Voices for Utah Children Tax Reform Policy Positions

September 2019

The mission of Voices for Utah Children is to make Utah a place where all children thrive. We start with one basic question: "Is it good for kids?" We believe that every child deserves the opportunity to reach his or her full potential.

Utah tax policy has a significant impact on a family’s ability to provide for their children’s needs and invest in their future. Tax policy affects the quality of public education and healthcare, community safety and livability, and whether lower-income families have enough disposable income to meet basic needs.

During the 2019 Legislative Session, lawmakers created the Tax Restructuring and Equalization Task Force to recommend ways to modernize and reform Utah tax policy, based on input from the public. Voices has prepared this document to outline our tax policy positions, to make recommendations, and to urge policy makers to carefully consider the impact of their decisions on families and children.

Policy Position #1:

Utah’s tax structure is regressive. Targeted tax reductions can reduce regressivity. Income tax rate cuts worsen the problem.

Utah’s overall tax structure is regressive: It asks those with the highest incomes to contribute the least toward Utah’s most pressing needs.

As the chart below illustrates, the wealthiest 1% of Utahns, those earning over about $500,000 annually (who collectively earn 16% of the state’s income), pay 6.7% of their incomes in state and local taxes, a lower share than that paid by every other income group.

Utah can reduce the regressivity in our tax code with tax reductions targeted to lower-income Utahns so as to reduce the number who are taxed into – or deeper into – poverty. Moreover, the effectiveness of such targeted reductions can be measured and evaluated.

State Earned Income Tax Credit (EITC)

A state EITC offsets a portion of low-income working families’ taxes so they can keep more of what they earn and work their way out of poverty. A state EITC is:

-

-

-

- easy to administer and less expensive than other tax cuts.

- a proven, cost-effective way to reduce poverty and improve educational, health, and employment outcomes.

- Eligible working families could receive 10% of the federal EITC – up to $640 depending on income and number of children.

- 29 other states fund their own EITC.

-

-

Refundable State Child Tax Credit

During the 2018 second special session, legislators passed a non-refundable state child tax credit (CTC) to mitigate the impact of federal tax reform for larger Utah families. Making the Utah CTC refundable will help low income families meet their children’s needs.

Reduce Sales Tax Rate

Because sales taxes are regressive, they could be offset by entirely removing the sales tax on food, creating an Idaho-style grocery tax credit, or reducing the state sales tax rate.

But income tax rate reductions make Utah’s tax system more regressive. The income tax is the only major Utah revenue source that is not regressive. In fact, it roughly matches Utah’s income distribution. About three-fifths of all income in Utah is earned by the top one-fifth of tax filers, and about three-fifths of the income tax is paid by that same high-earning quintile (those earning over about $100,000).

Policy Position #2:

Utah has a revenue problem. That problem would be exacerbated by income tax rate cuts.

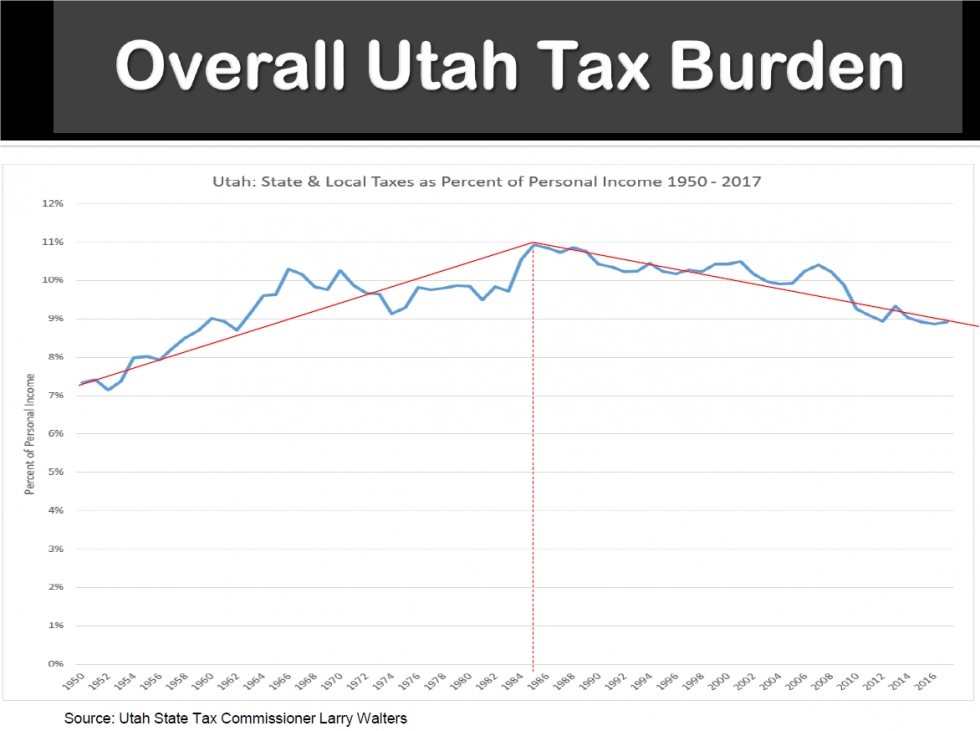

At the public hearings of the Tax Restructuring and Equalization Task Force, one of the most commonly heard refrains was the declaration that “Utah does not have a revenue problem.” Would that it were so! Alas, the unfortunate truth is that, after many years of tax cutting, Utah finds ourselves unable to keep up with the needs of a fast-growing state. Separate research reported by the Utah State Tax Commission and by the Utah Foundation has found that the overall Utah “tax burden,” as it is commonly known, is at a multi-decade low relative to our incomes. (The Utah Foundation report includes both taxes and the various user fees that make up nearly 40% of state and local government revenues in Utah.)

