Tax and Budget

Invest in Utah's Future Coalition: $5.6b of unmet needs should be prioritized over tax cuts

BROAD COALITION CALLS FOR INVESTMENT IN UTAH’S FUTURE RATHER THAN TAX CUTS, DOCUMENTS $5.6 BILLION IN URGENT UNMET NEEDS

Salt Lake City – On Monday, January 23, 2023 at the Utah State Capitol, a broad and diverse coalition of advocates for the poor, for disabled Utahns, for education, health care, clean air, the Great Salt Lake, transportation investment, and a variety of other popular Utah priorities held a press conference calling on the Utah Legislature to prioritize addressing Utah’s long and growing list of unmet needs over permanent tax cuts that undermine our long-term capacity to invest in Utah’s future.

Utah’s strong economy and rapid recovery from the pandemic, combined with the ongoing impact of federal spending, have generated unexpected state revenues amounting to a reported $3.3 billion available for FY2024. These revenues put Utah in a position to address chronic revenue shortages that have plagued numerous areas of state responsibility. Instead, state leaders have proposed roughly half a billion dollars in permanent tax cuts, tilted unfairly toward the high end of the income scale, as well as additional hundreds of billions in one-time tax breaks.

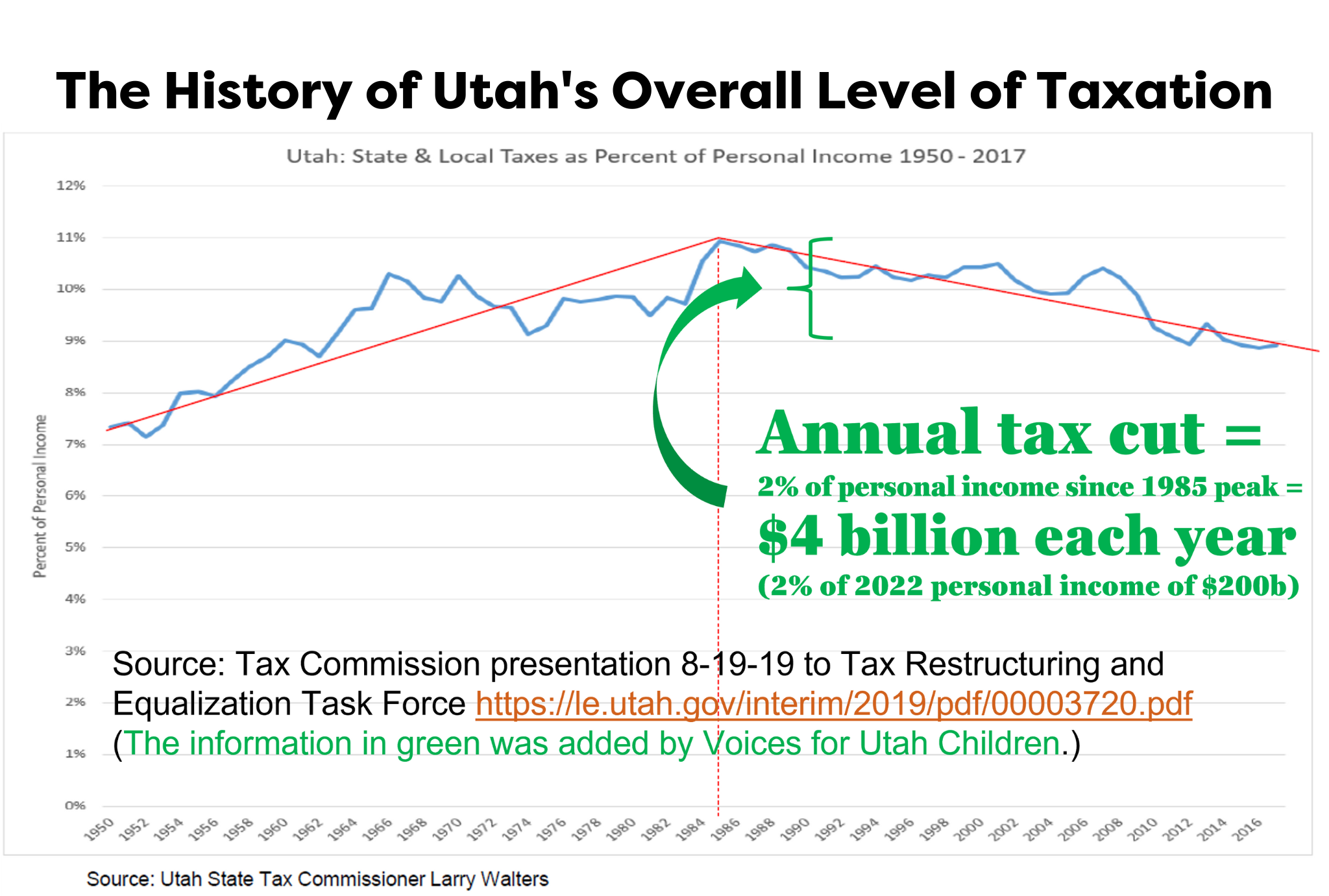

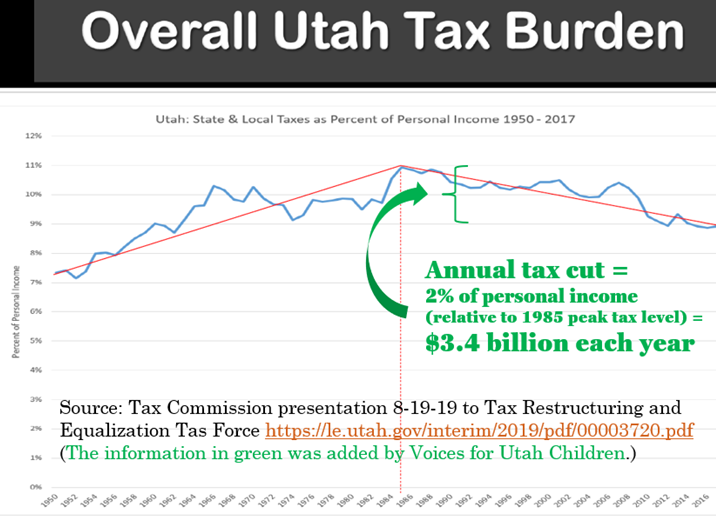

These new proposed permanent tax cuts would be over and above the roughly $4 billion that the Legislature has already cut from annual revenues in recent decades, leaving Utah’s taxes at their lowest level in half a century, relative to incomes.

In response, today the Invest in Utah’s Future coalition presented a list of urgent unmet needs amounting to $5.6 billion, over $2 billion more than the amount of the “surplus” revenues.

The advocates also pointed out that, according to data from the Utah State Tax Commission and the Utah Foundation, taxes in Utah are the lowest that they have been in decades, following repeated rounds of tax cutting. “Of course we all like paying lower taxes, but at a certain point we have to ask ourselves: Is it possible to have too much of a good thing? Are we, as the current generation of Utahns, meeting our responsibility, as earlier generations did, to set aside sufficient resources every year to invest in our children, in our future, in the foundations of the next generation’s prosperity and quality of life?” said Matthew Weinstein of Voices for Utah Children.

Speakers also referenced public opinion surveys by the Deseret News and Hinckley Institute that found that only 25% of Utahns support tax cutting over investing in Utah’s future, consistent with other polls done in recent years by the same organizations as well as by Envision Utah and the Utah Foundation.

Here is the list of urgent unmet needs that Utah has not been able to address due to the state’s chronic revenue shortages:

| Budget Area | Amount | Details | Contacts |

| K-12: Reduce class sizes from 29 to 15 | $1.1 billion ($612m K-6 only) |

Reduce class sizes/improve student/teacher ratio below the current Utah average of 29 (vs national average of 24) to optimum class size of 15. |

Utah Education Association Director of Policy and Research Jay Blain |

| K-12: Paraeducators | $312 million |

Expand paraeducators to all Utah elementary classrooms. |

Utah Education Association Director of Policy and Research Jay Blain |

| K-12: Increase school counselors | $130 million | Increase school counselors per student to the national standard optimum of 1:250. Utah’s current ratio is 1:648, compared to the national average of 1:455. | Utah Education Association Director of Policy and Research Jay Blain |

| K-12: school psychologists, social workers and special ed teachers | $285 million | Increase student access to school psychologists, social workers and special ed teachers.

Current and optimal ratios are: School psychologists: Now 1:1950/Optimal 1:500 Social workers: Now 1:3000/Optimal 1:250 Special ed teachers: Now 1:35/Optimal 1:25 |

Utah Education Association Director of Policy and Research Jay Blain |

| K-12 Education: reduce teacher attrition and shortages | $500-600 million | Envision Utah estimates that we need to invest an additional $500-600 million each year just to reduce teacher turnover, where we rank among the worst in the nation. Our leaders’ unwillingness to solve our education underinvestment problem is why the majority-minority gaps in Utah’s high school graduation rates are worse than nationally and our younger generation of adults (age 25-34) have fallen behind their counterparts nationally for educational attainment at the college level (BA/BS+). | |

| K-12 School Nurses | $78.5 million | The Utah Dept of Health annual report “Nursing Services in Utah Public Schools 2021-22” found that it would cost $78.5m to hire an additional 785 nurses so as to have one nurse in every public school building. There are currently only 261 nurse FTEs in Utah’s public schools, a ratio of 1 nurse for every 2,583 students. One nurse in every building would improve that ratio to 1:644, which would still be worse than the national average. https://heal.health.utah.gov/wp-content/uploads/2022/08/2022-Nursing-services-in-Utah-Public-schools-8-22-22-ADA.pdf |

Dr. William Cosgrove, Past-President, American Academy of Pediatrics – Utah |

| Full Day Kindergarten | $70 million | Gov. Cox is proposing $70 million in the FY24 budget to make full-day Kindergarten available to all Utah families who would choose to opt in to it. | Voices for Utah Children Anna Thomas |

| Child Care | $236 million |

$236 million is needed to continue stabilizing the child care industry as federal funds are depleted. This funding will allow for the continuation of child care stabilization grants, retention incentives for early childhood professionals, the coverage of licensing-related fees in order to lessen the barriers to expanding, maintaining, and opening new child care programs, and regional child care outreach grants for rural and urban child care deserts. Source: www.utahcareforkids.org/get-involved/2023-legislation |

|

| Pre-K and Child Care | $1 billion | Well over $1 billion is one estimate for a much needed comprehensive system of early childhood care and education (pre-k) in Utah. | |

| Afterschool Programs | $3.6 million | Utah’s 303 afterschool programs serve 43,000 kids but still leave 99,000 unsupervised every day after school. During the 2021 “21st Century Community Learning Center” grant competition in Utah, $1,062,816 was available and there was $4.6 million in requests, indicating a $3.6 million funding gap. | Utah Afterschool Network Director Ben Trentelman |

| Health Insurance: Children: Cover All Kids | $5 million | It would cost Utah about $5 million to remove barriers to health insurance coverage so that all Utah kids can access health insurance. Utah currently ranks last in the nation for covering the one-in-six Utah kids who are Latinx and in the bottom 5 states for all children. Source: Voices for Utah Children and www.100percentkids.health | Voices for Utah Children Ciriac Alvarez Valle |

|

Health Insurance: New parents |

$10 million |

HB 84 would cost $3m to extend post-partum Medicaid coverage for new parents from the current 60 days to one year. HB 85 would cost $7m to extend Medicaid coverage to pregnant women with household incomes up to 200% of poverty level. |

