Tax and Budget

Tax Reform and Utah's Most Vulnerable Populations

Open Letter to the Utah Legislature

February 23, 2017

Dear Senators and Representatives:

We, the undersigned organizations, urge you to consider the impact of any tax reform proposal on Utah’s most vulnerable populations.

We wish to make two important points in this regard:

- We support the additional public revenues that could result from tax reform because Utah would benefit from increasing our investment in our most vulnerable populations.

- Tax reform that increases the burden on low-income sectors of our population will do more harm than good for people struggling to pay for the basic necessities of life.

New Revenues Are Needed

The Utah Foundation has found that Utah’s overall tax burden is at a multi-decade low. As a result, funding for critically needed public services has suffered in many areas, including:

- K-12 education – where we remain last in the nation in per-pupil funding

- Pre-K – where Utah remains behind the nation in the percentage of at-risk children who have access to high-quality Pre-K.

- Higher education – where tuition continues to climb much faster than wages.

- Drug treatment and mental health – where underinvestment threatens to undermine criminal justice reform.

- Affordable housing – where state funding has not kept up with the effects of inflation, while rents rise faster than wages.

- Homelessness – though we are encouraged to see the emerging consensus on the urgency of action.

- Disability services – where starting wages for disabilities service workers remain below levels needed to reduce high turnover.

- Health care – where Utah children are uninsured at a higher rate than nationally and Hispanic children at a higher rate than any other state.

Low-Income Populations Should Be Held Harmless by Tax Reform

No one should be taxed into or deeper into poverty. So many of the individuals and families that we work with already struggle to keep a roof over their heads and food on the table. They already pay sales, payroll, and property taxes (either directly or indirectly through their rent), and many pay income taxes as well. To ask them to pay more, especially at a time of growing inequality and a minimum wage that loses value every year, is unfair and unjustifiable.

We urge the Legislature to consider the financial barriers faced by Utah’s most vulnerable populations as you grapple with the difficult challenge of reforming Utah’s tax structure.

|

AARP Utah American Academy of Pediatrics - Utah Catholic Diocese of Salt Lake City Peace and Justice Commission Community Action Partnership of Utah Comunidades Unidas |

Disability Law Center League of Women Voters of Utah Legislative Coalition for People with Disabilities Utah Community Action |

NAMI - Utah Utah Housing Coalition Utahns Against Hunger Voices for Utah Children |

Printer-friendly Version:

![]() Open Letter to the Utah Legislature: Tax Reform and Utah's Most Vulnerable Populations

Open Letter to the Utah Legislature: Tax Reform and Utah's Most Vulnerable Populations

Image Credit: Amanda Mills, Centers for Disease Control and Prevention

For 30 years now, Voices for Utah Children has called on our state, federal and local leaders to put children’s needs first. But the work is not done. The children of 30 years ago now have children of their own. Too many of these children are growing up in poverty, without access to healthcare or quality educational opportunities.

How can you be involved?

Make a tax-deductible donation to Voices for Utah Children—or join our Network with a monthly donation of $20 or more. Network membership includes complimentary admission to Network events with food, socializing, and opportunity to meet child advocacy experts. And don't forget to join our listserv to stay informed!

We look forward to the future of Voices for Utah Children and we hope you will be a part of our next 30 years.

Special thanks to American Express, our "Making a Difference All Year Long" sponsor.

The Utah Intergenerational Poverty Work and Self-sufficiency Tax Credit

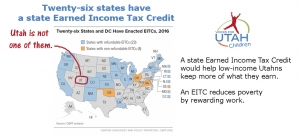

Voices for Utah Children Supports HB 294, the Utah Intergenerational Poverty Work and Self-sufficiency Tax Credit. HB 294 strengthens Utah’s groundbreaking Intergenerational Poverty (IGP) initiative with an Earned Income Tax Credit (EITC). Twenty-six other states across the nation and across the political spectrum have already created state EITCs, boosting work, independence, and self-sufficiency for low-income families. Utah should too, starting with our most at-risk population, the 37,512 adults and 57,602 kids grappling with intergenerational poverty (comprising 25% of all adults receiving public assistance, 62% of whom worked in 2015).

How would the IGP EITC work? (HB 294)

It would create a state EITC for IGP families that work, qualify for the federal EITC, and file their state taxes

How much would families receive?

10% of the federal EITC: ~$250 on average, up to ~$600, depending on income and # of kids

For more information, see the complete factsheet:

![]() Vote Yes on HB 294: The IGP EITC

Vote Yes on HB 294: The IGP EITC

For 30 years now, Voices for Utah Children has called on our state, federal and local leaders to put children’s needs first. But the work is not done. The children of 30 years ago now have children of their own. Too many of these children are growing up in poverty, without access to healthcare or quality educational opportunities.

How can you be involved?

Make a tax-deductible donation to Voices for Utah Children—or join our Network with a monthly donation of $20 or more. Network membership includes complimentary admission to Network events with food, socializing, and opportunity to meet child advocacy experts. And don't forget to join our listserv to stay informed!

We look forward to the future of Voices for Utah Children and we hope you will be a part of our next 30 years.

Special thanks to American Express, our "Making a Difference All Year Long" sponsor.

Planned pregnancies are healthier pregnancies.

New factsheets by the University of Utah School of Medicine describe two policy solutions that would help Utah families obtain healthcare they need to plan and space their pregnancies in order to better achieve the best health outcomes for the mother and child. In addition to promoting health, these solutions are cost-effective.

