacity. Additional state funding would make it possible to substantially increase the capacity of overburdened crisis shelters. We are one of the few states without domestic violence services in every county.

Given the large number of urgent needs that are not being met because of our chronic shortage of public revenues, we are concerned that Utah is missing the opportunity to make critically important upfront investments now that would allow us to reap substantial rewards in the future, and that our most vulnerable neighbors will pay the greatest price as a result.

Thus, we urge you to consider the ways that the state tax structure impacts single parents, disabled adults, low-income children, seniors on fixed incomes, and other vulnerable population groups as you decide on your tax restructuring and equalization proposals.

Finally, thank you for all the time and effort you are personally investing as volunteer members of this important Task Force, and for all that you do for our state through this and other forms of public service.

Yours truly,

|

American Academy of Pediatrics Utah Chap. Catholic Diocese of Salt Lake City Coalition of Religious Communities Community Action Program of Utah Community Development Finance Alliance Community Rebuild |

Comunidades Unidas Crossroads Urban Center Epicenter First Step House League of Women Voters Utah Legislative Coalition for People with Disabilities ICAST Habitat for Humanity of Southwest Utah |

Moab Area Hsg Task Force Provo Housing Authority RESULTS Utah Rocky Mountain CRC Self-Help Homes, Provo, UT Utah Citizens’ Counsel Utah Coalition of Manufactured Homeowners Utah Community Action Utah Food Bank Utah Housing Coalition Utahns Against Hunger Voices for Utah Children |

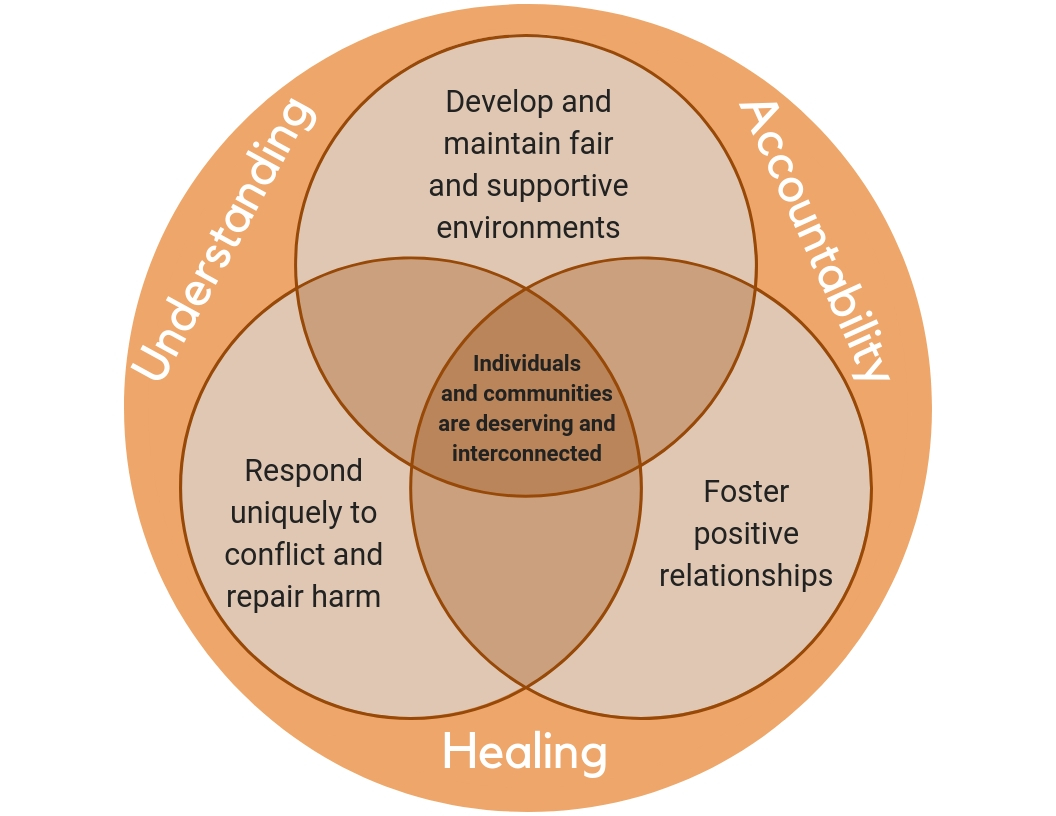

The Justice & Equality for Kids (JE4K) Rountable developed the ![]() Community Compact on Restorative Justice to bring integrity and focus to ongoing efforts to make our schools safer, our juvenile justice system more effective and compassionate, and our communities healthier.