Voices for Utah Children Ciriac Alvarez Valle |

| Mental Health & Substance Use Disorder Treatment | Uncertain |

Utah ranks last in the nation for mental health treatment access, according to a 2019 report from the Gardner Policy Institute. A 2020 report from the Legislative Auditor General found that Utah’s Justice Reinvestment Initiative had failed to achieve its goal to reduce recidivism -- and actually saw recidivism rise -- in part because “both the availability and the quality of the drug addiction and mental health treatment are still inadequate.” (pg 51) Amounts not determined to address large gaps in workforce capacity, but two bills this year are: HB 66: $11m for additional Mobile Crisis Outreach Teams and 2 additional Receiving Centers in rural parts of Utah HB 248: $5m for additional Assertive Community Treatment Teams |

|

| Disability Services | $31 million |

The DSPD disability services waiting list has more than doubled in the last decade from 1,825 people with disabilities in 2011 to 4,427 in 2021. The FY20 $1 million one-time appropriation made it possible to provide services to 143 people from the waiting list, implying that it could cost $31 million to eliminate the waiting list entirely. In the 2022 session, the Legislature added $6 million in ongoing and $3 million in one-time money to shorten the disabilities waiting list. This year, Rep. Ward is sponsoring HB 242 to dedicate additional base budget funding to reduce the waitlist by 200 people each year. |

Legislative Coalition for People with Disabilities – Jan Ferre |

| Rural Utah Economic Development | $20 million | Rural Utahns should not feel that they need to abandon their home communities and add to the growth pressures along the Wasatch Front in order to provide for their families. Rural economic development would benefit all Utahns and reduce disparities between the Wasatch Front and other areas of the state. $20 million was one estimate for funding for economic development projects like the San Rafael Energy Research Center (Emery County) and renewable energy projects around Beaver County, both serving areas where primary jobs such as Smithfield Foods have left recently, and renewable energy projects have the potential to stabilize county economies. | Community Action Partnership of Utah - Stefanie Jones and Clint Cottam – |

| Reduce/Eliminate Benefits Cliffs | Uncertain | The existing benefits cliffs in many public anti-poverty programs – where public assistance disappears suddenly rather than phasing out gradually when someone gets a raise or takes a new, higher-paying job – act as an unintended obstacle to the efforts of low-income people to work their way out of poverty. | Circles Salt Lake – Kelli Parker |

| Sexual and Domestic Violence Victim Services |

$310 million OR $68 million |

Our economy incurs steep economic costs as a result of sexual and domestic violence. The Center for Disease Control estimates that over a lifetime the costs for a female survivor are $103,762 and for a male survivor $23,414. These include medical costs, loss of employment or interruption of paid work, criminal justice system costs, among others. A coalition of victim service providers and state agencies estimates the annual funding needed as $310 million ongoing to meet standard of care for all victims of domestic and sexual violence OR $68 million ongoing to fund the most basic level of services at only the current level of demand for services. |

Erin Jemison, Director of Public Policy, Utah Domestic Violence Coalition (UDVC) |

| Housing | $346 million per year for 10 years |

Among extremely low-income renter households, 71% pay more than 50% of their income for housing, which is considered a severe housing burden. $346 million per year of state funding over the next decade will make it possible to build affordable housing statewide for people earning less than 50% AMI, based on a state cost share of $80,000 per unit, and Utah is short 43,253 units. For more information on the current and ongoing needs visit https://nlihc.org/gap/state/ut |

Utah Housing Coalition Tara Rollins |

| Housing for Seniors | $67.5 million |

$37.5 million a year for 10 years will fund rehabilitation of 500 units per year at a cost of $75,000 per unit. If we don’t fund preservation of affordable housing for seniors we will lose valuable units. $30 million per year will make available rental gap funding of $500 per month for 5,000 units so that seniors can afford to stay in their rented units. https://www.utahhousing.org/preserving-senior-affordable-housing-report.html https://nyuds.maps.arcgis.com/apps/webappviewer/index.html?id=b8318f874017488ea9bdd51a296e59ef for senior housing report |

Utah Housing Coalition Director Tara Rollins |

| Homeless Services | $154 million |

$100m in one-time funds to produce 2,000 units of deeply affordable housing $19m ongoing for tax credits and housing trust fund $5m to the housing trust fund to produce 1,000 new units of affordable housing over the next 10 years $30m one-time for projects to eliminate unsheltered homelessness for families with children: The total number of people needing emergency shelter services in Utah increased by 14% in 2022. For families with children the increase was 33%. This is why, for the first time in over 20 years, families with children were turned away from the family shelter in Midvale during the months of September, October and November of last year because there were not enough beds to meet the need. $30 million would help purchase a motel to convert into a second family shelter and purchase land that can be dedicated to produce mixed income housing developments that include permanent supportive housing for families with children headed by parents with disabling conditions that have been homeless for six or more months. |

|

| Air Quality in Schools | $5 million | Funding to continue the successful implementation of this year’s federally-funded program placing air purifiers in every classroom in Utah, which will reduce the risks both from COVID and from Utah’s air pollution and is expected to result in improved school performance, even more than standard interventions such as reducing class size by 30%, or “high dose” tutoring. (Source: Utah Physicians for a Healthy Environment) | UPHE Director Jonny Vasic - |

| Air Quality: Promote Transit | $25.5 million |

The Utah Transit Authority (UTA) experienced an increase in ridership during Free Fare February in 2022. Tens of thousands of riders, including many new to public transit, enjoyed the services, and stress on our transportation system and environment was lessened. Governor Cox’s Budget Recommendations for FY24 includes a $25 million, one-year pilot for statewide zero-fare transit. This pilot would include the state’s three transit systems that are not currently zero-fare: Cedar Area Transportation System, SunTran, and the Utah Transit Authority. The governor also recommends $500,000 for a zero fare transit study to analyze the impacts of the pilot. During Free Fare February, 87% of entities that subsidize UTA fares for their users continued paying subsidies to help enable the zero fare period. The Governor’s proposal calls on UTA fare subsidy partners to continue paying subsidies for their users during this one-year pilot period to cover $13.1 million in additional costs. This pilot will provide Utah families price relief to help offset the burden of gasoline prices, gasoline tax indexing, and inflation, while also allowing researchers to analyze factors related to permanent decisions about zero fare transit |

|

| Improve UTA transit service | $175.6 million |

$10.9m to match UTA projections to fully supplement free fares for a year. (In all, UTA projected $35.9 in fare revenue for 2023) $3.5 million to address UTA’s driver shortage ($20/hr*2,080 hours*60 operators + 40% for benefits, taxes, etc.) $30,000 to match CATS (Cedar City’s transit system) to fully supplement free fares for a year based on budget projections. $136,000 to match SunTran (St. George’s transit system) to fully supplement free fares for a year based on budget projections. $159 million to clear UTA’s debt to free UTA to expand and improve service. $2 million to fund a matching grant from the federal government to study the feasibility of a passenger rail route connecting Boise to Las Vegas via Salt Lake and points in between. |

Curtis Haring, Utah Transit Riders Union |

| Hunger | $1 million | It is clear that the state needs to do more in providing funding and other resources to help support local community food pantries. | Utahns Against Hunger – Gina Cornia – |

| Utah EITC | $57 million | Last year Utah became the 31st state with our own Earned Income Tax Credit, but we're one of the few who make it non-refundable, even though over 85% of the value of the federal EITC -- and the key to its poverty-reducing and workforce-enhancing power -- is its refundability. In 2022 under Gov. Youngkin, Virginia made their state EITC refundable. ITEP analysis shows 71% goes to the lowest-earning quintile and nearly all to the lower-income half of Utahns. | Voices for Utah Children – Matthew Weinstein – |

| Gov. Cox’s proposed refundable tax credit | $54 million | Utah's Taxpayer Tax Credit shields most low-income workers from the income tax, which is a good thing because it makes our overall tax system less regressive. Now Gov. Cox is proposing to make it even better by making up to $250 of this credit refundable. | Drew Cooper, United Today Stronger Tomorrow |

| Eliminate the sales tax on unprepared food | $200 million | The food tax is the most regressive tax. One-third of it is paid by the lowest-income half of Utah households, who earn less than a sixth of all Utah income. According to the U.S. Department of Agriculture’s Economic Research Service, low-income families pay 36% of their income on food while higher-income families spend only 8%. This is why 37 states do not charge any sales tax on food. | Drew Cooper, United Today Stronger Tomorrow |

| Save the Great Salt Lake | $333 million | Gov. Cox is proposing $133m in new resources to save the Great Salt Lake and $200 million to help reduce water waste in agriculture. Source: www.sltrib.com/news/2022/12/30/dear-legislature-heres-2023/ | Utah Rivers Council –Matt Berry |

| Racial Equity, Diversity, and Inclusion as it relates to undocumented Utahns | Our public fiscal policies – how we generate and expend public investment dollars – have a direct impact on whether we are widening or narrowing the gaps between different groups in Utah. The Utah Compact on Racial Equity, Diversity, and Inclusion must be more than just words on a page. slchamber.com/public-policy/utah-compact In particular, Utah is home to 95,000 undocumented men, women, and children. They work hard and pay taxes and need and deserve access to the same public services as every other Utahn. | Comunidades Unidas – Brianna Puga – | |

| The economic case against tax cuts | Tax cuts are usually enacted to provide additional stimulus to the economy. Given our very low unemployment rate, along with ongoing inflationary pressures, now is not really the right time for new economic stimulus. The future is uncertain – some economists expect we may face a recession in the coming year, though there’s a wide variety of opinions about the likely timing and severity of such a possible event. Additional tax cuts right now won’t do much to affect that. However, investing now in the many unmet needs we face, particularly in the areas of water and climate, education, child-care, and the many other needs listed here this morning, will put us in a better position to thrive whatever the coming years bring us in terms of economic conditions. | Univ. of Utah Economics Prof. Thomas Maloney PhD | |

TOTAL |

|

$5.6 billion – over $2b more than the amount of "surplus" revenue for FY2024 |

The press conference was broadcast live on Facebook: https://fb.watch/ieyT_0Zi14/?mibextid=RUbZ1f

Media coverage:

- KJZZ: Local organizations oppose statewide tax cuts, call for investments in Utah's future instead

- Deseret News: Time to invest more in education, housing, water and other areas, group says

- KUTV-2: Local organizers oppose tax cuts, call for investments in Utah's future instead

- KSL: Don't cut taxes, advocacy groups urge Utah lawmakers. Here's why.

- UtahPolicy.com

Additional one-pagers distributed by some of the coalition members:

- Circles Salt Lake: Background about Circles and one-pager about benefits cliffs

- Transit: Utah Transit Riders Union info and one-pager about free-fare transit

- Community Action Partnership of Utah one-pager about rural Utah's needs

- Child care one-pager from UtahCareforKids.org

- Housing affordability one-pager from Utah Housing Coalition

Comparing the Tax Cuts

* * SEE COMPLETE ANALYSIS OF THE LEGISLATURE'S $400 MILLION TAX CUT PROPOSAL AT THE BOTTOM OF THIS PAGE * *

The 2023 Legislature's annual seven-week General Session has begun! At the top of the agenda for the Governor and Legislative leadership: tax cuts.

While Voices for Utah Children and many other advocates for Utah's most vulnerable populations are deeply concerned about the long-term detrimental effect of tax cuts on state and local governments' abilities to meet their obligations to Utahns (see www.InvestInUtahsFuture.org for more about that), we are also cognizant of the political reality that tax cuts are popular with Utah's political leadership (in contrast to public opinion).

