Utah Taxes: Tax Day Resources 2019

Voices for Utah Children works to make Utah a place where all children thrive. In furtherance of this mission, our fiscal policy research and advocacy program seeks to advance two priorities:

-

-

- Revenue Sufficiency: Ensuring that public revenues are sufficient to make the critical investments today in Utah’s children – especially those at risk of not achieving their full potential – so as to ensure the success and prosperity of our state tomorrow.

- Tax Fairness: Our system of generating public revenues – taxes – should seek to avoid driving low-income families into -- or deeper into – poverty.

-

As Utah and the nation mark Tax Day 2019 on Monday, April 15, Voices for Utah Children offers the resources below from our recent publications and those of other organizations that shed light on how well Utah is doing in addressing the two challenges above. Especially at a time when policymakers are considering significant changes to Utah’s system of taxation, we hope these resources may help point the way toward a prosperous and successful future for all Utahns and all of Utah’s children.

Revenue Sufficiency Resources

- The most recent comprehensive analysis found Utah at a multi-decade low for our overall state and local tax burden.

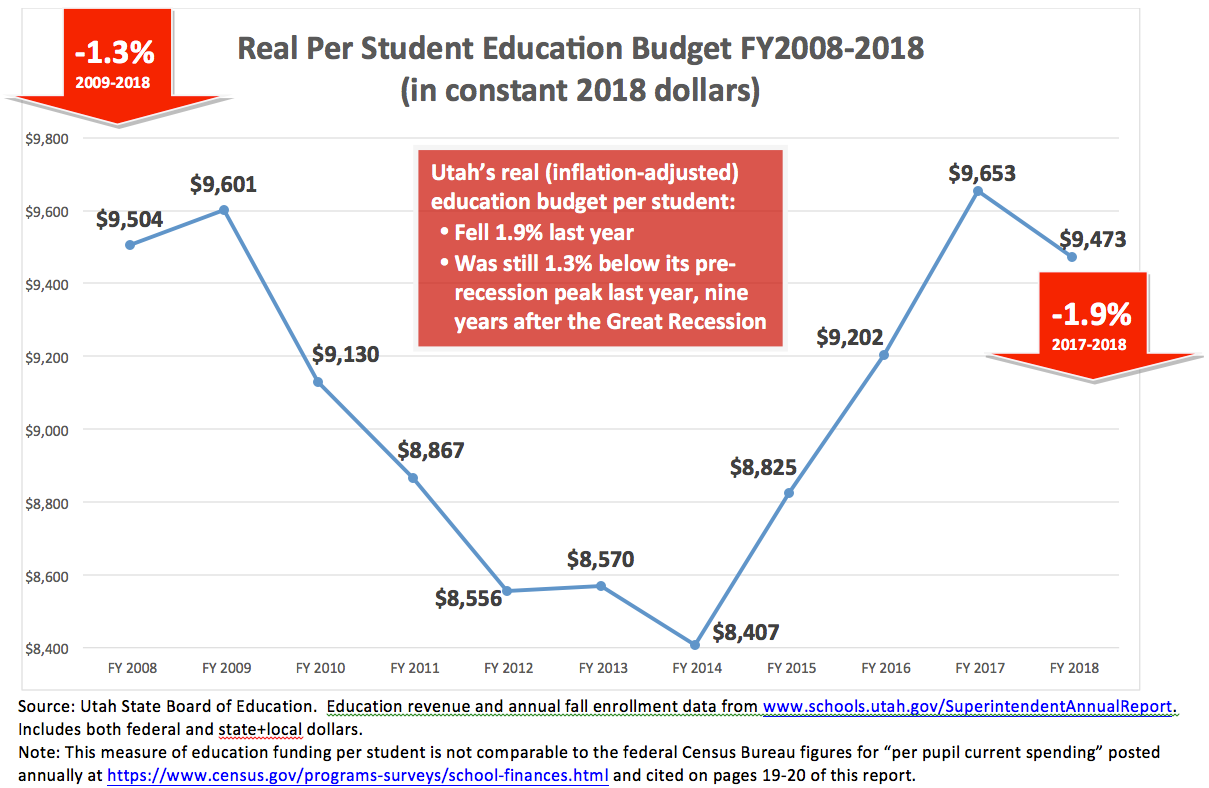

- The new Utah Children’s Budget Report 2019 released earlier this year documents that Utah’s K-12 education budget (including both state and local revenues) fell last year in real terms both overall for the first time in seven years (by $41 million) and on a per-student basis by 1.9%, leaving it 1.3% below its pre-recession peak, even after nine years of economic expansion.