Community Compact on Restorative Justice to bring integrity and focus to ongoing efforts to make our schools safer, our juvenile justice system more effective and compassionate, and our communities healthier.

Utahns have heard more and more about Restorative Justice over the past decade, sometimes in legislative proposals - such as this excellent offering by Rep. Sandra Hollins (R-Salt Lake) - and sometimes as part of discussions of about school-based discipline - such as this less instructive definition within the Utah State Board of Education's administative rules (R277-613-2.10). The term has been mentioned frequently in discussions about the appropriate role of School Resource Officers (SROs) practicing in Utah, as well as during the extensive juvenile justice reform process initiated by state leaders back in 2016.

Unfortunately, once a complex and deep-rooted philosophy becomes a buzzword, things can get a little hazy with regards to principles and definitions! But Restorative Justice does have a specific definition, grounded in historical pratice by indigenous cultures and built upon several key interrelated principles. The Community Compact on Restorative Justice is our iteration of that definition, developed in partnership with local Restorative Justice practitioners. It is an honest effort, by multiple community stakeholders, to assert that you can't just slap a "Restorative Justice" label on a random diversion program, and expect it to produce the positive results that are associated with the practice of this philosophy.

If you prefer to add an audiovisual element to your review of the Community Compact on Restorative Justice, JE4K Roundtable members unveiled the Compact for the first time at the Fourth Annual Breaking the Pipeline Symposium in March, hosted by fellow JE4K Roundatble member organization, Racially Just Utah. Here is a link to the livestreamed event, with discussion of the Community Compact on Restorative Justice beginning around the 39:09 minute mark.

It is hard to define Restorative Justice in a linear fashion, in a way that fits neatly into a slogan or list of bullet points. That is because the philosophy was not conceived in a linear way, and not developed by cultures that communicate in slogans or bullet points. That is why our Community Compact on Restorative Justice works together with a few simplified graphics, that stress the multi-dimensional nature of the approach. Below is the first and most foundational of the three graphics. The ![]() second graphic and

second graphic and ![]() third graphic demonstrate the practical application of these principles in an education and a juvenile justice setting, respectively.

third graphic demonstrate the practical application of these principles in an education and a juvenile justice setting, respectively.

So far, several organizations have signed on to the Community Compact on Restorative Justice - including the following members of our JE4K Roundtable:

- Voices for Utah Children (of course!),

- Journey of Hope,

- Ogden Branch NAACP,

- Utah Juvenile Defender Attorneys,

- Restorative Justice Collaborative of Utah,

- Disability Law Center,

- YWCA of Utah,

- ACLU of Utah,

- Mountain Mediation Center, and

- Racially Just Utah.

We would like your organization to join us on this list, and commit to holding restorative justice programs in our state to this standard. Your participation will also signal your organization's intention and commitment to practicing restorative justice in a manner that is based on this understanding of Restorative Justice. Our intent is to share this definition of Restorative Justice with governmental and community partners, toward the end of pushing policy in the direction of a more restorative framework.

For example, as we take part in policy conversations about "school safety" in the era of Parkland, Newtown and Santa Fe, we will continually point our stakeholder/partners to the underlying principles in this definition. That means a successful approach to school safety - if it truly aspires to be restorative - must be primarily preventative, relationship-based and encompassing of the whole school community. "Solutions" that focus only on emergency drills, mobilizing law enforcement, high-tech gadgetry and threat assessments cannot claim to be restorative, and will not lead to the positive outcomes associated with Restorative Justice practices (one of those positive outcomes being safe schools!). These approaches, when utilized, can and should be grounded in Restorative Justice principles, in order to ensure prevention of future problems rather than simply mitigation of current ones.