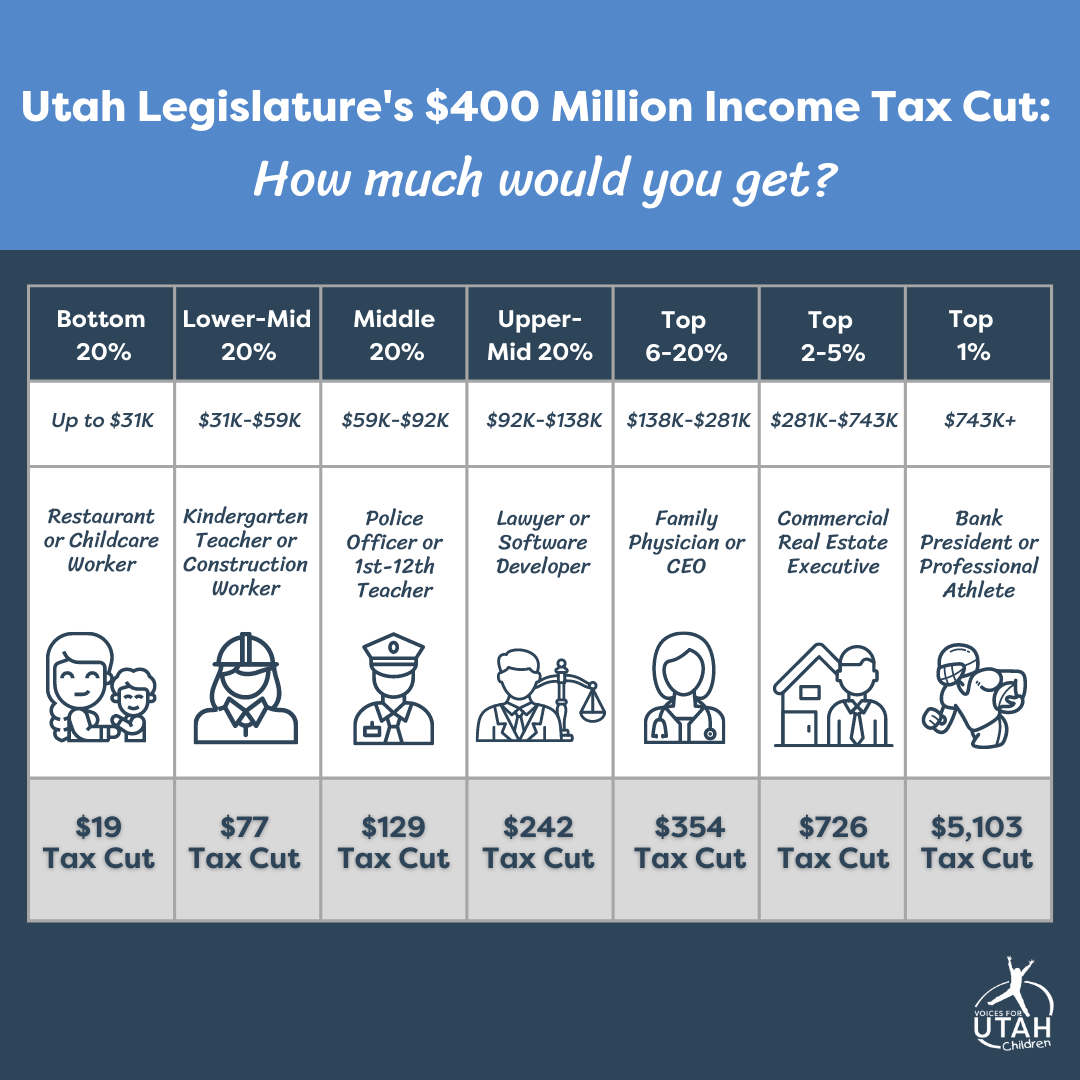

If there's one thing Voices for Utah Children has learned following tax policy in recent years, it's that not all tax cuts are created equal. Hence this guide to the tax cuts being proposed this year. Note, the legislature has since changed the proposed income tax cut from $200m to $400m further resulting in even greater tax cuts mostly for Utah's top income earners.

Ranking the Tax Cut Proposals

We rank the tax cuts by regressivity -- do they make our overall tax system more or less regressive than it currently is? Regressivity is about fairness. Utah's current overall state + local tax system is regressive/unfair in the sense that the highest income households pay a lower overall share of their incomes in state and local taxes than low- and middle-income households.

The chart above illustrates whether each individual proposed tax cut would make Utah's taxes even more unfair, or would it reduce the inequities in the current tax structure. We illustrate the impact of the proposals in the chart below two different ways:

1) By share of the tax cut: How does it slice the pie? Who gets the big pieces and who's stuck with the crumbs (or nothing at all)?

2) By dollar amounts: How much does an average family benefit each year at each income level? (we provided this information for each tax cut that is available to all taxpayers but not for the more targeted ones that only go to a smaller subset like the Social Security and child tax credits)

Important Background Information

What are the major taxes in Utah and who pays them?

- The sales tax: Our most regressive tax -- meaning it takes a bigger bite percentage-wise out of the incomes of low- and middle-income families than their high-income neighbors. (And same goes for the gas tax.)

- The property tax: Not as regressive as the sales or gas taxes but still costs lower-income families a greater share of their incomes than higher-income families, including non-homeowners who pay it indirectly through their rent.

- The income tax: Utah's only non-regressive tax. The only one that lines up with Utah's income distribution, following the 3/5--1/5 Rule: Three-fifths of all Utah income is earned by the top one-fifth of taxpayers, and three-fifths of the income tax is paid by that same high-income group. KEEP IN MIND: When the Legislature cuts the income tax rate, not only do they make our tax system more regressive overall, they also put more pressure on local property taxes, which tend to rise to make up for the lost education funding when the income tax rate is cut. As a result, cutting the income tax means a tax shift from state to local and from the highest-income Utahns to middle-class and low-income households.

See more details about who pays which taxes in Utah and how our overall tax structure is regressive at www.ITEP.org/WhoPays/Utah.

How Do These Proposed Tax Cuts Compare to Last Year?

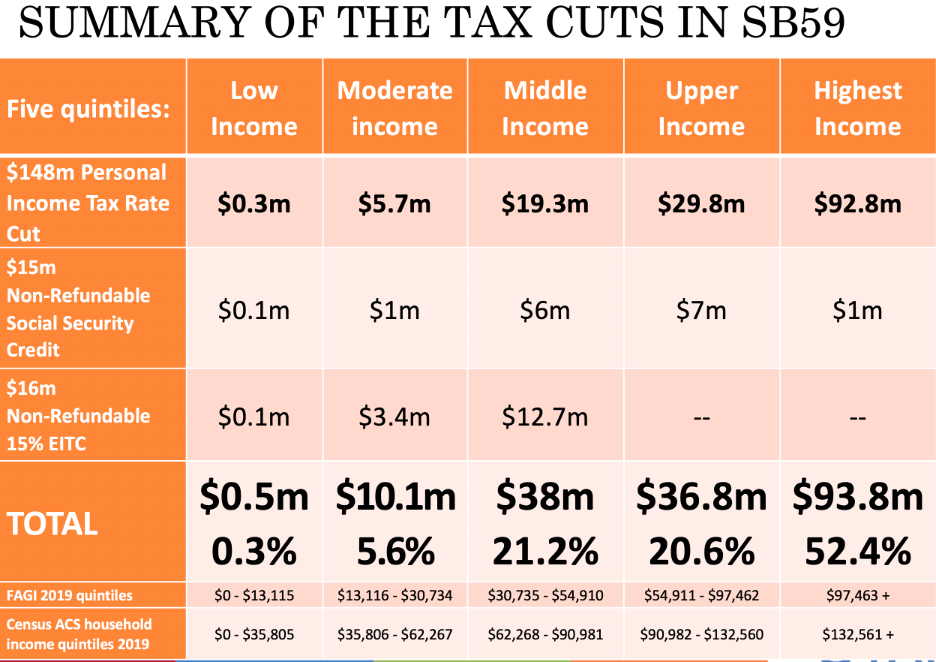

Last year, the 2022 Utah Legislature passed SB 59 -- about $200 million of permanent tax cuts.

- The majority of the breaks went to the highest income fifth of Utahns, those earning above about $130,000.

- Just 6% of last year's tax cuts went to the bottom two-fifths of Utahns, those earning under about $60,000 a year.

2022 SB 59 Tax Cuts Summary

ANALYSIS OF THE 2023 LEGISLATURE'S $400 MILLION TAX CUT PROPOSAL

The best holiday gift for Utah kids this year: An improved federal Child Tax Credit

Utah Economic Benchmarking Project 2022: Utah vs Texas

New Economic Benchmarking Report Finds Utah Ahead of Texas in Most Key Metrics of Economic Opportunity and Standard of Living

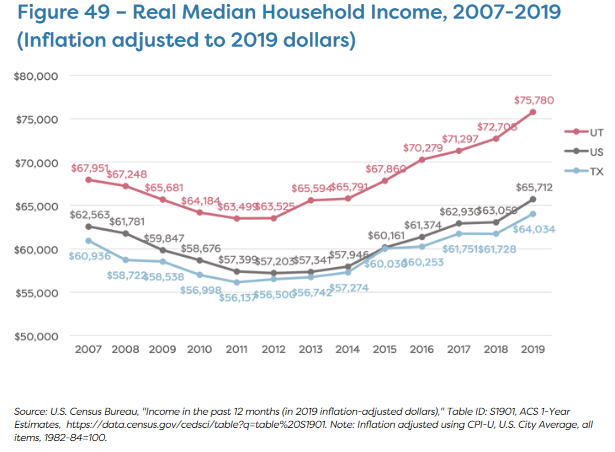

Salt Lake City, August 31, 2022 - Voices for Utah Children released today the fifth in its series of economic benchmarking reports that evaluate how the Utah economy is experienced by median- and lower-income families by benchmarking Utah against another state. This year's report, authored by Taylor Throne and Matthew Weinstein with support from intern Bryce Fairbanks from the University of Utah Department of Economics, compares Utah to Texas. While the Economic Opportunity benchmarks come out nearly even, with Utah ahead in 11 and Texas ahead in 8, in the Standard of Living category Utah predominates in 20 categories and Texas in just two.

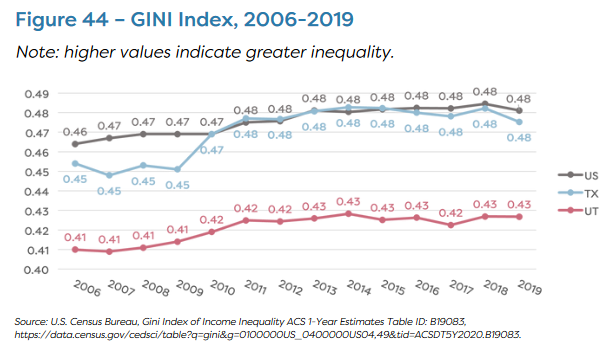

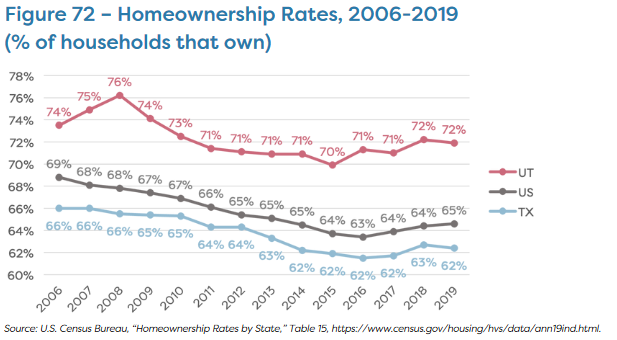

Voices for Utah Children's Economic Analyst Taylor Throne commented, "It seems clear that Texas has more to learn from Utah than vice versa. In terms of economic opportunity, Utah outperforms Texas for our labor force participation rate and our low unemployment rate (see page 13 of the report). In education, while both states are in the bottom 10 for investment, Utah claims much better 4th and 8th grade math and reading scores. At the university level, Utah invests more and enjoys stronger educational attainment levels (though our younger generation has lost the lead over the nation enjoyed by our older generations.) (See page 17.) Utah ranks 1st in the nation for our low level of income inequality, while Texas ranks 38th. We also stand out for intergenerational mobility and rank #1 for education funding fairness while Texas ranks 34th (see page 21). In the second part of the report where we measure standard of living. Utah is the clear winner in most measures. Utah enjoys much lower rates of poverty and uninsured children (though both states rank at the bottom for insuring Hispanic/Latino children) (see page 25).The most recent Kids Count overall ranking has Utah 4th and Texas 45th (see page 29). Utah also has shorter commutes, higher homeownership rates, and more volunteerism and voter participation (see page 33)."

