Tax and Budget

In-State vs Out-of-State Effects: The Key to Tax Restructuring Success?

If someone told you that the key to the success of the Utah Tax Restructuring and Equalization Task Force may well be found in an examination of the in-state vs out-of-state effects of the current draft proposal, your eyes would probably glaze over and you might suddenly recall a dentist appointment that you had forgotten.

But wait! Please tell the dentist you’ll reschedule and take a few minutes to read on.

Kansas: Tax Cuts That Went Too Far

The greatest danger for Utah’s future in the current debate is that fans of anti-tax/anti-government Pied Piper Grover Norquist and former Kansas Governor Sam Brownback will try to take advantage of the political pressures of the coming election year to follow in the footsteps of Kansas and include in the package a large revenue reduction. After all, tax cuts are always popular, and Utah has been giving in to that temptation for years.

Yet we know what an economic disappointment those tax cuts were in Kansas (it turns out that underinvesting in education and infrastructure does not actually help grow the economy), leading to devastating losses in subsequent elections for the plan’s proponents. The suddenly more moderate (while still Republican) Kansas legislature subsequently rolled back the tax cuts (though the voter backlash went on, electing a Democratic Governor last year in that very red state).

Apparently, it is possible to have too much of a good thing, even when it comes to tax cuts.

Successive rounds of tax cuts have left Utah with our lowest tax levels in decades, according to recent data from both the Utah Foundation and the Utah State Tax Commission. According to the Utah Foundation, the tax cuts of the last two decades have moved us from having the 6th highest taxes in the nation to #31 (even as we continue to have the nation’s highest percentage of children to educate). The Tax Foundation says that today we rank in the top 10 states for our business tax climate. By all accounts, our economy is booming and generating all the jobs we need, with an unemployment rate currently measured at 2.7%. So is it wise at this stage to use our temporary budget surplus to make even more permanent cuts to state revenues? Such additional tax cuts seem likely to have one of two possible outcomes, neither very desirable: Either they could rev our job-creating engine to the point that we’re creating enough new jobs not just for the next generation of Utahns but for hundreds of thousands of Californians to move here as well, or they could undermine the educational and infrastructural foundations of our long-term economic prosperity, as was the case in Kansas. Indeed, the tax cuts of recent decades have already crippled our ability to invest in education, infrastructure, air quality, public health, poverty prevention, and so many other areas where we have urgent unmet needs.

Should We Apply the Solutions of the Past to the Challenges of Today?

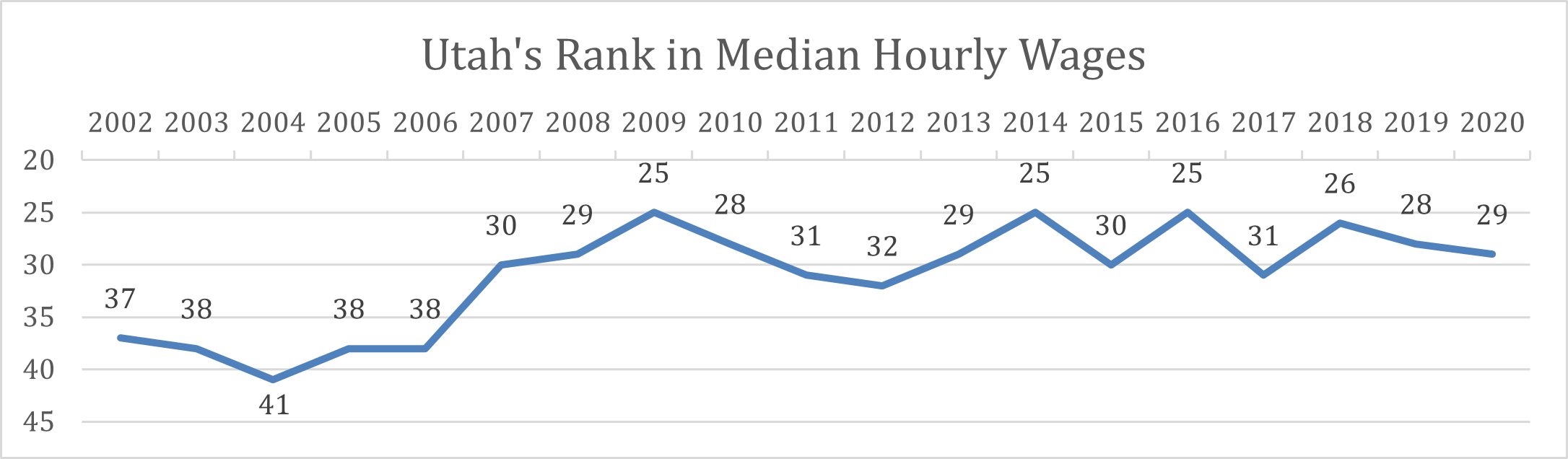

Certainly there is a strong case to be made that the tax cuts of recent decades helped Utah achieve our current economic success. Perhaps our most significant economic achievement of the last 20 years is that Utah has moved from being a low-wage state to middle-wage status, based on our rank for median hourly wage over the last two decades (#39 in 2006 vs. #27 last year). But rather than applying the solutions of the past to the challenges of today, the progress we've made puts us in a new position and allows us to ask a new question: Now that we have achieved middle-wage status, how can we, in the decades to come, follow in the footsteps of states like Colorado and Minnesota and move toward becoming a high-wage state?

Utah Has Fallen Behind on Educational Attainment

The secret to those states’ success lies in their higher levels of educational attainment. But right now Utah is behind on educational attainment. It is well-known that our teacher attrition rates are too high and so are our class sizes. But it is less well-known that, adjusted for demographics, our high school graduation rate is also behind the national average. In other words, for example, if you are White or Latino in Utah, you are less likely to graduate high school than Whites or Latinos nationally. At the college level, we have fallen behind national trends for BA/BS+ attainment among our younger generation, with only 34% of Utahns ages 25-34 having graduated college compared to 36% nationally, according to the latest 2018 Census data.

Utah’s Next Great Challenge: Our Growing Majority-Minority Gaps

Moreover, Utah is in the midst of a demographic transformation that is enriching our state immeasurably but also bringing majority-minority gaps of a type and at a scale that our state has not had to confront in the past. Education Week magazine recently ranked Utah among the worst 10 states for our growing educational achievement gap between haves and have-nots. Now is the time to make the upfront investments that will help us avoid going the way of other states that failed to close those gaps when they had the chance to do so in the most cost-effective manner.

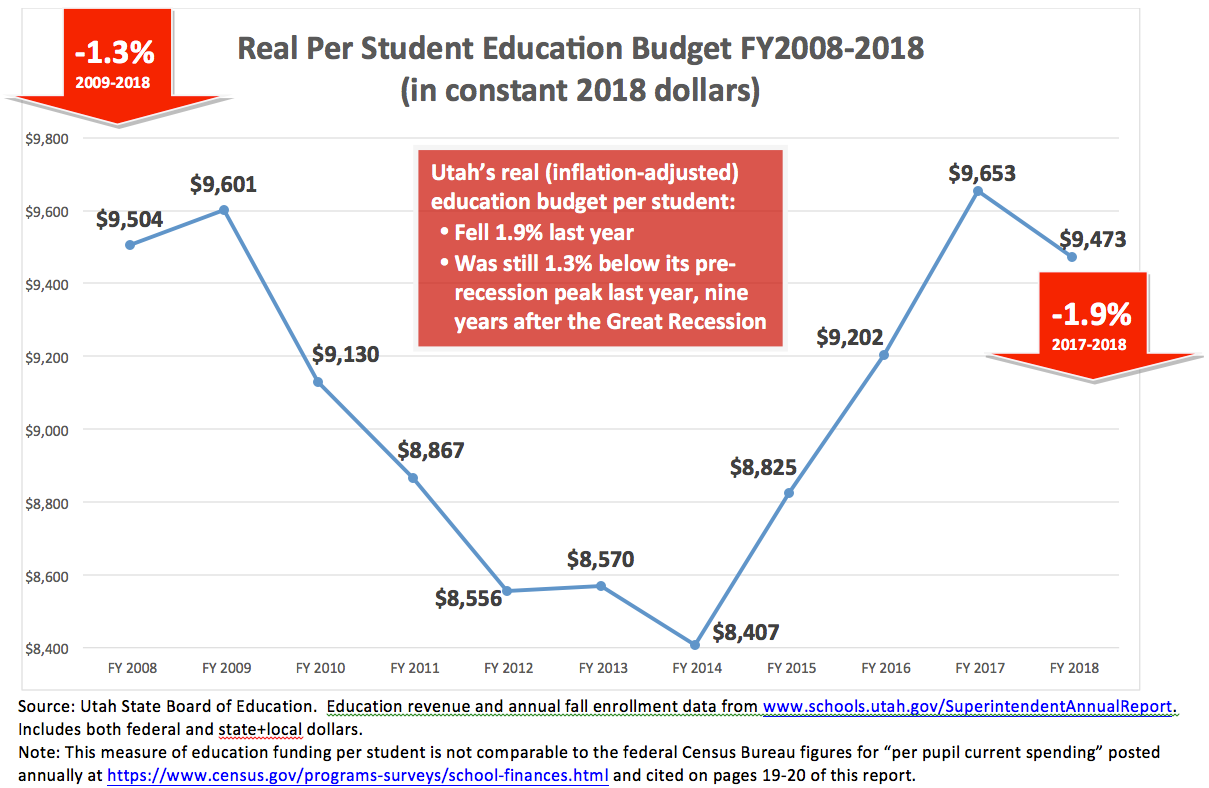

While there is little doubt that Utah does more with less better than any other state, we will not close our growing gaps and raise our educational attainment as long as we are stuck in last place for per-pupil investment. The unfortunate reality remains that our very real economic progress of recent decades has not resulted in increased investment in education. Rather, our total inflation-adjusted per-student state + local K-12 education revenues remained below pre-recession levels last year.

In-State vs. Out-of-State Effects

If we can agree that there could be real downsides to making additional cuts to state revenues in the proposed tax restructuring package, then what does this have to do with in-state vs. out-of-state effects of the proposed tax changes, and how could understanding those effects potentially save the package?

The answer is that the draft package’s roughly $600 million shift of revenues from income taxes to sales taxes also brings with it a less-noticed shift of about $100 million from in-state payers (aka Utahns) to out-of-state payers (non-Utahns). This is because a much higher share of the sales tax than of the income tax is paid by non-Utahns – about 25% of all sales tax revenues (though a much higher 40% for the gas tax and a much lower 5% for the grocery tax since tourists mostly eat prepared foods, which are already fully taxable). (That exact percent varies slightly from state to state. The state of Texas, for example, estimates that 21% of their sales tax is paid by non-Texans. while Minnesota estimates 23% for their sales tax.*)

The Implications of $100 Million of New Revenue from Out-of-State

The first implication of this $100 million shift is that the Task Force’s claim of an $80 million tax cut in their draft package actually understates the in-state tax cut (the tax cut for us Utahns) by roughly $100 million. This means that the draft package actually proposes a $180 million tax cut for Utahns -- in a package that costs the state $80 million of revenue annually.

The further implication of this is that the package could very easily be adjusted (simply by changing the proposed income tax rate) to make it revenue neutral overall – and still have a $100 million tax cut for Utahns.

But, building on the discussion above about our urgent unmet needs and chronic revenue shortages, the best implication of this in-state vs out-of-state shift is that this package could achieve one of the holy grails of tax policy – getting non-Utahns to pay for the things we Utahns need (education, infrastructure, etc.) – by using the new out-of-state revenue to get this package out of the red and permit a $100 million revenue enhancement for the state budget without costing Utahns a dime.

The Compromise That Could Carry the Day

But politics is politics, and politicians are politicians, and next year is an election year. Which brings us to the compromise that could potentially save this package: Take that $100 million of new out-of-state money and split it 50-50: Make the package $50 million revenue-positive so we can improve education and infrastructure and use the other $50 million for an in-state tax cut. Which is probably not anyone’s ideal solution, but it just might be the compromise that can carry the day.

* Here are the reports from the Texas and Minnesota state tax agencies that analyze the topic of exporting tax incidence to non-residents:

- Texas -- https://comptroller.texas.gov/transparency/reports/tax-exemptions-and-incidence/ -- see Table 1 on page 47 (p53 of the pdf) which reports that 21% of Texas' $37 billion of sales tax incidence is exported to out-of-state payers.

- Minnesota -- https://www.revenue.state.mn.us/sites/default/files/2019-03/%2B2019_tax_incidence_study_Nolinks_0.pdf -- see Table 2-1 on page 26 (page 40 of the pdf) which reports that 23% of Minnesota's sales tax incidence is exported to non-Minnesotans.

Tax Restructuring Process Picks Up Speed -- October 28, 2019 Update

Tax Restructuring Process Picks Up Speed

Last week (October 22, 2019) the Tax Restructuring and Equalization Task Force (TRETF) adopted its co-chairs’ proposal as its working document, passing a motion to produce draft legislation based on it for consideration at the Task Force’s next meeting on November 7th.

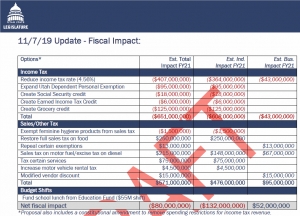

The chairs’ proposal is a mixed bag. When viewed through the lens of our tax reform position paper, we can say that it offers the potential to make Utah’s tax structure less regressive for most low-income Utahns, which would be welcome, but it also reduces overall public revenues by $79 million through an income tax rate cut that awards most of the total tax reduction to the wealthiest Utahns.

