Tax and Budget

2017 Measures of Child Well-Being in Utah and the National Annie E. Casey Data Book Released

Under Congressional Health Care Plan, Utah Stands to Lose Millions, New Estimates Show

Salt Lake City—A new analysis shows the impact that the Republican health plan bill, the American Health Care Act (AHCA), would have on Utah’s state budget. The report finds that the health plan’s proposed restructuring to the Medicaid program would lead to drastic cuts in federal funding.

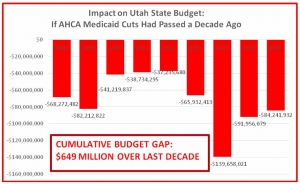

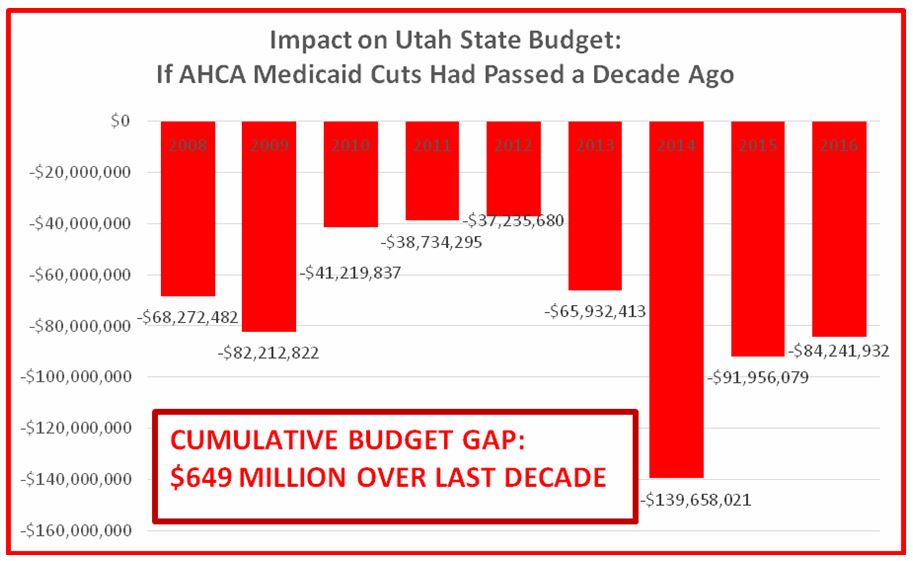

The analysis, released today by Voices for Utah Children, examines retrospective data and the impact of the proposed Medicaid changes, had they gone into effect a decade earlier. The estimates find that Utah would have experienced a budget gap of $649 million over the last ten years. The report concludes that given inflation and rising health care costs, Utah can expect the budget gap for the coming years to significantly exceed what it would have been in the past.

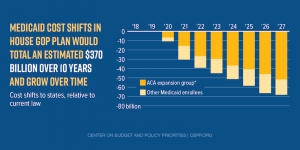

As part of the AHCA, federal funding for the Medicaid program would be capped and states would receive a per capita allotment. States would get less federal funding than under current law and would expect to see cuts increase over time. To make up for the decline in federal dollars, Utah may need to cut benefits to Medicaid enrollees. Under the per capita cap scenario, states would not have funding for unexpected health care cost growth from disease outbreaks or new life-saving drugs.

“The GOP health plan shifts costs to states and forces our state lawmakers to choose which health care services vulnerable kids will—and will not—receive,” said Jessie Mandle, Senior Health Policy Analyst with Voices for Utah Children. “These are decisions health care providers should be making, not politicians.”

The AHCA changes Medicaid’s current financing structure. The state budget shortfalls that would result would lead to limits placed on the Medicaid program, such as a reduction in benefits, lower provider payments or fewer children covered. The report suggests that the proposed restructuring of the Medicaid program puts Utah children’s health care and coverage at risk.

Read the full analysis here:

Under the ACA Repeal Bill, Utah Medicaid Stands to Lose Millions over a 10-Year Period

###

March 30, 2017 is Love UT Give UT!

March 30, 2017 is Love UT Give UT!

It’s a day for Utahns to give to the nonprofits that make Utah special. Every donation to Voices for Utah Children through Love UT Give UT gives Voices a chance to win matching grants and prizes—and gives you a chance to win a car!

And you don't have to wait! Donate now at http://bit.ly/loveUTchildren.

