Education

A Rough Legislative Session for Utah Kids (Again)

The Governor’s 2024 Budget: Hits and Misses for Utah Families

Governor Cox unveiled his budget last week, and the general direction of the budget is positive. Voices for Utah Children is interested in some specific components of the budget that directly impact Utah children and their families:

Public Education

$854 million increase, including a 5% jump in per-pupil funding and $55 million for rural schools

This is a much-needed investment in public education. We support the focus on rural schools and are anxious to see the details as they emerge. Public education consistently polls as a top priority for Utahns of all political parties and backgrounds.

Support for Utah Families

$4.7 million to expand Utah’s child tax credit and $5 million for accessible child care

We appreciate the fact that the Governor has begun to address the urgent needs of Utah families with young children. However, both allocations fall far short of the amount required to truly support and elevate these young families’ current needs. A truly impactful child tax credit would require an investment of at least $130 million, and the benefits in reducing child poverty in Utah would be substantial. Our recent report on child care in Utah clearly illustrates the need for bold action to support families in the workforce, who are struggling with the cost and unavailability of child care. The Governor’s $5M project will help very few Utah families and does not address the true need.

Housing

$128 million for homeless shelters and $30 million for deeply affordable housing

We support the Governor in his effort to better support the homeless residents of our state. We encourage a greater focus on expanding support for homeless children specifically. Early care and education opportunities for young children as well as more supportive programs for their parents and caregivers are critical to helping families find stable housing and better future opportunities. Investing in deeply affordable housing will help many Utah families.

Behavioral/Mental Health

$8 million for behavioral and mental health

This is not enough to address the current mental health needs of Utahns – in particular, those of our children and the folks tasked with raising them. We need more mental health professionals and greater access to services. We know this is a major concern for the Governor and we encourage increased strategic investment in this area.

It is also important to acknowledge and applaud some items the Governor wisely left out of his proposed budget:

No Proposed Tax Cuts

Utahns want to see more invested in our children while they are young, to prevent greater challenges later in life. It is our children who suffer most, when politicians toss our tax dollars away on polices that mostly benefit the wealthiest 1% of Utah households.

No Proposed Funding for Vouchers

Public funds should not be redirected to private entities. Utah needs an annual audit of the current program, to assess who is benefitting from school vouchers. In other states, the results are not good – vouchers are looking more and more like a tax break for wealthy families.

Bold Investments Needed for Utah's Children

Governor Cox's budget focuses on increasing funding for education, families, and affordable housing.

These are all areas where we believe bold investment is needed. We support the Governor in addressing these issues, but cannot overlook how this budget falls short in the face of the ongoing struggles faced by Utah families with children.

We encourage our Legislature to use the Governor’s budget as a roadmap and increase the allocations to the amount needed.

Our 2024 Legislative Agenda

Utah Children's Budget 2023

The care for the children in our state and communities can be measured by our public investment in our smallest humans. From the fiscal year 2008 to 2022, Voices for Utah Children divided all state programs concerning children into seven categories, without regard to their location within the structure of state government to quantify the level of public funding and identify trends. The seven categories are:

- K-12 Education

- Health

- Food & Nutrition

- Early Childhood Education

- Child Welfare

- Juvenile Justice

- Income Support

An appendix of our tables, sources, methodology and description of programs can be found here.

How Much We Spend

The interactive circle chart below compares how much we spend by category, program, and source of funding, just use the filter and click the category to zoom in.

-

K-12 Education makes up 92% of the state-funded portion of the Children’s Budget, while the federal-funded portion is more diversified across categories.

Spending Trends

We compare the budget to FY2008 because that was a peak year in the economic cycle before The Great Recession and all figures have been adjusted for inflation, so they are comparable across time.

- From FY2008 to FY2022, total public investment in children increased by 43%, growing much faster than Utah’s public-school enrollment (district & charter schools) by 26%, or the child population ages 0-17 by 13% from 2008-2021.

The federal share of the Children's Budget has fluctuated between 18-26% but had its biggest increase at the beginning of the Great Recession and the Covid-19 Pandemic. This is also when state funding for the Children's Budget has declined, for example real state & local K-12 education funding fell by $206 million since FY2020, the largest two-year decline since the Great Recession in 2008-2010. Several years after the Great Recession the federal share of the Children’s Budget decreased and the state share started to increase again, something that will hopefully happen again as pandemic relief funding rolls back.

Funding Sources: Federal vs. State

When the categories are disaggregated by source of funding, Food & Nutrition, Income Support, Health, and Early Childhood Education programs are mainly funded by federal sources, and Child Welfare, K-12 Education, and Juvenile Justice programs are funded mainly by state sources. And since Amendment G passed and allowed the income tax to be used to fund programs for children (in addition to K-12 and some Early Childhood Education & Nutrition Programs), the Child Welfare, Juvenile Justice, and Health categories are funded primarily by the income tax. In FY2022, 98% of Juvenile Justice, 100% of Child Welfare, and 88% of Health categories of the state funded Children's Budget were funded by the income tax totaling to $475 M.

When examining the state-funded portion of the budget since FY2008 each category has a different story.