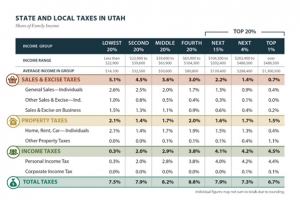

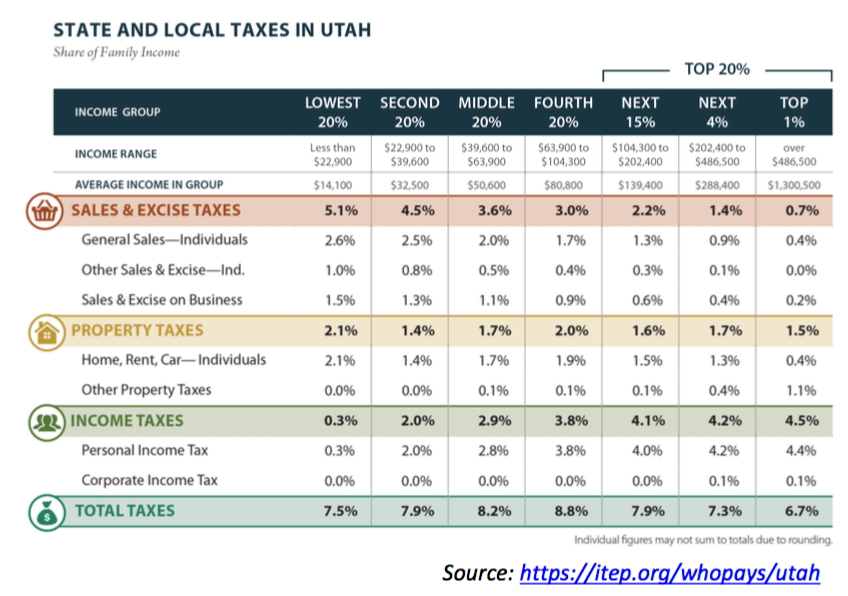

Utah’s current overall tax structure is regressive, in the sense that low- and middle-income Utahns pay 7.5%-8.8% of their incomes in state and local taxes, while the highest income Utahns pay just 6.7%. Under the Task Force co-chairs’ proposal, the tax rate for the lowest income Utahns would be reduced from 7.5% to 7%, at least on paper, but that estimate of a 0.5-percent-of-income reduction for the poor assumes that everyone who is eligible will file for the proposed new grocery tax credit that is intended to offset the regressive impact of the proposed increase in the state sales tax on groceries from 1.75% to 4.85%. We know from real-life experience that a considerable share of low-income Utahns will not file for the credit, mostly because they won’t know about it and because many low-income Utahns are not in the habit of filing tax forms every year because they are not required to do so, since their incomes are below the minimum threshold for mandatory filing.

The key to making this new proposed grocery tax credit a meaningful offset is to publicize it effectively to lower-income Utahns so that they will know about it and file for it. Right now, unfortunately, Utah gets a failing grade for our meager efforts to publicize the federal Earned Income Tax Credit (EITC), the closest analog to the proposed new grocery tax credit. The state budget included just $130,000 this year to help lower-income Utahns file for the EITC, which helps explain why our participation rate is estimated by the IRS at only 75% of eligible households, well below the national average of 80%.

Thus, Voices for Utah Children testified before the TRETF last week that Utah needs to increase our investment in publicizing low-income tax credits from a six-figure line item to a seven-figure item. Fortunately, this would be an expenditure with the potential to pay for itself because it will mean more Utahns will file not just for the new proposed grocery tax credit and IGP EITC included in the co-chairs’ proposal (thanks to an amendment offered by Rep. Robert Spendlove), but also for the federal EITC. If Utah were to reach the national average of 80% EITC participation among eligible households, that could result in an additional $30 million of consumer spending by lower-income households, most of which would likely be subject to the state sales tax, the increased revenue from which could well exceed the amount budgeted to publicize the new tax credits.

Voices for Utah Children will continue to press for the TRETF proposal to add a line item setting aside at least $1 million to publicize the new tax credits. Doing so would position Utah to have the most effective grocery tax credit among the handful of states that employ such a credit to try to shield low-income residents from the regressive effects of the sales tax on food.

Regarding the co-chairs’ proposal’s impact on overall Utah revenues, Voices for Utah Children participated in a coalition letter released last month in which 27 nonprofits serving lower-income Utahns documented a long list of urgent unmet needs that the state has not been able to address due to our chronic shortage of public revenues resulting from decades of tax cutting. Unfortunately, the co-chairs’ proposal makes use of a temporary state budget surplus to justify yet another permanent revenue reduction of $79 million annually. It must also be noted that this $79 million net revenue loss is almost exactly equal to the amount of the net tax cut going to the top 5% of Utahns, those earning over $238,000.

Therefore Voices for Utah Children will continue to advocate for removing from the proposal the part that reduces the statutory income tax rate from 4.95% to 4.59%, since about 60% of any income tax rate reduction goes to the highest income 20% of Utah households. This results from the fact that about 3/5 of all Utah income is earned by the top 1/5 of Utah households, and the state income tax matches the state's income distribution in this regard.

It is hard to avoid noticing the irony that this sector of top-earning Utahns that is benefitting the most from this proposed $79 million overall revenue reduction includes most of the leaders of the Our Schools Now proposal that just two years ago proposed to raise the income tax rate so that high-earning Utahns could contribute more to Utah’s education system. This certainly seemed to indicate at that time that upper-income Utahns were ready, willing, and able to invest more, not less, in Utah’s education system, where enhanced investment in Utah’s children would help lay the foundation for our state’s future prosperity and success. Voices for Utah Children hopes that many of these leading Utahns will speak up in the coming weeks to express their views on this proposed windfall for them that would accomplish the opposite of the goals of Our Schools Now.

Poverty Advocates Tax Reform Letter

Utah Poverty Advocates Call for Fairer Taxes and Restoration of Public Revenues

Salt Lake City - Today (September 26, 2019) at the Utah State Capitol, a group of two dozen non-profit organizations that provide services to and advocate on behalf of Utah's low- and moderate-income population released a letter to the Tax Restructuring and Equalization Task Force. The letter calls on the Task Force to consider the impact on low-income Utahns as they consider tax changes that could, in the worst case scenario, make Utah's tax structure more regressive and less able to generate the revenues needed to make critically important investments in education, public health, infrastructure, poverty prevention, and other foundations of Utah's future prosperity and success.

The text of the letter and the list of signatories appears below (and is accessible as ![]() a pdf at this link):

a pdf at this link):

Open Letter to the Tax Restructuring and Equalization Task Force (TRETF)

Tax Reforms for Low- and Moderate-Income Utahns

September 2019

Dear Senators, Representatives, and Other Members of the TRETF:

We, the undersigned organizations that work with and advocate for low- and moderate-income Utahns, urge you to consider the impact on the most vulnerable Utahns of any tax policy changes that you propose this year.

We urge you to address the two major challenges facing our tax structure as it impacts lower-income Utahns:

1) Utah’s current system of taxation is regressive, in the sense that it requires lower-income Utahns to pay a higher share of their incomes to state and local government than it asks of the highest-income Utahns, even though about 100,000 lower-income Utah households are forced into – or deeper into – poverty by their tax burden every year.

This regressivity could be addressed with tax policy changes including the following:

- A Utah Earned Income Tax Credit (EITC) to allow the working poor to keep more of what they earn.

- Remove the sales tax entirely from food, as 34 other states have done.

- Remove the state income tax on Social Security benefits for low- and moderate-income seniors; Utah is one of only 13 states that tax these benefits.

- Restore the income tax rate to 5% or increase it above that level. (Because the majority of all Utah income is earned by the top quintile of taxpayers, and because the Utah income tax more closely matches Utah’s income distribution than any other tax, most of such an income tax rate increase would be paid by the top-earning 20% of Utahns, while most lower-income Utahns are shielded from income tax rate increases.)

- Disclose and evaluate the effectiveness of tax expenditures (revenue lost to the taxing system because of tax deductions, exemptions, credits, and exclusions); Utah’s lack of transparency in this area of taxation earned us a C grade from the Volcker Alliance, a leading evaluator of state budgetary practices founded by former Federal Reserve chairman Paul Volcker.

2) For decades, Utah’s overall level of taxation relative to the state’s economy has been dropping, as illustrated in the chart below from the Utah State Tax Commission:

The unfortunate result is that we are left with a tax structure that fails to generate sufficient revenues to allow our state and local governmental entities to properly meet their responsibilities and fulfill their appropriate role in a number of critical areas, including the following:

- Education: Utah ranks last nationally for our per-pupil investment in K-12 education. Particular areas of weakness include:

-

- · Teacher turnover rates are higher than the national average. One study found the majority of new teachers leave within seven years.

- · Pre-K: Utah ranks 36th for our percent of lower-income 3- and 4-year-olds attending pre-school, private or public. We are also 1 of only 7 states not to have statewide public preschool programs. (The state offers only small-scale programs in a limited number of local school districts.) Yet we know from multiple research sources that every dollar invested in high-quality day care and preschools produces at least a $7 return on that investment in future years.

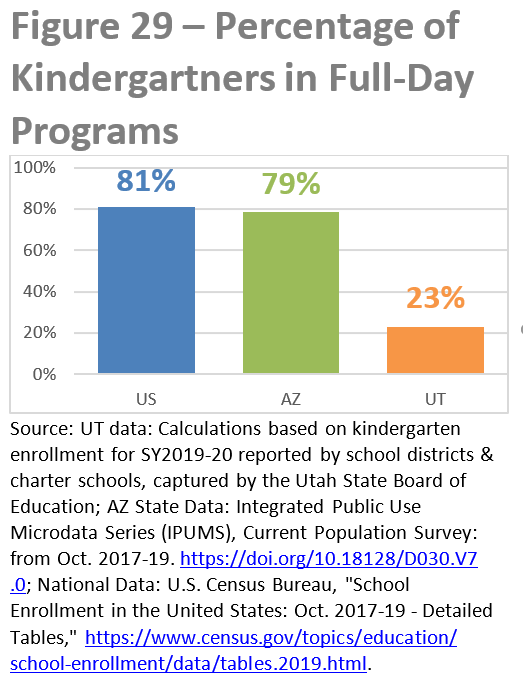

- · Kindergarten: Only a third of Utah kids participate in full-day kindergarten, less than half the national average, because local school districts can’t afford to offer it. Voices for Utah Children estimates that it would cost at least $75 million to offer full-day K to all Utah kids (not including potential capital costs).

- · According to the January 2019 report of the Utah Afterschool Network, the need for after-school programs exceeds the supply many times over, leaving tens of thousands of children completely unsupervised, meaning they are less likely to do their homework and more likely to engage in unsafe activities.

In addition to these input measures, Utah is also lagging behind in terms of several significant educational outcome measures:

-

- · Our high school graduation rates are lower than national averages for nearly every racial and ethnic category, including our two largest, Whites and Latinos.

- · Among Millennials (ages 25-34), our percent of college graduates (BA/BS or higher) lags behind national trends overall and among women.

Moreover, Utah is in the midst of a demographic transformation that is enriching our state immeasurably but also resulting in majority-minority gaps at a scale that is unprecedented in our history. For example, in our education system:

-

- · Our gap between White and Latino high school graduation rates is larger than the national gap.

- · Education Week recently reported that Utah ranks in the worst 10 states for our growing educational achievement gap between haves and have-nots.

- · We are beginning to see concentrations of minority poverty that threaten to give rise to the type of segregation and socio-economic isolation that are common in other parts of the country but that Utah has largely avoided until now.

B. Infrastructure: Utah’s investment has fallen behind by billions of dollars. This is another area where the Volcker Alliance ranked Utah in the worst nine states for failing to track and disclose to the public the dollar value of deferred infrastructure replacement costs. In addition. Internet infrastructure is lacking in some rural counties, limiting their integration into Utah’s fast-growing economy.

C. Mental Health and Drug Treatment: Utah was recently ranked last in the nation for our inability to meet the mental health needs of our communities, according to a recent report from the Kem C. Gardner Policy Institute. Underfunding of drug treatment and mental health services costs taxpayers more in the long run as prison recidivism rates rise because the needed services are not available. Estimates are that Utah meets only 15% of the need for these vital, life-saving services.

D. Affordable housing units fall 41,266 units short of meeting the need for the 64,797 households earning less than $24,600, yet the annual $2.2 million state allocation to the Olene Walker Housing Loan Fund has not changed in over two decades, despite inflation of over 60%. Among extremely low-income renter households, 71% pay more than 50% of their income for housing, which is considered a severe housing burden. This year, the Olene Walker Housing Loan Fund used up most of its annual $14 million budget at its very first meeting of the fiscal year (made up of both state and federal funds).

E. Health care: Our rates of uninsured children are higher than national averages – and rising – especially among the one-in-six of our children who are Latino. In Utah 35,000 or 5% of White children are uninsured (national rank = 36th place), compared to 31,000 or 18% of Latino children (rank = 46th = last place in 2017).

F. Disability services: The 2018 annual report from the Utah Department of Human Services’ Division of Services for People with Disabilities reports that the wait list for disability services grew to a record level of 3,000 individuals last year and that the average time on the wait list is 5.7 years.