Restorative Justice |

NOT Restorative Justice |

| A values-based approach to building trust, strengthening relationships and resolving conflict. | A discretely-packaged program with a defined curriculum that will work in any setting, from school to prison. |

| A philosophy with deep roots in many indigenous cultures, with broad practical application. | A cool new idea, created by modern professionals and espoused only by bleeding heart liberals. |

| Practices are primarily preventative and can be easily integrated into other activities. | Practices are only employed after harm has been caused and all "traditional" solutions exhausted. |

| Example: Law enforcement officers and administrators meet regularly with community members to discuss neighborhood needs and issues. | Example: City officials hold an annual Town Hall where frustrated and angry community members sit in a circle and vent their frustrations at members of the local police department, who are forced to attend and listen. |

| Example: Bringing a group of students together to check in about their day before beginning the lesson. | Example: Forcing a student who has bullied a peer to apologize, then sit with the bullied student at lunch for a month to "get to know her." |

Restorative Justice is harder to explain than an active shooter drill or counseling program. It requires more than the hiring of a few new staff people, or the implementation of a new curriculum. It is not a quick fix, but it is a research-supported and fruitful investment in our community's health, prosperity and safety. This approach is worth the investment of time and intention, and we will continue to champion its principles in Utah's education, justice, and community landscapes in order to achieve the best possible outcomes for Utah kids.

To add your organization's name to this Compact, please contact the JE4K Roundtable via .

Response to Govenor's Budget Recommendations FY2020

On December 6, 2018, Governor Herbert released his budget recommendations for the next fiscal year (2020). The budget is based on a consensus forecast developed by the Governor’s Office of Management and Budget, the Office of the Legislative Fiscal Analyst and the Utah State Tax Commission.

In summary, the budget recommendations reflect an estimated $1 billion in surplus revenue due to Utah’s booming economy; a $200 million tax cut and a call to modernize Utah’s tax system. The budget’s theme is Growth and Quality of Life and presents budget recommendations covering the following key areas: Quality of Life, Qualified Workforce, and Tax Modernization.

Voices for Utah Children works to make Utah a place where all children thrive. While reviewing the Governor’s recommendations we asked one simple, important question: "Is it good for kids?" If it’s good for kids that means Utah’s families can fully participate in the economy and support their children. That means parents are able to ensure their children reach their full potential and grow up ready to contribute to Utah’s thriving communities.

Continuing the Governor’s theme of Growth and Quality of Life, Voices staff have reviewed the budget and make the following observations:

1. Quality of Life

Funding for Medicaid Expansion Implementation

In November, Utahns expressed their clear support for Medicaid expansion and chose to extend health insurance to 150,000 new individuals. Utah voters elected to expand Medicaid to individuals and parents, without work requirements or caps. Voters even chose a small sales tax increase to support affordable health coverage. The Governor recognizes this historic step forward for Utahns in his budget recommendations and allocates funds for expansion implementation by April 1, 2019. The policy brief accompanying the budget also explores different scenarios and “what ifs” about the provider and consumer safeguards included in the ballot initiative; however, none of these questions preclude expansion from rolling out April 1st. It is paramount that individuals and parents in the coverage gap be able to enroll in coverage as soon as possible, without any added delays or restrictions, and we thank the Governor for supporting expansion funds in the budget.

Proposition 3 did not include any additional work requirements or barriers to care, as the Governor’s budget and policy brief also notes. Our new state law does not stipulate that Medicaid enrollees meet a work requirement as a condition to health coverage. We support exploring future programs that help connect Medicaid beneficiaries with job resources, training, or helps facilitate community engagement. However, we should not rush into changes and any work support program should not preclude someone from receiving coverage. As we have seen in other states, the complexities and confusion around reporting a work requirement often result in individuals unnecessarily losing coverage- even though they are working (See Arkansas’ recent experience). We support programs that help individuals be healthy and work; but people cannot work if they are not healthy.

Funding for Children’s Health Coverage

The Governor’s budget includes important funding recommendations to ensure that Utah children are covered, as demonstrated through Medicaid consensus figures. The Governor’s recommendations are particularly timely as recent data show an alarming increase in the number of uninsured children in Utah. In fact, Utah was one of only nine states to experience an increase in our child uninsured rate. We thank the Governor for extending a welcome mat to ensure that more children can receive health insurance. Going forward, there are additional steps we hope the Governor will support, so that more children do not lose health coverage: it is critical to ensure children can avoid unnecessary insurance loss or disruptions, by implementing a policy of 12-month continuous eligibility in Medicaid; in addition, Utah must counter the ‘chilling effect’ in health coverage due to federal policies targeting immigrant communities. We thank the Governor for his previous efforts encouraging qualifying parents to sign their children up for Children’s Health Insurance Program (CHIP). It is especially critical now that the Governor continue to create a welcoming, safe environment for Utah families to obtain affordable health coverage.

