Early Education

Child care certainly received its fair share of discussion this legislative session, but did anything really happen? The short answer is kinda. Here’s what happened.

Funding Requests

During the session, Voices for Utah Children teamed up with parents, child care professionals, and early childhood advocates to lobby the state legislature for more than $260 million to stabilize Utah’s child care system. This was, admittedly, a big ask. But the requests highlighted the reality of the child care sector’s needs. Many of the state funding requests aimed to replace expiring federal pandemic money that has been propping up the sector. This emergency federal funding will begin to end in June 2023 and will fully expire by June 2024.

Child Care Stabilization Grants, Rep. Andrew Stoddard

Federal Child Care Stabilization Grants have been a lifeline for Utah's child care sector. Child care providers have indicated the lack of ongoing stabilization funding will result in one or more of the following three outcomes: child care programs will close, tuition will be raised for families, and/or employees will have lower wages. This funding would have allowed for a one-year extension of the stabilization grants currently received by hundreds of child care providers in Utah.

Requested: $216 Million

Outcome: NOT FUNDED

Retention Incentives for Early Childhood Professionals, Sen. Luz Escamilla

In 2022, federal funding allowed Utah's Office of Child Care issued $2,000 bonuses to eligible workers serving in child care positions to provide recognition for their critical work throughout the COVID pandemic and to improve retention within the field. 9,368 child care professionals received retention incentives through this program. This funding request would have continued this incentive program for an additional two years while structural reforms were pursued.

Requested: $38 Million

Outcome: NOT FUNDED

Regional Child Care Development Grants, Rep. Ashlee Matthews

Through federal funding, Utah's six Regional Care about Child Care Resource & Referral Agencies supported new programs for rural outreach, small business training, start-up grants, and professional development. This funding would have continued these grants for another three years to continue programming that works to expand child care access and improve care in both rural and urban areas.

Requested: $2.1 Million

Outcome: NOT FUNDED

Child Care Licensing-Related Fees, Rep. Ashlee Matthews

With COVID-relief funding, the Office of Child Care Licensing has waived the fees associated with licensing in order to lessen the barriers to expanding, maintaining, and opening new child care programs. This funding would have extended this fee coverage for another three years as the state tackles the child care crisis.

Requested: $3 Million

Outcome: NOT FUNDED

Child Care Solutions and Workforce Productivity Plan, Sen. Luz Escamilla

A priority of the Governor’s Office of Economic Opportunity’s Women in the Economy Subcommittee, these funds will support strategic planning for child care solutions.

Requested: $250,000

Outcome: $150,000

Legislation

HB 167: State Child Care, Rep. Ashlee Matthews & Sen. Luz Escamilla

This bill provides the framework for State agencies to convert empty state buildings to on-site child care. It will allow private providers to rent the space and operate from the facility, creating greater access to child care for employees and the greater community.

Outcome: PASSED

HB 170: Child Tax Credit Revisions, Rep. Susan Pulsipher & Sen. Daniel McCay

This bill provides a non-refundable yearly tax credit of $1,000 per child between the ages of 1-3 for families making up to $43,000 for single filers and $54,000 for households filing married jointly. Because the bill’s original intent was to help with the cost of child care, we’d like to see this expanded to help children ages 0-6, as it did in the original bill. This legislation makes Utah the 13th state with its very own state child tax credit.

Outcome: AMENDED VERSION PASSED

HB 282: Child Care Sales Tax Exemption, Rep. Christine Watkins

This bill would have allowed for a sales and use tax exemption for construction materials used to construct or expand a child care program.

Outcome: BILL NEVER HEARD IN COMMITTEE

Advocacy

While our policy wins feel small, it was a stellar year for child care advocacy. We hosted our first Child Care Advocacy Day, where we welcomed over 100 parents, kiddos, providers, and supporters of child care in Utah’s Capitol Rotunda! The turnout far surpassed expectations and we hosted many new faces. We look forward to continuing to grow our network of child care advocates and working on solutions to child care during the interim.

https://utahchildren.org/2021-utah-legislative-tracker/itemlist/tag/Early%20Education?start=10#sigProIdd97ffa0e95

To learn more about child care advocacy in Utah, visit UtahCareforKids.org.

Full Steam Ahead for Full-Day Kindergarten in Utah!

Congratulations, Utah parents and educators! Together, we did it. Funding for optional full-day kindergarten is now a reality for schools statewide.

The Utah Legislature passed HB477, "Full Day Kindergarten Amendments," sponsored by Rep. Robert Spendlove (R-Sandy). This bill establishes the same flexible, stable funding stream for full-day kindergarten as currently exists for all other grades of public school, first through twelfth. Last week, Governor Spencer Cox signed this historic bill into law!