G. Seniors: The official poverty measure undercounts senior poverty because it does not consider the impact of out-of-pocket medical expenses. A 2018 study found that seniors spent $5,503 per person on out-of-pocket medical expenses in 2013, making up 41% of their Social Security income. (For most seniors, Social Security is the majority of their income, and it makes up 90% or more of income for 21% of married couples and about 45% of unmarried seniors.)

H. Domestic Violence: Although Utah's overall homicide rate is significantly lower than the national average, domestic-violence-related homicides constitute over 40% of Utah's adult homicides compared to 30% nationally. Several thousand women continue to be turned away annually from crisis shelters because of lack of capacity. Additional state funding would make it possible to substantially increase the capacity of overburdened crisis shelters. We are one of the few states without domestic violence services in every county.

Given the large number of urgent needs that are not being met because of our chronic shortage of public revenues, we are concerned that Utah is missing the opportunity to make critically important upfront investments now that would allow us to reap substantial rewards in the future, and that our most vulnerable neighbors will pay the greatest price as a result.

Thus, we urge you to consider the ways that the state tax structure impacts single parents, disabled adults, low-income children, seniors on fixed incomes, and other vulnerable population groups as you decide on your tax restructuring and equalization proposals.

Finally, thank you for all the time and effort you are personally investing as volunteer members of this important Task Force, and for all that you do for our state through this and other forms of public service.

Yours truly,

|

American Academy of Pediatrics Utah Chap. Catholic Diocese of Salt Lake City Coalition of Religious Communities Community Action Program of Utah Community Development Finance Alliance Community Rebuild |

Comunidades Unidas Crossroads Urban Center Epicenter First Step House League of Women Voters Utah Legislative Coalition for People with Disabilities ICAST Habitat for Humanity of Southwest Utah |

Moab Area Hsg Task Force Provo Housing Authority RESULTS Utah Rocky Mountain CRC Self-Help Homes, Provo, UT Utah Citizens’ Counsel Utah Coalition of Manufactured Homeowners Utah Community Action Utah Food Bank Utah Housing Coalition Utahns Against Hunger Voices for Utah Children |

2019 Tax Reform Task Force

The Tax Reform Task Force legislatively mandated during the 2019 general session by HB495 has been created. Meetings have not been scheduled but we expect to hear something soon. In the meantime, House Democrats are holding town hall meetings on tax reform.

Draft tax reform legislation is expected to include a statewide EITC. Other proposals include increasing the sales tax on food and using a state EITC as the offset. Advocate worry about families obtaining immediate savings on food vs waiting for a refund. Concerns have been raised about the 25% to 30% tax filers who don’t file taxes and their ability to obtain both a federal EITC and state EITC.

Voices has prepared a tax reform position paper and will monitor tax reform discussions, especially around broadening the base and lowering the rate to mitigate the shift of the tax burden on the lower and middle income families.

![]() Voices for Utah Children 2019 Tax Reform Position

Voices for Utah Children 2019 Tax Reform Position

Utah Taxes on Tax Day 2019

Utah Taxes: Tax Day Resources 2019

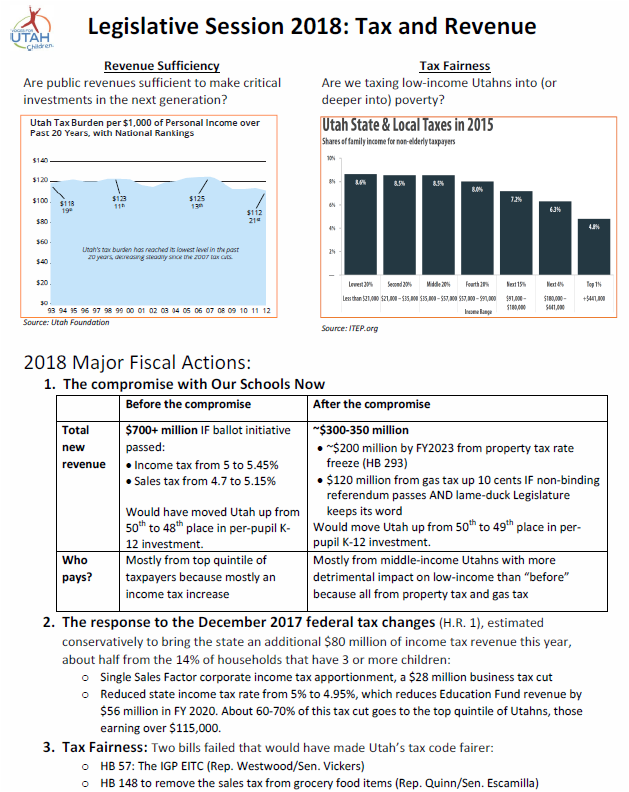

Voices for Utah Children works to make Utah a place where all children thrive. In furtherance of this mission, our fiscal policy research and advocacy program seeks to advance two priorities:

-

-

- Revenue Sufficiency: Ensuring that public revenues are sufficient to make the critical investments today in Utah’s children – especially those at risk of not achieving their full potential – so as to ensure the success and prosperity of our state tomorrow.

- Tax Fairness: Our system of generating public revenues – taxes – should seek to avoid driving low-income families into -- or deeper into – poverty.

-

As Utah and the nation mark Tax Day 2019 on Monday, April 15, Voices for Utah Children offers the resources below from our recent publications and those of other organizations that shed light on how well Utah is doing in addressing the two challenges above. Especially at a time when policymakers are considering significant changes to Utah’s system of taxation, we hope these resources may help point the way toward a prosperous and successful future for all Utahns and all of Utah’s children.

Revenue Sufficiency Resources

- The most recent comprehensive analysis found Utah at a multi-decade low for our overall state and local tax burden.

- The new Utah Children’s Budget Report 2019 released earlier this year documents that Utah’s K-12 education budget (including both state and local revenues) fell last year in real terms both overall for the first time in seven years (by $41 million) and on a per-student basis by 1.9%, leaving it 1.3% below its pre-recession peak, even after nine years of economic expansion.

- A Voices for Utah Children fact sheet at https://utahchildren.org/images/pdfs-doc/2019/Leg2019_tax_cuts_agenda_1-pager.pdf addresses the risks of current proposals to enact additional income tax rate reductions as opposed to smaller, targeted tax cuts that bring specific, measurable benefit to Utah.

- A recent report found that Utah could generate an additional $103 million of Education Fund revenue by closing a state tax loophole that allows major international corporations doing business here – many in direct competition with local Utah businesses – to hide their profits in offshore tax havens like the Cayman Islands.

Tax Fairness Resources

- Utah’s overall system of state and local taxation is regressive. Low- and middle-income Utahns pay an overall effective tax rate that is higher than the rate paid by upper-income Utahns. For additional details, visit www.itep.org/whopays/utah.

- Thanks to legislative champions including Rep. Robert Spendlove and Sen. Evan Vickers, the sponsors of HB 103 in the 2019 legislative session, as well as Rep. Tim Quinn, who included that proposal in his own HB 441, Utah may be on the verge of creating our own state version of the federal Earned Income Tax Credit (EITC). The bill proposes to offset $7 million of the $25 million of state and local taxes paid by the lowest-income Utahns every year. To learn more about this legislative proposal and how it would help promote independence and self-sufficiency for Utahns seeking to work their way out of poverty, download the fact sheet at http://www.utahfamilytaxcredits.org/learn-more/.

- Speaking of the EITC, only about 75% of eligible working Utahns file for this very valuable tax credit every year. This means tens of thousands of Utah households are losing the opportunity to receive an average refundable tax credit of over $2,000 -- up to a maximum of $6,400, depending on income and number of children. Utahns earning up to $54,000 can get free help with filing from certified volunteers at any VITA location – visit www.UtahTaxHelp.org for details!

The Utah Legislature’s Tax Overhaul Plan

The Utah Legislature’s Tax Overhaul Plan – 3/5/19 Update

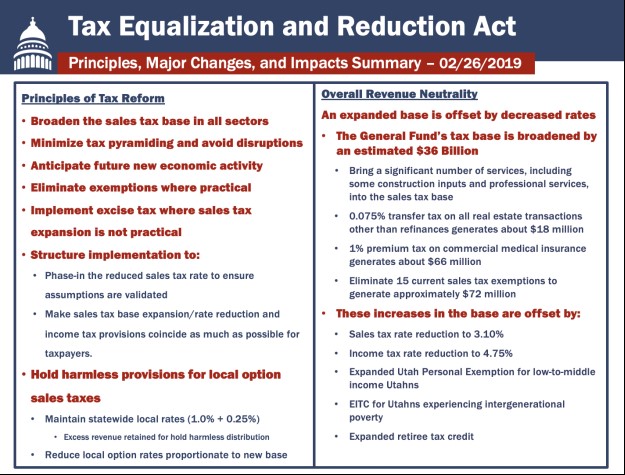

HB441 Tax Equalization and Reduction Act, sponsored by Representative Tim Quinn

The bill is an attempt to modernize Utah’s tax structure to keep pace with Utah’s changing economy. It had its first hearing on 3/1/19, in House Revenue and Taxation Standing Committee.

The bill passed out of committee by a vote of 12 to 2 and was placed on the 3rd Reading Calendar. It will get a hearing on the floor of the House on 3/5/19, at 6pm.

A summary of Rep. Quinn’s presentation follows:

|

IMPLEMENTATION Implementation structure that phases-in the reduced sales tax rate to ensure assumptions are validated

|

Yesterday (2/26/19) the Utah Legislature revealed its tax overhaul plan.

The plan marks the beginning of the Governor’s and Legislature’s attempt to modernize Utah’s tax structure to keep pace with a changing economy.

For detailed information about the Governor’s proposals click here.

For news reports which detail the Legislature’s plan click here and here.

We focus our attention on:

- Reduction of sales tax rate from 4.7% to 3.1%

- elimination of sales tax exemptions for businesses and services that are currently not required to pay sales tax.

- Reduction of income tax rate from 4.95% to 4.75%

- expand personal exemptions for low to middle income earners

- implement a targeted state earned income tax credit (EITC)

WHAT WE LIKE

We are encouraged to see light shined on businesses that are exempt from sales tax. Eliminating those tax exemptions expands responsibility for raising revenue to fund vital government services and infrastructure.

We are pleased the legislature included a targeted EITC for families experiencing intergenerational poverty. These working families earn less than $13,000 annually on average. The federal EITC ups their income by over $3000. A state EITC will provide another $300 on average and up to $650 depending on income and number of kids. For many, this income boost will be the push needed to get their children out of poverty.

ROOM FOR IMPROVEMENT

We are concerned about using this year’s temporary surplus to permanently lower the income tax rate from 4.95% to 4.75%. While a 0.2% reduction may seem minor, the decrease will harm Utah’s chronically underfunded schools.

Utah’s education system is predominately funded by state income tax revenue. Estimates show that for every 0.1 percent reduction in income tax rates, education funding will be reduced by $100 million. Last week’s Children’s Budget Report found that Utah’s education budget has been falling and remains below where it was a decade ago, before the Great Recession, so it can hardly afford to take another $200 million reduction.

Adding to our concern is Utah’s income tax is regressive at the top end, meaning that low to middle income families will continue paying a higher percent of their income to fund education than higher earning families.

CONCLUSION

As the bill goes through the public hearing process in the final weeks of the legislative session, Voices will monitor and provide input to ensure that Utah’s tax system is equitable and a shared responsibility among citizens and businesses alike.

Response to Govenor's Budget Recommendations FY2020

On December 6, 2018, Governor Herbert released his budget recommendations for the next fiscal year (2020). The budget is based on a consensus forecast developed by the Governor’s Office of Management and Budget, the Office of the Legislative Fiscal Analyst and the Utah State Tax Commission.

In summary, the budget recommendations reflect an estimated $1 billion in surplus revenue due to Utah’s booming economy; a $200 million tax cut and a call to modernize Utah’s tax system. The budget’s theme is Growth and Quality of Life and presents budget recommendations covering the following key areas: Quality of Life, Qualified Workforce, and Tax Modernization.

Voices for Utah Children works to make Utah a place where all children thrive. While reviewing the Governor’s recommendations we asked one simple, important question: "Is it good for kids?" If it’s good for kids that means Utah’s families can fully participate in the economy and support their children. That means parents are able to ensure their children reach their full potential and grow up ready to contribute to Utah’s thriving communities.

Continuing the Governor’s theme of Growth and Quality of Life, Voices staff have reviewed the budget and make the following observations:

1. Quality of Life

Funding for Medicaid Expansion Implementation

In November, Utahns expressed their clear support for Medicaid expansion and chose to extend health insurance to 150,000 new individuals. Utah voters elected to expand Medicaid to individuals and parents, without work requirements or caps. Voters even chose a small sales tax increase to support affordable health coverage. The Governor recognizes this historic step forward for Utahns in his budget recommendations and allocates funds for expansion implementation by April 1, 2019. The policy brief accompanying the budget also explores different scenarios and “what ifs” about the provider and consumer safeguards included in the ballot initiative; however, none of these questions preclude expansion from rolling out April 1st. It is paramount that individuals and parents in the coverage gap be able to enroll in coverage as soon as possible, without any added delays or restrictions, and we thank the Governor for supporting expansion funds in the budget.

Proposition 3 did not include any additional work requirements or barriers to care, as the Governor’s budget and policy brief also notes. Our new state law does not stipulate that Medicaid enrollees meet a work requirement as a condition to health coverage. We support exploring future programs that help connect Medicaid beneficiaries with job resources, training, or helps facilitate community engagement. However, we should not rush into changes and any work support program should not preclude someone from receiving coverage. As we have seen in other states, the complexities and confusion around reporting a work requirement often result in individuals unnecessarily losing coverage- even though they are working (See Arkansas’ recent experience). We support programs that help individuals be healthy and work; but people cannot work if they are not healthy.

