Federal Policy

Tax Policy 101: What is Refundability?

Tax policy is complicated. Talking about taxes involves jargon, and concepts that can be confusing. For example, what is a 'refundable' tax credit? What exactly does that mean, and how does it help families? We answer these questions here with a quick breakdown of what refundability is and how it impacts families.

What is a "refundable" tax credit?

When a tax credit is refundable, it is available to all families. Even if a family doesn’t owe anything when they file their income taxes, a refundable tax credit makes it possible for them to get money back in the form of a tax refund. Families can then use that money to pay for necessities.

What is a "non-refundable" tax credit?

A non-refundable tax credit can only ever be used to pay for taxes. If a family doesn’t owe any taxes after deductions, they can’t access any of the tax credit. If the family only owes a little in income taxes, they can only use the non-refundable credit to pay down whatever they owe.

How does refundability impact a family like yours?

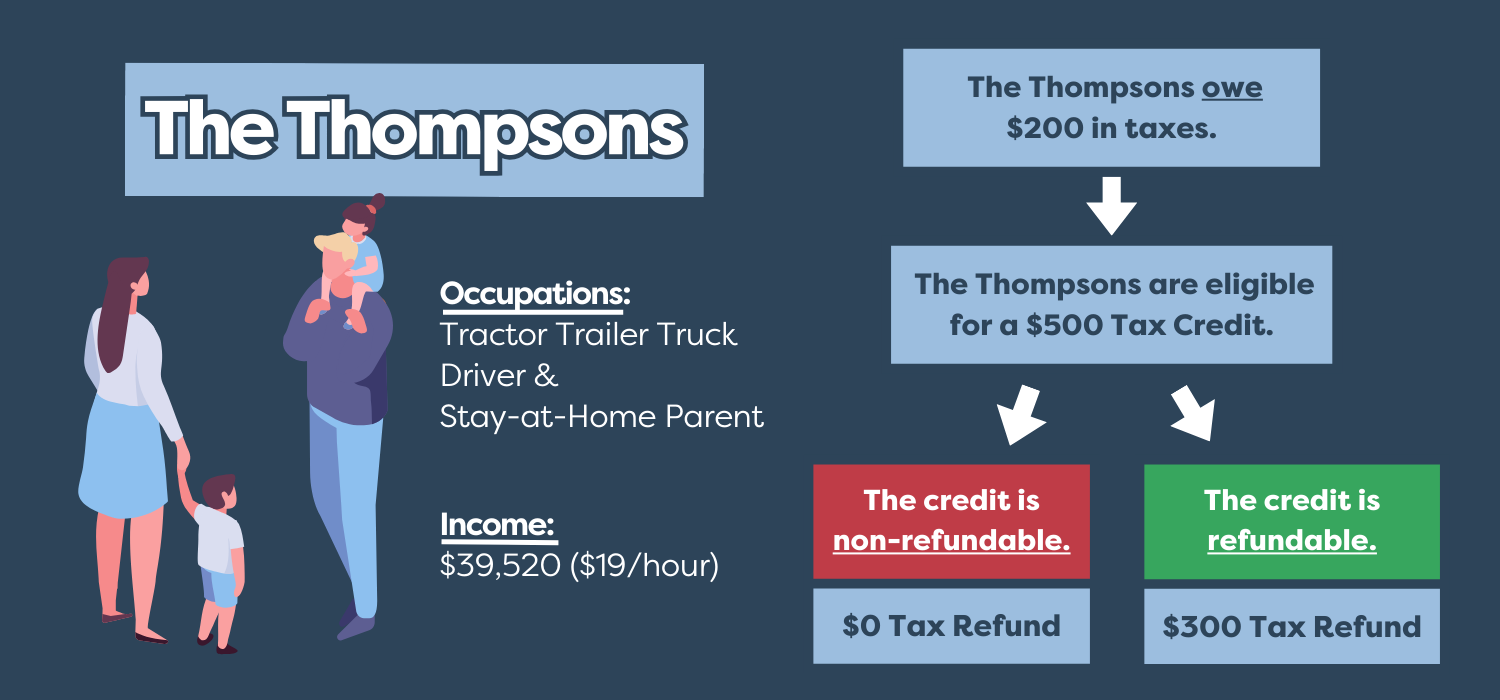

In the illustrated example below, the Thompsons have two young children and make a family household income of $39,520 for the year. Based on their income and after deductions, they owe $200 in taxes. Now imagine they qualify for a $500 tax credit. Refundability can greatly impact how much they owe in taxes and whether they'll keep more of their earnings through a refund.

If the $500 tax credit is non-refundable, it will be applied to offset what the Thompsons owe in taxes. Since they owe $200, the credit will help reduce the amount they owe to $0 – a positive outcome.

However, an even better outcome for young families arises when that $500 tax credit is refundable. If refundable, the $500 tax credit can go towards the amount they owe in taxes ($200) and the remaining amount of $300 would go back to the Thompsons as a refund. This $300 can help with expenses like car repairs, new winter coats for the kids, and baby formula. Though it may not seem like a lot, families facing financial challenges can make good use of this help.

To learn more about making Utah’s EITC refundable, go here.

To learn more about making Utah’s CTC refundable, go here.

To read about other refundable tax credits in Utah, go here.

Glossary

Tax Credit: a dollar-for-dollar amount that a taxpayer (s) claim on their tax return to reduce the income tax they owe. You can use this to reduce your tax bill and potentially increase your refund amount.

Nonrefundable Tax Credit: reduces the taxes you owe --- allows a taxpayer to only receive a reduction of their tax liability until it reaches zero.

