Tax Restructuring Process Picks Up Speed

Last week (October 22, 2019) the Tax Restructuring and Equalization Task Force (TRETF) adopted its co-chairs’ proposal as its working document, passing a motion to produce draft legislation based on it for consideration at the Task Force’s next meeting on November 7th.

The chairs’ proposal is a mixed bag. When viewed through the lens of our tax reform position paper, we can say that it offers the potential to make Utah’s tax structure less regressive for most low-income Utahns, which would be welcome, but it also reduces overall public revenues by $79 million through an income tax rate cut that awards most of the total tax reduction to the wealthiest Utahns.

Utah’s current overall tax structure is regressive, in the sense that low- and middle-income Utahns pay 7.5%-8.8% of their incomes in state and local taxes, while the highest income Utahns pay just 6.7%. Under the Task Force co-chairs’ proposal, the tax rate for the lowest income Utahns would be reduced from 7.5% to 7%, at least on paper, but that estimate of a 0.5-percent-of-income reduction for the poor assumes that everyone who is eligible will file for the proposed new grocery tax credit that is intended to offset the regressive impact of the proposed increase in the state sales tax on groceries from 1.75% to 4.85%. We know from real-life experience that a considerable share of low-income Utahns will not file for the credit, mostly because they won’t know about it and because many low-income Utahns are not in the habit of filing tax forms every year because they are not required to do so, since their incomes are below the minimum threshold for mandatory filing.

The key to making this new proposed grocery tax credit a meaningful offset is to publicize it effectively to lower-income Utahns so that they will know about it and file for it. Right now, unfortunately, Utah gets a failing grade for our meager efforts to publicize the federal Earned Income Tax Credit (EITC), the closest analog to the proposed new grocery tax credit. The state budget included just $130,000 this year to help lower-income Utahns file for the EITC, which helps explain why our participation rate is estimated by the IRS at only 75% of eligible households, well below the national average of 80%.

Thus, Voices for Utah Children testified before the TRETF last week that Utah needs to increase our investment in publicizing low-income tax credits from a six-figure line item to a seven-figure item. Fortunately, this would be an expenditure with the potential to pay for itself because it will mean more Utahns will file not just for the new proposed grocery tax credit and IGP EITC included in the co-chairs’ proposal (thanks to an amendment offered by Rep. Robert Spendlove), but also for the federal EITC. If Utah were to reach the national average of 80% EITC participation among eligible households, that could result in an additional $30 million of consumer spending by lower-income households, most of which would likely be subject to the state sales tax, the increased revenue from which could well exceed the amount budgeted to publicize the new tax credits.

Voices for Utah Children will continue to press for the TRETF proposal to add a line item setting aside at least $1 million to publicize the new tax credits. Doing so would position Utah to have the most effective grocery tax credit among the handful of states that employ such a credit to try to shield low-income residents from the regressive effects of the sales tax on food.

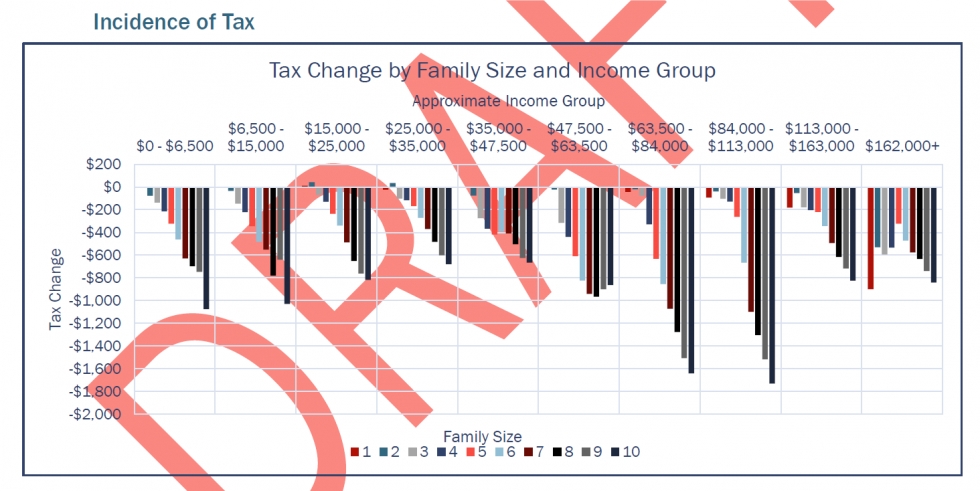

Regarding the co-chairs’ proposal’s impact on overall Utah revenues, Voices for Utah Children participated in a coalition letter released last month in which 27 nonprofits serving lower-income Utahns documented a long list of urgent unmet needs that the state has not been able to address due to our chronic shortage of public revenues resulting from decades of tax cutting. Unfortunately, the co-chairs’ proposal makes use of a temporary state budget surplus to justify yet another permanent revenue reduction of $79 million annually. It must also be noted that this $79 million net revenue loss is almost exactly equal to the amount of the net tax cut going to the top 5% of Utahns, those earning over $238,000.

Therefore Voices for Utah Children will continue to advocate for removing from the proposal the part that reduces the statutory income tax rate from 4.95% to 4.59%, since about 60% of any income tax rate reduction goes to the highest income 20% of Utah households. This results from the fact that about 3/5 of all Utah income is earned by the top 1/5 of Utah households, and the state income tax matches the state's income distribution in this regard.

It is hard to avoid noticing the irony that this sector of top-earning Utahns that is benefitting the most from this proposed $79 million overall revenue reduction includes most of the leaders of the Our Schools Now proposal that just two years ago proposed to raise the income tax rate so that high-earning Utahns could contribute more to Utah’s education system. This certainly seemed to indicate at that time that upper-income Utahns were ready, willing, and able to invest more, not less, in Utah’s education system, where enhanced investment in Utah’s children would help lay the foundation for our state’s future prosperity and success. Voices for Utah Children hopes that many of these leading Utahns will speak up in the coming weeks to express their views on this proposed windfall for them that would accomplish the opposite of the goals of Our Schools Now.