(Click here to jump to our four-minute explainer video, which is also included at the bottom of this page)

Does this mean that next school year, every family in Utah will have the opportunity to enroll their kindergartner in a full-day program in their neighborhood school? Unfortunately, no. It DOES mean that the number of families who will have access to full-day kindergarten will increase dramatically - we estimate between 60% and 65% of kindergarteners will be able to enroll in an optional full-day program during the 2023-24 school year. This is is a huge leap from fewer than 25% just five years ago!

The passage of HB477 means that next school year (2023-24), every district and charter elementary school will have the opportunity to offer optional full-day kindergarten, using this new state funding stream.

In order to offer more full-day kindergarten, schools must have more classroom space, more teachers, and more equipment like tables and chairs. Some school districts and charter schools have spent the last several years making plans to overcome these challenges, and will be ready to offer optional full-day kindergarten to most, if not all, of their local families in the coming school year.

Some elementary schools are not quite ready to take advantage of this opportunity. These schools will need some time to overcome the challenges of: 1) limited classroom space; 2) recruiting new teachers; 3) purchasing new materials and equipment; 4) busing adjustments; and other practical issues. This is true particularly in some of our large, suburban school districts, such as Jordan, Davis and Alpine. Other small- and mid-size districts face some of these issues, as well.

We estimate that it will take between three and five years before all Utah families have the opportunity to enroll their child in a full-day kindergarten program. Based on the popularity of newly expanded full-day programs in different parts of the state, we expect to see more than 90% of parents opt for full-day kindergarten for their children when it becomes available to them.

The best way to find out whether your local elementary will be offering optional full-day kindergarten during the 2023-24 school year is to contact the current principal of that school (or the director, in case of charter schools) and ask them directly! Not only will this help you to plan for your family's schooling schedules, but it will help our local education leaders assess how much community interest exists for more optional full-day kindergarten.

In case you were worried, the new law preserves parents' right to enroll their child in a half-day program, and does not make kindergarten mandatory. There is nothing in the law that tells districts and charters how much optional full-day kindergarten they must offer to their communities, or how soon they have to do so. HB477 was created to be as flexible as possible, allowing local communities to decide the right mix of half- and full-day programming for them.

Thanks to all the hard work of education leaders, insistent parents and committed community advocates, we have finally accomplished state funding for optional full-day kindergarten in Utah! We especially appreciate the commitment of the United Way of Salt Lake and the Utah PTA, our core partners in the Utah Full-Day Kindergarten Now Coalition.

Of course, this would not have happened without the support and leadership of State Superintendent Sydnee Dickson, Sara Wiebke, Christine Elegante and other superhero staff at the Utah State Board of Education. We owe a lot to our bill sponsor, Rep. Spendlove, and the other legislative champions like Senator Ann Millner who have been key to this effort in the past (former Reps. Lowry Snow and Steve Waldrip, we are looking at you!).

Utah's Proposed Child Tax Credit

To date, the state legislature’s minimal efforts to address Utah’s complex child care crisis are completely out of proportion to the scope of the problem.

None of those efforts have offered much relief for Utah families with young children who are struggling with the rising cost of child care. They certainly don’t contemplate the urgency of the impending “federal funding cliff” that is about to push child care costs even further through the roof.

Policy proposals that require a meaningful investment of state dollars - and pretty much all the effective ones will - have been ignored by elected officials.

Before the session ends on March 3rd, however, the legislature has a chance to pass legislation that would actually provide financial relief for some families with young children.

Yes, it will require state investment - but the one kind of investment that legislators seem most enthusiastic about: a tax cut!

Well, a tax CREDIT, which is sort of like a tax cut for the Utahns who qualify.

Representative Susan Pulsipher (R-South Jordan) has introduced a narrowly-tailored Child Tax Credit, which would allow families to claim up to an extra $1,000 per child each year, to help cover a small portion of the staggering costs of caring for a child. Families that make more money can claim a smaller amount, on a sliding scale.

The bill is House Bill 170: Child Tax Credit Amendments (originally named "Child Care Tax Credit Amendments). It has only recently moved forward in the legislative process, after its initial introduction in mid-January. With just a couple of weeks left in the session, there is still a chance that this tax credit - with a price tag of less than $41 million - could be included in whatever tax package the legislature inevitably passes.

Rep. Pulsipher’s goal is to help families who still struggle to afford the costs of raising young children.

The money they save with this tax credit can be used by families in any way that works for them. If a parent stays home, it can help cushion the financial burden of having a one-income household. If both parents work, it can be used to cover the costs of child care while they are working.

There are a few catches, though:

- This $1,000 tax credit can only be claimed for children who are under the age of six at the time you file your taxes. Child care costs go way down for a family once a child is enrolled in school.