A Medicaid State Plan Amendment (SPA) allows family planning coverage for individuals that do not qualify for full Medicaid benefits. Expanding family planning coverage would maximize the the federal match and support the health of Utah families. There are 28 states that take advantage of the option to offer family planning coverage for individuals that do not qualify for full Medicaid benefits. These existing programs have proven to be budget neutral or cost-saving.

Long-acting reversible contraceptives (LARC) are highly effective contraception devices with minimal side effects that can be safely inserted immediately following delivery or during the mother's hospital stay. However, current Medicaid reimbursement procedures create a disincentive to offering LARC in this context. Unbundling LARC insertions from the global fee could improve access to this effective option.

For more information, see the complete fact sheets:

![]() Expanding Family Planning Coverage with Medicaid

Expanding Family Planning Coverage with Medicaid

![]() Expanding Options for Postpartum Contraception

Expanding Options for Postpartum Contraception

For 30 years now, Voices for Utah Children has called on our state, federal and local leaders to put children’s needs first. But the work is not done. The children of 30 years ago now have children of their own. Too many of these children are growing up in poverty, without access to healthcare or quality educational opportunities.

How can you be involved?

Make a tax-deductible donation to Voices for Utah Children—or join our Network with a monthly donation of $20 or more. Network membership includes complimentary admission to Network events with food, socializing, and opportunity to meet child advocacy experts. And don't forget to join our listserv to stay informed!

We look forward to the future of Voices for Utah Children and we hope you will be a part of our next 30 years.

Special thanks to American Express, our "Making a Difference All Year Long" sponsor.

2019 Utah Legislative Bill Tracker

Bill |

Sponsor |

Description |

Voices is |

House Bills |

|||

|

HB011 Property Tax Amendments |

Rep. Timothy Hawkes Sen. Daniel Hemmert |

This bill modifies the property tax valuation and appeals processes for county assessed real property. |

Following |

| HB017 Firearm Violence and Suicide Prevention Amendments |

Rep. Steve Eliason Sen. Curtis Bramble |

This bill reenacts and modifies previously sunsetted provisions relating to a voluntary firearm safety program and a suicide prevention education course. | Following |

|

HB024 Property Tax Exemptions, Deferrals, and Abatements Amendments |

Rep. Steve Eliason Sen. Daniel McCay |

This bill amends provisions related to property tax exemptions, deferrals, and abatements. |

Following |

|

HB025 Tax Commission Amendments |

Rep. Steve Eliason Sen. Lincoln Fillmore |

This bill modifies provisions relating to closed meetings held by the State Tax Commission. |

Following |

|

HB041 Transportation Sales Tax Amendments |

Rep. Kay Christofferson |

This bill modifies sales and use tax provisions relating to certain sales and use tax dedications. |

Following |

|

HB042 Utah Net Loss Effective Date Clarification |

Rep. Travis Seegmiller Sen. Curtis Bramble |

This bill modifies an uncodified effective date. |

Following |

|

HB047 Early Childhood Coordination Amendments |

Rep. V. Lowery Snow; Sen. Ann Millner |

This bill creates the Early Childhood Utah Advisory Council and the Governor's Early Childhood Commission. |

Priority Supporting |

|

HB049 Repatriation Transition Tax Amendments |

Rep. Steve Eliason Sen. Lincoln Fillmore |

This bill modifies corporate income tax provisions relating to deferred foreign income. |

Following |

|

HB071 Health Education Amendments |

Rep. Ray Ward Sen. Todd Weiler |

This bill amends provisions regarding instruction in health. |

Supporting |

|

HB087 Safe Storage of Firearms Amendments |

Rep. Elizabeth Weight |

This bill relates to firearm storage. |

Supporting |

| HB092 Violence Data Study |

Rep. Susan Pulsipher |

This bill establishes a grant award for a violence data study. | Following |

|

HB102 Campaign Funds Uses Amendments |

Rep. Stephanie Pitcher |

This bill allows candidates for public office to use campaign funds to pay for child care expenses incurred as part of campaign activities. |

Supporting |

|

HB103 Utah Intergenerational Poverty Work & Self-sufficiency Tax Credit. |

Rep. Robert Spendlove |

This bill enacts a state earned income tax credit. |

Priority Supporting |

|

HB120 Student and School Safety Assessment |

Rep. Ray Ward Sen. Ann Millner |

This bill enacts provisions related to school safety. |

Following |

|

HB129 Campaign Amendments |

Rep. Craig Hall Sen. Deidre Henderson |

This bill allows candidates for public office to use campaign funds to pay for child care expenses incurred as part of campaign activities. |

Supporting |

| HB153 Utah Vital Statistics Act Amendments |

Rep. Merrill Nelson Sen.Ralph Okerlund |

This bill amends provisions regarding the completion and amendment of a birth certificate. | Following |

| HB205 Railroad Crossing Amendments |

Rep. Joel Ferry |

This bill amends provisions related to the operation of a train that blocks traffic at a railroad crossing in a high-traffic area. |

Following |

| HB208 Safe Routes to School Program |

Rep. Suzanne Harrison Sen. Daniel Hemmert |

This bill requires the Department of Transportation to implement a program to provide safe routes to school. |