- Juvenile Justice programs declined the most in dollar amount, $32.9 M or 28% mainly due to a reduction in correctional facility and rural programs and it also had an increase in early intervention services which advocates consider to be a goal of juvenile justice reform.

- Child Welfare programs declined by 16% or $21.8 M, mainly from the Service Delivery program which funds caseworkers to deliver child welfare, youth, and domestic violence services.

- Income Support declined 49% or $2.1 M and appears to be more cyclical, rising and falling with the Great Recession. Interestingly, the TANF grant is a mix of state and federal funds, and only a small amount goes to Income Support or cash assistance.[i]

- Food & Nutrition increased by 56% or $19.7 M due to an increase in liquor & wine tax revenues which supports the school lunch program.

- Early Childhood Education had the largest percentage increase of 109% or $42.0 M mainly from the Upstart program but increasing in every program except Child Care Assistance.

- Health has increased by 80% or $139.3 M from the Medicaid and CHIP program but also had a 58% or $12.4 M decrease in Maternal & Child Health.

- The category that has increased the most in dollar amount is K-12 Education.

K-12 Education Funding

State and local sourced funding for K-12 education increased by $1.6 billion in constant 2022 dollars from FY2008 to FY2022, but per-pupil spending only increased from $10,212 to $10,537 per student. This means that even though more is being spent in total dollars, it barely covers the increase in students during the same time.

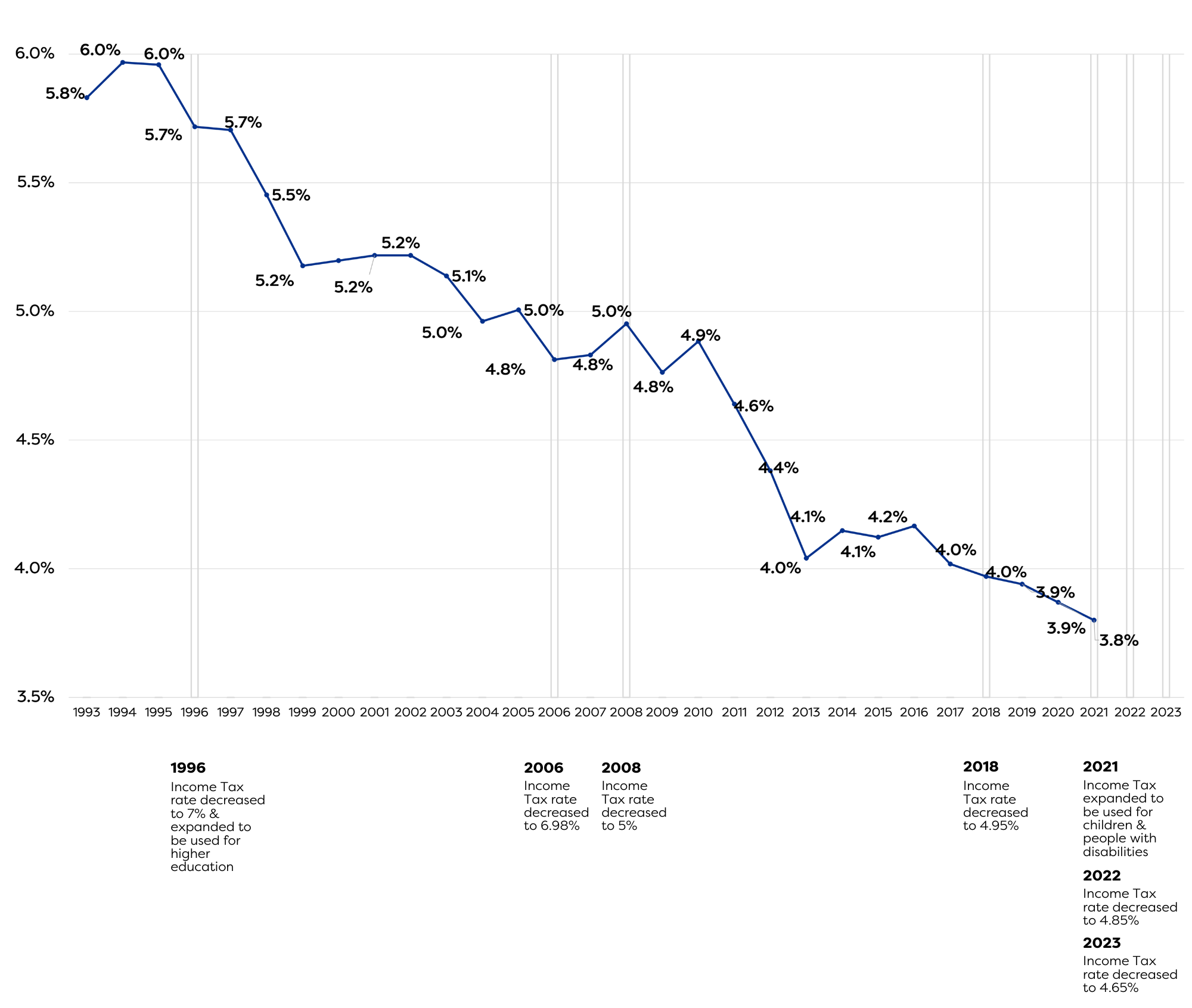

In 1948, 100% of the income tax was allocated to public education, an increase from 75% when it was originally imposed in 1931. It was expanded in 1996 to include higher education, in 2021 to include non-education services for children and people with a disability, and may be expanded again depending on a 2024 ballot measure placed by the Utah Legislature.