- In order to be eligible, your household must meet certain household income requirements (for example, a household with a joint filing status must be less than $54,000 to quality for the full amount of the credit).

- If your family makes more than a certain amount of money, you can still claim this tax credit, but it is phased out based on your household income.

- If you don’t end up owing any income taxes when all the math is said and done, you won’t get a check in the mail from the state for each child. This tax credit would be “non-refundable.” That means the tax credit can only be used to put a dent in the income taxes you owe; it can’t put extra money in your pocket if your income taxes calculate down to zero.

- You won’t be able to claim the tax credit THIS YEAR. Or even next year. It would go into effect when you file your 2024 taxes in 2025.

Even with these strict parameters, we think having a Child Tax Credit available for some Utah families is a great step toward grappling with our state’s child care problems in a meaningful way.

HB170 offers legislators an opportunity to show they are willing to invest in families with young children in the face of a crisis that is about to get a lot worse. We hope they take it!

Write to your legislators about HB170 “Child Tax Credit Amendments!”

Utah's State Child Tax Credit

As many Utahns experienced firsthand during the pandemic, a generous child tax credit (CTC) can make a world of difference for families raising young children. During this challenging time, the CTC was temporarily expanded and made refundable, granting families $300 per month per child under six and $250 per child aged six to seventeen – providing significant tax relief for working families. This expansion had a far-reaching impact, reducing child poverty to its lowest recorded level in 2021, dropping by 46% from 9.7% in 2020 to 5.2% in 2021. Unfortunately, a year after the expansion ended, child poverty returned to 12.4%. In Utah, the federal CTC expansion helped lift 32,000 children from poverty.

In 2023, Utah became the 13th state to introduce its very own child tax credit, thanks to the leadership of Representative Susan Pulsipher. Like the federal child tax credit, a state-level child tax credit is intended to help families with the costs of raising children.

As Utah’s legislators prepare for the 2024 legislative session, they should consider meaningful ways to expand Utah’s child tax credit to ensure it provides real support for families.

How it Works

Utah’s narrowly tailored Child Tax Credit allows some families to claim up to an additional $1,000 per child each year. Whether a parent stays home or both parents work, this tax credit can provide much-needed financial support.

Who is Eligible

-

This $1,000 tax credit is for children who are ages 1-3 on the last day of the claimant’s taxable year.

-

There are household income requirements. Families with an income of $54,000 for a couple or $43,000 for a family with a single parent (also called Head of Household) can claim the credit.

-

If a family makes more than a certain amount of money, they can still claim this tax credit, but it is phased out based on household income.

It's important to note that Utah's CTC is non-refundable. It can only be used to help reduce the amount of income taxes you owe but Utah’s CTC doesn’t help any families whose income tax burden is zero. [For more information on refundability, go here.]

Who it Helps

Utah's CTC won't take effect until families file their 2024 taxes in 2025. According to an analysis from the Institute on Taxation and Economic Policy (ITEP):

- 1.4% of households in Utah will benefit from the state CTC.

- Among those eligible, the average annual tax savings will be around $400.

- 4.3% of children will benefit from the CTC.

- No family will receive the full $1,000 per child.

Looking Ahead

Utah’s narrowly-tailored CTC doesn’t serve enough families. With its restrictions, the current state CTC doesn’t really help low- and middle-income households, especially those with more children. It also leaves out families with newborns and kids aged four to eighteen. Many more families could be helped by expanding our state child tax credit.

A bold state child tax credit gives Utah parents opportunities and choices to set their children up for future success. Children need parents to give them a solid start in life - and parents need the support of their community to be there for their kids. Expanding our state CTC gives critical community support to young parents raising children in Utah.

Edit: ITEP Analysis numbers were updated on November 21, 2023, to use estimations based on 2024 incomes.

How to Strengthen Utah's Child Tax Credit

In 2023, Utah introduced its own child tax credit (CTC) marking a positive step forward. However, the credit's limited scope falls short of providing real assistance to families raising young children. As we approach the 2024 legislative session, there is a crucial opportunity for lawmakers to make meaningful changes and expand the CTC to better serve Utah families.

The current $1,000 child tax credit is for families with children ages 1-3 with an income of $54,000 for a couple or $43,000 for a family with a single parent. Under the current child tax credit, 1.4% of families and 4.3% of children benefit. For those eligible, the average tax credit is $400.

