NEW ANALYSIS FINDS THAT THE FINAL HOUSE AND SENATE TAX BILLS STILL PENALIZE UTAH FOR OUR LARGER FAMILIES

Salt Lake City - Voices for Utah Children today released an updated analysis of the final versions of the House- and Senate-passed tax bills that finds that the two bills continue to discriminate against Utah because of our larger family sizes.

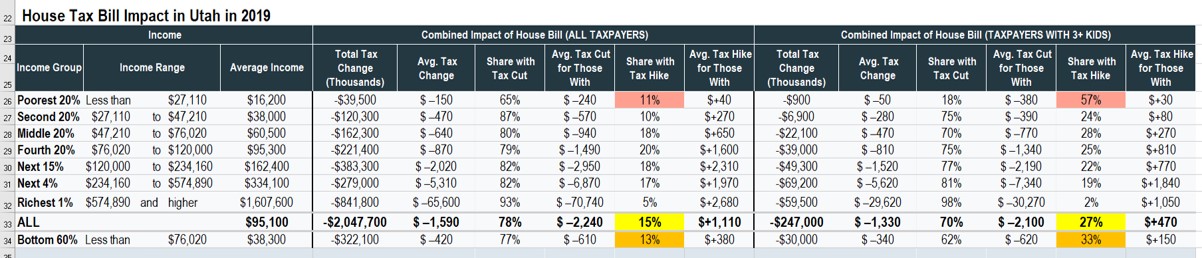

The new analysis finds that the bill passed by the US House of Representatives hurts larger families both in the early and later years of the standard 10-year outlook window. In 2019, for example, 27% of Utah taxpayers with 3 or more children pay higher taxes rather than lower, compared to just 15% of all Utah taxpayers. This penalty for larger families in 2019 is especially widespread among low- to-middle-income Utahns. For example, among the lower 60% of Utahns (those earning up to $76,020 in 2019), 33% of families with 3+ kids pay higher taxes, compared to just 13% of all Utahns. For the lowest quintile of Utah taxpayers (those earning under $27,110 in 2019), fully 57% of large families (those with 3+ kids) get hit with a tax increase, compared to just 11% of all Utah households in that first income quintile. These effects are highlighted in the chart below.

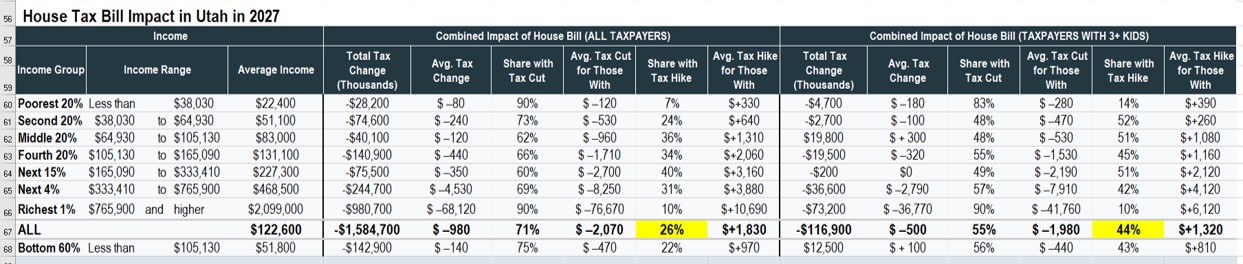

The House bill goes from bad to worse over time. By 2027, 26% of Utahns see a tax increase (vs 15% in 2019), but 44% of large families pay higher taxes that year (vs 27% in 2019), as shown in the chart below.