Supporting |

| HB209 Extreme Risk Protective Order |

Rep. Stephen Handy |

This bill creates the Extreme Risk Protective Order Act. |

Supporting |

|

HB210 Medicaid Expansion Program Revisions |

Rep. Ray Ward |

This bill amends provisions relating to Medicaid expansion. |

Priority Supporting |

|

HB234 Marriage Amendments |

Rep. Angela Romero Sen. Luz Escamilla |

This bill imposes an age, below which an individual may not marry and makes technical and conforming amendments. | Following |

| HB244 Misdemeanor Sentencing Timeline Clarifications |

Rep. Eric Hutchings Sen. Daniel Thatcher |

This bill reduces the maximum penalty for a misdemeanor conviction by one day to 364. |

Supporting |

| HB267 Prescription Drug Importation Program |

Rep. Norman Thurston Sen. Curtis Bramble |

This bill creates a program and reporting requirements relating to prescription drugs and the importation of prescription drugs. |

Supporting |

| HB274 Retail Tobacco Specialty Business Amendments |

Rep. Jennifer Dailey-Provost |

This bill amends provisions relating to the sale of flavored tobacco products. |

Supporting |

| HB275 Contraception for Women Prisoners |

Rep. Jennifer Dailey-Provost |

This bill requires that jails must continue to allow female prisoners access to contraceptives. | Following |

|

HB286 Financial and Economic Literacy Education Amendments |

Rep. Jefferson Moss Sen. Todd Weiler |

This bill amends provisions related to financial and economic literacy education. | Following |

| HB303 School Community Council Amendments |

Rep. Keven Stratton |

This bill modifies provisions related to the School LAND Trust Program. |

Following |

| HB317 Homeless Resource Center Drug-free Zone |

Rep. Steve Eliason |

This bill modifies provisions related to penalties for certain prohibited acts. | Following |

| HB324 Tobacco Age Amendments |

Rep. Steve Eliason Sen. Curtis Bramble |

This bill modifies the minimum age for obtaining, possessing, using, providing, or furnishing of tobacco products, paraphernalia, and under certain circumstances, electronic smoking devices from 19 to 20 then to 21 years of age. |

Supporting |

| HB333 Workforce Development Incentives Amendments |

Rep. Suzanne Harrison Sen. Jacob Anderegg |

This bill amends provisions related to tax credit incentives for economic development. |

Supporting |

| HB336 Nurse Practice Act Amendments |

Rep. James Dunnigan Sen. Curtis Bramble |

This bill amends provisions relating to the prescriptive authority of certain licensed nurse practitioners. |

Supporting |

| HB340 School Absenteeism and Truancy Amendments |

Rep. V. Lowry Snow |

This bill amends provisions related to truancy. |

Supporting |

| HB344 Student Asthma Relief Amendments |

Rep. Mark Wheatley Sen. Ronald Winterton |

This bill enacts provisions governing the administration of stock albuterol by certain entities to an individual. |

Supporting |

| HB360 School Water Testing Requirements |

Rep. Stephen Handy |

This bill enacts provisions related to monitoring and mitigating lead in drinking water in schools and child care centers. |

Supporting |

| HB371 Consent to Services for Homeless Youth |

Rep. Elizabeth Weight |

This bill relates to a homeless youth's ability to consent to a temporary shelter, care, or services. |

Supporting |

| HB373 Student Support Amendments |

Rep. Steve Eliason Sen. Ann Millner |

This bill repeals and enacts provisions related to school-based mental health support. |

Supporting |

| HB379 Intergenerational Poverty Solution |

Rep. Norman Thurston |

This bill creates the Earned Income and Education Savings Incentive Program. | Following |

| HB399 Prohibition of the Practice of Conversion Therapy upon Minors |

Rep. Craig Hall |

This bill prohibits certain health care professionals from providing conversion therapy to a minor; and adds a violation of the prohibition to the list of conduct that constitutes unprofessional conduct for licensing purposes. |

Followed- Bill was pulled |

| HB430 Prohibition of Genital Mutilation |

Rep. Ken Ivory |

This bill prohibits female genital mutilation and provides a penalty. | Following |

| HB441 Tax Equalization and Reduction Act |

Rep. Tim Quinn |

This bill modifies the sales tax rate by attempting to broaden the tax base and lowering the income tax from 4.9% to 4.7% |

Monitored - Bill was pulled. |

|

HR003 House Resolution Supporting Humane Response to Refugee Crisis |

Rep. Jen Dailey-Provost |

This House resolution urges a humane response to the immigration crisis at the U.S.-Mexico border. |

Supporting |

|

HCR004 Concurrent Resolution Supporting Utah's Every Kid Outdoors Initiative |

Rep. Patrice Arent Sen. Lincoln Fillmore |

This concurrent resolution expresses support for Utah's Every Kid Outdoors Initiative. |

Supporting |

| HCR005 Concurrent Resolution Urging Policies That Reduce Damage from Wildfires |

Rep. Raymond Ward Sen. Ronald Winterton |

This resolution urges the federal government to pursue policies that allow for easier reduction of excess forest fuel loads. |

Supporting |

| HJR008 Proposal to Amend Utah Constitution - Slavery and Involuntary Servitude Prohibition |

Rep. Sandra Hollins Sen. Jacob Anderegg |

This joint resolution of the Legislature proposes to amend the Utah Constitution to modify a provision prohibiting slavery and involuntary servitude. |