Funding for Children’s Health Coverage

The Governor’s budget includes important funding recommendations to ensure that Utah children are covered, as demonstrated through Medicaid consensus figures. The Governor’s recommendations are particularly timely as recent data show an alarming increase in the number of uninsured children in Utah. In fact, Utah was one of only nine states to experience an increase in our child uninsured rate. We thank the Governor for extending a welcome mat to ensure that more children can receive health insurance. Going forward, there are additional steps we hope the Governor will support, so that more children do not lose health coverage: it is critical to ensure children can avoid unnecessary insurance loss or disruptions, by implementing a policy of 12-month continuous eligibility in Medicaid; in addition, Utah must counter the ‘chilling effect’ in health coverage due to federal policies targeting immigrant communities. We thank the Governor for his previous efforts encouraging qualifying parents to sign their children up for Children’s Health Insurance Program (CHIP). It is especially critical now that the Governor continue to create a welcoming, safe environment for Utah families to obtain affordable health coverage.

E-Cigarette Taxes

The Governor recommends a sales-tax increase on e-cigarettes. As the Governor notes, e-cigarette use is on the rise and can have a significant, harmful impact on the health of our youth. We are encouraged that the Governor recommends taxing e-cigarette and related paraphernalia like traditional tobacco products. This is an important step to keeping our kids healthy. National research shows e-cigarette use can be highest among some of our most marginalized youth, including LGBTQI, gender non-conforming and transgender youth. We hope that, in addition, state agencies will also ensure that 1) we are collecting state-level data to better understand impacted kids here in Utah and 2) we are providing the right kinds of care and services, so all kids feel affirmed, loved and supported.

Integrating Physical and Behavioral Health

We applaud the Governor for addressing Utah’s bifurcated healthcare system where different entities are responsible for physical and behavioral health services. The policy brief accompanying the budget discusses efforts to better integrate these systems. We hope that these efforts will also incorporate the behavioral health care needs of specific populations including children and new mothers. The behavioral health care needs of these populations are often overlooked and under-resourced. For example, women suffering from perinatal mood disorders - commonly called “maternal depression”- often have trouble finding treatment and care. Going forward, new efforts to better integrate services should make sure kids and parents can get the unique behavioral health care they need early on, before a condition escalates.

Jessie Mandle, Senior Health Policy Analyst

School Safety

When it comes to spending on “school safety,” the Governor’s budget has given us cause for concern. Governor Herbert appears to support the recommendations of the “School Safety Advisory Committee,” a group which has drawn criticism for its lack of representation and for conducting its business outside the public view.

In November of this year, this Committee presented a $194 million bill titled “School and Student Safety Amendments,” which designated $164 million for schools to upgrade their physical facilities with student safety in mind. In his budget, Governor Herbert includes $66 million in “flexible” funding for this same purpose. We have no problem with funding for schools to modernize and improve their infrastructure, as many schools are in need of basic maintenance anyway. Why not build in new safety features while modernizing facilities?

We appreciate that the Governor has set aside $31.7 million in his budget for a “school counseling program,” which appears to reflect a similar $30 million ask from the School Safety Advisory Committee during November interim. We applaud Governor Herbert for explicitly saying that this funding should be used for counselors. Mental health professionals, social workers, counselors and other professionals are critical for building a safe and positive school climate. Investing in prevention when it comes to bullying, violence and suicide makes more sense than trying to deal with the aftermath of these ongoing challenges.

Our concern about school safety funding arises from what is not said in the Governor’s budget, but which exists in the proposed legislation from the School Safety Advisory Committee: a mandate for each school in the state to form “Threat Assessment and Student Support Teams” that are authorized to respond to “significantly disruptive behavior” from students – whatever that may mean.

This approach, which is loosely based on a specific protocol that has yielded good results in other states, could jeopardize the recent juvenile justice reforms that received a great deal of well-deserved attention and praise in the Governor’s budget document. Utah’s impressive juvenile justice reforms have included a focus on using restorative, rather than punitive, practices in schools. This approach decreases the number of youth who are referred to court for very low-level offenses (such as truancy and smoking), incurring high costs to taxpayers and negative outcomes for the youth themselves. We are very concerned that the legislation recommended by the School Safety Advisory Committee does not align with these important reforms. We all want our kids to be safe at school, but not every proposed solution creates actual safety, and some approaches actually make some groups of students less safe. Voices for Utah Children will have much more to say on this subject as we move closer to the 2019 Legislative Session.

Anna Thomas, Senior Policy Analyst

2. Quality Workforce

Education

We at Voices, are particularly happy about the recommendations for sustained and improved funding of public education. Education is the key to future career success for so many Utah kids – and our teachers are key to education. That’s why we are so pleased with the Governor’s support for boosting teacher pay. When teachers do well, students do well.

We scoured the Governor’s budget for any mention of investment in early education with no luck. We’re not panicking yet. The Governor’s Education Road Map, released a year ago this month, included an entire section of recommendations related to early learning. We expect to see more investment in this area as current state-funded early education programs become better aligned and coordinated.

Child Care

We couldn’t help but notice the absence of any mention of state investment in – or even attention to – the pressing child care needs of Utah’s workers and students. We agree with Governor Herbert that “Utah must invest in its people to achieve long-term success,” and that “a dynamic economy requires a skilled and education population.”

Having the right skills and the willingness to work isn’t enough to make our workforce successful, though. More Utah workers than ever before are now also parents. They can’t be expected to engage productively in our thriving economy unless they have access to affordable, accessible child care. The state currently does a good job of managing federal dollars that help to subsidize child care costs for working parents but invests very few state tax dollars for this purpose. The Governor’s proposed budget would do little to change this.

The irony is, Utah doesn’t just need to fill “high-paying jobs” with “highly skilled” workers. We need many more individuals who are willing to work jobs that don’t pay well enough relative to their importance to our economic development. These critical jobs are in the early care and education sector. Currently, the Utahns who provide child care to working parents all over the state, barely make enough to keep their own families out of poverty.

One easy way the Governor could bolster state investment in child care, would be to provide sufficient funding for subsidized childcare while parents are attending college. The Governor’s budget rightly emphasizes the importance of higher education in creating opportunity to otherwise “at-risk” families. However, lack of affordable child care keeps many parents – moms, especially – from going back to school to enhance their earning potential. If Utah is serious about investing in the workforce, the Governor’s budget should prioritize investment in college-based child care centers such as the Wee Care Center at Utah Valley University and the Sorenson Legacy Foundation Child & Family Development Center at Southern Utah University.

Anna Thomas, Senior Policy Analyst

anna@utahchildren.org

3. Tax Modernization

Utah’s economic structure is moving from goods based to service based. Most purchased goods generate a sales tax. Some services are taxed, but many others enjoy a sales tax exemption or a reduced tax rate. The following table illustrates a few examples.

| State Sales Tax Bases: Consumer Goods & Services as of 7/1/18 | |

| Groceries | Alternate Rate |

| Clothing | Taxable |

| Prescription Medication | Exempt |

| Non-Prescription Medication | Taxable |

| Gasoline | Exempt |

| Legal | Exempt |

| Financial | Exempt |

| Accounting | Exempt |

| Medical | Exempt |

| Landscaping | Exempt |

| Repair | Taxable |

| Real Estate Services | Exempt |

| Parking | Exempt |

| Dry Cleaning | Taxable |

| Fitness | Taxable |

| Barber | Exempt |

| Veterinary | Exempt |

| Tax Foundation 2019 State Business Tax Climate Index | |

| https://files.taxfoundation.org/20180925174436/2019-State-Business-Tax-Climate-Index.pdf | |

| https://tax.utah.gov/sales/food-rate | |

| Utah grocery sales tax is 3%, a higher rate is charged if food items are mixed or combined by seller and/or heated by seller, or utensils are provided. | |

The increase in services as an engine for economic growth is not generating enough tax revenue to keep pace with the rising cost to build and maintain Utah’s infrastructure and provide services which support communities and keep the economy humming. As Utah moves to a service based economy, transactions generating sales tax have declined from about 70% (in the 1980s) to 40%. As a percent of income, 95% of Utah’s families pay more in sales and other local taxes than the top 5% of higher income families.

Source: https://itep.org/whopays/

This is not the first time the Governor has called for a tax overhaul. Removing a few exemptions is a commonsense way to broaden the tax base. It is time for special interests to do their part to boost revenues needed to pay for investments which support Utah’s Growth and Quality of Life.

Revenue Earmarks

Earmarks are revenue assigned to fund specific government projects, services or programs. For example, gas taxes are earmarked for transportation needs while a portion of tobacco taxes are designated to fund antismoking initiatives. The recent voter approved Prop 3 calls for a sales tax increase earmarked to expand Medicaid access.

The Governor wants to reform the state’s earmark policy. He notes that 48% of new sales tax revenue growth is earmarked in FY2020 and further argues that earmarks are not transparent and do not allow policy makers to prioritize the state’s most pressing needs. He proposes that some earmarks be replaced by user fees.

The online dictionary defines fee as “a payment made to a professional person or to a professional or public body in exchange for advice or services.” A tax is “a compulsory contribution to state revenue, levied by the government on workers' income and business profits or added to the cost of some goods, services, and transactions.” Whether it’s a tax or fee, broadening the tax base must be done fairly, equitably and shared by all.

Patrice Schell Scott, State Priorities Partnership Fellow

2018 Utah Legislative Update

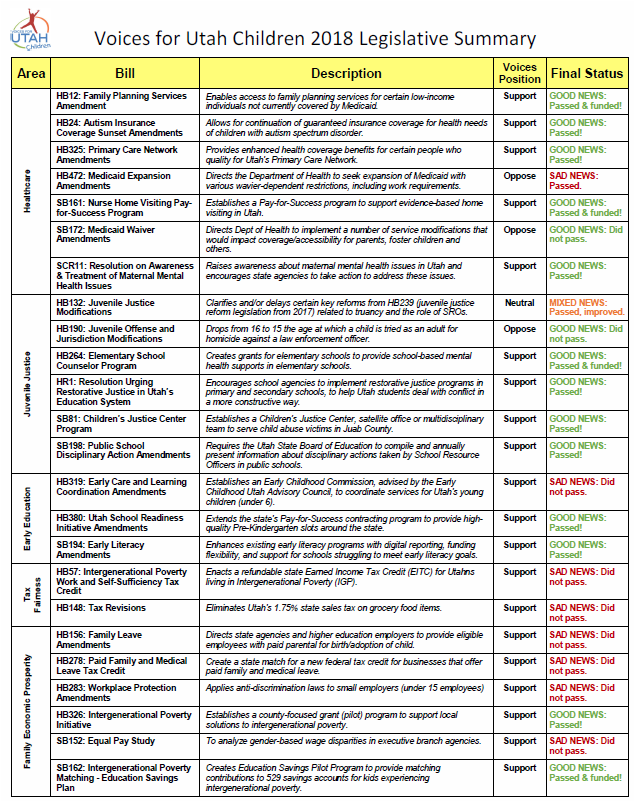

The 2018 Legislative Session is over. Voices for Utah Children worked tirelessly to advocate for Utah’s children and families, and we had some great wins and some painful losses. Nonetheless, Utah children and families are in a better place now than they were in January.

Health

WIN: HB12 Family Planning Services Amendments (Rep. Ward)

- This legislation was championed by a number of Voices allies (YWCA, Utah Women’s Coalition, ACLU, and Planned Parenthood) to provide family planning services to low-income individuals through Medicaid

WIN: HB325 Primary Care Network Amendments (Rep. Eliason)

- This bill will direct the Department of Health to get a waiver to expand current PCN services for adults receiving coverage from the state.

DEFEATED: SB48 Medicaid Waiting Period Amendments (Sen. Christensen)

- This legislation would have re-imposed a five-year waiting period on legal immigrant children before they could enroll in health coverage. Our advocacy work helped ensure this bill never got heard

DEFEATED: SB 172 Medicaid Waiver (Sen. Hemmert)

- This bill would have done away with Medicaid’s children’s health benefit and EPSDT. This would have caused 2,600 parents and former foster youth to lose their health coverage. Voices defeated it in the House Health and Human Services Committee and again in the House Revenue and Taxation Committee.

LOSS: Keeping Kids Covered – 12-month continuous eligibility on Medicaid

- Rep. Ward appropriation requested wasn’t prioritized high enough to receive funding this year.

LOSS: Dental hygiene check-ups for kids in public education settings

- Dental Code for use by dental professionals providing hygiene check-ups for kids in public education settings - did not get prioritized high enough to be funded for this year - but we’ve strengthened our relationship with a huge association of highly motivated dental hygienists!

LOSS: HB472 Medicaid Expansion Revisions (Rep. Spendlove)

- HB472 seeks a waiver, that is highly unlikely Utah will receive from the Trump Administration. This waiver would provide Medicaid benefits to eligible individuals below 95% of the federal poverty level.

The Utah Decides Ballot Initiative is now our last hope to get Medicaid expansion done in 2018.

Early Childhood

LOSS - HB319 Early Care and Learning Coordination Amendments (Rep. Chavez-Houck)

- A priority bill to form an Early Childhood Commission for better governance and coordination among agencies offering services to Utah’s youngest kids (0 to 5).