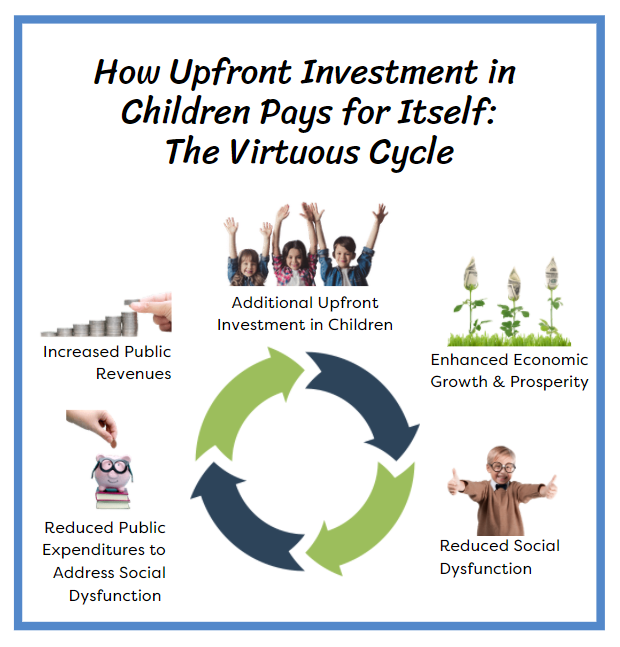

Voices for Utah Children's State Priorities Partnership Director Matthew Weinstein commented, "The main takeaways from this report and the others in the series are that Utah's economic successes put us in a position to make the new upfront investments we need to make now -- in education, public health, poverty prevention, and closing racial/ethnic gaps -- so that we can achieve our true potential and follow in the footsteps of states like Colorado and Minnesota that have become high-wage states and achieved a higher standard of living, and do it in such a way that all our children can have a better future."

The report release presentation took place online and can be viewed at https://fb.watch/ffuSPZ09MR/. The presenters included both Taylor Throne and Matthew Weinstein as well as a special guest, Brandon Dew, President of Central Utah Labor Council.

Utah's Top Economic Advantages: Hard Work & Strong Families Allow Utah to Enjoy High Household Incomes and Low Poverty

Can Texas Learn Any Lessons from Utah?

Utah enjoys a higher real median household income than Texas, ranking #11 nationally, although past inequities have left a legacy of barriers causing significant gaps between the median wage of different racial and ethnic groups. Utah's higher incomes are due largely to our high labor force participation rates and our preponderance of two-worker (often two-parent) households.

Even though Texas has a larger GDP per capita and ranks ahead of Utah for business climate, Utah has a higher share of people working and fewer people looking and unable to find work. Utah ranks 1st in the nation for income equality by the GINI Index, 1st for K-12 funding equity, and has fewer people living below the poverty line.

Utah is the clear winner by most standard of living measures. The most recent Kids Count overall ranking has Utah 4th and Texas 45th. Utah also has shorter commutes, higher homeownership rates, and more volunteerism and voter participation. Utah also has a much fairer tax system. Texas applies one of the highest tax rates in the nation (6th highest) to households with the lowest incomes and applies one of the lowest tax rates (9th lowest) to households with the highest income. This is because Texas has no personal or corporate income tax to offset the regressivity of their major revenue sources: sales, excise, and property taxes. As a result, Texas is one of the highest-tax states in the nation for lower-income residents, and one of the lowest-tax states for the wealthy.

Can Utah Learn Any Lessons from Texas?

Texas leads in early childhood education for pre-k and full-day kindergarten participation. Texas also has a much smaller gender wage gap than Utah, which ranks as one of the worst states for gender equality. When disaggregated by race and ethnicity, Texas has a smaller gender wage gap than Utah for every race and ethnicity except Latino and Native Hawaiian and Pacific Islander women.

Policy Implications

Strengthening the Labor Force

Utah and Texas are both far below the national average for median (50th percentile) and 10th percentile hourly wages, likely due to the fact that both are among the 20 states that never raised their minimum wages above the 2009 federal minimum of just $7.25 (now at its lowest level since 1956), and both states are among the 27 that discourage union membership through “right-to-work” laws.

Addressing the Legacy of and Present Barriers Causing Racial & Ethnic Gaps

Racial and ethnic gaps are evident in almost every outcome where race and ethnicity are disaggregated, such as high school graduation rates, wages, gender pay gaps, poverty rates, and uninsured rates. It is important to note that these gaps were caused by social, economic, and political structures and policies that have perpetuated racial inequality, elaborated in our report. Such policies have had very serious consequences for people of color, especially children of color. And as in the rest of the nation, the COVID-19 pandemic has exacerbated these hardships. Addressing these gaps through investments in early childhood and K-12 education, specifically where there is a high concentration of children of color (which includes many communities along the Wasatch Front, including Ogden, Salt Lake City, South Salt Lake, West Valley City, Midvale, and Provo) would likely increase educational attainment, wages, and standard of living overall and would therefore contribute to reducing racial and ethnic gaps in the future.

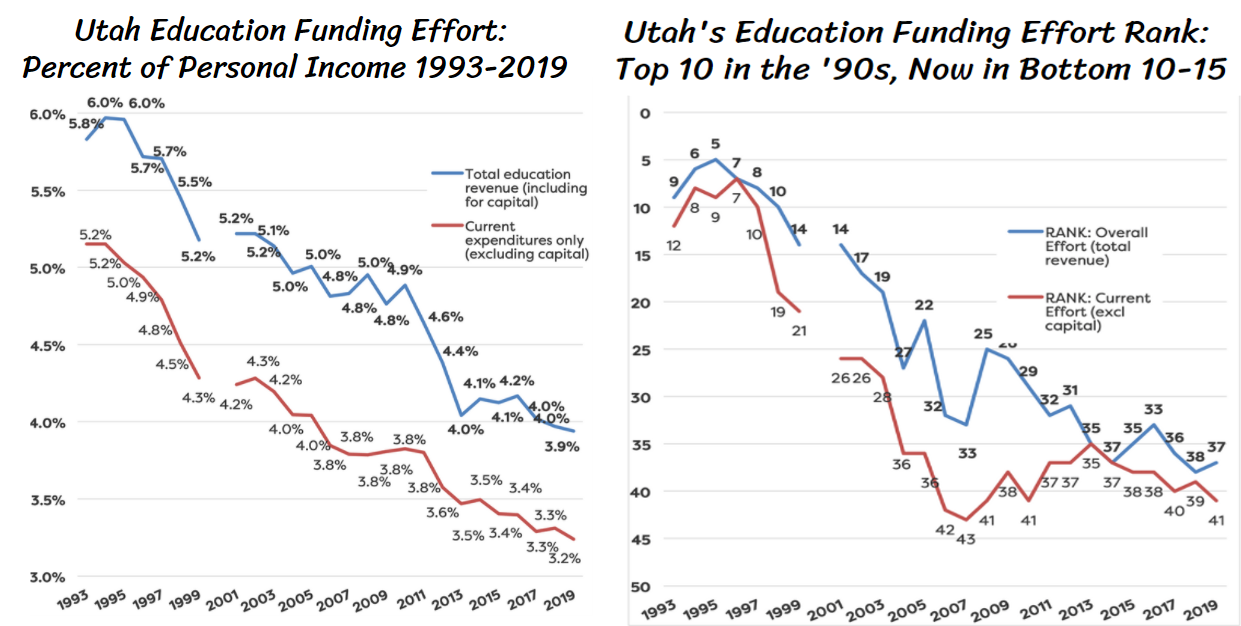

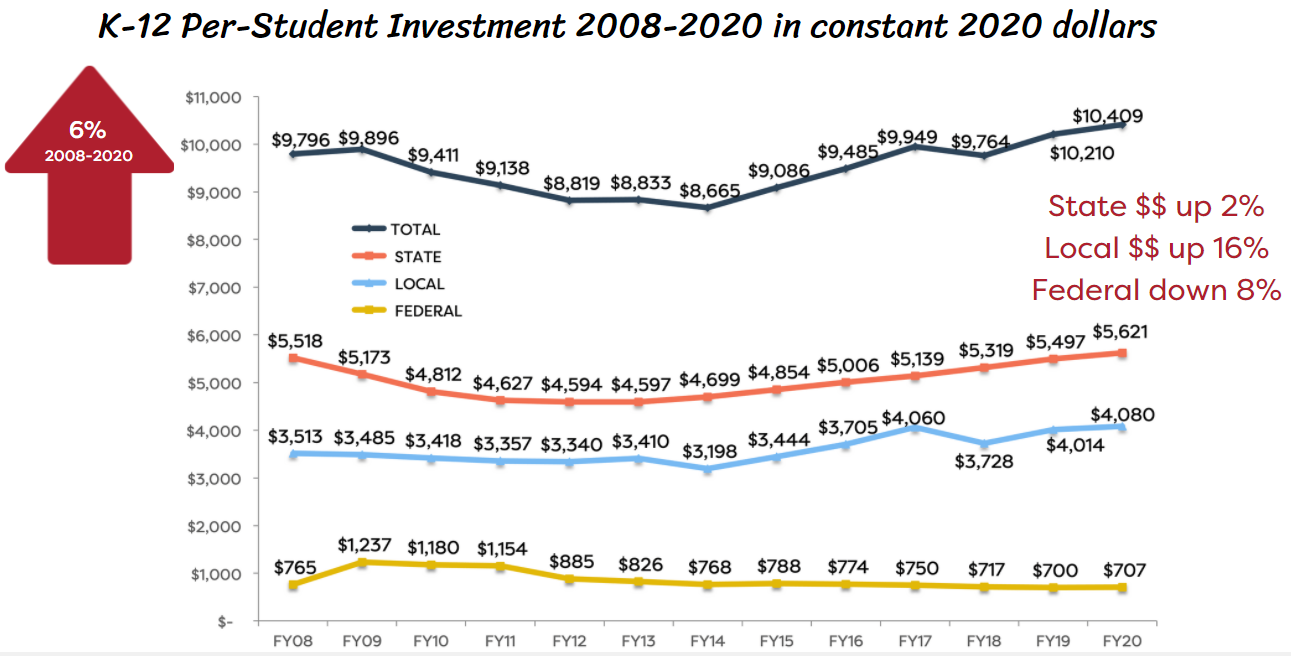

Restoring Education Funding Effort

The link between education and income is well-established. States with higher education levels generally have higher levels of worker productivity, wages, and incomes. Voices for Utah Children has demonstrated elsewhere that Utah’s education funding effort has fallen from top 10 in the nation in the 1990s to the bottom 10 states today. While Utah “does more with less” in education compared to other states, will we be able to continue to advance without addressing the underfunding in our public education system? Utah has racial/ethnic educational outcome gaps which are larger than the national average, our pupil-to-teacher ratio is 3rd worst in the nation at 23:1 vs the national average of 16:1, and teacher pay has also fallen by 2% over the past 50 years, while teacher salaries nationally have increased 7%.