E-Cigarette Taxes

The Governor recommends a sales-tax increase on e-cigarettes. As the Governor notes, e-cigarette use is on the rise and can have a significant, harmful impact on the health of our youth. We are encouraged that the Governor recommends taxing e-cigarette and related paraphernalia like traditional tobacco products. This is an important step to keeping our kids healthy. National research shows e-cigarette use can be highest among some of our most marginalized youth, including LGBTQI, gender non-conforming and transgender youth. We hope that, in addition, state agencies will also ensure that 1) we are collecting state-level data to better understand impacted kids here in Utah and 2) we are providing the right kinds of care and services, so all kids feel affirmed, loved and supported.

Integrating Physical and Behavioral Health

We applaud the Governor for addressing Utah’s bifurcated healthcare system where different entities are responsible for physical and behavioral health services. The policy brief accompanying the budget discusses efforts to better integrate these systems. We hope that these efforts will also incorporate the behavioral health care needs of specific populations including children and new mothers. The behavioral health care needs of these populations are often overlooked and under-resourced. For example, women suffering from perinatal mood disorders - commonly called “maternal depression”- often have trouble finding treatment and care. Going forward, new efforts to better integrate services should make sure kids and parents can get the unique behavioral health care they need early on, before a condition escalates.

Jessie Mandle, Senior Health Policy Analyst

School Safety

When it comes to spending on “school safety,” the Governor’s budget has given us cause for concern. Governor Herbert appears to support the recommendations of the “School Safety Advisory Committee,” a group which has drawn criticism for its lack of representation and for conducting its business outside the public view.

In November of this year, this Committee presented a $194 million bill titled “School and Student Safety Amendments,” which designated $164 million for schools to upgrade their physical facilities with student safety in mind. In his budget, Governor Herbert includes $66 million in “flexible” funding for this same purpose. We have no problem with funding for schools to modernize and improve their infrastructure, as many schools are in need of basic maintenance anyway. Why not build in new safety features while modernizing facilities?

We appreciate that the Governor has set aside $31.7 million in his budget for a “school counseling program,” which appears to reflect a similar $30 million ask from the School Safety Advisory Committee during November interim. We applaud Governor Herbert for explicitly saying that this funding should be used for counselors. Mental health professionals, social workers, counselors and other professionals are critical for building a safe and positive school climate. Investing in prevention when it comes to bullying, violence and suicide makes more sense than trying to deal with the aftermath of these ongoing challenges.

Our concern about school safety funding arises from what is not said in the Governor’s budget, but which exists in the proposed legislation from the School Safety Advisory Committee: a mandate for each school in the state to form “Threat Assessment and Student Support Teams” that are authorized to respond to “significantly disruptive behavior” from students – whatever that may mean.

This approach, which is loosely based on a specific protocol that has yielded good results in other states, could jeopardize the recent juvenile justice reforms that received a great deal of well-deserved attention and praise in the Governor’s budget document. Utah’s impressive juvenile justice reforms have included a focus on using restorative, rather than punitive, practices in schools. This approach decreases the number of youth who are referred to court for very low-level offenses (such as truancy and smoking), incurring high costs to taxpayers and negative outcomes for the youth themselves. We are very concerned that the legislation recommended by the School Safety Advisory Committee does not align with these important reforms. We all want our kids to be safe at school, but not every proposed solution creates actual safety, and some approaches actually make some groups of students less safe. Voices for Utah Children will have much more to say on this subject as we move closer to the 2019 Legislative Session.

Anna Thomas, Senior Policy Analyst

2. Quality Workforce

Education

We at Voices, are particularly happy about the recommendations for sustained and improved funding of public education. Education is the key to future career success for so many Utah kids – and our teachers are key to education. That’s why we are so pleased with the Governor’s support for boosting teacher pay. When teachers do well, students do well.

We scoured the Governor’s budget for any mention of investment in early education with no luck. We’re not panicking yet. The Governor’s Education Road Map, released a year ago this month, included an entire section of recommendations related to early learning. We expect to see more investment in this area as current state-funded early education programs become better aligned and coordinated.