WIN - HB380 Utah School Readiness Initiative Amendments – (Rep. Last)

- With a close collaboration with United Way of Salt Lake, this bill will continue the school readiness program, Pay-for-Success. Since 2014 this has provided thousands of at-risk kids in Salt Lake county with high-quality pre-school.

WIN - SCR11 Concurrent Resolution on Awareness and Treatment of Maternal Depression and Anxiety (Sen. Zehnder)

- With the efforts of the Maternal Mental Health Coalition, this resolution energized and inspired story-sharing and education on maternal mental health.

WIN: SB161 Nurse Home Visiting Pay-for-Success Program (Sen. Escamilla)

- This legislation will fully fund the Nurse Family Partnership by putting it forward as a Pay-for-Success Program.

Juvenile Justice

WIN: HR1 House Resolution Urging Restorative Justice in Utah’s Education System – (Rep. Sandra Hollins)

- Resolution to encourage the use of restorative justice practices in Utah schools

NOT A WIN BUT NOT A LOSS: HB132 Juvenile Justice Modifications (Rep. Snow)

- Updates to last year’s big juvenile justice reform effort - we fought hard with our allies (ACLU, Libertas Institute, YWCA, Racially Just Utah) to keep the changes to a minimum. This bill gives school a limited amount of time to update their programs to comply with HB239 from 2017.

WIN: SB198 – Public School Disciplinary Action Amendments (Sen. Anderegg)

- This legislation requires the Board of Education to produce an annual report looking at law enforcement and disciplinary action in schools. This data will be helpful as we work to reduce racial disparities in school discipline and work to build a system that produces better outcomes for all kids.

Tax and Budget

NOT QUITE A WIN BUT OH SO CLOSE: HB57 Utah Intergenerational Poverty Work and Self-sufficiency Tax Credit (Rep. Westwood/Sen. Vickers)

- This bill would have created a $6 million Earned Income Tax Credit (EITC) for 25,000 working families identified as being in the Intergenerational Poverty (IGP) cohort by the state Department of Workforce Services. These families, which pay tens of millions of dollars in state and local taxes every year, would have been able to keep more of what they earn with a tax credit averaging $240 (and up to $600 maximum). This legislation received unanimous support in both House and Senate committees, passed the House, and received a 22-4 vote on 2nd reading in the Senate. But on the final day of the session, leadership decided to leave it out of the final tax package.

NOT QUITE A WIN BUT COULD HAVE BEEN A LOSS --SCHOOL FUNDING

- The most notable fiscal outcome of the 2018 Legislative Session was a deal between legislative leadership and education funding advocates. The compromise deal included two big choices:

- Investing up to about $350 million in new education funding dollars – which should move Utah up one position in the national rankings for per-pupil K-12 funding, from 50th place to 49th if it is fully implemented.

- Shifting who pays these new dollars in a way that unfortunately more negatively impacts poor and middle class families. The Our Schools Now initiative proposal that was set aside in favor of this compromise would have raised over $700 million mostly from an income tax increase paid by the top 20% of Utahn (those who earn over $115,000). The compromise shifted these funds to come from more regressive gas and property tax increases.

LOSS: HB 148: House Bill 148 Tax Revisions- Sales Tax on Food (Rep. Quinn)

- Sought to eliminate the state sales tax on grocery food items (currently 1.75%) and make up for the $88 million in lost revenue by slightly increasing the general state sales tax rate from 4.7 to 4.92%. One underappreciated benefit of this tax change would have been to shift 20% of the $88 million, or $17.6 million, off of state residents and onto tourists and out-of-state residents who purchase Utah exports. The bill passed the House but was killed by the Senate Revenue and Taxation Committee.

WIN: Two Significant Intergenerational Poverty (IGP) bills

- HB 326 Intergenerational Poverty Initiative (Rep. Redd) establishes a one-time $1 million grant program for local IGP initiatives.

- SB 162 Intergenerational Poverty Matching – Education Savings Plan (Sen. Vickers) establishes a $100,000 matching grant program for IGP families that invest in a Utah Educational Savings Plan for their children's post-secondary education.

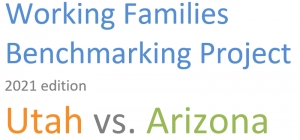

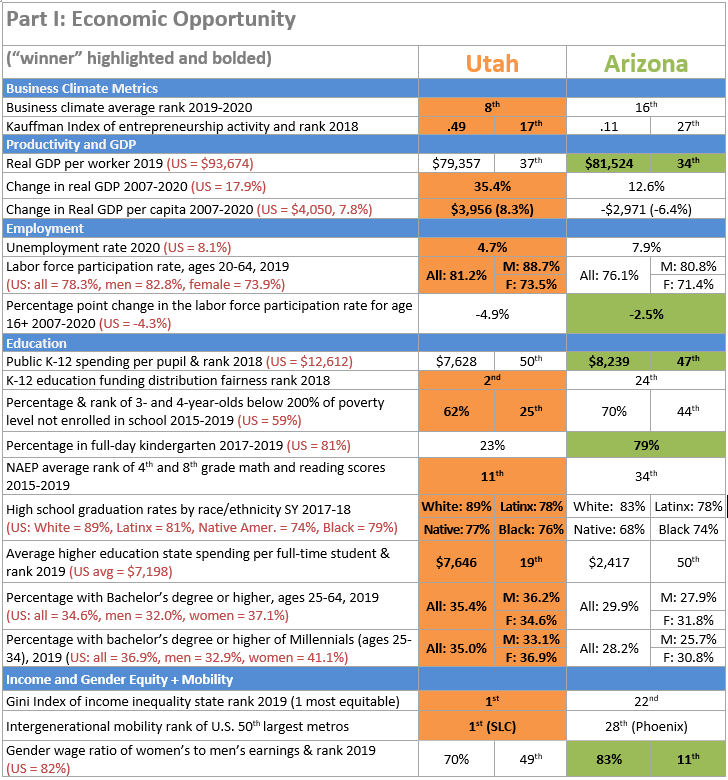

New Economic Benchmarking Report Finds Utah Ahead of Arizona in Most Key Metrics of Economic Opportunity and Standard of Living

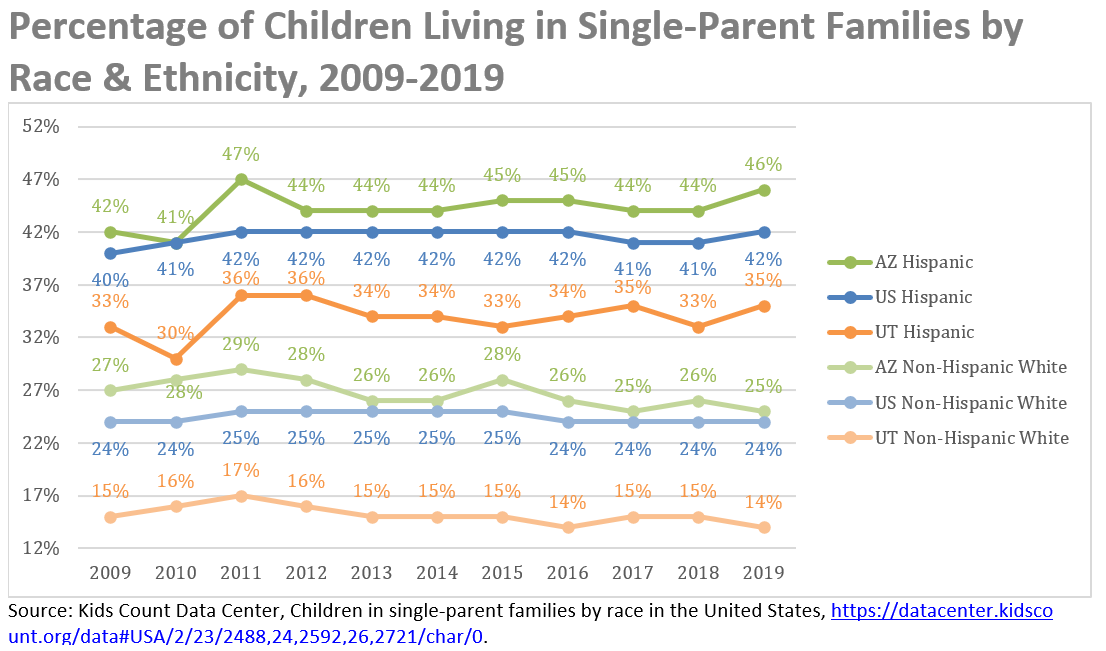

Salt Lake City, May 6, 2021 - Voices for Utah Children released today the fourth in its series of ![]() economic benchmarking reports that evaluate how the Utah economy is experienced by median- and lower-income families by benchmarking Utah against another state. This year's report, authored by Taylor Throne and Matthew Weinstein with support from interns from the University of Utah Department of Economics, compares Utah to its southern neighbor, Arizona. Utah and Arizona have a nearly identical proportion of working age adults (18 to 64 years), increasingly diverse populations, and ready access to outdoor recreational opportunities here in the American Southwest. The findings in this year's report shed light on some of Utah's greatest strengths as well as where we can continue to improve.

economic benchmarking reports that evaluate how the Utah economy is experienced by median- and lower-income families by benchmarking Utah against another state. This year's report, authored by Taylor Throne and Matthew Weinstein with support from interns from the University of Utah Department of Economics, compares Utah to its southern neighbor, Arizona. Utah and Arizona have a nearly identical proportion of working age adults (18 to 64 years), increasingly diverse populations, and ready access to outdoor recreational opportunities here in the American Southwest. The findings in this year's report shed light on some of Utah's greatest strengths as well as where we can continue to improve.

Voices for Utah Children's State Priorities Partnership Director Matthew Weinstein commented, "The main takeaways from this report and the others in the series are that Utah's economic successes put us in a position to make the new upfront investments we need to make now -- in education, public health, poverty prevention, and closing majority-minority gaps -- so that we can achieve our true potential and follow in the footsteps of states like Colorado and Minnesota that have become high-wage states and achieved a higher standard of living, and do it in such a way that all our children can have a better future."

The report release presentation took place online and can be viewed at https://fb.watch/5jZBVxpKOY/ . The presenters included both Taylor Throne and Matthew Weinstein as well as a special guest, David Lujan, Director of the Arizona Center for Economic Progress, to share the Arizona perspective on the report.