At the college level, Utah historically was always ahead of the national average for attainment of bachelor’s degrees and above. But Census data show Utah’s lead shrinking relative to the nation with each successive generation, to the point now that Utah millennials (ages 25-34) have fallen behind their peers nationally, despite relatively generous state support and low tuition levels. In addition, for young adults who do not seek to complete a college degree, apprenticeships and other skilled training programs or ensuring state contracts pay the prevailing local wage are two policies that have proven their value for achieving higher wages.

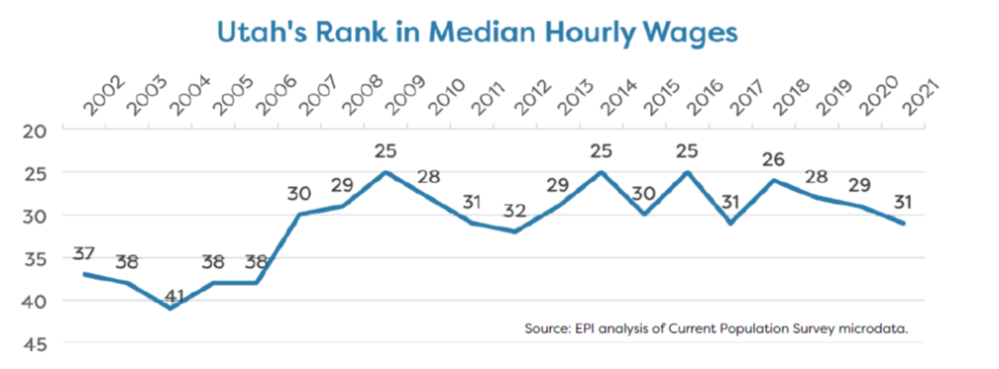

Can Utah Become a High-Wage State?

Utah has gone from being a low-wage state a generation ago to middle-wage status today, a considerable accomplishment. One question Utah leaders may now wish to consider is, is that good enough? Should we declare, “Mission Accomplished”? Or is Utah in a position, like Colorado and Minnesota before us, to become, over time, a high-wage state and set our sights on taking the necessary steps today to achieve that goal over the years and decades to come?

Similarly, how do we include those earning the lowest wages in the gains Utah has made and will potentially make in the future? Utah is not even a half percentage point lower than the national share of workers earning poverty-level wages and lags behind the nation’s 10th percentile wage, ranking 33rd. Even as the state with the lowest income inequality ranking in the nation, Utah suffers from a tremendous gap between low-income workers and the rest of the income scale.

The main lesson that emerges from the Working Families Benchmarking Project reports comparing Utah to Colorado, Minnesota, Idaho, Arizona and now Texas is the following: Higher levels of educational attainment translate into higher hourly wages, higher family incomes, and an overall higher standard of living. The challenge for policymakers is to determine the right combination of public investments in education, infrastructure, public health, and other critical needs that will enable Utah to continue our progress and achieve not just steady growth in the quantity of jobs, but also a rising standard of living that includes moderate- and lower-income working families from all of Utah’s increasingly diverse communities.

The 41-page report is available for download here.

MEDIA COVERAGE OF THE BENCHMARKING PROJECT:

The Spectrum: https://www.thespectrum.com/story/news/2022/09/02/report-compares-utah-texas-economy-standard-living-homes-jobs/7970912001/

KSL News Radio: https://kslnewsradio.com/1974565/new-report-ranks-utah-above-texas-in-aspects-of-economic-opportunity-and-standard-of-living/

Salt Lake Tribune: https://www.sltrib.com/opinion/commentary/2022/09/15/matthew-weinstein-taylor-throne/

The story of tax policy in the 2022 Legislative session is a tale of two tax cuts:

-

- A large, top-heavy cut to the income tax rate from 4.95% to 4.85%. How large? $164 million. How top-heavy? 63% of it goes to the top 20% of taxpayers. all of whom have six-figure incomes.

- The creation of a small ($16 million, just one-tenth the size of the income tax rate cut) state-level Earned Income Tax Credit. The EITC is widely considered to be the nation's most effective anti-poverty program, since it reduces poverty by promoting work and self-sufficiency. Special recognition goes to Rep. Mike Winder, who, in his final legislative session, leaped at the opportunity to sponsor HB 307 and persuade his colleagues that 2022 was the year to make Utah the 31st state with our own EITC, something that advocates for reducing poverty have sought for decades.

The new Earned Income Tax Credit is non-refundable, which means it will not reach the lowest-income fifth of Utah workers who need it the most, including those struggling to work their way out of intergenerational poverty. About 80% of the value of the federal EITC is the refundable portion, which offsets other federal taxes paid by the lowest income workers. Most state level EITCs are also refundable, allowing them to offset the sales, gas, and property taxes paid by low-income workers to state and local governments. In Utah, the lowest income workers pay, on average, 7.5% of their incomes in those taxes, which is a higher share of their incomes than that paid in all state and local taxes by the highest income Utahns. The new nonrefundable EITC will help moderate income Utahns (the second fifth of the income distribution), primarily those earning between $30,000 and $55,000. Moderate income Utah families certainly need the help, so the creation of a Utah EITC is a great step in the direction of better tax policy. We hope that Utah will soon follow in the footsteps of other states that began with a non-refundable EITC and then decided to make it refundable.

The income tax rate reduction continues an unfortunate pattern in recent decades of tax breaks for those who need them the least -- tax breaks that both increase inequality and starve Utah's schools of the resources they need to succeed. In 2007 we cut the top income tax rate from 7% to 5%, then in 2018 to 4.95%, now this year to 4.85%. The income tax is the only non-regressive tax Utah has, the only one that actually lines up with Utah's income distribution. Ironically, as income inequality worsens, it is also Utah's fastest growing source of revenue, which offered Utah our best hope for seeing our education system benefit from Utah's rapid economic growth -- until we began targeting that rapidly growing revenue source for tax cuts.

Here is a summary chart of this year's tax cuts and how they impact Utahns in each fifth of Utah's income distribution:

Source: Utah Legislative Fiscal Analyst (excluding the $15 million corporate portion of the income tax rate cut)

Source: Utah Legislative Fiscal Analyst (excluding the $15 million corporate portion of the income tax rate cut)

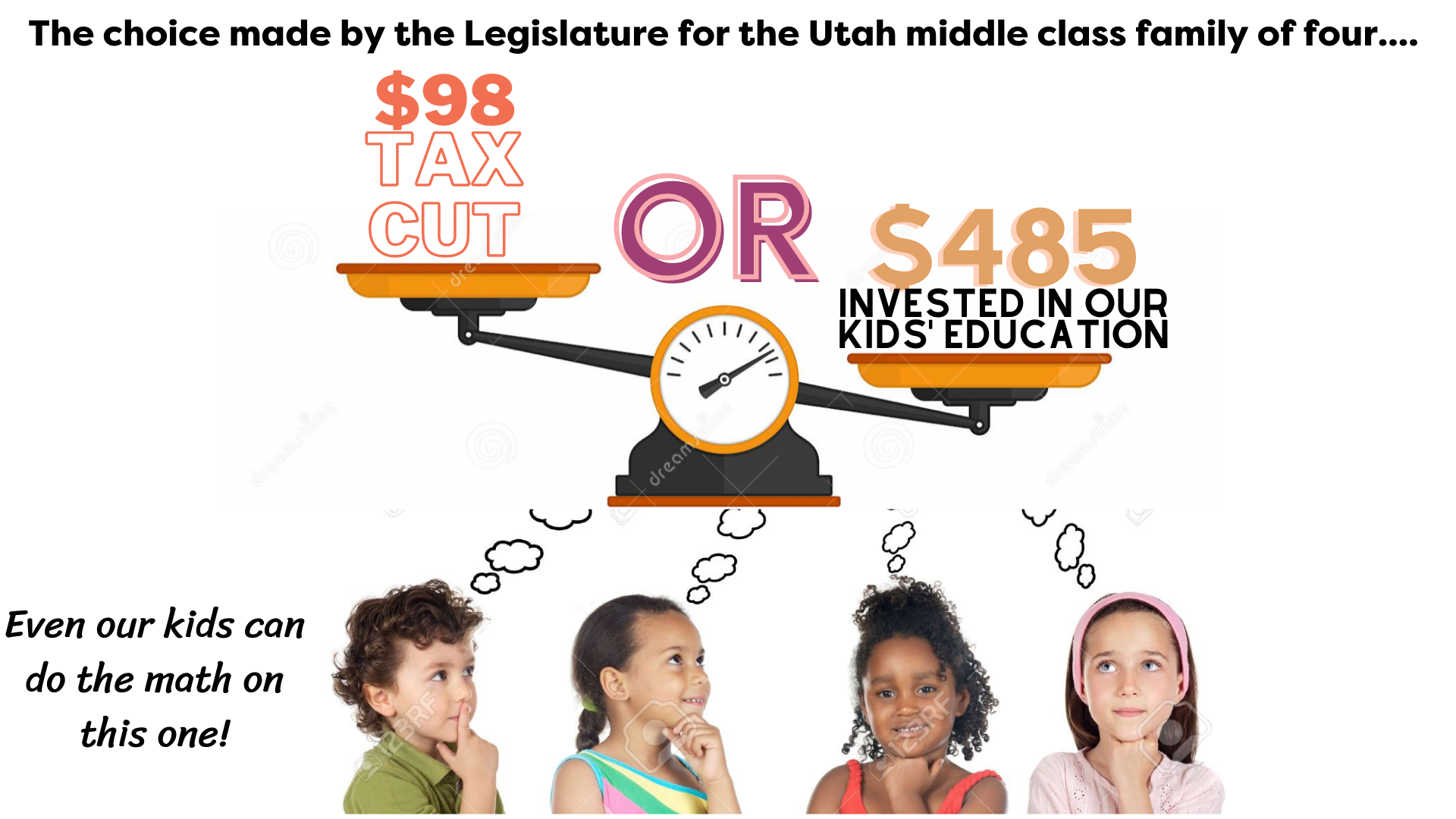

Another way to think about the income tax rate reduction from 4.95% to 4.85% is to consider how it impacts a median income family of four. According to the Legislative Fiscal Analyst, such a family receives a tax cut of $98. But when you divide the $164 million price tag of the income tax rate reduction by Utah’s K-12 student population of about 675,000, then multiply by the two kids that the median income family of four has in school, you see that that average family that is gaining $98 in a tax break is giving up $485 that is now not going to be spent on their kids’ education every year. Not going to be spent on smaller class sizes or more experienced teachers or more up-to-date technology. Not going to be spent on closing the gaps in our education system between majority and minority groups and between haves and have-nots, gaps which are larger than nationally.

It's also important to see this year's income tax rate cut in the context of decades of top-heavy tax breaks passed by the Legislature. According to the Utah State Tax Commission, Utah has been passing, on average, $100 million a year of new tax breaks for over 35 years. This now adds up to over $3.5 billion not available every year to invest in Utah's children -- their education, health care, and basic economic security. In fact, the Invest in Utah's Future Coalition has identified over $5 billion of unmet needs in a wide range of areas of public responsibility.

For a full summary of this year's legislative actions on taxes, you can....

- Download our Powerpoint slideshow summary

- View a video recording of our presentation "Utah Legislature's 2022 Tax Changes: What happened and how will it impact Utah children" at https://fb.watch/bpbVN8Mwms/

Voices Statement Re: Constitutional Amendment to End Education Earmark

Voices for Utah Children Statement on the News that the Legislature Is Considering a Constitutional Amendment to End the Education Earmark of Income Tax Revenue:

A Constitutional Amendment Won’t Help If Utah Keeps Cutting Taxes

It is understandable that Utah legislators would want greater flexibility in how they can use public revenues. But there is a much larger problem that increased flexibility would do nothing about and would even delay solving: the chronic public revenue shortages that afflict our state following decades of tax cutting.