Here's how expansion could impact families:

| Percent of Families Benefiting | Percent of Children Benefiting | Avg Tax Cut (per eligible household) |

|

| Current Child Tax Credit | 1.4% | 4.3% | $400 |

| Original 2024 Legislative Proposal HB 153 expands credit to 4- and 5-year-olds |

2.9% | 8.9% | $599 |

| Current 2024 Legislative Proposal HB 153 2nd Substitute expands credit to 4-year-olds (and adds dangerous child care licensing changes) |

1.8% | 5.4% | $456 |

|

Meaningful Expansion |

7.2% | 21.7% | $1,298 |

Key Recommendations

-

The credit should be available to families with children from birth to 5 years (adding newborns, 4-year-olds, and 5-year-olds).

The first five years of a child's life are the most financially demanding for parents. Diapers, clothing, formula, and child care costs create a significant burden. Expanding the credit to all children aged 0-5 acknowledges the unique financial challenges faced by families during these crucial early years. -

The credit should be refundable.

Utah's current CTC is non-refundable, limiting its impact. Making the CTC refundable would mean that even if a family doesn’t owe income tax after credits and deductions, they could receive the credit through a tax refund. A refundable CTC ensures that low- and middle-income families—who pay sales and other taxes but have little or no income tax liability—can still benefit from the CTC. Because our current CTC is non-refundable, our analysis shows that currently, no families receive the full $1,000/per child benefit. Eleven of the 14 states with a child tax credit have structured their CTCs to be refundable. If a family makes more than a certain amount of money, they can still claim this tax credit, but it is phased out based on household income.

What are elected officials considering this year for child tax credit expansion?

For the 2024 legislative session, Representative Susan Pulsipher has introduced legislation making 4- and 5-year-old children eligible for the CTC, therefore expanding the age range to children ages 1-5 (but still excluding newborns). Governor Spencer Cox’s proposed budget also advocates for this change.

While we support this first step, we strongly recommend a more comprehensive, impactful approach. We recommend making the tax credit available for families with any child between birth and age five. Additionally, the CTC should be made refundable, ensuring that all families receive the full benefit of $1,000/per child. This expansion would create more substantial financial relief for families.

With the CTC’s current limitations, this tax credit is not functioning as a genuine support for families bearing the cost of raising young children. By making the credit refundable and extending eligibility to cover children ages 0-5, the state has the opportunity to create a more meaningful child tax credit that aligns with the financial realities faced by families.

NOTE: As of January 25th, there has been a damaging change to HB 153. An adopted substitute includes dangerous changes to child care quality expectations, allowing unlicensed people to watch even more kids without safety training or home inspections. This step backward is bad for kids, does nothing to solve our child care issues in Utah, and absolutely should not be wedged into a Child Tax Credit bill. Read about why we oppose this bill here.

Learn more about Utah's Child Tax Credit here

Oppose HB 153: Child Care Revisions - Protect Kids in Care!

-

Representative Susan Pulsipher’s HB 153 was initially aimed at providing tax relief for families with young children through an expanded state child tax credit. Originally, the bill aimed to extend the child tax credit eligibility from ages one to three to ages one to five. We considered this original bill to be a top Voices for Utah Children priority. Unfortunately, during the session the bill was hijacked and an adopted substitute now adds a damaging provision allowing unlicensed child care providers to look after up to 8 children without safety training or home inspections.

While we appreciate the expanded background check measures and child ratio requirement for children under 3 for unlicensed providers, the bill lacks enforcement provisions for those operating without checks or failing them, as well as for existing unlicensed providers.

Why We Oppose HB 153 S03

This change jeopardizes the safety of Utah children by permitting unlicensed providers, without CPR and First Aid training or home inspections, to care for more children without oversight. This bill does not increase capacity for licensed family child care providers, rather, it specifically allows unlicensed individuals to watch more children.

Addressing child care licensing standards within a tax code bill is inappropriate. While expanding Utah’s Child Tax Credit was a key priority, it does not belong in the same bill that seeks to lower standards for child care quality.

Utah has seen previous attempts to increase the number of children allowed in unlicensed care. In 2021, HB 271 attempted to increase the number of children an unregulated provider could care for from 4 to 6. While it failed, it resurfaced in 2022 under HB 15, passing despite extensive opposition from providers and child safety groups, including Voices for Utah Children. HB 153 S03 takes this effort a step further by increasing the number of children from 6 to 8.

Why HB 153 S03 is Dangerous

This proposal disempowers parents, grandparents, foster parents, and working adults seeking safe child care options for their children. The lack of oversight and transparency in under-the-radar child care puts families in a precarious position, unable to access vital information about providers (e.g. verified background checks, safety violations and complaints, and guaranteed levels of basic safety training). While we appreciate the added provisions requiring background checks for unlicensed providers, the bill lacks enforcement and does not specify whether background check results will be available to the public.

Homeowners insurance doesn't cover providers caring for more than four unrelated children, and providers cannot access outside liability insurance without a license, leaving parents with minimal legal recourse if their child is hurt, injured, or killed while in care.