Supporting |

Senate Bills |

|||

|

SB012 FDIC Premium Deduction Amendments |

Sen. Jerry Stevenson Rep. Tim Quinn |

This bill modifies the Corporate Franchise and Income Taxes code and the Individual Income Tax Act by amending provisions relating to certain subtractions from unadjusted income or adjusted gross income. |

Following |

|

SB013 Income Tax Domicile Amendments |

Sen. Curtis Bramble Rep. Steve Eliason |

This bill modifies tax provisions relating to income tax domicile requirements. |

Following |

|

SB028 Income Tax Revisions |

Sen. Curtis Bramble Rep. Steve Eliason |

This bill modifies corporate income tax provisions. |

Following |

|

SB032 Indigent Defense Act Amendments |

Sen. Todd Weiler Rep. Michael McKell |

This bill amends provisions of Utah’s Indigent Defense Act to ensure appropriate legal representation for all young people appearing in juvenile court. |

Priority Supporting |

| SB038 Substitute Mental Health Amendments |

Sen. Lincoln Fillmore Rep. Brad Daw |

This bill amends provisions of the civil commitment code and the definition of "unprofessional conduct" applied to mental health professionals. |

Following |

|

SB041 Interest Deductions Amendments |

Sen. Daniel McCay |

This bill modifies the Corporate and Franchise Income Tax Act and the Individual Income Tax Act by amending provisions relating to additions and deductions for certain business interest. |

Following |

|

SB042 Tangible Personal Property Amendments |

Sen. Daniel McCay Rep. Karianne Lisonbee |

This bill provides for the exemption of certain tangible personal property from property tax if the tangible personal property is eligible for sales and use taxation. |

Following |

| SB083 Partnerships for Healthy Communities |

Sen. Ann Millner Rep. Paul Ray |

This bill creates the Partnerships for Healthy Communities Grant Program and will address the social determinants of health that affect early childhood health outcomes. |

Priority Supporting |

|

SB096 Medicaid Expansion Adjustments |

Sen. Allen Christensen Rep. James Dunnigan |

This bill amends provisions relating to the state Medicaid program and the state sales |

Opposing |

|

SB097 Medicaid Program Revisions |

Sen. Jacob Anderegg |

This bill repeals the expansion of the state Medicaid program under the Affordable Care Act and changes the sales tax rate. |

Opposing |

| SB103 Victim Targeting Penalty Enhancements |

Sen. Daniel Thatcher Rep. Lee Perry |

This bill enacts provisions relating to sentencing for a criminal offense committed against a victim who is selected because of certain personal attributes. | Following |

| SB106 Mental Health Services in Schools |

Sen. Lincoln Fillmore Rep. Susan Pulsipher |

This bill enacts provisions relating to coverage of certain mental health services by the Medicaid program and certain health insurers. |

Following |

|

SB110 Family Medical Unpaid Leave Amendments |

Sen. Daniel Hemmert Rep. Mike Schultz |

Provides state-eligible companies (those that have between 30 and 50 employees) to make available three weeks of unpaid medical leave to employees. |

Supporting |

| SB143 Public Education Vision Screening |

Sen. Luz Escamilla Rep. Brad Daw |

This bill modifies provisions regarding public education vision screening. |

Supporting |

| SB166 School Readiness Amendments |

Sen. Ann Millner Rep. Bradley Last |

This bill amends and enacts preschool provisions. |

Priority Supporting |

| SB222 Children's Outdoor Recreation Program |

Sen. Lincoln Fillmore Rep. Mike Winder |

This bill creates the Utah Children's Outdoor Recreation and Education Grant Program in the Governor's Office of Economic Development. |

Supporting |

|

SJR003 Proposal to Amend Utah Constitution - Tangible Personal Property Tax Exemption |

Sen. Daniel McCay |

This joint resolution of the Legislature proposes to amend the Utah Constitution to modify a provision relating to tangible personal property tax exemptions. |

Following |

2020 Utah Legislative Bill Tracker

|

Bill |

Sponsor |

Description |

Voices is |

House Bills |

|||

|

Juvenile Justice Bills |

|||

|

Rep. Snow |

Creates a standard definition for “truancy” and chronic truancy” and seeks to improve data reporting by schools to the state board of education |

Following |

|

|

Rep. Dailey-Provost |

Prevents the state from sending fees related to juvenile incarceration to debt collection |

Support |

|

|

Rep. Hall |

Requires law enforcement to notify a school when a student is under investigation for a violent felony or weapons offense, |

Following |

|

|

HB171 - School Threat Amendments |

Rep. Stoddard |

Defines the crime of threatening a school (or committing an intentional hoax threat), creates certain criminal penalties (including restitution for the costs of a school response to a threat), and requires a mental health assessment. |

Following |

|

Rep. Handy |

Enables a family member or law enforcement to ask a court to restrain a person from possessing any firearms or ammunition for a specified length of time; |

Support | |

|

Child Care and Early Education |

|||

|

Rep. Harrison |

Allows GOED to consider the “working parent benefits” that a company offers, when calculating potential incentives packages |

Support |

|

|

Rep. Arent |

Updates Utah’s “Safe Haven Law” to allow parents to leave newborn children, up to 30 days old, at a hospital, safely and without fear of criminal prosecution. Also includes provisions to ensure notification of fathers when possible, and to prevent birth record duplications |

Support |

|

|

Rep. Snow |

Expands state-funded Optional-Extended Day Kindergarten administered by Utah State Board of Education. Boosts current spending about 2.5 times |