Utah has been cutting taxes by an average of $100 million annually for at least the last 35 years. According to Tax Commission data (see slide #8), this now adds up to about $3.5 billion in revenue not available for Utah’s annual state budget every year. As a result, public revenues are now lower than they've been in half a century relative to Utahns' incomes. The decisions in recent decades by Utah's Governors and Legislatures to give in to the tax cut temptation are at the root of Utah’s chronic revenue shortages in nearly every imaginable area of public responsibility, as documented by the Invest in Utah’s Future Coalition.

This year’s decision to pass a $164 million cut in the income tax rate from 4.95% to 4.85% (SB59 1st sub fiscal note) is an unfortunate example of this impulse toward thinking about short-term gain rather than the long-term needs of our state. This change gives a middle-class family of four a $98 tax cut, but it also means that $485 will now not be invested in that family’s two children in school. ($164 million divided by 675,000 children in Utah’s K-12 education system multiplied by two kids)

Every Utah family with children should ask the Governor and Legislative leaders, “Will you use this increased flexibility to enact even more tax cuts that deprive our children of the education that they need and deserve?” If our leaders are not prepared to answer that question unequivocally, then Utahns should know that such an amendment would just enhance budget writers' ability to "rob Peter to pay Paul" and not address the root cause of Utah’s problem.

2021 Utah Kids Count Data Book Release

Kids Count Utah: A Data Book on the Measures of Child Well-Being in Utah, 2021 is the first glance at the effects of the COVID-19 pandemic on Utah’s children. Please click on the button below for the full report.

2021 UTAH KIDS COUNT DATA BOOK

Children under the age of 18 make up a third of the state’s population. Not surprisingly, Utah children and their families faced additional challenges as a result of living through a global pandemic.

Unfortunately, over 10 percent of Utah children are experiencing poverty. Additionally, since 2019 Utah saw an increase of over 4,000 additional children considered to be in Intergenerational Poverty (IGP). More children caught in a cycle of IGP is concerning as it could mean that their own children may continue that same cycle if their economic situation does not improve.

Providing a quality education to children during the pandemic continues to be a challenge. The most recent data shows that student proficiency assessment results decreased over the past year. And data also shows that many children are not receiving the mental health treatment they need. A new data indicator shared in the 2021 data book looked at access to mental health. The data collected from the National Survey of Children’s Health shows that approximately 60% of three- to 17-year-olds struggling with mental health are not receiving treatment.

Voices for Utah Children hopes that the yearly KIDS COUNT data book project and the publication of Measuring of Child Well-Being in Utah continues to be a valuable resource that can provide guidance to both policymakers and the general public on how to improve the lives and futures of Utah children.

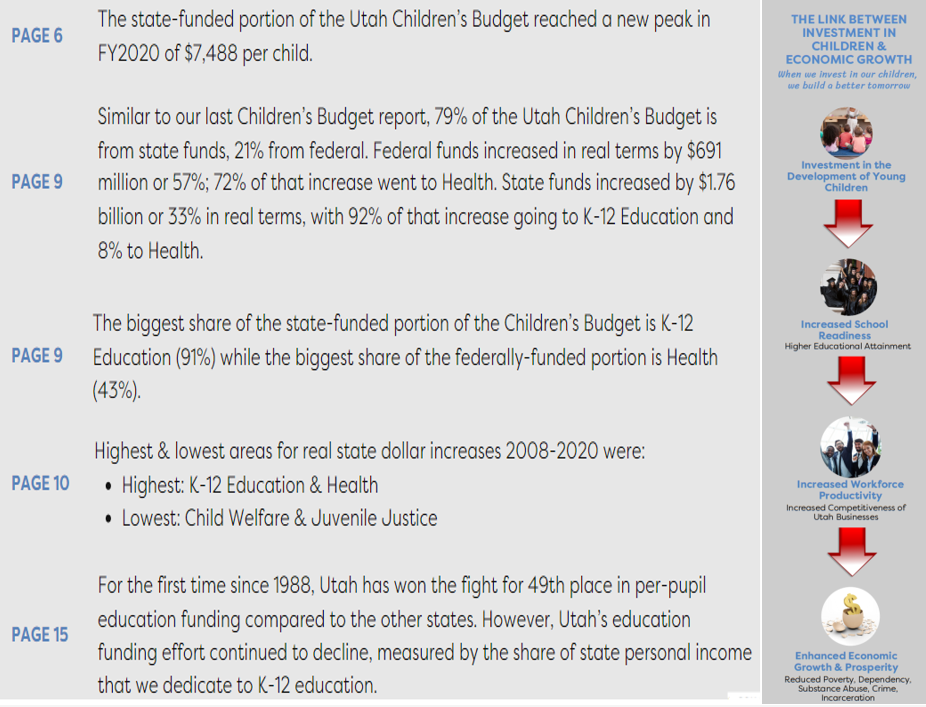

Utah Children's Budget Report 2021

Children’s Budget Report Finds Utah Is Spending More On Children Than Ever Before, But Education Funding Effort Is At A Record Low

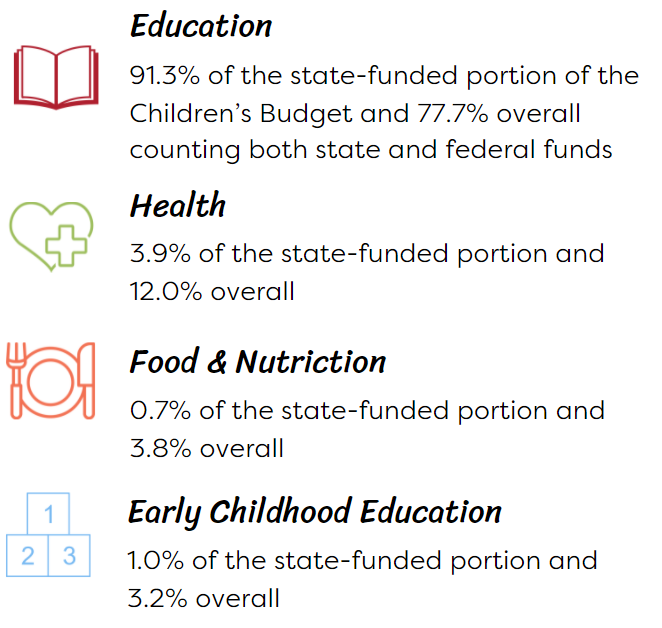

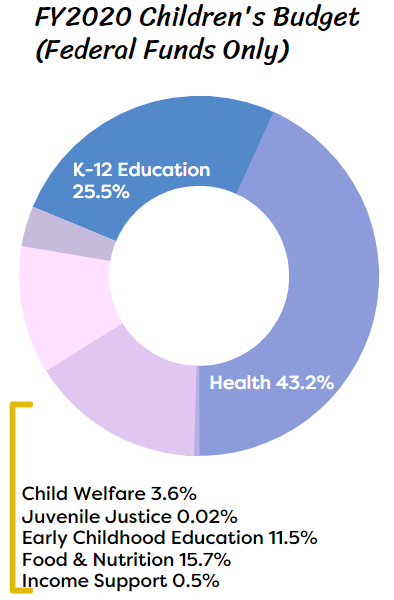

Salt Lake City, December 9, 2021 - Voices for Utah Children, the state’s leading children’s policy advocacy organization, released its biennial Children's Budget Report. The report, published every other year, measures how much (before and after inflation) the state invests every year in Utah’s children by dividing all state programs concerning children (which add up to about half of the overall state budget) into seven categories, without regard to their location within the structure of state government. The seven categories are as follows, in descending order by dollar value (adding state and federal funds together):

Public investment in children should be understood as a central component of Utah’s economic development strategy. Examining how much Utah invests in children can help the state evaluate whether it is maximizing the potential of our future workforce through our investment in human capital.

This is especially important given the rapid demographic changes taking place in our state. The 2020 Census found that 30% of Utahns under 18 are members of a racial or ethnic minority (almost one-third of our future workforce), compared to just 24% in 2010. The investments we make today in reducing racial and ethnic gaps among Utah’s children will enable the state to thrive and prosper for generations to come