This change would solidify Utah’s place as the second-worst state nationally in this aspect, with only South Dakota allowing higher unregulated care capacity. If Utah is supposed to be a state that is good for kids and families, this bill sets us back.

Why HB 153 S03 Doesn’t Help Fix the Child Care Crisis

Many child care experts predict that this change would actually decrease the supply of available child care in Utah. This proposal could incentivize some programs to reduce their size and drop their licenses, leaving fewer families with access to any care.

Many proposals have been made to address Utah’s child care crisis, but lowering standards for the people who care for children is not, and should not be, one of them. This is not requested or supported by early care and learning professionals and experts. Parents seek easier access to good, affordable child care with certainty that their children are safe, happy, healthy, and learning. Parents and providers want the state to prioritize the well-being of Utah’s children, rather than advancing simplified policy proposals that divert attention from the genuine problem-solving needed to address the child care crisis.

What About Supporting the Child Tax Credit?

Although HB 153 was initially one of our priority pieces of legislation, the recent licensing changes have led us to withdraw our support for this bill. Originally, the bill only made incremental expansions to the child tax credit, but with the adoption of the third substitute, eligibility for 5-year-olds was removed, effectively cutting the expansion in half. Our analysis indicates that HB 153 S03 will only extend the credit to 0.4% more families, which is insufficient. The proposed changes to childcare licensing are concerning and not worth the marginal increase in tax credit eligibility. Voices for Utah Children believes it's preferable to either revert to the original bill or forego its passage entirely. Moving forward, we will focus on advocating for a more comprehensive child tax credit without compromising on childcare safety standards.

Note: HB 153 passed on February 29, 2024. For more information on this complex bill we created an FAQ to address questions about the passed bill and explain its significant implications.

As we entered the 2024 session, supporting families with young children remained a top policy priority of Voices for Utah Children. At the forefront of our advocacy efforts is the urgent need to address the critical child care needs of these families.

We worked closely with several legislators to propose much-needed public investment in the child care sector. We also supported multiple early care and education bills that were championed by other legislators and organizations. Here's what passed (and what didn't):

Child Care Priorities

HB 461: Child Care Grant Amendments, Rep. Ashlee Matthews & Sen. Luz Escamilla

This bill makes child care workers eligible for child care subsidies regardless of income, mirroring Kentucky's successful initiative. This helps child care owners cover the costs of providing a child care benefit and helps staff keep more of their paycheck. However, its enactment is contigent on federal funding approval, delaying implementation until that is secured. Initially, this bill also created the Child Care Workers Wage Supplement Grant Program, to help child care providers maintain a $15/hour wage for their staff, once stabilization grants end. Unfortunately, this provision was removed through an amendment. Eliminating the wage program and tying subsidy eligibility to federal funding made the bill cost-free for the state. Despite our disappointment with the continued lack of public investment in the child care sector, we remain optimistic about its potential positive impact, estimated to benefit 2,200 parents employed in child care.

Position: SUPPORT

Outcome: AMENDED VERSION PASSED

HB 541: Child Care Grants Amendments, Rep. Andrew Stoddard

This bill would extend Utah’s current child care stabilization grant program, funded at 50% of the original grant size, for another two years as an emergency stopgap measure. The proposal aimed to address Utah's impending loss of over $400M in expiring federal funds allocated for the child care sector. With the $240M cost, we did not anticipate its passage. Still, we hoped for a hearing where parents and providers could share their thoughts on the program and how they have been impacted by the dwindling funding. Despite the bill not advancing, we were pleased the federal funding cliff received significant media attention during the session.

Position: SUPPORT

Outcome: BILL NEVER HEARD IN COMMITTEE

HB 153: Child Care Revisions, Rep. Susan Pulsipher & Sen. Dan McCay

Originally, this bill sought to expand Utah’s new and very limited Child Tax Credit to allow families to claim a tax benefit for any child aged one to five. Unfortunately, the bill took an unexpected turn when a substitute version was adopted, introducing a dangerous provision raising the cap on the number of children unlicensed providers can care for from six to eight. In response to strong objections from the child care community over safety issues, new regulations were introduced for unlicensed providers, marking the first time such measures have been implemented. These include mandatory background checks and limits on caring for more than two children under 3 years old. We anxiously await information on how the Department of Health and Human Services will enforce these provisions. Additionally, an amendment passed on the House floor that scaled back the child tax credit expansion to only cover 4-year-olds, effectively halving its impact. This modified expansion will extend the credit to a marginal 0.4% more families, benefiting 1.1% more children, with an average annual tax savings of $456 per eligible family. While the child tax credit was initially a top priority of Voices for Utah Children, the dangerous child care licensing provisions led us to change our position and advocate against the bill. For more information on this complex bill, check out our HB 153 FAQs Blog.