Support |

|

|

Rep. Waldrip |

Expands teacher professional development program focused on early literacy to include numeracy skills and to boost embedded coaching/technical assistance support to educators. |

Support |

|

|

HB153 - Parental Leave Amendments |

Rep. Weight |

Directs state agencies (except for universities) to offer up to sic weeks of paid parental leave for the birth or adoption of a child |

Support |

|

Rep. Harrison |

Creates a non-refundable tax credit for employers who offer financial support for their employee’s child care expenses |

Support |

|

| HB264 - Infant at Work Pilot Program | Rep. Pitcher |

This bill establishes the Infant at Work Pilot Program for eligible employees of the Department of Health. |

Support |

Health |

|||

|

Rep. Johnson |

Broadens the use of school lunch revenues to include school meals and will strengthen evaluation among schools participating in meal programs. |

Support |

|

|

HB34 – Tanning for Minors |

Rep. Daw |

This bill prohibits minors from tanning without parental consent. Youth tanning increases health risks for youth, including cancer |

Support |

|

Rep. Pulsipher |

Allows school administrators and educators to take certain steps to combat vaping misconduct at public schools, including a comprehensive health curriculum section and promoting positive alternatives. |

Following |

|

|

Rep. Arent |

Directs employers that offer their employees paid sick leave, to allow those employees to use at least five paid sick days to care for an immediate family member who is ailing |

Support |

|

|

HB88 - School and Child Care Center Water Testing Requirements |

Rep. Handy |

Direct schools and child care centers to test water for lead and connects centers and schools with remediation support resources. Let’s keep our kids hydrated and healthy! |

Support |

| HB108 - Medical Specialists in Public Schools | Rep. Spackman Moss | We support efforts that may lead to greater access to school-based health services. This bill seeks to clarify and offer greater guidance for schools regarding the pay schedule they can use for school-based health staff. | Support |

| HB118 – Retail Tobacco Amendments | Rep. Daily-Provost |

This bill will limit which types of stores can sell flavored tobacco or vaping products. These products are often used to target and appeal to youth. In addition, this bill will give cities greater authority to curb underage vaping. |

Support |

| HB204 – Insurance Coverage for in Vitro Fertilization | Rep. Stoddard | Will require a health benefit plan to cover in vitro fertilization if it provides a maternity benefit | Support |

|

Rep. Ward |

The number of uninsured kids in Utah has increased over the last two years. This bill would address this problem, by implementing 12-month continuous coverage for children on Medicaid and make it easier for eligible kids to get covered and stay covered. |

Support |

|

| HB222 - Start Smart Utah Breakfast Program | Rep. Johnson |

Will help more kids get breakfast at school. When kids aren't hungry, they are better learners! |

Support |

| B313 - Telehealth Parity Amendments | Rep. Ballard |

This bill will allow for coverage parity between telehealth and in-person visits. It will help more individuals in rural and underserved areas to receive care. |

Support |

| HB323 - School Mental Health Amendments | Rep. Eliason |

Will establish a grant program for schools to conduct age-appropriate mental health screenings for students and then connect high-risk students with care. Optional grant program for schools, specifically aimed to help identify children before they are in a life-threatening crisis. |

Support |

|

HB372 - Digital Wellness, Citizenship, and Safe Technology Commission |

Rep. Keven Stratton | This bill would create the Digital Wellness, Citizenship, and Safe Technology Commission and requires the commission to: identify best practices and compile resources for training students in healthy behavior related to technology use; and report to the Education Interim Committee and the State Board of Education on efforts related to delivering training in healthy behavior related to technology use | Support |

Tax and Budget Bills |

|||

Senate Bills |

|||

Health |

|||

|

Sen. Iwamoto |

Encourages more children to get lead screening so we can make sure kids are getting connected with the care and follow-up treatment they need. |

Support |

|

| SB74 - Family Planning Services Amendments | Sen. Kitchen |

This bill will help more low-income individuals access family planning health care services. |

Support |

| SB135 - Dental Practice Act Amendments | Sen. Christensen |

We support this bill because it advances teledentistry efforts and rules in Utah. Teledentistry is a promising practice that has the potential to help more people access dental care in rural and underserved areas. |

Support |

| SB155 - Medical Billing Amendments | Sen. Mayne |

Directs the Department of Insurance and insurers to report on the practice of balance billing or so-called “surprise” medical billing. |

Support |

Tax and Budget |

|||

|

Sen Fillmore |

This bill modifies provisions related to payment of income tax on global intangible low-taxed income. |

Oppose |

|

SB39 -Affordable Housing Amendments |

Sen Anderegg |

This bill modifies the allowable uses for a community reinvestment agency's housing allocation and modifies the requirements for distributing money from the Olene Walker Housing Loan Fund; |

Support |

2018 Utah Legislative Session

The 2018 Utah Legislative Session will take place from January 22 to March 8, with 45 days chock full of long committee meetings, urgent Action Alerts, conversations between community members and legislators, demonstrations on the steps of the State Capitol Building and much more!

We'll be following a lot of different bills during the 2018 session, not all of which will be made public before the session officially begins. Some bills are introduced with language that we support, and then that language changes over the course of the legislative process. Occasionally, the changes are subtantial enough to warrant a change in our position. We will do our best to keep this list of bills - as well as our positions - updated for your information, but it can be tricky when things are so busy for our staff during this crazy time of year.

We are working on several bills that will be priorities for us in 2018. You can learn more about these priority legislative proposals by clicking on the topic links below.