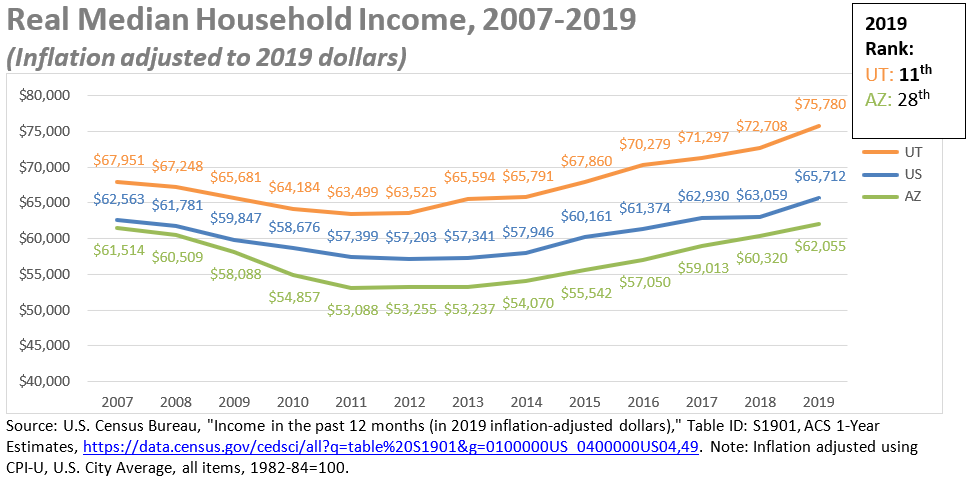

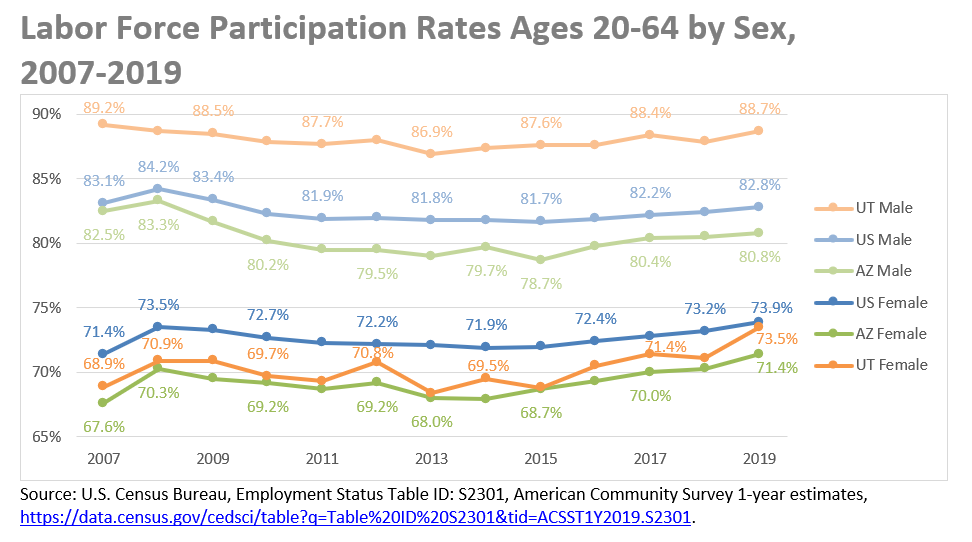

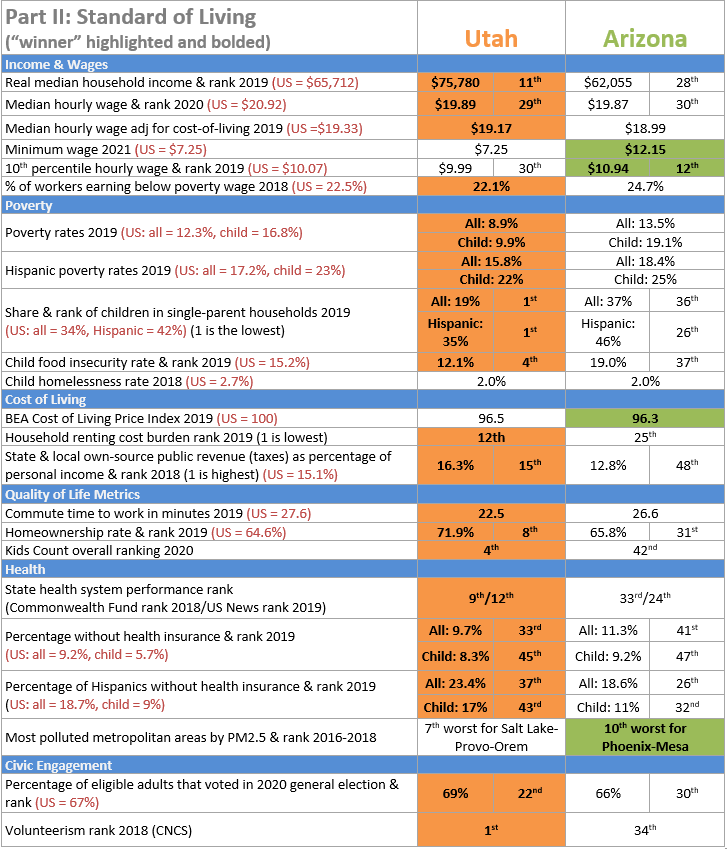

Utah's Top Economic Advantages: Hard Work & Strong Families Allow Utah to Enjoy High Household Incomes and Low Poverty

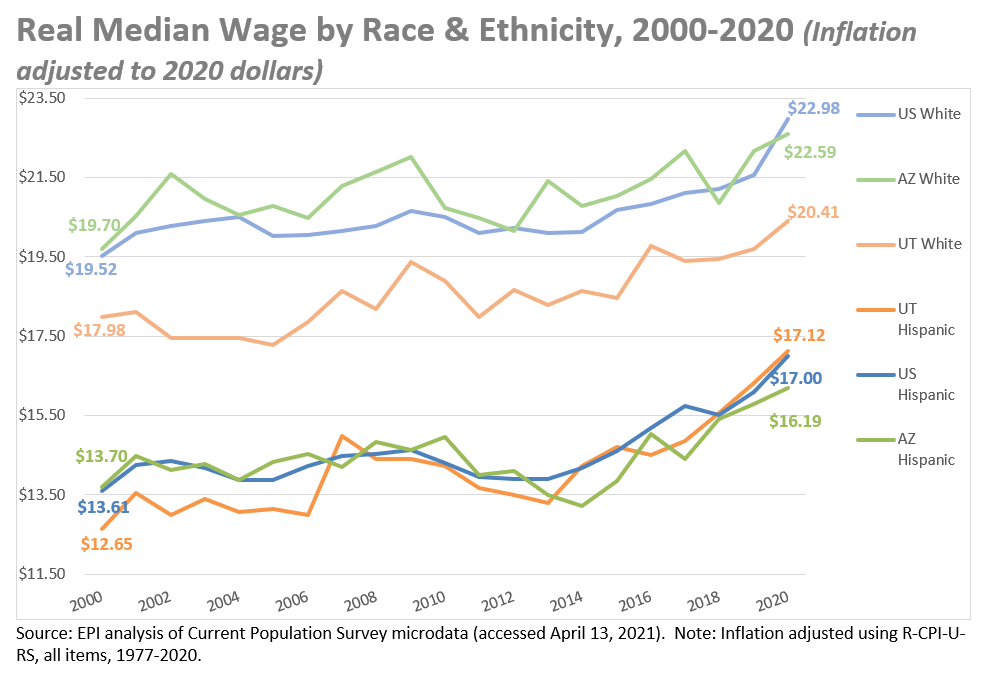

Utah enjoys a higher real median household income than Arizona, ranking #11 nationally, although there are significant gaps between the median wage of different racial and ethnic groups. Utah's higher incomes are due largely to our high labor force participation rates and our preponderance of two-worker (often two-parent) households.

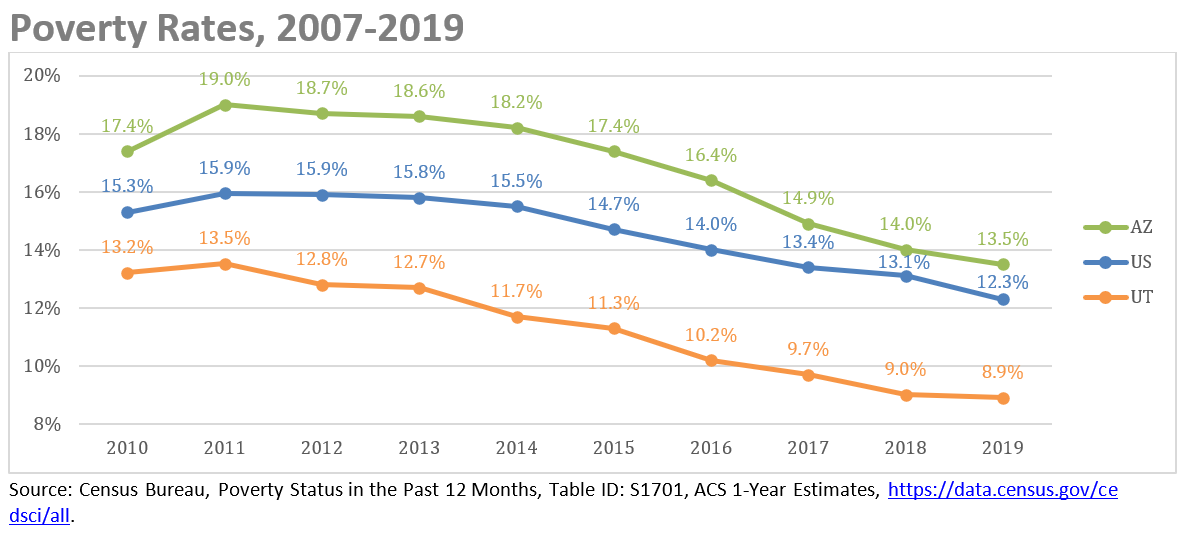

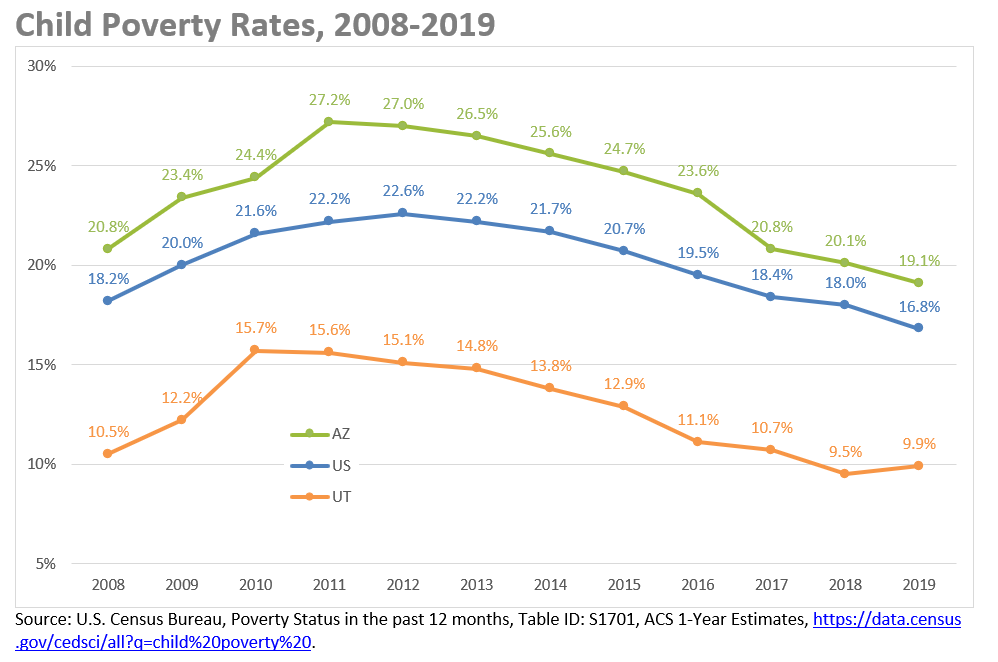

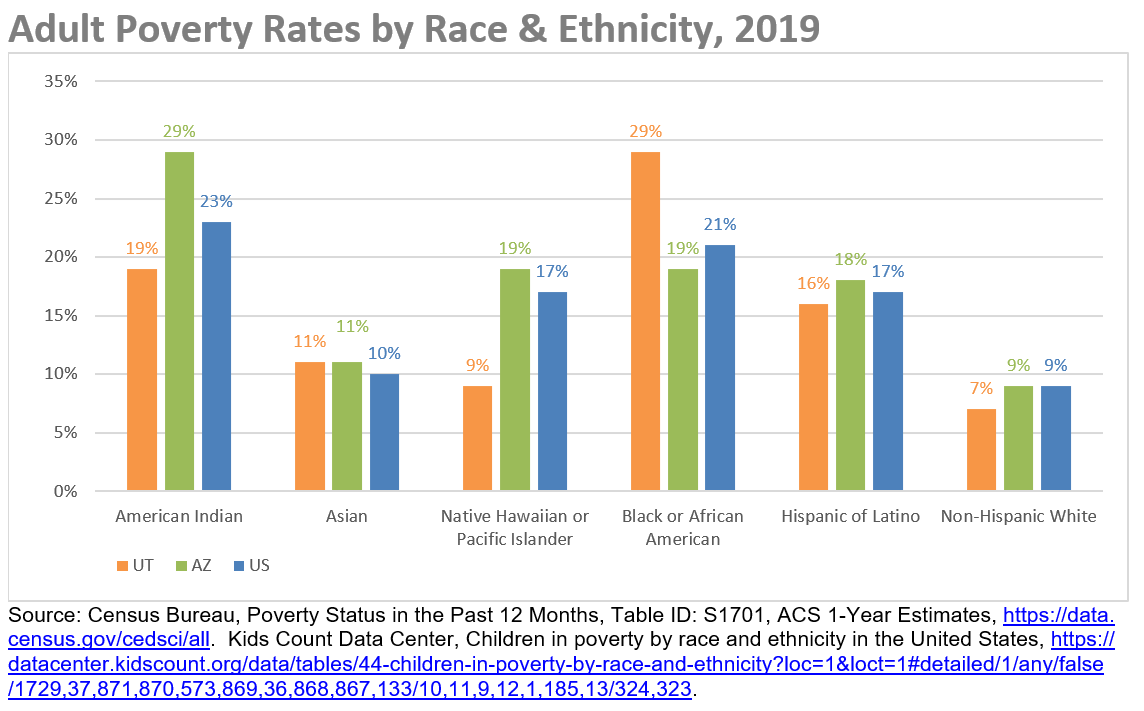

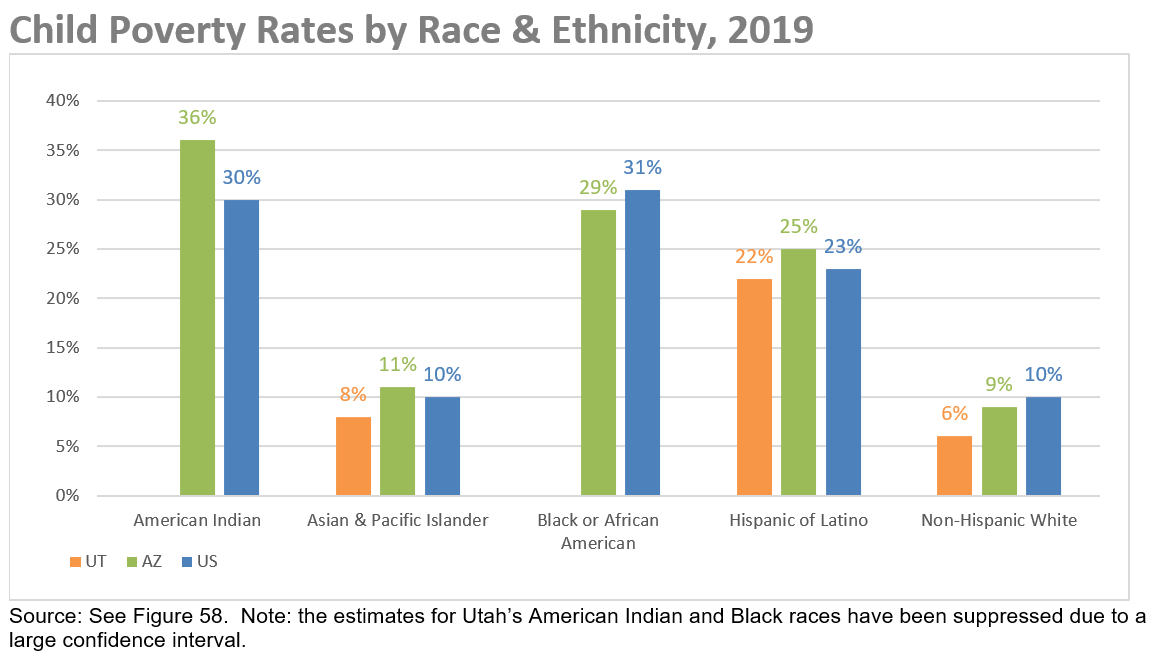

Utah Has Lower Poverty Rates Overall But Still Suffers from Large Racial/Ethnic Gaps