Position: OPPOSE

Outcome: AMENDED VERSION PASSED

Other Child Care Legislation & Funding Requests

SB 220: School Readiness Grant Program Modernization, Sen. Ann Millner & Rep. Katy Hall

This bill will streamline and improve the state’s current High Quality School Readiness (HQSR) program, Utah's preschool program, by cleaning up the governing code. Promise Partnership Utah, our partner organization, led out on this bill.

Position: SUPPORT

Outcome: PASSED

School Readiness Grant Program Funding, Rep. Katy Hall

This funding request sought $6M in ongoing funds for the School Readiness Program, as demand for the program is higher than funds allow. Promise Partnership Utah, our partner organization, led out on this funding request.

Position: SUPPORT

Outcome: NOT FUNDED

SB 176: Child Care Services Amendments, Sen. Luz Escamilla & Rep. Robert Spendlove

This bill would have created a Salt Lake County pilot project to retrofit empty state-owned buildings for child care facilities. With the goal of creating a public-private partnership solution for child care, local employers would have worked with child care providers to offer care to their employees in the facilities. Under the proposal, 60% of the child care slots would be designated for the business's employees, while the remaining 40% would be reserved for children from low-income families, state employees, and military families. This bill was supported by the Governor's Office of Economic Opportunity. The bill passed unanimously through the Senate, but unexpectedly failed in the House on the final days of the session.

Position: SUPPORT

Outcome: FAILED

HB 96: Child Care Program Sales Tax Exemption, Rep. Christine Watkins

This bill would allow for a sales and use tax exemption for construction materials used to construct or expand a child care program.

Position: SUPPORT

Outcome: BILL NEVER HEARD IN COMMITTEE

Advocacy

While we anticipated a challenging session for child care advocacy, there are still significant achievements to celebrate!

We hosted four Child Care Champion Lobby Days and a Child Care Advocacy Day hosting nearly 100 parents, providers, and kiddos to the Capitol Rotunda. With the help of our partners, we facilitated over 40 constituent meetings with legislators, and sent over 2,000 emails to lawmakers advocating for child care support! With our partners at Neighborhood House, we released an open letter with 140 businesses, philanthropists, and community members calling on the legislature to address the child care crisis. Furthermore, our advocacy efforts garnered more media coverage than ever before, bringing attention to child care issues across the state.

Our efforts to educate lawmakers on the importance of child care licensing, led to more nuanced discussions about child care than ever before. Thanks to the invaluable contributions of parents and child care providers who testified or contacted legislators, lawmakers undoubtedly know more about child care than they did 45 days ago.

Thank you to everyone who contributed to child care advocacy efforts during the 2024 Legislative Session! Also a special shout out to our partners, Utah Care for Kids, Promise Partnership Utah, United Way of Salt Lake, Utah Private Child Care Association, Utah Professional Family Child Care Association, YWCA Utah, Utah Afterschool Network, UAEYC, Early Childhood Alliance, Neighborhood House, Bolder Way Forward Child Care Spoke, Utah Community Builders and The Salt Lake Chamber, Powerful Moms Who Care, Community Change, MomsRising, and the countless parents and providers who made time in their busy schedules to advocate for child care.

https://utahchildren.org/2021-utah-legislative-tracker/itemlist/tag/Early%20Education?start=10#sigProId70f637744b

How Much Will Each Utah County Soon Lose in Child Care Funding?

During the pandemic, the child care sector was decimated. Nationally, 16,000 childcare programs permanently closed and 100,000 workers left the industry entirely. But even before the pandemic began, Utah only had enough licensed child care to meet about 35% of our state child care needs.

Nationally, more than 3 million child care spots were saved by American Rescue Plan Funding. And Utah actually bucked the trend of closing child care programs. Thanks to federal intervention, Utah has more licensed child care slots available to families than before the pandemic began in 2020. This was thanks to federal funding that infused desperately needed investment into the long-ignored sector. Utah received close to $600 million in extra federal funding, starting in 2020, during the COVID pandemic to help keep child care businesses open so parents could continue to work.