Tax and Budget Issues

Tax and Budget Issues

Creating a State Earned Income Tax Credit (EITC)

Restoring Investment in Children

Health Issues

12-Month Continuous Eligibility for Utah Kids with Medicaid

Early Childhood Care & Education Issues

High Quality Child Care

Governance and Coordination of Early Childcare Services

Juvenile Justice Issues

Implementing Juvenile Justice Reform

Bills

News Contact Lawmakers Sign Up for E-AlertsFollow @utchildren

For 30 years now, Voices for Utah Children has called on our state, federal and local leaders to put children’s needs first. But the work is not done. The children of 30 years ago now have children of their own. Too many of these children are growing up in poverty, without access to healthcare or quality educational opportunities.

How can you be involved?

Make a tax-deductible donation to Voices for Utah Children—or join our Network with a monthly donation of $20 or more. Network membership includes complimentary admission to Network events with food, socializing, and opportunity to meet child advocacy experts. And don't forget to join our listserv to stay informed!

We look forward to the future of Voices for Utah Children and we hope you will be a part of our next 30 years.

Healthy Moms = Healthy Kids

For Printable Version ![]() Maternal Mental Health Support Flyer

Maternal Mental Health Support Flyer

For 30 years now, Voices for Utah Children has called on our state, federal and local leaders to put children’s needs first. But the work is not done. The children of 30 years ago now have children of their own. Too many of these children are growing up in poverty, without access to healthcare or quality educational opportunities.

How can you be involved?

Make a tax-deductible donation to Voices for Utah Children—or join our Network with a monthly donation of $20 or more. Network membership includes complimentary admission to Network events with food, socializing, and opportunity to meet child advocacy experts. And don't forget to join our listserv to stay informed!

We look forward to the future of Voices for Utah Children and we hope you will be a part of our next 30 years.

Special thanks to American Express, our "Making a Difference All Year Long" sponsor.

Creating a Targeted State Earned Income Tax Credit (EITC)

The federal Earned Income Tax Credit (EITC) lifts 60,000 Utahns out of poverty each year, half of them children, by letting low-income families keep more of what they earn.

EITC helps working families make ends meet.

EITC keeps families working.

EITC reduces poverty, especially among children.

EITC put $426 mil. back into Utah’s economy in 2017.

A state EITC targeted to families living in intergenerational poverty (IGP) will give a boost to the 25,000 working families who qualify for the federal EITC and file state taxes.

It will ensure that eligible working families receive 10% of federal EITC - up to $640 depending on income and number of children.

A state EITC may increase participation in the federal EITC. Only 75% of tax filers take advantage of the federal EITC

No bureaucracy or staff to administer.

FISCAL IMPACT

$6 million from General Fund which is a small portion of the over $25 million in state and local taxes paid every year by these working families.

Simply put, 58,820 children identified as living in intergenerational poverty amounts to $102 per child.

STATES WITH A STATE EITC

Twenty-nine states across the nation and political spectrum have created state EITCs.

EITC has strong bipartisan support

“… the proposed EITC helps people who are ready and able to help themselves escape intergenerational poverty through work…It is both sound economic policy and prudent welfare policy… It is good for those in poverty, good for the economy, and good for taxpayers as well.” Sutherland Institute

“I know of no public policy innovation over the past 30 years to help low-income individuals that has as much promise as Utah’s intergenerational poverty work. When combined with an EITC, Utah will be able to show the nation how public policies that are targeted, incentivize work, are fiscally constrained and include measurable outcomes are the best way to help families and children with great need.”

Natalie Gochnour

Associate Dean, David Eccles School of Business,

University of Utah, Deseret News column, March 1, 2018

For 30 years now, Voices for Utah Children has called on our state, federal and local leaders to put children’s needs first. But the work is not done. The children of 30 years ago now have children of their own. Too many of these children are growing up in poverty, without access to healthcare or quality educational opportunities.

How can you be involved?

Make a tax-deductible donation to Voices for Utah Children—or join our Network with a monthly donation of $20 or more. Network membership includes complimentary admission to Network events with food, socializing, and opportunity to meet child advocacy experts. And don't forget to join our listserv to stay informed!

We look forward to the future of Voices for Utah Children and we hope you will be a part of our next 30 years.

Special thanks to American Express, our "Making a Difference All Year Long" sponsor.