Child Care

We couldn’t help but notice the absence of any mention of state investment in – or even attention to – the pressing child care needs of Utah’s workers and students. We agree with Governor Herbert that “Utah must invest in its people to achieve long-term success,” and that “a dynamic economy requires a skilled and education population.”

Having the right skills and the willingness to work isn’t enough to make our workforce successful, though. More Utah workers than ever before are now also parents. They can’t be expected to engage productively in our thriving economy unless they have access to affordable, accessible child care. The state currently does a good job of managing federal dollars that help to subsidize child care costs for working parents but invests very few state tax dollars for this purpose. The Governor’s proposed budget would do little to change this.

The irony is, Utah doesn’t just need to fill “high-paying jobs” with “highly skilled” workers. We need many more individuals who are willing to work jobs that don’t pay well enough relative to their importance to our economic development. These critical jobs are in the early care and education sector. Currently, the Utahns who provide child care to working parents all over the state, barely make enough to keep their own families out of poverty.

One easy way the Governor could bolster state investment in child care, would be to provide sufficient funding for subsidized childcare while parents are attending college. The Governor’s budget rightly emphasizes the importance of higher education in creating opportunity to otherwise “at-risk” families. However, lack of affordable child care keeps many parents – moms, especially – from going back to school to enhance their earning potential. If Utah is serious about investing in the workforce, the Governor’s budget should prioritize investment in college-based child care centers such as the Wee Care Center at Utah Valley University and the Sorenson Legacy Foundation Child & Family Development Center at Southern Utah University.

Anna Thomas, Senior Policy Analyst

anna@utahchildren.org

3. Tax Modernization

Utah’s economic structure is moving from goods based to service based. Most purchased goods generate a sales tax. Some services are taxed, but many others enjoy a sales tax exemption or a reduced tax rate. The following table illustrates a few examples.

| State Sales Tax Bases: Consumer Goods & Services as of 7/1/18 | |

| Groceries | Alternate Rate |

| Clothing | Taxable |

| Prescription Medication | Exempt |

| Non-Prescription Medication | Taxable |

| Gasoline | Exempt |

| Legal | Exempt |

| Financial | Exempt |

| Accounting | Exempt |

| Medical | Exempt |

| Landscaping | Exempt |

| Repair | Taxable |

| Real Estate Services | Exempt |

| Parking | Exempt |

| Dry Cleaning | Taxable |

| Fitness | Taxable |

| Barber | Exempt |

| Veterinary | Exempt |

| Tax Foundation 2019 State Business Tax Climate Index | |

| https://files.taxfoundation.org/20180925174436/2019-State-Business-Tax-Climate-Index.pdf | |

| https://tax.utah.gov/sales/food-rate | |

| Utah grocery sales tax is 3%, a higher rate is charged if food items are mixed or combined by seller and/or heated by seller, or utensils are provided. | |

The increase in services as an engine for economic growth is not generating enough tax revenue to keep pace with the rising cost to build and maintain Utah’s infrastructure and provide services which support communities and keep the economy humming. As Utah moves to a service based economy, transactions generating sales tax have declined from about 70% (in the 1980s) to 40%. As a percent of income, 95% of Utah’s families pay more in sales and other local taxes than the top 5% of higher income families.

Source: https://itep.org/whopays/

This is not the first time the Governor has called for a tax overhaul. Removing a few exemptions is a commonsense way to broaden the tax base. It is time for special interests to do their part to boost revenues needed to pay for investments which support Utah’s Growth and Quality of Life.

Revenue Earmarks

Earmarks are revenue assigned to fund specific government projects, services or programs. For example, gas taxes are earmarked for transportation needs while a portion of tobacco taxes are designated to fund antismoking initiatives. The recent voter approved Prop 3 calls for a sales tax increase earmarked to expand Medicaid access.

The Governor wants to reform the state’s earmark policy. He notes that 48% of new sales tax revenue growth is earmarked in FY2020 and further argues that earmarks are not transparent and do not allow policy makers to prioritize the state’s most pressing needs. He proposes that some earmarks be replaced by user fees.

The online dictionary defines fee as “a payment made to a professional person or to a professional or public body in exchange for advice or services.” A tax is “a compulsory contribution to state revenue, levied by the government on workers' income and business profits or added to the cost of some goods, services, and transactions.” Whether it’s a tax or fee, broadening the tax base must be done fairly, equitably and shared by all.