For Immediate Release Contact: Matthew Weinstein (see contact info below)

UTAH PENALIZED FOR LARGER FAMILIES IN PROPOSED FEDERAL TAX REFORM

LIKE REST OF U.S., MOST UTAH TAX CUTS GO TO TOP EARNERS

Salt Lake City -- A new analysis released this morning (November 6, 2017) finds that the proposed federal tax reform penalizes Utah for having larger families. The analysis also shows that most of the benefits of the proposal accrue to the highest income Utahns and that that advantage grows over time.

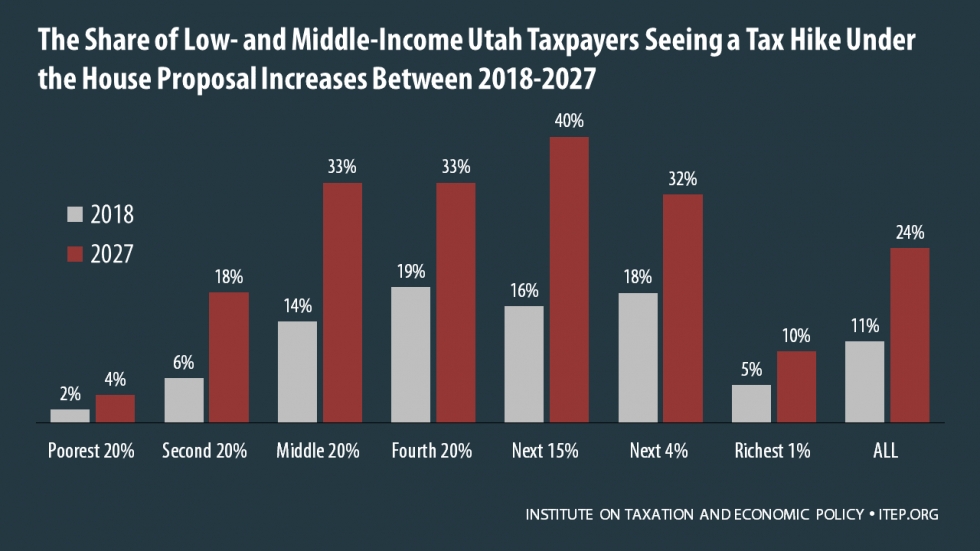

The analysis by the Institute on Taxation and Economic Policy finds that by 2027, a third of middle-income Utahns will pay a tax increase, compared to 21% nationally, and that tax increase will average $1380, compared to $1010 nationally, mostly due to our larger family sizes. Larger families are hit harder because the proposal eliminates entirely the personal exemptions that currently exist in the federal income tax system. The proposal tries to offset the loss of personal exemptions by increasing the standard deduction and the child tax credit, but larger families suffer more from losing the personal exemptions than they gain from those other changes.

Utah generally ranks #1 or #2 in the nation every year for household and family sizes, according to the US Census Bureau.

The new analysis also shows that most of the proposed tax cuts go to the wealthiest Utah households. Most of the immediate tax cuts -- 71% of them -- will go to the top quintile of Utahns, those earning over about $116,320; their average tax cut will be $5,302 per year or about $102 per week. And most of the immediate tax cuts -- 51% of them -- will go to the top 5% of Utahns, those earning over $226,530, whose tax cuts will average $15,298, or $294/week. By contrast, the neediest quintile of Utahns, those earning up to $26,260, will see their taxes fall by about $3/week or $160/year.

Over time the share and amount of the tax cut going to the wealthiest Utahns will grow, while the tax cuts for other Utahns will decline. In 2027 90% of the top percentile of Utahns (the top 1% -- those with incomes over $765,900) will get a tax cut averaging $84,230. In 2027 the top 1% will receive 64% of the tax cuts, the top 5% will receive 76%, and the top quintile will receive 80% of the tax cuts. By that year the average tax cut for the lowest-income quintile of Utahns will have shrunk to just $120.

The full report is available at https://itep.org/housetaxplan and the Utah-specific charts and data are at https://itep.org/housetaxplanut.

Matthew Weinstein, state priorities partnership director at Voices for Utah Children, commented, "It is unfortunate that the tax reform proposal that has emerged in the House of Representatives is one that penalizes the larger families that are so common in Utah. We hope that the Senate proposal will be more reflective of the needs of the home state of the chair of the Finance Committee, our own Senator Orrin Hatch. We are also very concerned about a tax proposal that increases the federal deficit by $1.5 trillion over the next ten years, which will increase pressure to enact the severe safety net cuts contained in the Trump Administration's and the House Budget Committee's federal budget proposals, as discussed at https://utahchildren.org/newsroom/speaking-of-kids-blog/item/839-president-trump-s-proposed-fy18-budget."

###