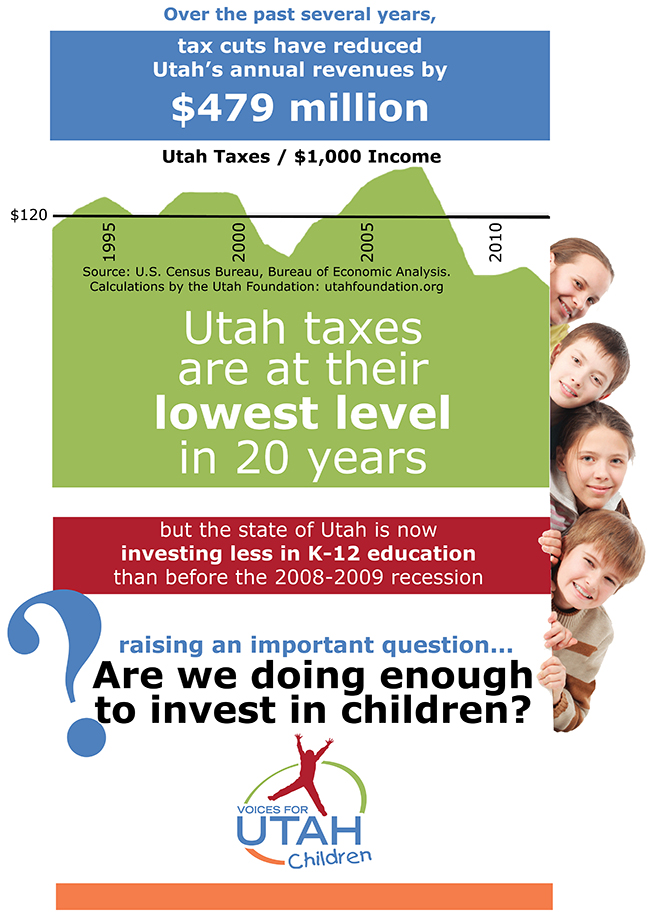

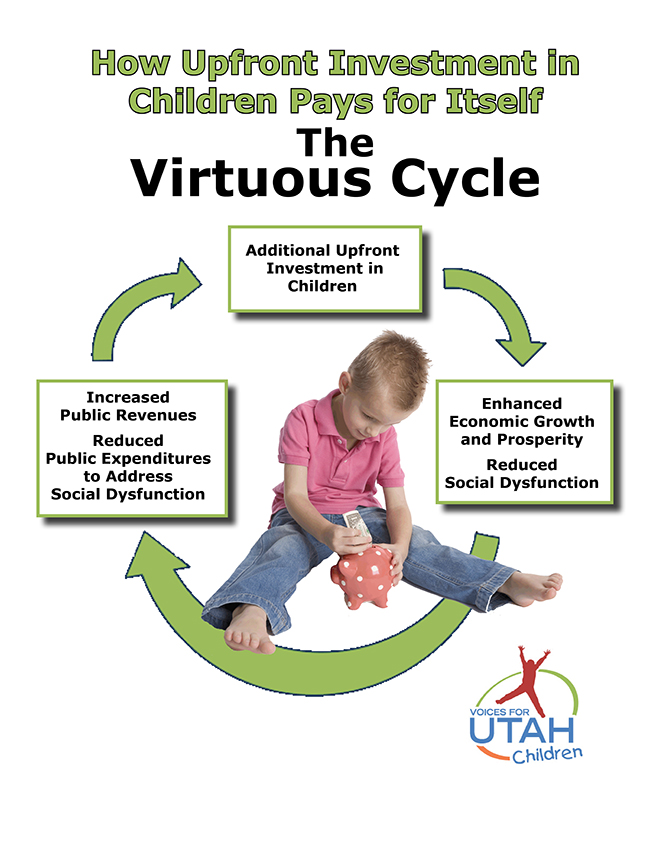

Restoring Investment in Children

In January 2015, the Utah Foundation reported that Utah’s overall tax burden, including all state and local taxes and fees, had fallen to its lowest level in at least 20 years: “Over the past several years, tax cuts have reduced Utah’s annual revenues by $479 million.”

In January 2015, the Utah Foundation reported that Utah’s overall tax burden, including all state and local taxes and fees, had fallen to its lowest level in at least 20 years: “Over the past several years, tax cuts have reduced Utah’s annual revenues by $479 million.”

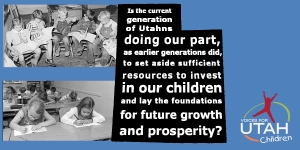

As a result, our investment in education remains well below pre-recession levels. Per-pupil state formula funding for K-12 education is down 11.9% from FY 2008 to 2017 (the current fiscal year). This 11.9% drop measures just the state contribution that constitutes two-thirds of our total public education budget. But the picture is no better when we look at the older data that include both state and local funding, which showed us seventh worst in the nation with a 17% drop in per-pupil expenditure for 2008-2014. The Voices for Utah Children's Utah Children’s Budget Report 2015 found that FY2014 real state spending per child remained 6% below pre-recession levels. Moreover, investment in K-12 education in particular has actually fallen in real terms since the 2008-2009 recession, before even accounting for the 7% growth in the number of children in Utah from FY2008 to FY2014.

While everyone enjoys paying lower taxes and having more dollars in our pockets today, these findings raise important questions about whether the current generation of Utahns is doing its part, as earlier generations did, to invest in our children and lay the foundations for Utah’s future growth and prosperity.

Moreover, recent data on high school graduation rates and college degrees raise warning signs that should concern all Utahns. Every racial and ethnic group in our state — including our two largest populations, whites and Hispanics — is below national averages for high school graduation rates. At the level of higher education, Utah’s share of college degrees among our younger generation has not kept up with the increases seen nationally.

Opponents of new education revenues have for years counseled patience, assuring us that the economic boom that will generate new public education revenues is just around the corner or perhaps just another tax cut away. How long will we wait and watch our educational performance suffer — endangering our future prosperity — before taking seriously the challenge before us?

Printer-friendly Version:

![]() 2017 Children's Fiscal Policy Agenda

2017 Children's Fiscal Policy Agenda

More Information:

Utah Tax Reform Proposals: Who Wins and Who Loses?

Tax Reform and Utah's Most Vulnerable Populations

For 30 years now, Voices for Utah Children has called on our state, federal and local leaders to put children’s needs first. But the work is not done. The children of 30 years ago now have children of their own. Too many of these children are growing up in poverty, without access to healthcare or quality educational opportunities.