- A Voices for Utah Children fact sheet at https://utahchildren.org/images/pdfs-doc/2019/Leg2019_tax_cuts_agenda_1-pager.pdf addresses the risks of current proposals to enact additional income tax rate reductions as opposed to smaller, targeted tax cuts that bring specific, measurable benefit to Utah.

- A recent report found that Utah could generate an additional $103 million of Education Fund revenue by closing a state tax loophole that allows major international corporations doing business here – many in direct competition with local Utah businesses – to hide their profits in offshore tax havens like the Cayman Islands.

Tax Fairness Resources

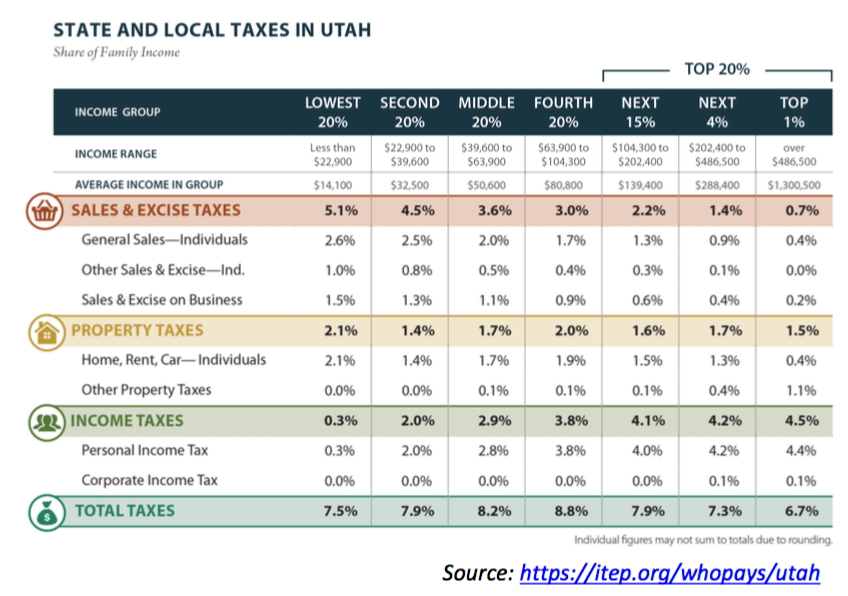

- Utah’s overall system of state and local taxation is regressive. Low- and middle-income Utahns pay an overall effective tax rate that is higher than the rate paid by upper-income Utahns. For additional details, visit www.itep.org/whopays/utah.

- Thanks to legislative champions including Rep. Robert Spendlove and Sen. Evan Vickers, the sponsors of HB 103 in the 2019 legislative session, as well as Rep. Tim Quinn, who included that proposal in his own HB 441, Utah may be on the verge of creating our own state version of the federal Earned Income Tax Credit (EITC). The bill proposes to offset $7 million of the $25 million of state and local taxes paid by the lowest-income Utahns every year. To learn more about this legislative proposal and how it would help promote independence and self-sufficiency for Utahns seeking to work their way out of poverty, download the fact sheet at http://www.utahfamilytaxcredits.org/learn-more/.

- Speaking of the EITC, only about 75% of eligible working Utahns file for this very valuable tax credit every year. This means tens of thousands of Utah households are losing the opportunity to receive an average refundable tax credit of over $2,000 -- up to a maximum of $6,400, depending on income and number of children. Utahns earning up to $54,000 can get free help with filing from certified volunteers at any VITA location – visit www.UtahTaxHelp.org for details!