The story of tax policy in the 2022 Legislative session is a tale of two tax cuts:

-

- A large, top-heavy cut to the income tax rate from 4.95% to 4.85%. How large? $164 million. How top-heavy? 63% of it goes to the top 20% of taxpayers. all of whom have six-figure incomes.

- The creation of a small ($16 million, just one-tenth the size of the income tax rate cut) state-level Earned Income Tax Credit. The EITC is widely considered to be the nation's most effective anti-poverty program, since it reduces poverty by promoting work and self-sufficiency. Special recognition goes to Rep. Mike Winder, who, in his final legislative session, leaped at the opportunity to sponsor HB 307 and persuade his colleagues that 2022 was the year to make Utah the 31st state with our own EITC, something that advocates for reducing poverty have sought for decades.

The new Earned Income Tax Credit is non-refundable, which means it will not reach the lowest-income fifth of Utah workers who need it the most, including those struggling to work their way out of intergenerational poverty. About 80% of the value of the federal EITC is the refundable portion, which offsets other federal taxes paid by the lowest income workers. Most state level EITCs are also refundable, allowing them to offset the sales, gas, and property taxes paid by low-income workers to state and local governments. In Utah, the lowest income workers pay, on average, 7.5% of their incomes in those taxes, which is a higher share of their incomes than that paid in all state and local taxes by the highest income Utahns. The new nonrefundable EITC will help moderate income Utahns (the second fifth of the income distribution), primarily those earning between $30,000 and $55,000. Moderate income Utah families certainly need the help, so the creation of a Utah EITC is a great step in the direction of better tax policy. We hope that Utah will soon follow in the footsteps of other states that began with a non-refundable EITC and then decided to make it refundable.

The income tax rate reduction continues an unfortunate pattern in recent decades of tax breaks for those who need them the least -- tax breaks that both increase inequality and starve Utah's schools of the resources they need to succeed. In 2007 we cut the top income tax rate from 7% to 5%, then in 2018 to 4.95%, now this year to 4.85%. The income tax is the only non-regressive tax Utah has, the only one that actually lines up with Utah's income distribution. Ironically, as income inequality worsens, it is also Utah's fastest growing source of revenue, which offered Utah our best hope for seeing our education system benefit from Utah's rapid economic growth -- until we began targeting that rapidly growing revenue source for tax cuts.

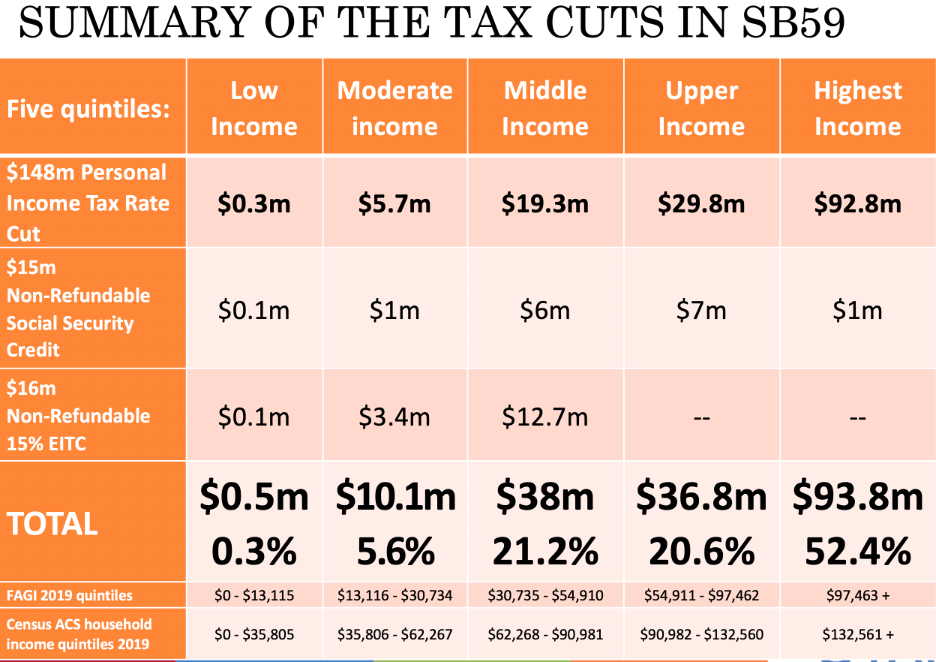

Here is a summary chart of this year's tax cuts and how they impact Utahns in each fifth of Utah's income distribution:

Source: Utah Legislative Fiscal Analyst (excluding the $15 million corporate portion of the income tax rate cut)

Source: Utah Legislative Fiscal Analyst (excluding the $15 million corporate portion of the income tax rate cut)