How can you be involved?

Make a tax-deductible donation to Voices for Utah Children—or join our Network with a monthly donation of $20 or more. Network membership includes complimentary admission to Network events with food, socializing, and opportunity to meet child advocacy experts. And don't forget to join our listserv to stay informed!

We look forward to the future of Voices for Utah Children and we hope you will be a part of our next 30 years.

Special thanks to American Express for sponsoring our 30th Anniversary Year.

For 30 years now, Voices for Utah Children has called on our state, federal and local leaders to put children’s needs first. But the work is not done. The children of 30 years ago now have children of their own. Too many of these children are growing up in poverty, without access to healthcare or quality educational opportunities.

How can you be involved?

Make a tax-deductible donation to Voices for Utah Children—or join our Network with a monthly donation of $20 or more. Network membership includes complimentary admission to Network events with food, socializing, and opportunity to meet child advocacy experts. And don't forget to join our listserv to stay informed!

We look forward to the future of Voices for Utah Children and we hope you will be a part of our next 30 years.

Special thanks to American Express, our "Making a Difference All Year Long" sponsor.

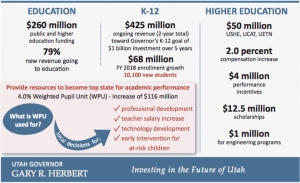

What We Like about Governor Herbert's New Budget Recommendations

Yesterday, Governor Herbert released his annual state budget recommendations.

The staff of Voices for Utah children found several reasons to be encouraged by his proposals.

We support the Governor and his team for their commitment to social services, and our most vulnerable children and families. Specifically, we applaud the Governor’s fiscally-prudent step to support family planning. This will have important benefits for families, including those in intergenerational poverty. With this investment, the state can expect to see savings by 2019. We thank the Governor for his leadership on this issue critical to children and families.

As an organization dedicated to helping all Utah children and families succeed, we believe that our social safety net provides a critical role to help families who have fallen on hard times get back on their feet. As noted in the Budget Recommendations, Utah has a “longstanding social fabric of self-determination.”

Our state budget priorities should support families’ ability to access and utilize public benefits in their time of need. Utah has the highest rate of children who are eligible for CHIP and Medicaid, but not enrolling in public programs. These children are uninsured and not able to benefit from health care services.

As the Governor declares, “the most effective programs, in terms of both quality outcomes and costs, prioritize preventative service delivery.” We strongly support the Governor’s focus. Health insurance coverage is the foundation to build successful prevention initiatives. We must strengthen and support our health insurance programs so that families and children can achieve their optimal health.

We are encouraged by the Governor’s recognition that early childhood is the cornerstone for lifelong learning. We support the Governor’s appropriation for the Baby Watch Early Intervention program as a critical first step. We look forward to seeing the Governor’s 10-year education plan, and hope the Governor will maintain his commitment to early childhood, so that we can establish a strong foundation for children’s healthy development, setting them up for success in school and beyond.

Voices for Utah Children welcomes Governor Herbert’s call in his FY2018 Budget Recommendations to conduct a comprehensive review of the state’s overall tax structure. In the section entitled “Taxation and a Free Market Economy” on page 9-12 (pages 13-16 of the pdf), there is an extended discussion of the trends and challenges facing Utah in terms of taxes and public revenues. The report highlights the downward trend in Utah’s overall level of taxation (including all state and local taxes and fees) and refers to the growing public sentiment that current revenues fall short of meeting the state’s minimum needs. The Governor declares his intention to address this pressing challenge with two concrete actions:

1. “the Governor will be establishing a task force of business leaders and education stakeholders to develop a comprehensive solution that aligns Utah’s tax structure with the modern economy (not just a rate increase), and

2. will request that the Tax Review Commission study and make recommendations regarding the state’s current tax structure, including alternatives for aligning the tax structure with the modern economy and identifying and reviewing tax credits, tax exemptions, tax exclusions, and other preferential tax loopholes.” (page 12)

The Governor and his team should be applauded for addressing these issues so thoughtfully and directly in the Budget Recommendations document and for his intent to convene further study and discussion about how to address this challenge going forward. In other states across the nation and across the political spectrum, the presence or absence of gubernatorial leadership has been a critical factor in determining whether states have been able to address their pressing challenges.

Voices for Utah Children has for a number of years raised the question of whether the current generation of Utahns is doing its part, as earlier generations did, to set aside sufficient resources each year to invest in the building blocks of our future growth and prosperity. Utah’s longstanding commitment to fiscal responsibility should extend beyond balanced budgets and strong bond ratings to also include taking responsibility for making the necessary investments today that reap benefits for future generations in the years and decades to come.

The complete document is available here:

Budget Recommendations Fiscal Year 2018

For 30 years now, Voices for Utah Children has called on our state, federal and local leaders to put children’s needs first. But the work is not done. The children of 30 years ago now have children of their own. Too many of these children are growing up in poverty, without access to healthcare or quality educational opportunities.

How can you be involved?

Make a tax-deductible donation to Voices for Utah Children—or join our Network with a monthly donation of $20 or more. Network membership includes complimentary admission to Network events with food, socializing, and opportunity to meet child advocacy experts. And don't forget to join our listserv to stay informed!

We look forward to the future of Voices for Utah Children and we hope you will be a part of our next 30 years.

Special thanks to American Express, our "Making a Difference All Year Long" sponsor.