For 30 years now, Voices for Utah Children has called on our state, federal and local leaders to put children’s needs first. But the work is not done. The children of 30 years ago now have children of their own. Too many of these children are growing up in poverty, without access to healthcare or quality educational opportunities.

How can you be involved?

Make a tax-deductible donation to Voices for Utah Children—or join our Network with a monthly donation of $20 or more. Network membership includes complimentary admission to Network events with food, socializing, and opportunity to meet child advocacy experts. And don't forget to join our listserv to stay informed!

We look forward to the future of Voices for Utah Children and we hope you will be a part of our next 30 years.

Special thanks to American Express for sponsoring our 30th Anniversary Year.

Under the ACA Repeal Bill, Utah Medicaid Stands to Lose Millions over a 10-Year Period

Congress’ health plan bill, the American Health Care Act, proposes a major restructuring to the Medicaid program. The proposal would cap the federal funding states receive on a per-Medicaid beneficiary basis, starting in 2020. Using retrospective data, Voices for Utah Children investigated the impact of these changes on Utah’s state budget, had they been enacted a decade earlier.

The chart below illustrates the Utah budget impact of the Medicaid per capita cap allotment, if it had gone into effect a decade ago. The scenario is based on the American Health Care Act and state Medicaid annual reports. Given inflation and rising health care costs, Utah could expect the budget gap for the coming years to significantly exceed what it would have been in the past.

The proposed Medicaid caps would be based on states’ per-beneficiary spending, set in fiscal year 2016, and would rise annually to match growth in the medical care component of the Consumer Price Index (M-CPI). States are already locked into their capped amount. However, according to Congressional Budget Office forecasts, Medicaid costs per beneficiary are expected to rise 0.2 percentage points faster each year than the capped amount.

Consequently, states would get less federal funding than under current law and could expect to see cuts growing each year.

States would be expected to make up any excess costs or cut benefits to enrollees. Any unanticipated health care cost growth, such as a Zika outbreak or a new opioid treatment drug, would not be accounted for in the federal per capita cap amount.

As retrospective data illustrate, Utah consistently would have less available funding for health care costs. Today over 200,000 children rely on Medicaid coverage, including children with special health care needs. The majority of Medicaid enrollees (63%) are children. The Congressional proposal would create situations where state lawmakers choose which health services vulnerable children are eligible to receive, and which services or benefits they will not be eligible to receive. These are decisions best left up to health care providers, not politicians.

The American Health Care Act puts children’s health care and coverage at risk. Changes to Medicaid’s financing structure through a per capita cap would create large shortfalls in Utah’s state funding. These shortfalls would inevitably lead to limits placed on the program, such as a reduction in benefits, cuts to provider payments or fewer children covered. This unprecedented restructuring of the Medicaid program puts Utah children’s health care and coverage at risk.

March 30, 2017 is Love UT Give UT!

March 30, 2017 is Love UT Give UT!

It’s a day for Utahns to give to the nonprofits that make Utah special. Every donation to Voices for Utah Children through Love UT Give UT gives Voices a chance to win matching grants and prizes—and gives you a chance to win a car!

And you don't have to wait! Donate now at http://bit.ly/loveUTchildren.

For 30 years now, Voices for Utah Children has called on our state, federal and local leaders to put children’s needs first. But the work is not done. The children of 30 years ago now have children of their own. Too many of these children are growing up in poverty, without access to healthcare or quality educational opportunities.

How can you be involved?

Make a tax-deductible donation to Voices for Utah Children—or join our Network with a monthly donation of $20 or more. Network membership includes complimentary admission to Network events with food, socializing, and opportunity to meet child advocacy experts. And don't forget to join our listserv to stay informed!

We look forward to the future of Voices for Utah Children and we hope you will be a part of our next 30 years.

Special thanks to American Express for sponsoring our 30th Anniversary Year.

The 2017 legislative session was remarkable for focusing more on tax policy than any session since 2007. This came in response to the November 29, 2016 announcement by Our Schools Now of their intention to pursue a campaign to place on the 2018 ballot an initiative to generate $750 million for public education through an increase in Utah’s income tax rate from 5% to 5.875%. In response, the Legislature engaged in a detailed and wide-ranging examination of several tax restructuring options. In that process several important lessons were learned:

LESSON #1: RESTORING REVENUES:

The Utah Legislature is unlikely to pass a tax reform package that is more than marginally or perhaps gradually revenue positive. While it appeared that the Senate was willing to support restoring some state revenues to address the current underinvestment in children, the House of Representatives was particularly averse to generating new revenues for the public investments that our state critically needs, despite strong evidence that Utah’s tax burden remains at a multi-decade low. This strengthens the argument for taking the question directly to voters through the initiative process.