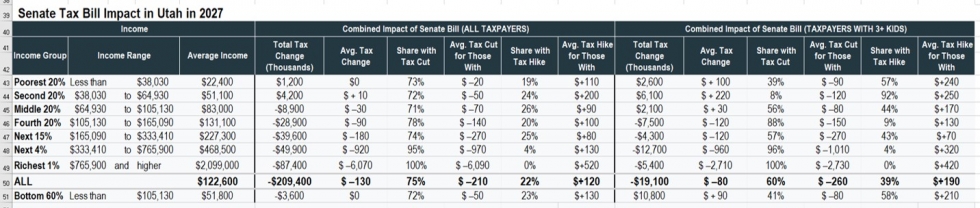

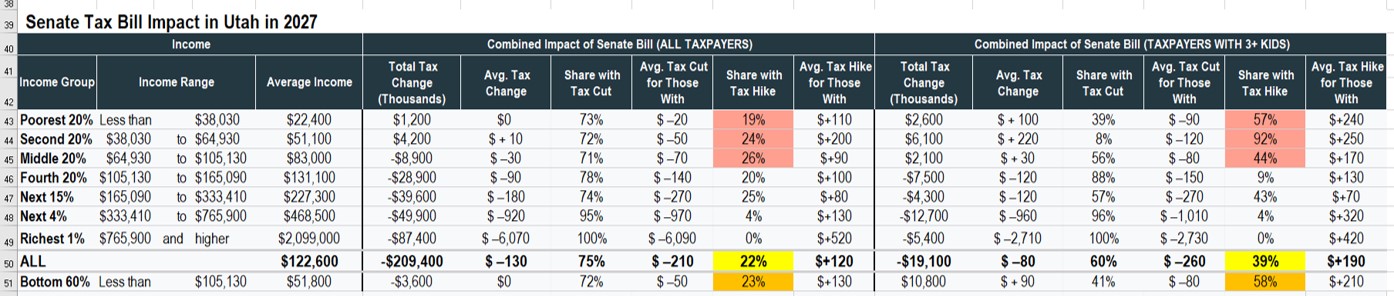

The bill passed by the US Senate on December 2 does not harm larger families disproportionately in its early years, but by 2027 it raises taxes for 39% of larger families (again, those with 3+ children) compared to only 22% of all Utah tax filers. Moreover, because the bill's tax cuts are skewed toward the top of the income scale, low- and middle-income families get hit the hardest in the Senate bill by 2027. For example, if one looks only at the bottom three quintiles (in other words, up to the 60th percentile of income, which is projected to be about $105,130 in 2027), 58% of Utah taxpayers with 3 or more children pay a tax hike that year, compared to 23% of all Utahns below that income level. Among the lowest income quintile (those earning up to 38,030 in 2027), 57% of larger families pay higher taxes, compared to 19% of all taxpayers in the poorest quintile. The second and third quintiles see a similary disproportionate impact on larger families.

The disproportionate impact on larger families found in the two bills is evident at the national level as well as in Utah. But the bills can be said to have a punishing effect on Utah because we have the largest households and families in the nation. Therefore, the bills' detrimental effect on large families is felt more in Utah than any other state.

One cause of the problem is that larger families lose more from elimination of the personal exemptions than they gain from the increases in the standard deduction and child tax credit (CTC). Moreover, both the House and Senate bills failed to include the proposed amendment from Senators Marco Rubio and Mike Lee that would substantially increase the refundable portion of the child tax credit. (The refundable portion of the CTC is the only part that is accessible to most low- and moderate-income taxpayers since their incomes are generally too low to incur federal income tax liability.)

Matthew Weinstein, state priorities partnership director at Voices for Utah Children, commented, "This finding that the proposed tax bills passed by the House and Senate hurt larger families is of great concern to us, especially for their harmful impact on lower-income families already struggling to provide economic stability for their children. Children growing up in economically unstable circumstances have been found to be more likely to fall victim to adverse health and educational outcomes and even end up in the criminal justice system instead of the workforce when they grow up. In addition, the finding by ITEP and by Congress's own scorekeepers that these supposed tax cut bills ultimately raise taxes for so many low- and moderate-income Utahns comes as a very unpleasant and unwelcome surprise. We urge Congress to slow down and take the time to full think through how these very significant changes to the tax code will impact families and children."

The analysis was conducted by the Institute on Taxation and Economic Policy, a nonpartisan think tank that has developed a sophisticated tax incidence model to produce distributional analyses that not only estimate the revenue impact of current and proposed tax policies but also project the real-life economic effects on taxpayers at every income level. The ITEP analysis does not reflect the impact of the elimination of the individual mandate under the Affordable Care Act (ACA), which is why ITEP finds fewer households with a tax increase overall in 2027 than Congress's Joint Committee on Taxation, which found that every income group making less than $75,000 in 2027 would pay higher taxes by that year, in part because it counted as a tax increase the increased burden of healthcare costs that would face moderate- and middle-income households without ACA subsidies. A spreadsheet with the full results of the analysis can be accessed ![]() at this link.

at this link.