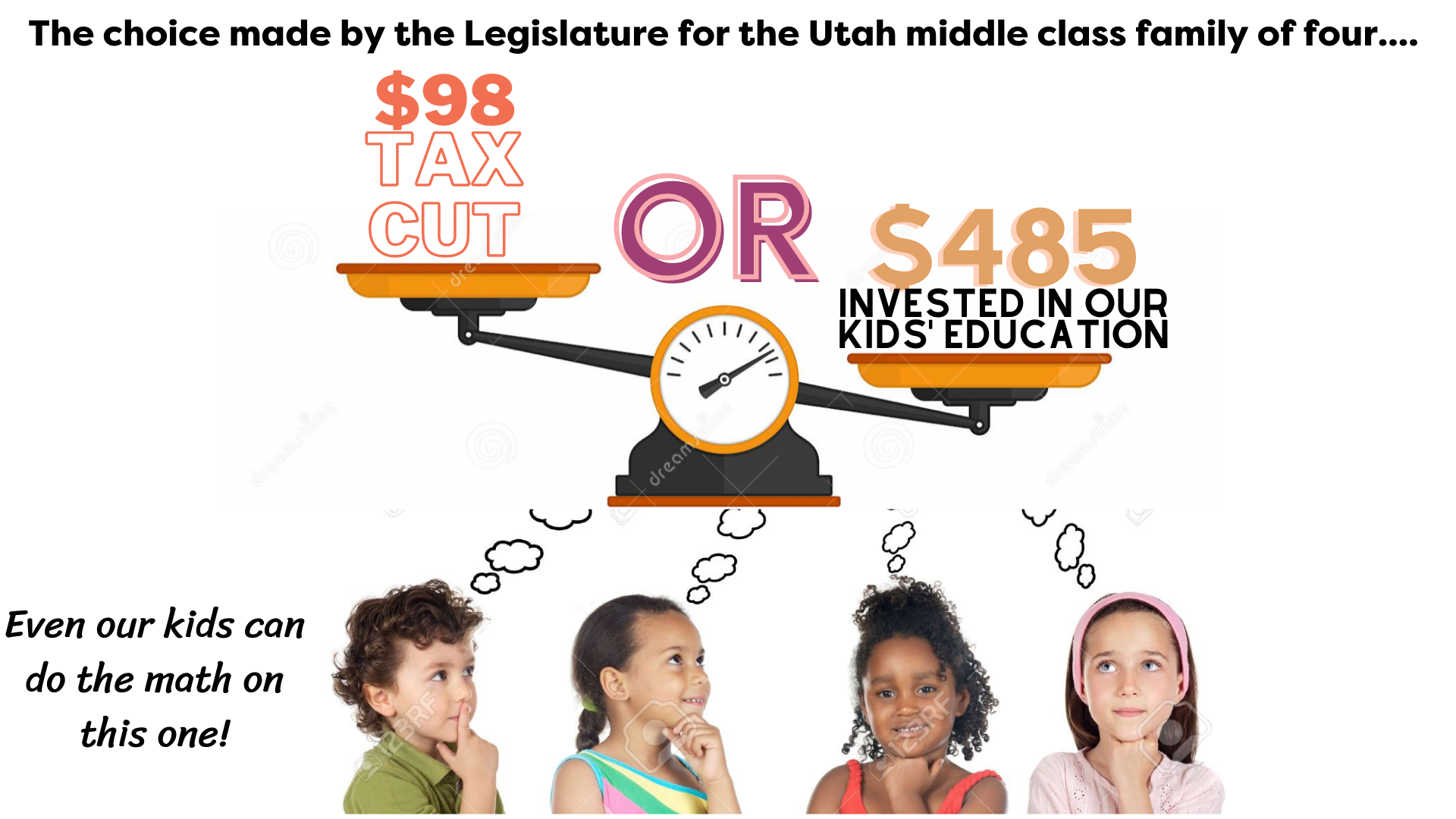

Another way to think about the income tax rate reduction from 4.95% to 4.85% is to consider how it impacts a median income family of four. According to the Legislative Fiscal Analyst, such a family receives a tax cut of $98. But when you divide the $164 million price tag of the income tax rate reduction by Utah’s K-12 student population of about 675,000, then multiply by the two kids that the median income family of four has in school, you see that that average family that is gaining $98 in a tax break is giving up $485 that is now not going to be spent on their kids’ education every year. Not going to be spent on smaller class sizes or more experienced teachers or more up-to-date technology. Not going to be spent on closing the gaps in our education system between majority and minority groups and between haves and have-nots, gaps which are larger than nationally.

It's also important to see this year's income tax rate cut in the context of decades of top-heavy tax breaks passed by the Legislature. According to the Utah State Tax Commission, Utah has been passing, on average, $100 million a year of new tax breaks for over 35 years. This now adds up to over $3.5 billion not available every year to invest in Utah's children -- their education, health care, and basic economic security. In fact, the Invest in Utah's Future Coalition has identified over $5 billion of unmet needs in a wide range of areas of public responsibility.

For a full summary of this year's legislative actions on taxes, you can....

- Download our Powerpoint slideshow summary

- View a video recording of our presentation "Utah Legislature's 2022 Tax Changes: What happened and how will it impact Utah children" at https://fb.watch/bpbVN8Mwms/