LESSON #2: SALES TAX ON FOOD:

Restoring the sales tax on food is not only the most regressive of the options that were considered, it also fails to substantially reduce revenue volatility during recessions. Moreover, we also learned that restoring the sales tax on food while offsetting that with a lower overall sales tax rate involves a $40 million shift of sales tax burden from out-of-state to in-state taxpayers, since 97% of the food sales tax increase would have been paid by Utahns, while out-of-staters would have received 23% of the overall sales tax rate reduction.

LESSON #3: PROTECTING THE POOREST:

The legislative leadership was genuinely concerned about the impact that raising the food sales tax would have on the poor and made a sincere effort to find ways to achieve their goal of broadening the base without burdening low-income Utahns. Since we never saw a final proposal, we can’t evaluate it properly, but it was clear from the evolution of their ideas that House and Senate leaders were sensitive to the concerns of advocates for the poor such as Voices for Utah Children and our partners. They incorporated into their proposals some ideas from the research that we released at our coalition press conference on February 23 at the Capitol.

LESSON #4: OUR SCHOOLS NOW:

The Our Schools Now proposal to raise the income tax rate from 5% to 5.875% is the fairest to low-income Utahns of any of the leading tax reform proposals. Only 2% of its new revenues come from the lowest quintile of tax filers, those earning under $25,000, who could easily be shielded with an offsetting EITC. And 58% of the $750 million of new revenues comes from the highest quintile, those earning over $111,000. Indeed, that 58% share is approximately equal to the share of all Utah income earned by the top quintile of Utahns. But what about the cost to middle-income Utahns? Under the proposal, the median household pays about $350 more annually. If that family has two kids in the public schools, then their $350 upfront payment will reap a gain of over $2,000 in new investment in their own children – good luck trying to get a return like that in the stock market!

LESSON #5: EITC:

The Earned Income Tax Credit gained in popularity this year, winning 61 votes on the House floor (vs. 38 in 2014) and gaining Senate committee approval. But legislators appear unconvinced by the evidence presented by the American Enterprise Institute on Interim Day last September that, for low-income kids, investing in their family economic stability through an EITC brings greater educational gains than investing those same dollars in the classroom. Thus, it appears that the EITC’s best chance for approval is as part of a larger income tax reform package. Fortunately, legislative leaders have declared that such a package is already a goal for the 2018 legislative session.

LESSON #6: BUSINESS TAX CUTS:

Even though the Tax Review Commission declined to recommend them following months of study, the Legislature remains committed to gradually implementing two business tax reductions: Single Sales Factor corporate income tax apportionment and extending the sales tax exemption for manufacturing inputs to inputs lasting less than three years. While legislation to fully implement those two proposals was not passed, reduced versions applying those changes to more industries did pass, including a creative application of the sales tax exemption as an incentive to switch refineries over to producing cleaner Tier 3 fuels.

Photo Credit: Antoniodiaz | Dreamstime.com - Taking a test in high school

March 30, 2017 is Love UT Give UT!

March 30, 2017 is Love UT Give UT!

It’s a day for Utahns to give to the nonprofits that make Utah special. Every donation to Voices for Utah Children through Love UT Give UT gives Voices a chance to win matching grants and prizes—and gives you a chance to win a car!

And you don't have to wait! Donate now at http://bit.ly/loveUTchildren.

For 30 years now, Voices for Utah Children has called on our state, federal and local leaders to put children’s needs first. But the work is not done. The children of 30 years ago now have children of their own. Too many of these children are growing up in poverty, without access to healthcare or quality educational opportunities.

How can you be involved?

Make a tax-deductible donation to Voices for Utah Children—or join our Network with a monthly donation of $20 or more. Network membership includes complimentary admission to Network events with food, socializing, and opportunity to meet child advocacy experts. And don't forget to join our listserv to stay informed!

We look forward to the future of Voices for Utah Children and we hope you will be a part of our next 30 years.

Special thanks to American Express for sponsoring our 30th Anniversary Year.