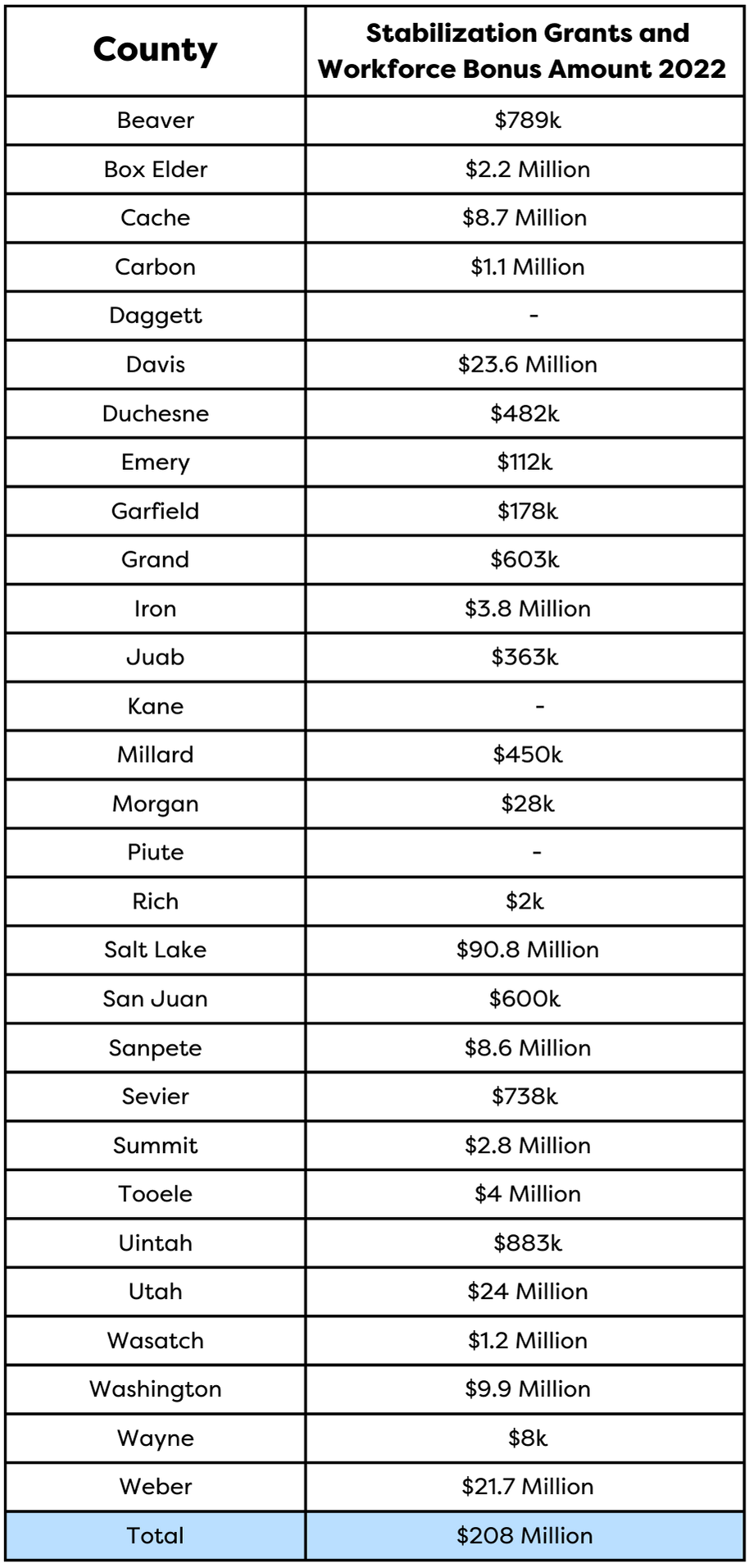

This money will soon be completely spent. By June 2024, Utah will run out of money for almost all of the COVID-era support for our child care system. The following chart details the annual funding lost per county.

The majority of these funds went to Child Care Stabilization Grants, dispersed by the Utah Office of Child Care. These have been one of the most important factors in allowing Utah’s child care sector to survive, and even expand. Since last January, the Office of Child Care has distributed $189 million of ARPA and CRRSA funds directly to child care programs statewide to ensure that they can continue to operate despite workforce shortages and rising costs of food and materials. The size of the grants are based on the licensed capacity of the eligible program.

More than 1,000 licensed and exempt programs are currently receiving monthly stability grants. Since the beginning of this program, around 1,500 programs have benefitted, serving more than 80,000 Utah children.

With these grants, child care programs have been able to do several critical things:

- Hire enough staff to ensure that their full program capacity can be utilized;

- Raise the wages of at least half of their workers to $15/hr, so they have even a slim chance of competing with fast food establishments and retail chains;

- Keep tuition costs down for families that are also struggling with inflation;

- Pay for critical facility maintenance needs that have been unmet previously due to cost.

The other major program that sustained Utah’s child care sector was the Youth and Early Care Workforce Bonus, dispersed by the Utah Office of Child Care. Utah joined dozens of other states in using federal child care stabilization funding to pay child care workers a bonus of $2,000 per individual. This was meant to acknowledge the work and sacrifices of child care workers - most of whom remained working throughout the pandemic - as well as incentivize their continued participation in the field.