The income tax rate has been reduced in 1996, 2006, 2008, 2018, 2022, and 2023. The graphs below illustrate a timeline of these changes and Utah’s total elementary and secondary public schools (district & charter) funding effort (including capital) as a percentage of personal income and rank compared to other states.

Unfortunately, the result is a downward trajectory and likely explains our second to last place in per-pupil funding in the country.[ii]

Utah's Education Funding Effort as a Percent of Personal Income

According to the fiscal notes, the last two bills that reduced the Income Tax rate in 2022 and 2023 estimated a loss of $1.3 billion in the Income Tax Fund from FY2022-2025 with more ongoing.[iii]

State & Local Funded Portion of K-12 Education

Another result of these changes has been shifts in the funding source for K-12 education. From the fiscal year 2008 to 2022, the federal-funded portion increased by 74% and the state-funded portion declined by 3%.

Meanwhile, Local sources have increased by 12%, possibly to meet the needs of their communities while state-funded sources decline and putting greater pressure on sources like the property tax which is more regressive than the income tax because it takes a greater toll on low-and middle-income families.

Rank of Utah's Education Funding Effort Compared to Other States

We Need to Prioritize Children in the Budget

While Utah doesn’t have the most kids than any other state, we do have the highest share of kids in our population. And we as a community are entrusted to make sure they are cared for, safe, and have the tools they need to achieve their aspirations. As the Utah Legislature drafts, holds hearings on, debates, and passes the Utah state budget we hope they prioritize our most vulnerable and precious group, Utah’s children.

[i] https://www.cbpp.org/sites/default/files/atoms/files/tanf_spending_ut.pdf

[ii] https://www.census.gov/programs-surveys/school-finances.html

[iii] https://le.utah.gov/~2022/bills/static/SB0059.html, https://le.utah.gov/~2023/bills/static/HB0054.html These fiscal notes show the loss from the income tax fund but they are not disaggregated by changes from the income tax rate or tax credit portion of the bills.

It’s Official: Access to Licensed Child Care Statewide is Really Bad (and Getting Worse)

Invest in Utah's Future Coalition: $5.6b of unmet needs should be prioritized over tax cuts

Digital Media Policies & Kids: The need for more thoughtful approaches to solutions

By Sariah Villalon (Voices Policy Intern)

We live in a digital world where social media has become integral to our society. It has broadened our communication, allowing us to connect and share information with anyone around the world. It has helped bring awareness to many issues and achievements within our society. But let's face it, unintended risks and consequences come with every innovation. One of them is its effect on our mental health, especially our young people's mental health.

Over the years, there has been an increase in depression, anxiety, and suicide among the youth, especially among girls. Social media may influence these mental health problems through social comparison, cyberbullying, and exposure to other toxic content (Nesi, 2020).

Governor Spencer Cox recently addressed the relationship between social media on the mental health of our youth and how we could improve the mental health of our youth in Utah. Some of his recommendations are the following:

- Hold social media companies accountable by providing tools for parents to safeguard their children,

- Implement a cell phone-free environment in schools to reduce distraction for students.

- Encourage parents to set an example for their children by spending quality social time with one another without social media use.

- Educate their children on what is appropriate to say on these platforms.

- Monitor their children's social media use by using different tools.

- Have an honest conversation about social media

There are multiple good points that the governor pointed out. We agree that social media companies need to be held accountable for the algorithm and design of their apps that provide a toxic environment for their users. A couple of legislative efforts have been created to hold social media responsible. But is it enough?

We do not see so much urgency from these big techs. Even if they get fined, they could pay everything off quickly. It also puts too much burden on the parents to monitor and safeguard their children. We also have to be honest that we cannot blame everything on these companies. So, what can we do?

We need to hold these social media companies responsible by making them contribute to funding social media education for the youth. Organizations such as Digital Respons-Ability train parents, students, and educators on digital citizenship.

We cannot escape the digital world, and it will only progress from here on. We need to teach our youth how to use the technology and social media they have properly. Removing phones during school time will not solve our problems. By educating the youth, they can be better equipped to make informed decisions for their lives and improve their learning.

Another is research on the effect of social media on youth mental health. As we know, mental health is multi-faceted. We cannot just say that one factor causes mental health problems. We need more longitudinal studies on its effects to counter better or mitigate its adverse effects.

More importantly, let's talk more openly about our mental health. Let us educate ourselves and share our experiences with our children so they can also be aware of their well-being. Give them the resources to improve or manage their mental health. When children are more knowledgeable, it can increase their chances of knowing when and where to get the help they might need.

Learn more on how we can help through this video. You can also download this infographic on Youth Mental Health & Digital Media for more information.