Report highlights are as follows

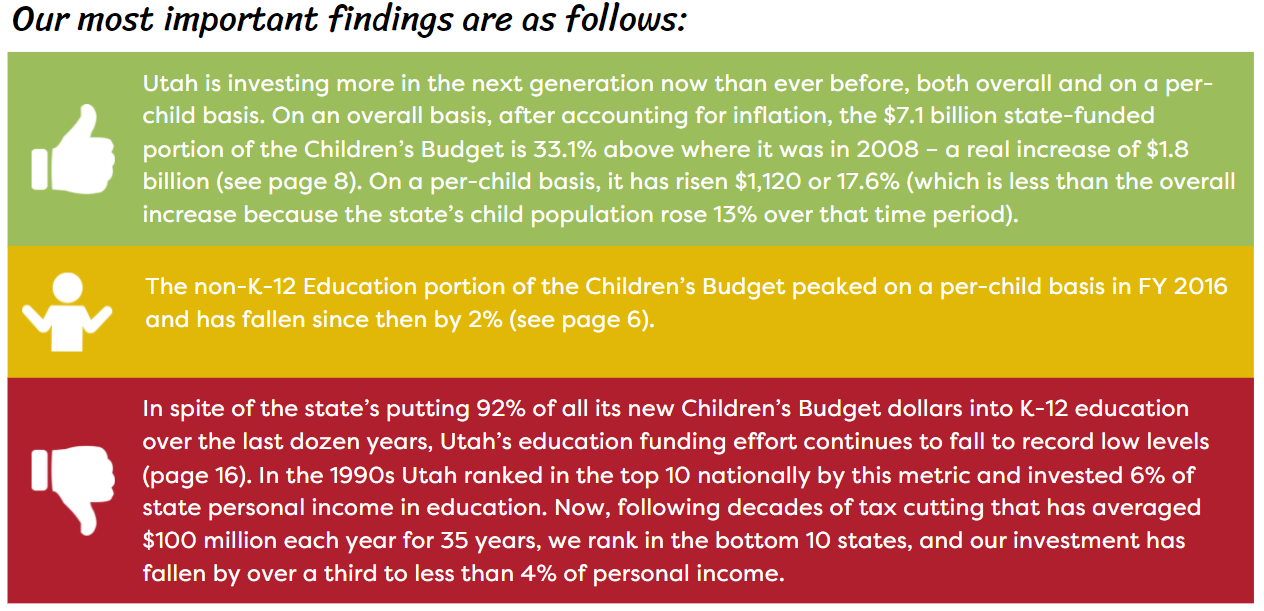

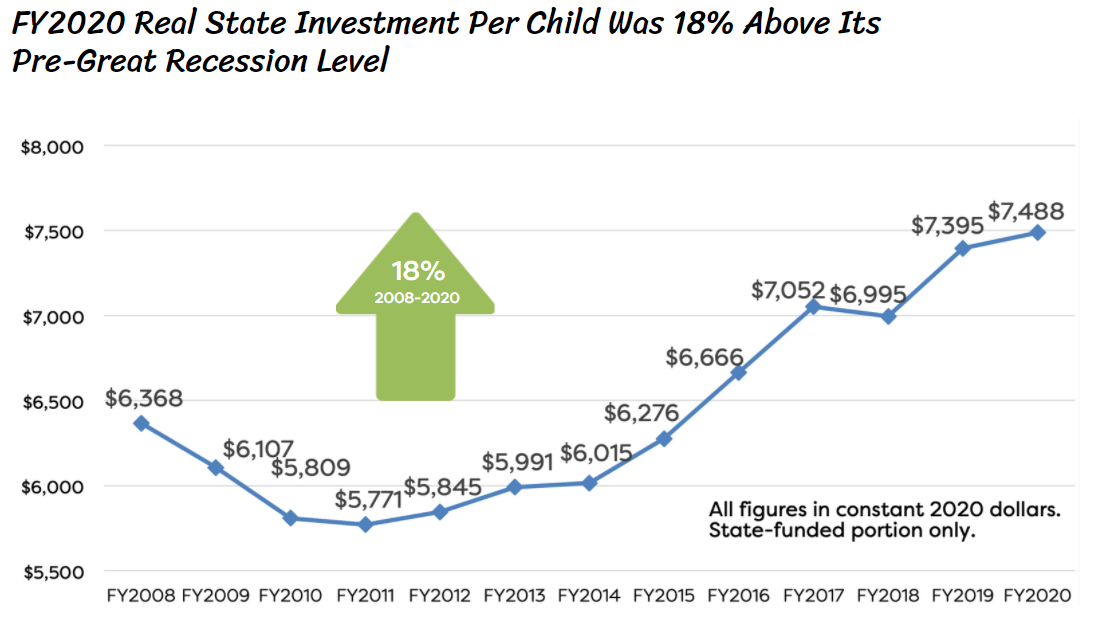

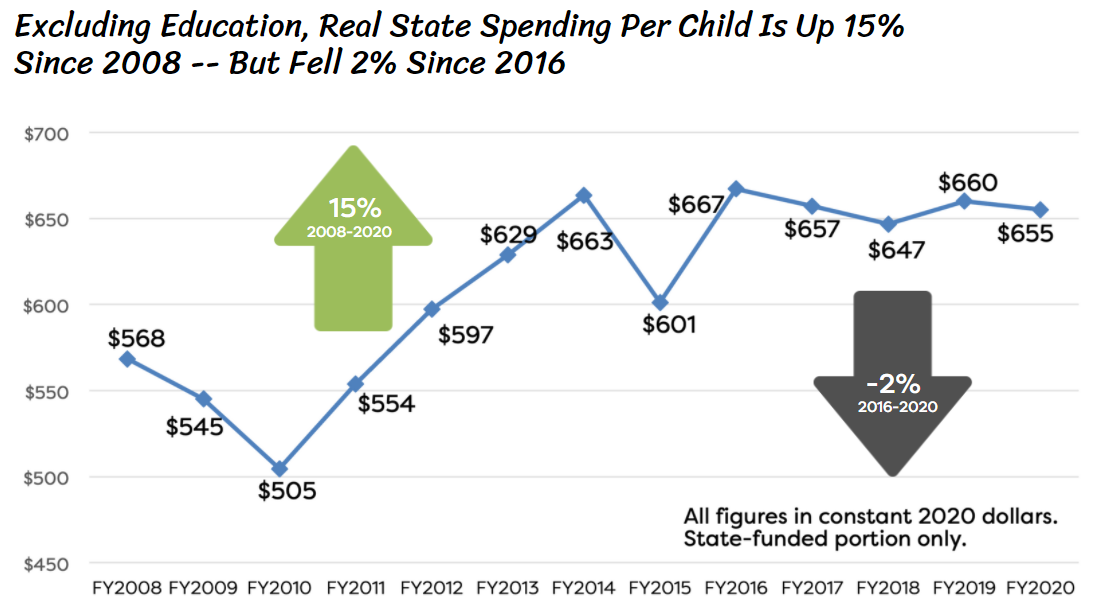

Good News: Utah is investing more in the next generation now than ever before, both overall and on a per-child basis

Not-so-good News: The non-K-12 Education portion of the Children’s Budget peaked on a per-child basis in FY 2016 and has fallen since then by 2%

Bad News: Utah’s education funding effort continues to fall to record low levels

Additional Trends: Changes in Funding by Source

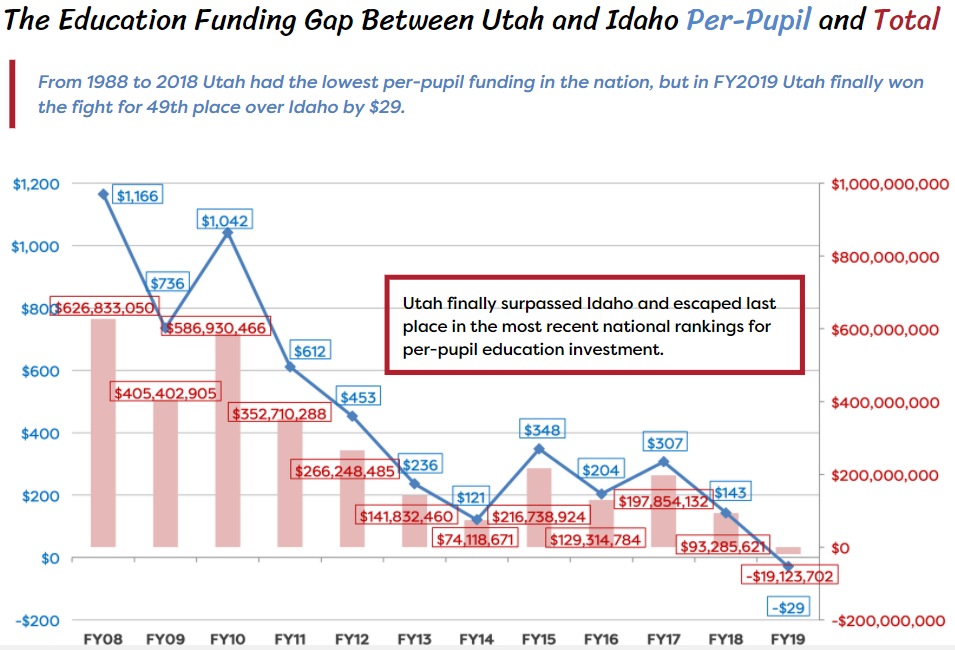

Trends in Education Funding: UT beat ID for 49th place, still far behind US overall

MEDIA COVERAGE OF THE CHILDREN'S BUDGET REPORT:

Facebook Live Event presenting the 2021 Children's Budget Report, major findings and summaries of all the categories of funding that impact children in Utah. https://fb.watch/9O05ECPAHi/

Invest in Utah's Future, Not Tax Cuts

BROAD COALITION CALLS FOR INVESTMENT IN UTAH’S FUTURE, NOT TAX CUTS, DOCUMENTS $5.2 BILLION IN URGENT UNMET NEEDS

Salt Lake City – On Monday, November 8, 2021 on the steps of the Utah Capitol, a broad and diverse coalition of advocates for the poor, for disabled Utahns, for education, health care, clean air, and a variety of other popular Utah priorities held a press conference calling on the Utah Legislature to avoid cutting taxes until it has developed a comprehensive plan to address Utahns’ top concerns by investing in Utah’s future.

Following nearly two years of the COVID-19 pandemic, Utah is fortunate to have achieved a more rapid economic recovery than nearly every other state. Utah has also received billions in federal assistance that have padded state revenues – but only temporarily. It is expected that the Governor and Legislature will have at least $2.5 billion in new revenues to appropriate in the 2022 General Session of the Utah Legislature.

This has led some to say that Utah is “swimming in money” and should cut the state income tax rate from 4.95 to 4.5%, a tax break of $600 million (that mostly benefits upper income families rather than Utahns in need). This tax break would be over and above the roughly $3.5 billion that the Legislature has already cut from annual revenues in recent decades (seehttps://le.utah.gov/interim/2021/pdf/00003683.pdf slide #3).

In response, today the Invest in Utah’s Future coalition presented a list of urgent unmet needs amounting to $5.2 billion, more than double the amount of the expected new revenues.

The advocates also pointed out that, according to recent reports from the Utah State Tax Commission and the Utah Foundation, taxes in Utah are the lowest that they have been in decades, following repeated rounds of tax cutting. “We understand that tax cuts are popular, but we’ve reached the point where we must ask ourselves: Are we, as the current generation of Utahns, meeting our responsibility, as earlier generations did, to set aside sufficient resources every year to invest in our children, in our future, in the foundations of the next generation’s prosperity and quality of life?” said Matthew Weinstein of Voices for Utah Children.

Speakers also referenced the recent public opinion survey by the Deseret News and Hinckley Institute that found that only 27% of Utahns support tax cutting over investing in Utah’s future, consistent with other polls done in recent years by the same organizations as well as by Envision Utah and the Utah Foundation.

Here is the list of urgent unmet needs that Utah has not been able to address due to the state’s chronic revenue shortages, adding up to a total of $5.2 billion:

| Budget Area | Amount | Details | Contacts |

| K-12: Reduce class sizes from 29 to 15 |

$1.1 billion ($612m K-6 only) |

Reduce class sizes/improve student/teacher ratio below the current Utah average of 29 (vs national average of 24) to optimum class size of 15. (Source: UEA) |

Utah Education Association Director of Policy and Research Jay Blain |

| K-12: Paraeducators | $312 million |

Expand paraeducators to all Utah elementary classrooms. (Source: UEA) |

|

|

K-12: Increase school counselors |

$130 million |

Increase school counselors per student to the national standard optimum of 1:250. Utah’s current ratio is 1:648, compared to the national average of 1:455. (Source: UEA) |

|

| K-12: school psychologists, social workers and special ed teachers | $285 million |

Increase student access to school psychologists, social workers and special ed teachers. (Source: UEA) Current and optimal ratios are: School psychologists: Now 1:1950/Optimal 1:500 Social workers: Now 1:3000/Optimal 1:250 Special ed teachers: Now 1:35/Optimal 1:25 |

|

| K-12 Education: reduce teacher attrition and shortages | $500-600 million | Envision Utah estimates that we need to invest an additional $500-600 million each year just to reduce teacher turnover, where we rank among the worst in the nation. Our leaders’ unwillingness to solve our education underinvestment problem is why the majority-minority gaps in Utah’s high school graduation rates are worse than nationally and our younger generation of adults (age 25-34) have fallen behind their counterparts nationally for educational attainment at the college level (BA/BS+). | |

| K-12 School Nurses | $84.4 million |

The Utah Department of Health annual report “Nursing Services in Utah Public Schools 2020-21” found that it would cost $84.4m to hire an additional 844 nurses so as to have one nurse in every public school building. There are currently only 224 nurse FTEs in Utah’s public schools, a ratio of 1 nurse for every 2,617 students. One nurse in every building would improve that ratio to 1:623, which would still be worse than the national average. Sources: www.utahschoolnurses.org/, www.nasn.org, www.sltrib.com/opinion/commentary/2021/10/01/diane-nicoll-utah-schools/ |

Dr. Jennifer Brinton, MD, President, American Academy of Pediatrics – Utah and Dr. William Cosgrove, Past-President - |

|

K-12: Homeless Students |

$105.8 million |

HUD vouchers do not cover students and their families who are homeless under McKinney Vento Dept. of Education definition. For the 2019-2020 school year, Utah had a little over 13,500 K-12 homeless students. Some of them are duplicates as students move from one district to another. Also the same household has multiple children. If we assume we have:

