* * SEE COMPLETE ANALYSIS OF THE LEGISLATURE'S $400 MILLION TAX CUT PROPOSAL AT THE BOTTOM OF THIS PAGE * *

The 2023 Legislature's annual seven-week General Session has begun! At the top of the agenda for the Governor and Legislative leadership: tax cuts.

While Voices for Utah Children and many other advocates for Utah's most vulnerable populations are deeply concerned about the long-term detrimental effect of tax cuts on state and local governments' abilities to meet their obligations to Utahns (see www.InvestInUtahsFuture.org for more about that), we are also cognizant of the political reality that tax cuts are popular with Utah's political leadership (in contrast to public opinion).

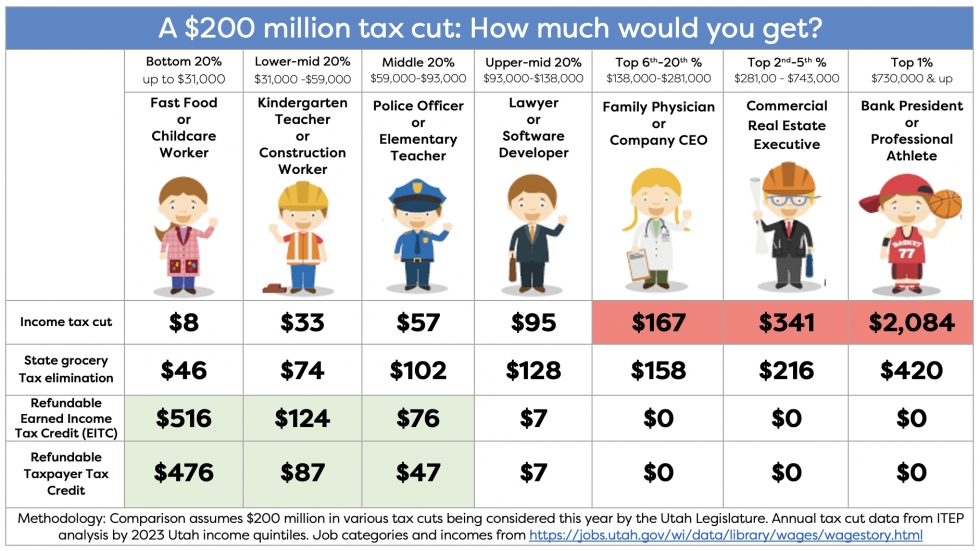

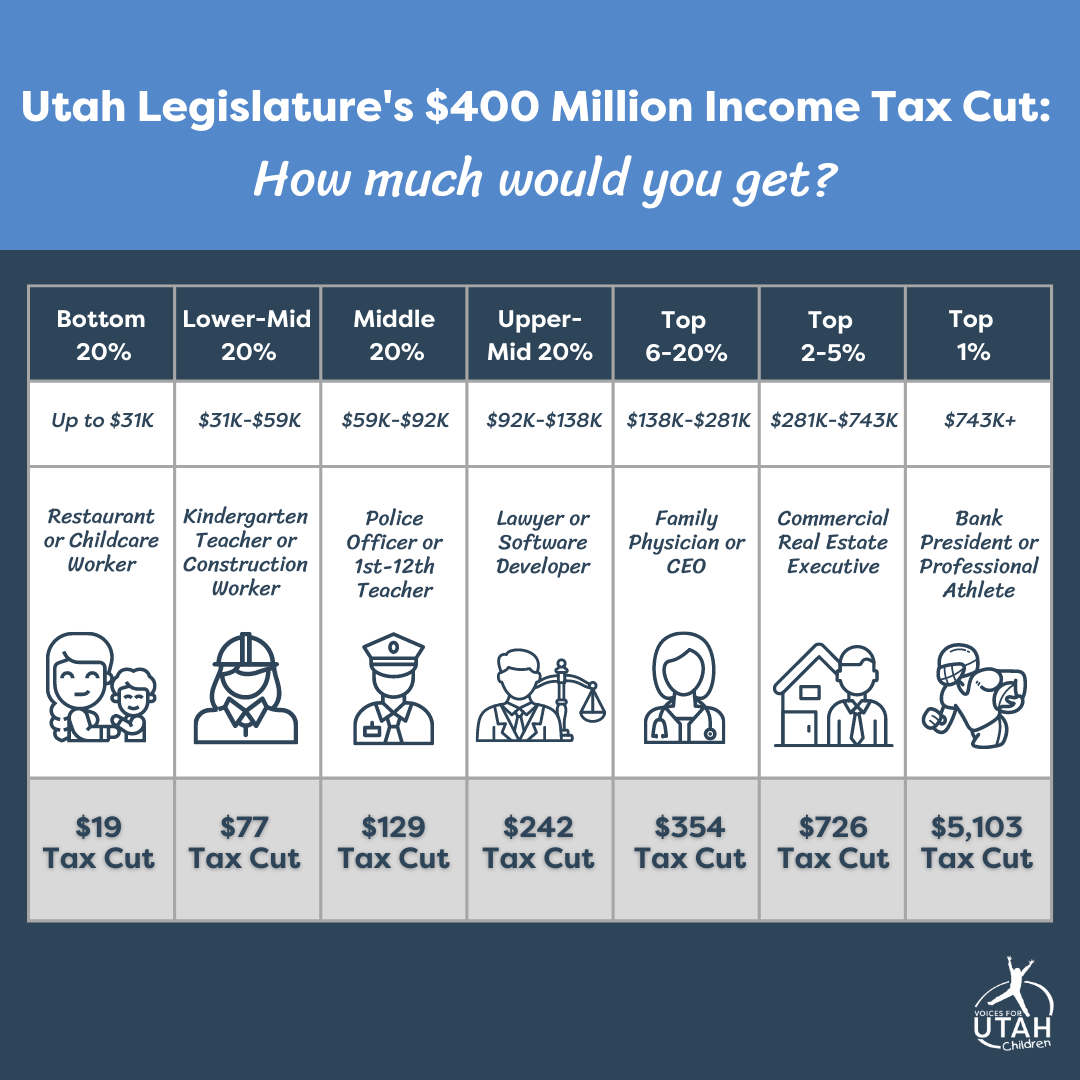

If there's one thing Voices for Utah Children has learned following tax policy in recent years, it's that not all tax cuts are created equal. Hence this guide to the tax cuts being proposed this year. Note, the legislature has since changed the proposed income tax cut from $200m to $400m further resulting in even greater tax cuts mostly for Utah's top income earners.

Ranking the Tax Cut Proposals

We rank the tax cuts by regressivity -- do they make our overall tax system more or less regressive than it currently is? Regressivity is about fairness. Utah's current overall state + local tax system is regressive/unfair in the sense that the highest income households pay a lower overall share of their incomes in state and local taxes than low- and middle-income households.

The chart above illustrates whether each individual proposed tax cut would make Utah's taxes even more unfair, or would it reduce the inequities in the current tax structure. We illustrate the impact of the proposals in the chart below two different ways:

1) By share of the tax cut: How does it slice the pie? Who gets the big pieces and who's stuck with the crumbs (or nothing at all)?