In many ways, lower taxes are a cause for celebration. Everyone likes having more money in our pockets to spend today. Lower taxes sometimes help attract business investment, fueling economic growth. But taxes are not the only factor for businesses deciding where to locate and expand. Higher on most companies’ wish lists are the questions of whether a state has a suitable workforce and infrastructure to ensure that high-wage (often meaning high-tech) businesses can thrive.

Utah’s education system is famous for its ability to “do more with less” better than any other state. But are we – and should we be – satisfied with an education system that just performs “respectably,” in the words of one recent report? If we are satisfied with the status quo, that implies we are willing to accept lagging behind not just in terms of inputs but also on several significant outcome measures. For example:

-

- Our high school graduation rates are lower than national averages for nearly every racial and ethnic category, including our two largest, Whites and Hispanics.

- Among Millennials (ages 25-34), our percent of college graduates (BA/BS or higher) lags behind national trends overall and among women. (Utah’s young men continue to outperform young men nationally, but not by enough to offset the gap among young Utah women – who themselves outperform Utah’s young men, but not by as much as do young women nationally.)

Moreover, Utah is in the midst of a demographic transformation that is enriching our state immeasurably but also creating majority-minority gaps of a type and at a scale that is unprecedented in our history. For example:

-

- Our gap between White and Latino high school graduation rates is larger than the national gap.

- Education Week recently reported that Utah ranks in the worst 10 states for our growing educational achievement gap between haves and have-nots.

- We are beginning to see concentrations of minority poverty that threaten to give rise to the type of segregation and socio-economic isolation that are common in other parts of the country but that Utah has largely avoided until now.

And it is not just in the area of elementary and higher education that Utah is not measuring up. Many other areas suffer from underinvestment, including:

-

- Infrastructure: Utah’s investment has fallen behind by billions of dollars.

- Health care: Our rates of uninsured children are higher than national averages – and rising – especially among the one-in-six of our children who are Hispanic. In Utah 35,000 or 5% of White children are uninsured (national rank = 36th place), compared to 31,000 or 18% of Latino children (rank = 46th = last place in 2017).

- Pre-K: Utah ranks 36th for our share of lower-income 3- and 4-year-olds attending pre-school.

- Kindergarten: Only a third of Utah kids participate in full-day kindergarten, less than half the national average, because local school districts can’t afford to offer it. Voices for Utah Children estimates that it would cost at least $75 million to offer full-day K to all Utah kids (not including potential capital costs).

- Mental Health and Drug Treatment: Utah was recently ranked last in the nation for our inability to meet the mental health needs of our communities, according to a recent report from the Kem Gardner Policy Institute. Underfunding of drug treatment and mental health services costs taxpayers more in the long run as prison recidivism rates rise because the needed services are not available. Estimates are that Utah meets only 15% of the need for these vital, life-saving services.

- Affordable housing units fall 41,266 units short of meeting the need for the 64,797 households earning less than $24,600, yet the annual $2.2 million appropriation to the Olene Walker Housing Loan Fund has not changed in over two decades, despite inflation of over 60%. Among extremely low-income renter households, 71% pay more than 50% of their income for housing, which is considered a severe housing burden. This year, the Olene Walker Housing Loan Fund used up most of its annual $14 million allocation at its very first meeting of the fiscal year.

Given these – and many other – unmet needs and the urgency of action, is now the time to be considering major cuts to public revenues yet again? Or is it time to consider whether now might be the time to, as we tell our children, eat our broccoli so that we can grow up to be big and strong?

Given the challenges we face and the evidence that tax cuts have taken a toll on our ability to respond to them, it is worth asking whether the current generation of Utahns is doing our part, as earlier generations did, to set aside sufficient resources every year to invest in our state’s future.

Certainly these are difficult questions, especially for a generation of elected officials – and voters – accustomed to the easy, instantaneous gratification of never-ending tax cuts.

Policy Position #3:

Earmarks reduce budget flexibility – but can only be ended by addressing the state’s chronic public revenue shortage.

In 2014, Voices for Utah Children published a report entitled, “What’s Still Eating Utah’s General Fund: How Unfunded Earmarks Are Undermining the Budget Process and Affecting Utah Families and Children.” In that report, we expressed the view that “Earmarking ties policymakers’ hands so they can’t adapt to the evolving needs of the state’s ever-growing and ever-changing economy and population,” and we noted, “Robbing Peter to pay Paul has become an unfortunate pattern in Utah’s public finance decision-making.”

In a 2015 report presented to the Legislature, the Tax Review Commission (TRC) examined earmarks and recommended rolling back about 95% of them. In a letter to the Legislature, the TRC wrote, “In nearly all cases, the TRC opposes earmarks to the state sales and use tax.”

An additional lesson that we would note today is that earmarking has served the political purpose of avoiding raising taxes to address newly identified needs. For example, rather than allow the gas tax to rise with inflation, the Legislature has used earmarks to divert existing General Fund revenues to meet the newly identified transportation infrastructure investment needs.

The current proposal to end the state Constitutional earmark of income tax revenues for education is intended to promote budget flexibility, but it would also permit the diversion of current education revenues to fill the hole in the General Fund created by the transportation earmarks. In other words, proponents want to end one earmark to solve the problems created by another earmark.

Instead, policymakers should consider eliminating the need for any earmarks by addressing the chronic public revenue shortages that give rise to them. Indeed, the public seems quite unlikely to support ending the state Constitutional earmark of income tax revenues for education without a guarantee that such a change will increase rather than decrease education investment and get Utah out of last place in per-pupil funding.