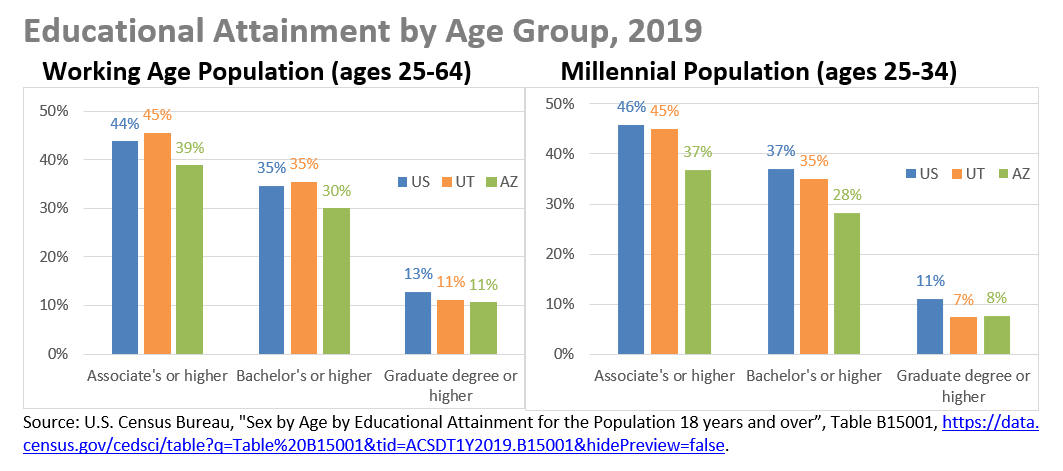

Educational Attainment: Utah Ahead of Arizona But Falling Behind the Nation

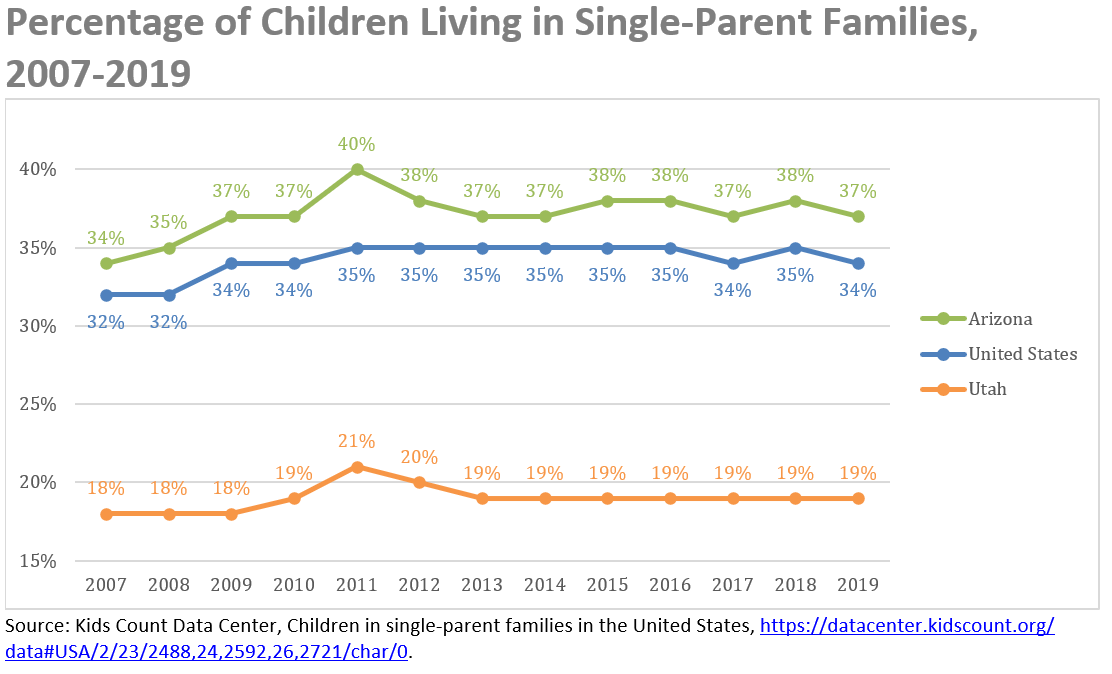

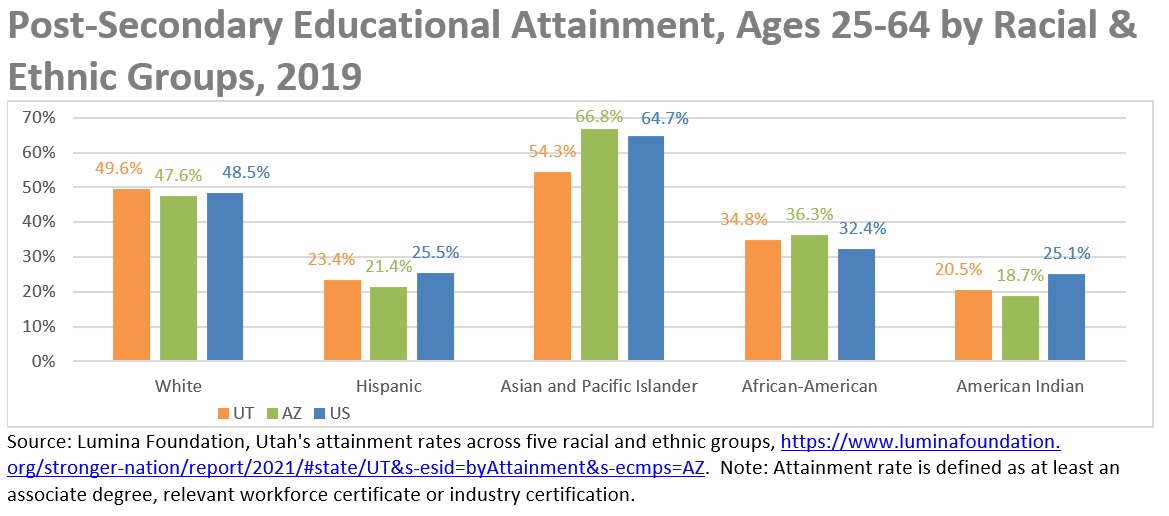

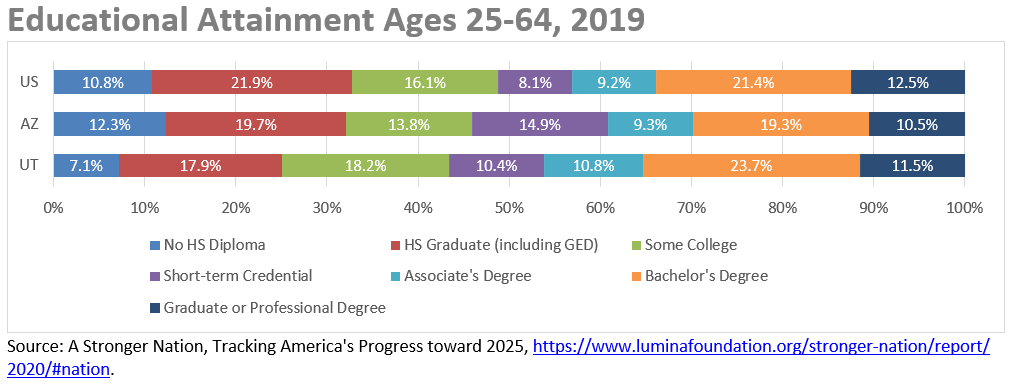

The charts below from our latest benchmarking report compare Utah, Arizona and the nation as a whole on educational attainment. Historically Utah was well ahead of the nation, but more recently evidence has mounted that the younger generation of Utahns is not keeping up with the nation's gains at the level of higher education. Moreover, there are stark racial/ethnic gaps in both states and the nation as a whole.

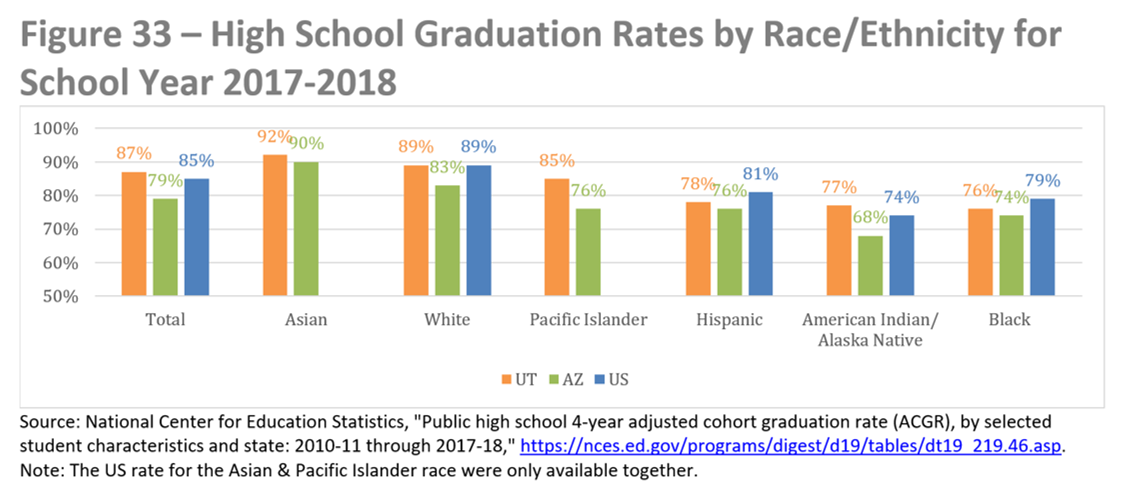

Utah's high school graduation rates are at or below national averages for most racial/ethnic categories, including our two largest groups, Whites and Latinos.

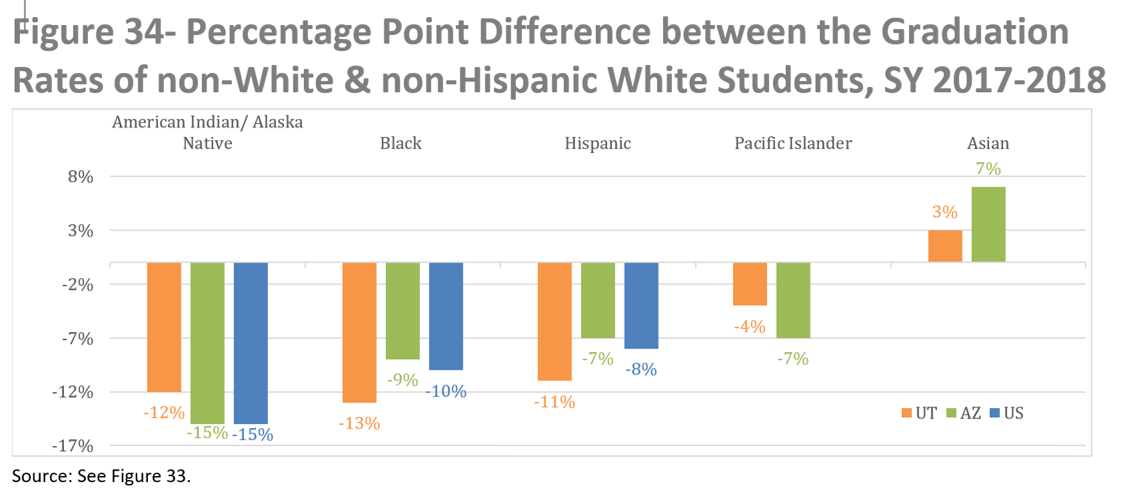

We're also very concerned that Utah's gap between high school graduation rates for Whites and Latinos is larger than nationally.

The chart below illustrates the way that Utah's younger generation of adults has fallen behind the higher education attainment of the Millennial generation nationally.

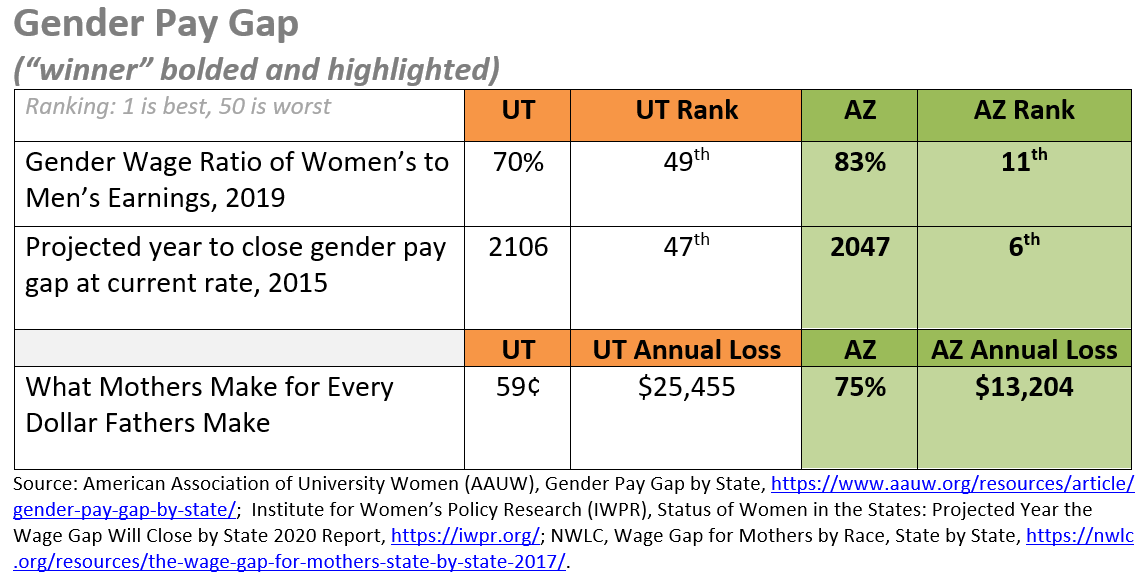

Can Utah Learn Any Lessons from Arizona's Strengths?