2) By dollar amounts: How much does an average family benefit each year at each income level? (we provided this information for each tax cut that is available to all taxpayers but not for the more targeted ones that only go to a smaller subset like the Social Security and child tax credits)

Important Background Information

What are the major taxes in Utah and who pays them?

- The sales tax: Our most regressive tax -- meaning it takes a bigger bite percentage-wise out of the incomes of low- and middle-income families than their high-income neighbors. (And same goes for the gas tax.)

- The property tax: Not as regressive as the sales or gas taxes but still costs lower-income families a greater share of their incomes than higher-income families, including non-homeowners who pay it indirectly through their rent.

- The income tax: Utah's only non-regressive tax. The only one that lines up with Utah's income distribution, following the 3/5--1/5 Rule: Three-fifths of all Utah income is earned by the top one-fifth of taxpayers, and three-fifths of the income tax is paid by that same high-income group. KEEP IN MIND: When the Legislature cuts the income tax rate, not only do they make our tax system more regressive overall, they also put more pressure on local property taxes, which tend to rise to make up for the lost education funding when the income tax rate is cut. As a result, cutting the income tax means a tax shift from state to local and from the highest-income Utahns to middle-class and low-income households.

See more details about who pays which taxes in Utah and how our overall tax structure is regressive at www.ITEP.org/WhoPays/Utah.

How Do These Proposed Tax Cuts Compare to Last Year?

Last year, the 2022 Utah Legislature passed SB 59 -- about $200 million of permanent tax cuts.

- The majority of the breaks went to the highest income fifth of Utahns, those earning above about $130,000.

- Just 6% of last year's tax cuts went to the bottom two-fifths of Utahns, those earning under about $60,000 a year.

2022 SB 59 Tax Cuts Summary

ANALYSIS OF THE 2023 LEGISLATURE'S $400 MILLION TAX CUT PROPOSAL