Source: Utah Housing Coalition |

Utah Housing Coalition Advocacy & Outreach Coordinator Francisca Blanc – |

| Full Day Kindergarten |

$52.5 million |

Voices for Utah Children estimates that it will cost $52.5 million to make full-day Kindergarten available to all Utah families who would choose to opt in to it. | Voices for Utah Children Sr. Policy Analyst Anna Thomas and Pastor Brigette Weier, Our Saviour’s Lutheran Church |

| Pre-K and Child Care |

$1 billion |

Well over $1 billion is one estimate for a much needed comprehensive system of early childhood care and education (pre-k) in Utah. | |

| Afterschool Programs |

$3.6 million |

Utah’s 303 afterschool programs serve 43,000 kids but still leave 99,000 unsupervised every day after school. During this past year’s 21st Century Community Learning Center grant competition in Utah, $1,062,816 was available and there was $4.6 million in requests, indicating a $3.6 million funding gap. (Source: Utah Afterschool Network) | Utah Afterschool Network Director Ben Trentelman – |

| Health Insurance: Children | $5 million | It would cost Utah about $5 million to pay for SB158 to remove barriers to health insurance coverage so that all Utah kids can access health insurance, including 12-month continuous eligibility. Utah currently ranks last in the nation for covering the one-in-six Utah kids who are Latinx and in the bottom 5 states for all children. Source: Voices for Utah Children | Voices for Utah Children Deputy Director Jessie Mandle |

|

Health Insurance: New parents |

$5 million | Extending Post-Partum Medicaid Coverage for new parents up to one year (now just 60 days) Source: Voices for Utah Children | |

| Mental Health & Substance Use Disorder Treatment | Uncertain |

Utah ranks last in the nation for mental health treatment access, according to a 2019 report from the Gardner Policy Institute. A 2020 report from the Legislative Auditor General found that Utah’s Justice Reinvestment Initiative had failed to achieve its goal to reduce recidivism -- and actually saw recidivism rise -- in part because “both the availability and the quality of the drug addiction and mental health treatment are still inadequate.” (page 51) Stakeholders identify the highest priority items as: housing and workforce capacity. There is a need to expand student enrollment slots in universities for MSWs (Masters in Social Work), MFTs (Marriage & Family Therapists) and MHCs (Mental Health Counselors), and to provide scholarships at these institutions to attract students. |

|

| Disability Services | $30 million |

The DSPD disability services waiting list has doubled in the last decade from 1,953 people with disabilities in 2010 to 3,911 in 2020. The FY20 $1 million one-time appropriation made it possible to provide services to 143 people from the waiting list, implying that it could cost $30 million to eliminate the waiting list entirely. |

Legislative Coalition for People with Disabilities – Jan Ferre |

|

Rural Utah Economic Development |

Uncertain | Rural Utahns should not feel that they need to abandon their home communities and add to the growth pressures along the Wasatch Front in order to provide for their families. Rural economic development would benefit all Utahns and reduce disparities between the Wasatch Front and other areas of the state. | Community Action Partnership of Utah - Stefanie Jones and Clint Cottam – |

| Transportation Access | $300 million |

Increase access to employment and educational opportunities for more people, especially lower-income communities. Provide additional transit connections, including extended evening and weekend service. Establish more ‘active transportation‘ (bike and pedestrian) connections to increase equity of access. Source: Wasatch Front Regional Council |

|

| Left Behind Workers and Families | $154 million |

Last year’s report “Left Out: Adding Up the Cost of Excluding Undocumented Utahns from State and Federal COVID-19 Relief” showed how undocumented Utahns and their families (comprising 39,000 households with over 100,000 individuals) work hard and pay taxes but were excluded from $154 million of federal COVID and unemployment relief. |

Comunidades Unidas – Brianna Puga – |

| Sexual and Domestic Violence | $85 million |

Our economy incurs steep economic costs as a result of sexual and domestic violence. The Center for Disease Control estimates that over a lifetime the costs for a female survivor are $103,762 and for a male survivor $23,414. These include medical costs, loss of employment or interruption of paid work, criminal justice system costs, among others. The Utah Domestic Violence Coalition 2017 Needs Assessment identified insufficient funding for shelters, affordable housing, child care, legal representation, and mental health and substance abuse treatment services as major obstacles to protecting women from domestic violence. In the 2021 Utah Legislative Session, fourteen private non-profit domestic violence service providers submitted an appropriations request of $3.4 million in ongoing state funds. However, only $1.7 million was funded through federal TANF funds. No ongoing state funds were approved. Unfortunately, only two domestic violence service providers were able to accept and utilize the TANF funds. The remaining twelve domestic violence service providers were unable to accept those funds because TANF eligibility requirements conflict with Violence Against Women Act (VAWA) confidentiality provisions. The actual cost to meet the needs of Utahns experiencing sexual and domestic violence is much higher than is reflected in the 2021 appropriations request and has been estimated to total $85 million. (Source: Utah Domestic Violence Coalition, Utah Coalition Against Sexual Assault, Restoring Ancestral Winds) |

Gabriella Archuleta, Director of Public Policy, YWCA Utah and Yolanda Francisco-Nez, Executive Director of Restoring Ancestral Winds |

| Housing | $415 million |

Funding to build affordable housing state-wide for people earning less than 50% AMI. In Salt Lake County alone, the current need is $1 billion. Affordable housing units fall 41,266 units short of meeting the need for the 64,797 households earning less than $24,600. Among extremely low-income renter households, 71% pay more than 50% of their income for housing, which is considered a severe housing burden. For more information on the current and ongoing needs visit https://endutahhomelessness.org/wp-content/uploads/2021/06/HousingNow-Deck-12.pdf |

|

| Homeless Services | $55 million | Case manager positions have been underfunded for the past several years and most do not make a living wage. The homeless resource centers in Salt Lake County also maintain a perpetual gap in state funding of at least $3 million per year. In 2019, homeless service providers across the state sought $41 million in funding for ongoing programs, including case management. At that time, the state provided $12 million. The following year, the state provided $9 million. Covering even the basic needs of providers would be a huge step forward in our efforts to reduce homelessness across the state. | |

| Housing for Seniors |

$30 million/ year for 10 years |

If we don’t fund preservation of affordable housing for seniors we will lose valuable units. A very general estimate would be $50,000 per unit for perhaps 5,000 units. This equates to $250 million in rehab costs. What is more realistic is subsidizing 5,000 at say $500 per month or $30 million per year which would allow these projects to Borrow the money for rehab. Over 10 years the total is $300 million but the state would pay this over 10 years. The $250 million up front to rehab the units would likely keep them going for 10 years, then more rehab would be required. https://www.utahhousing.org/preserving-senior-affordable-housing-report.html https://nyuds.maps.arcgis.com/apps/webappviewer/index.html?id=b8318f874017488ea9bdd51a296e59ef for senior housing report |

Utah Housing Coalition Director Tara Rollins |

| Air Quality | $100 million | In 2018 Gov. Gary Herbert proposed $100 million for clean air initiatives but the Legislature did not fully fund this goal.

The Wasatch Front ranks as the 11th worst air quality in the nation for ozone and 7th worst for short-term particle pollution. Investments should align with the principles in Kem C. Gardner Policy Institute Road Map, and have fallen short in previous years. |

|

| Air Quality in Schools |

$35 million |

Funding for air purifiers in every classroom in Utah, which would reduce the risks both from COVID and from Utah’s air pollution and could be expected to result in improved school performance, even more than standard interventions such as reducing class size by 30%, or “high dose” tutoring. (Source: Utah Physicians for a Healthy Environment) | UPHE Director Jonny Vasic - |

| Air Quality: Promote Transit | $60 million | Funding for UTA to eliminate fares entirely on all UTA conveyances as has been done already in dozens of cities to varying degrees, including in the SLC Free Fare Zone. (Source: Steve Erickson fiscal estimate, https://freepublictransport.info/city/ ) | Steve Erickson - |

| Hunger | Uncertain | It is clear that the state needs to do more in providing funding and other resources to help support local community food pantries. Earlier this year, Utahns Against Hunger conducted a community food pantry survey and found that in 2020, a quarter of pantry respondents had a funding gap, with 15% of respondents having a gap of $10,000 or more. | Utahns Against Hunger – Gina Cornia – and Alex Cragun |

| Utah EITC |

$100 million |

Utah should become the 31st state to offer a 20% state match to this highly popular federal tax break. This refundable tax cut targeted to low- and moderate-income working families has been proven to reduce poverty by drawing lower-skilled persons into the workforce, moving them toward independence and self-sufficiency. Most of this tax cut goes to the lowest income fifth of Utahns, those earning under $28,000, and the rest goes to the second fifth of the income scale, those earning under $50,000. | Voices for Utah Children – Matthew Weinstein – |

| Eliminate the sales tax on unprepared food | $130 million |

The food tax is the most regressive tax. One-third of it is paid by the lowest-income half of Utah households, who earn less than a sixth of all Utah income. According to the U.S. Department of Agriculture’s Economic Research Service, low-income families pay 36% of their income on food while higher-income families spend only 8%. This is why 37 states do not charge any sales tax on food. |

Rev Libby Hunter, Cathedral Church of St. Mark, speaking on behalf of the Coalition of Religious Communities (Bill Tibbitts – ) |

| About those water project boondoggles… | Federal rules permit the use of ARPA funds for water infrastructure projects, but Utah would save billions of dollars and millions of gallons by investing in conservation first to reduce usage in one of the most water-wasteful states in the nation. Those ARPA dollars would be better used addressing the urgent unmet human needs of our fellow Utahns. | Utah Rivers Council – Zach Frankel – and Lindsey Hutchison | |

| Racial Equity, Diversity, and Inclusion |

Our public fiscal policies – how we generate and expend public investment dollars – have a direct impact on whether we are widening or narrowing the gaps between different groups in Utah. The new Utah Compact on Racial Equity, Diversity, and Inclusion must be more than just words on a page. https://slchamber.com/public-policy/utah-compact/ |

Angel Castillo, Ogden NAACP | |

TOTAL |

$5.177 billion – more than double the amount of “surplus” revenue that the Legislature expects to have |

||

Live recording of the Invest in Utah's Future press conference 11/8/21: https://fb.watch/99bpgYEAqp/

Printable version of this document is here.

Media coverage is posted at KSL and Deseret News and Fox-13.

ONE PAGERS ABOUT THE VARIOUS UNMET NEEDS:

- K-12 education: UEA data infographic and UEA 2022 budget priorities

- K-12 school nurses info from American Academy of Pediatrics - Utah Chapter

- Rural Utah economic development from CAP-Utah and additional information from Governor's Office of Economic Opportunity

- Disability services information from annual report of the Utah Division for Services to People with Disabilities

- Air quality: Classroom air purifiers from Utah Physicians for a Healthy Environment

- Air quality and low-income transportation access: Free Fare UTA one-pager from Crossroads Urban Center

- Sexual and domestic violence one-pager from YWCA-Utah

- Sales tax on food op-ed from Deseret News

- Income tax rate cut vs Utah EITC one-page summary

Beginning this Summer 2021, Utah Local Education Agencies (LEAs) will be receiving approximately $615 million in Elementary and Secondary School Emergency Relief Funds (ESSER) funds from the American Rescue Plan. Now is the time to use this funding to help our youngest learners that will need the additional instruction and interventions now more than ever.

In this explainer, Voice's staff Anna Thomas and Laneta Fitisemanu will cover the ESSER funding Utah is set to receive as well as ways that we can use the funds and support full day kindergarten and preschool expansion.

We have exactly two school years (2021-22, 2022-23) and three summers (2021, 2022, 2023) to spend these funds. It is critical that we think big picture about where we invest this money when it comes to education.

We have strong data and evidence supporting that full day kindergarten and preschool programs help improve learning gaps for children that participate particularly for our most vulnerable and underrepresented student groups. This is why using ESSER funds to help expand these much wanted and needed programs is critical and one of the most important investments we can make that will have a huge impact for years to come.

Let's invest in Utah kids by using this relief funding to expand early education programs and further support the value and importance of giving more of Utah children and families access to full day kindergarten and preschool programs!