Before the pandemic, Utah’s median hourly wage for child care educators was $10.47, on average less than a dog walker. $2,000 represents as much as 10% of the average child care worker’s annual income, making the bonus incredibly impactful for providers and their families. 9,368 early care and education professionals received this bonus.

The funding above shows the combined funding amounts lost per county due to emergency funding expiration. But it is a floor, not a maximum. The totals do not take into account funding used for:

- Co-pay Coverage: Cover co-pays for families that use child care subsidies (ranges between $19-$807 per family): $18,181,881

- Licensing-related Fees Coverage: Cover the costs to eliminate barriers to licensure: $1,200,000

- Regional Child Care Development Grants: Grants for regional Care about Child Care agencies to expand child care access and improve care: $2,003,244

- Training and Education: Numerous professional development, continuing education, and training scholarships: $5,734,424

This over $572,000,000 of federal funding will soon end, destabilizing the child care sector. To read about the impacts, see our blog post: Utah's Child Care Crisis is About to Hit a Whole New Level.

To see the breakdown of child care funds per county, see the full excel file here. To request a city or town breakdown, please contact .

To learn more about our campaign to invest in child care, go to UtahCareforKids.org.

Invest in Utah's Future Coalition: $5.6b of unmet needs should be prioritized over tax cuts

Utah's Child Care Crisis is About to Hit a Whole New Level

Since the start of the pandemic, Utah has received nearly $600 million in emergency federal funding to ensure that our child care sector can continue to serve families despite nearly overwhelming COVID-era challenges.

In one year, at the end of September 2023, most of that funding will be exhausted. The potential impacts of this “funding cliff” are:

-

- More child care program closures,

- Much higher child care costs for families, and

- More dramatic workforce turnover due to lowered wages.

By this time next year, Utah’s working families with young children will be in even more serious trouble when it comes to child care. That is, if we don’t start talking about how to use state dollars to fund the programs that have kept child care programs stable and open over the past two years.

Utah’s child care industry struggled long before the COVID-19 pandemic. The pandemic exacerbated persistent issues in the sector such as:

-

- Tuition costs that are as high or higher than rent or mortgage payments, and

- Wages for providers so low that more than one-half (53%) of child care educators across the nation use public benefits to make ends meet.

Utah’s child care industry would not have been able to weather the COVID pandemic if not for $572 million in federal dollars, $325 million of that through the American Rescue Plan. This infusion of desperately-needed financial support:

-

- Kept hundreds of center- and home-based child care programs open even in the darkest moments of the pandemic;

- Allowed more families to access child care subsidies with fewer out-of-pocket expenses;

- Funded higher wages and even a workforce bonus for early care and education professionals; and

- Supported regional efforts to recruit new child care providers into the field, while paying startup and licensing costs for these new business owners.

Perhaps the greatest impact was felt through child care stabilization grants offered through the state Office of Child Care. These grants helped child care providers defray the unexpected costs associated with the pandemic, and stabilize their business operations so they could continue to provide care. The grants also helped many providers pay their staff members $15/hour or more. Thanks to these grants, Utah has experienced much fewer child care program closures than many other states.

While very grateful for this support, early care and education providers across Utah tell us that the impending funding cliff has them feeling worried and even hopeless about the future of their work. What they will do when the stabilization grants end in September 2023, and this long-needed government support vanishes?

A report based on surveys of child care providers in Kentucky reported that when federal American Rescue Plan COVID relief dollars run out in that state:

-

- More than 70% will be forced to raise tuition for working parents

- Close to 40% indicated they would cut staff wages, and

- More than 20% said they would permanently close their child care center.

Even before the pandemic, Utah had a 65% gap between the need for child care and the capacity of programs to provide it. When relief dollars end, this gap could widen, forcing parents to leave their jobs in an already desperate job market. The lack of accessible child care already accounts for a loss of $512 million in lost earnings, business productivity, and revenue each year in Utah.

The end of ARPA funds could also mean wage losses in a profession already vastly underpaid at $10.47/hour (or $20,940/year) in Utah.

State leaders can and need to find ways to continue these business-saving policies. With Utah lawmakers talking about overflowing state coffers and potential tax cuts, we know the money exists. These dollars can be redirected to make a real investment in the child care sector. Even small efforts like covering the costs associated with licensing or removing the bureaucratic burdens of city parking requirements can make an impact.

This month, newly released Census Bureau data showed an incredible national decline in childhood poverty. Poverty fell to the lowest level on record in 2021 and it was the largest year-to-year decline in history. The decline is largely attributed to a combination of emergency pandemic aid and the child tax credit expansion. We know that access to quality, affordable, safe child care is a good investment in children and families. Let’s learn from the lessons of the last two years and make the investment in children and families that Utah needs.