The Utah Legislature’s Tax Overhaul Plan – 3/5/19 Update

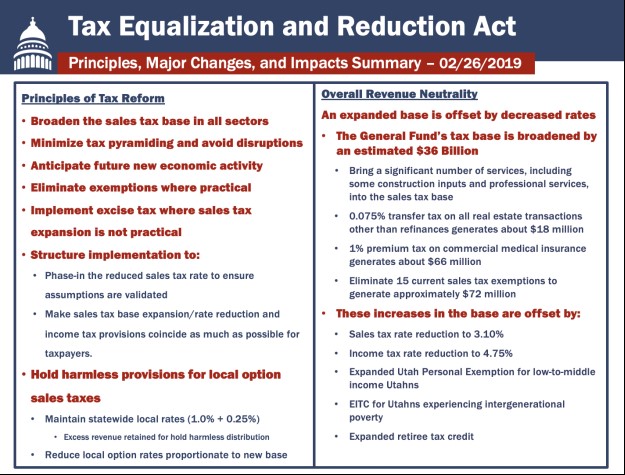

HB441 Tax Equalization and Reduction Act, sponsored by Representative Tim Quinn

The bill is an attempt to modernize Utah’s tax structure to keep pace with Utah’s changing economy. It had its first hearing on 3/1/19, in House Revenue and Taxation Standing Committee.

The bill passed out of committee by a vote of 12 to 2 and was placed on the 3rd Reading Calendar. It will get a hearing on the floor of the House on 3/5/19, at 6pm.

A summary of Rep. Quinn’s presentation follows:

|

IMPLEMENTATION Implementation structure that phases-in the reduced sales tax rate to ensure assumptions are validated

|

Yesterday (2/26/19) the Utah Legislature revealed its tax overhaul plan.

The plan marks the beginning of the Governor’s and Legislature’s attempt to modernize Utah’s tax structure to keep pace with a changing economy.

For detailed information about the Governor’s proposals click here.

For news reports which detail the Legislature’s plan click here and here.

We focus our attention on:

- Reduction of sales tax rate from 4.7% to 3.1%

- elimination of sales tax exemptions for businesses and services that are currently not required to pay sales tax.

- Reduction of income tax rate from 4.95% to 4.75%

- expand personal exemptions for low to middle income earners

- implement a targeted state earned income tax credit (EITC)

WHAT WE LIKE

We are encouraged to see light shined on businesses that are exempt from sales tax. Eliminating those tax exemptions expands responsibility for raising revenue to fund vital government services and infrastructure.

We are pleased the legislature included a targeted EITC for families experiencing intergenerational poverty. These working families earn less than $13,000 annually on average. The federal EITC ups their income by over $3000. A state EITC will provide another $300 on average and up to $650 depending on income and number of kids. For many, this income boost will be the push needed to get their children out of poverty.

ROOM FOR IMPROVEMENT

We are concerned about using this year’s temporary surplus to permanently lower the income tax rate from 4.95% to 4.75%. While a 0.2% reduction may seem minor, the decrease will harm Utah’s chronically underfunded schools.

Utah’s education system is predominately funded by state income tax revenue. Estimates show that for every 0.1 percent reduction in income tax rates, education funding will be reduced by $100 million. Last week’s Children’s Budget Report found that Utah’s education budget has been falling and remains below where it was a decade ago, before the Great Recession, so it can hardly afford to take another $200 million reduction.

Adding to our concern is Utah’s income tax is regressive at the top end, meaning that low to middle income families will continue paying a higher percent of their income to fund education than higher earning families.

CONCLUSION

As the bill goes through the public hearing process in the final weeks of the legislative session, Voices will monitor and provide input to ensure that Utah’s tax system is equitable and a shared responsibility among citizens and businesses alike.