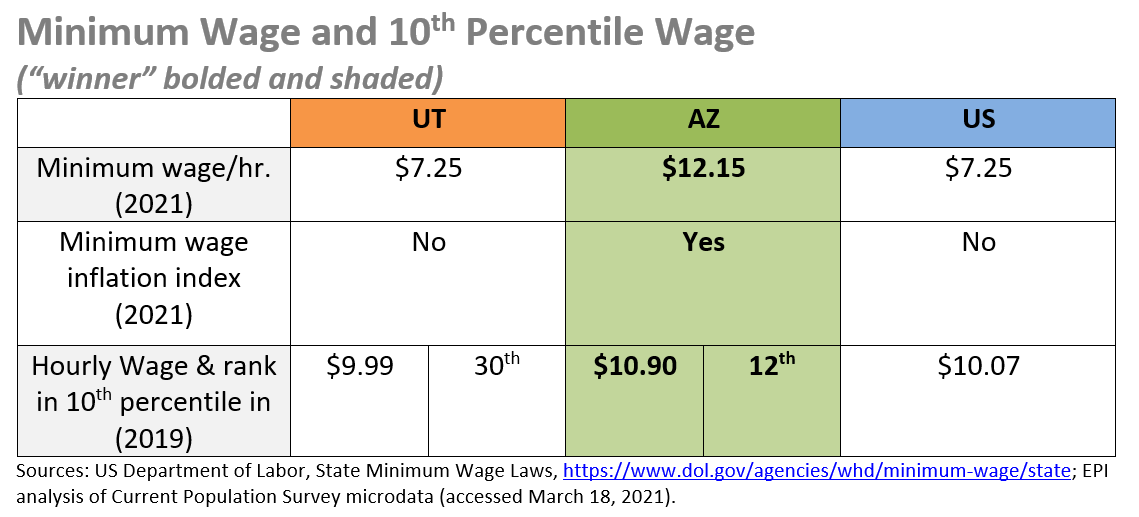

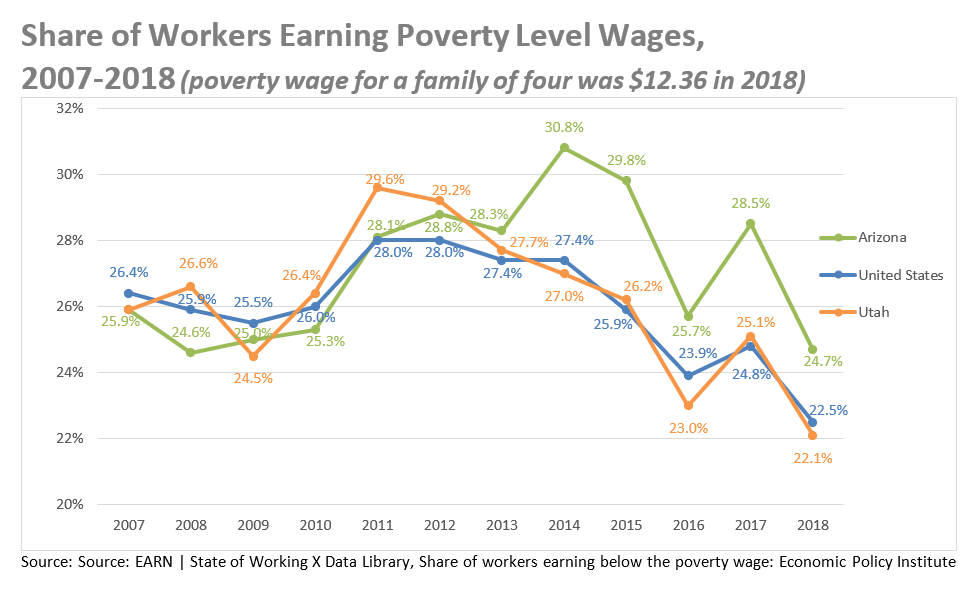

Besides Arizona's #11 rank for equal gender wage ratio (while Utah ranks #49), Arizona has more of its children in full-day kindergarten, has a lower 10th percentile hourly wage, and higher productivity. Arizona's higher 10th percentile hourly wage is likely due to their higher minimum wage, although they do have more people earning poverty level wages overall. Meanwhile, Utah has fewer people earning poverty level wages overall, but those at the 10th percentile for hourly wages earn less than their Arizonian counterparts.

Summary of Key Findings

The full 56-page report is ![]() available here as a pdf download.

available here as a pdf download.

Policy Implications

Racial/Ethnic Gaps

Racial and ethnic gaps remain a major challenge in the nation overall, and Utah and Arizona are no exception. Disparities in Utah between minority racial & ethnic groups compared to their White non-Hispanic peers are evident in high school graduation rates, wages, gender pay gaps, poverty rates, and uninsured rates. Addressing these gaps through an upfront investment in education would likely increase educational attainment, wages, and standard of living overall and would therefore contribute to reducing racial and ethnic gaps in the future.

The Link Between Education and Income

The link between education and income is well-established. States with higher education levels generally have higher levels of worker productivity, wages, and incomes. In the current comparison with Arizona, Utah’s higher education levels make for higher levels of wages and income. The lesson for Arizona would be raise education levels to raise the state’s standard of living. The same applies to Utah, where the Legislature has struggled to turn seemingly large dollar increases in education funding every year into increases in real per-pupil investment sufficient to get Utah out of last place in the national ranking.

The latest data from the Census Bureau reports that Utah remains in last place in per-pupil education investment at $7,628, with Arizona only slightly better at $8,239 and 47th in the nation (for FY 2018). While Utah has done well for its meager investment levels, achieving impressive gains in educational performance as measured by NAEP 4th and 8th grade math and reading scores (see Figure 31, page 25), will we be able to continue to advance while remaining in last place?

While Utah “does more with less” in education compared to other states, we have growing challenges to address. Utah has racial/ethnic education gaps which are larger than the national average, for example for Hispanic and American Indian high school graduation rates (see Figure 33, page 26). Utah’s pupil-to-teacher ratio is 22.9, ranking 48th while the national average is 16 (see Figure 22, page 21). Moreover, Utah teacher pay has also fallen over the past 50 years by 1.8% while nationally teacher salaries have increased 6.7% (see figure 24, page 22).

At the college level, Utah historically was always ahead of the national average for attainment of bachelor’s degrees and above. But Census data show Utah’s lead shrinking relative to the nation with each successive generation, to the point now that Utah millennials (ages 25-34) are behind their peers nationally, despite relatively generous state support and low tuition levels.

Can Utah Become a High-Wage State?

For many years, economists have debated whether Utah is a low-wage state, as the Utah Foundation discussed in their 2008 report, “Is Utah Really a Low-Wage State?”[1] That report argued that our seemingly low wages were explained by our younger demographic profile and lower cost of living. While this report does not examine how wages intersect with age demographics, Utah ranks 29th in median hourly wages, compared to 41st in 2004 (see chart below). When adjusted for our low cost of living, Utah’s median hourly wage in 2019 was $19.17, just 16 cents lower than the national level. These data seem to demonstrate that Utah has gone from being a low-wage state a generation ago to middle-wage status today, a considerable accomplishment.

One question Utah leaders may now wish to consider is, is that good enough? Should we declare, “Mission Accomplished”? Or is Utah in a position, like Colorado and Minnesota before us, to become, over time, a high-wage state and set our sights on taking the necessary steps today to achieve that goal over the years and decades to come?

Similarly, how do we include those earning the lowest wages in the gains Utah has made and will potentially make in the future? Utah is not even a half percentage point lower than the national share of workers earning poverty level wages (see Figure 55, page 38) and lags behind the nation’s 10th percentile wage, ranking 30th (see Figure 54, page 37). Even as the state with the lowest income inequality ranking in the nation (see Figure 45, page 31), Utah suffers from a tremendous gap between low-income workers and the rest of the income scale.

The main lesson that emerges from the Working Families Benchmarking Project reports comparing Utah to Colorado, Minnesota, Idaho and now Arizona is the following: Higher levels of educational attainment translate into higher hourly wages, higher family incomes, and an overall higher standard of living. The challenge for policymakers is to determine the right combination of public investments in education, infrastructure, public health, and other critical needs that will enable Utah to continue our progress and achieve not just steady growth in the quantity of jobs, but also a rising standard of living that includes moderate- and lower-income working families from all of Utah’s increasingly diverse communities.

MEDIA COVERAGE OF THE BENCHMARKING PROJECT:

Facebook Live Event discussing the report overall joined by David Lujan, Director of Arizona Center for Economic Progress at Children's Action Alliance: https://fb.watch/68E_JarLMT/

Facebook Live Event focusing on women in higher education, the gender pay gap, and income equality with panelists: Dr. Susan Madsen, Founder and Director of the Utah Women & Leadership Project; Marshall Steinbaum Ph.D., Associate Professor at the University of Utah's department of Economics; and Gabriella Archuleta JPP MPP, Policy Analyst with YWCA Utah. https://fb.watch/68FoEVvGwY/

Facebook Live Event focusing on Utah's economic success and economic development strategy with panelists: Howard Stephenson MPA, former Utah Senator; Phil Dean MS MPA, public finance senior research fellow at the Gardner Institute; and Thomas Maloney PhD., Professor, Department of Economics, University of Utah. https://fb.watch/6r25O5rdDd/

Facebook Live Event focusing on education in Utah from pre-school to higher education, focusing on educational attainment & closing racial and ethnic gaps with panelists: Carrie Mayne, Chief Economist for Utah System of Higher Education; Andrea Rorrer PhD., Director of the University of Utah's Education Policy Center; and Anna Thomas MPA, Senior Policy Analyst at Voices for Utah Children. https://fb.watch/7iKYaR9Zy4/

Congress Missed the Deadline on CHIP: What Does That Mean for Utah Kids? (And what we can do about it)

September 30th was the deadline for Congress to renew the Children’s Health Insurance Program, or CHIP. So what happens now to the almost 20,000 Utah children who currently rely on CHIP for their health insurance?

First (a little) good news: Utah has enough money in its CHIP program to make it through the end of the year. Plus CHIP is a very popular program. Utah’s own Senator Hatch has come out with strong statements in support of CHIP renewal, and is spearheading a bipartisan proposal to keep the program funded.

But here’s the bad news: If Congress doesn’t act soon, Utah’s CHIP program will have to start sending notices to families by early November. So thousands of families could receive notices that their children no longer have health insurance coverage.

The other troubling news: While there are strong bipartisan solutions to extend CHIP funding for 5 years, the bill could get muddied up in GOP attempts to cut back funding to other vulnerable populations. It could become a messy, bargaining ‘chip’…

What can you do? Tell Congress to stop playing games with children’s health. They must act now on a clean, 5-year extension of CHIP funding. Otherwise almost 20,000 Utah kids could lose health coverage.

We cannot let that happen.

Call Utah Senators and House members today. Tell them to protect CHIP now -- without any interruptions to kids’ coverage.

Sen. Orrin Hatch (202) 224-5251 (DC) // (801) 524-4380 (SLC) // (801) 375-7881 (Provo) // (435) 634-1795 (St. George) // (801) 625-5672 (Ogden) // (435) 586-8435 (Cedar City)

Sen. Mike Lee 202-224-5444 (DC) // 801-524-5933 (SLC) // 435-628-5514 (St. George) // 801-392-9633 (Ogden)

Rep. Rob Bishop (Congressional District 1): 202-225-0453 (DC) // 801-625-0107 (Ogden)

Rep. Chris Stewart (Congressional District 2): 202-225-9730 (DC) // 801-364-5550 (SLC) // 435-627-1500 (St. George)

Rep. Mia Love (Congressional District 4): (202) 225-3011 (DC) // 801-996-8729 (West Jordan)

Not sure who your U.S. Representative is? https://www.utah.gov/government/contactgov.html

For 30 years now, Voices for Utah Children has called on our state, federal and local leaders to put children’s needs first. But the work is not done. The children of 30 years ago now have children of their own. Too many of these children are growing up in poverty, without access to healthcare or quality educational opportunities.

How can you be involved?

Make a tax-deductible donation to Voices for Utah Children—or join our Network with a monthly donation of $20 or more. Network membership includes complimentary admission to Network events with food, socializing, and opportunity to meet child advocacy experts. And don't forget to join our listserv to stay informed!

We look forward to the future of Voices for Utah Children and we hope you will be a part of our next 30 years.

Special thanks to American Express, our "Making a Difference All Year Long" sponsor.