Refundable Tax Credit: allows a taxpayer to receive a refund if the credit they receive is greater than their tax liability.

Tax Policy: policies that determine how we collect taxes.

Tax Cuts Hurt Kids

Why Voices Opposes Proposed Income Tax Cuts

Over the past four years, Utah's Legislative Leadership has consistently prioritized tax cuts above the needs of Utah's families. Despite a $400 million tax cut passed last year that benefited the most wealthy Utahns, and now fearmongering about a supposed $130 million budget shortfall, Legislative Leadership is yet again pushing for another $170 million in tax cuts.

As the 2024 Legislative Session unfolds, many legislators will claim a need to curb spending and tighten purse strings - that we can’t afford to fully fund social services or any new programs. The question arises: How can we afford $160 million in tax cuts when many crucial needs remain unmet? In a time when working families are struggling to afford groceries, granting more tax cuts to the wealthy is a step in the wrong direction.

Who Benefits from the Proposed Tax Cuts?

The proposed tax cut will help the richest 1% more than anyone. Our analysis shows the proposal will save the bottom 80% of Utah earners between $24 and $107. While the top 1% of Utah earners will save a whopping $2,676. These tax cuts will not provide real help to working families.

Out of the proposed $170 million tax cut, $40 million will go to the top 1% of Utah's wealthiest individuals. In contrast, the bottom 80% will split about $61 million.

Note: This image was updated to reflect the changed fiscal note for SB69, increasing the estimate from $160 Million to $170 Million on 2/23/24.

Utah's Unfair Tax Code

Contrary to the argument that the top 1% pays more in taxes, the reality is that low- and middle-income families bear a higher tax burden. Families making less than $29,900 per year pay 9.8% of their total income in state and local taxes, while the top 1% pays an effective tax rate of only 6.4%.

Why Voices Opposes the Proposed Income Tax Cuts

Voices for Utah Children opposes the proposed tax cuts due to the unmet needs of children and families in Utah. Our income tax should be used to increase funding for education, child care, nutrition, mental health programs, and other services with long-term societal benefits.

The appeal of tax cuts fades when we realize it means losing essential services. Children need us to be their voice, and we need to show up and advocate for their future. It's not just the right thing to do for them; it's a move that benefits all of Utah. Here's why investing in children pays off:

- Investment in the future: Children are the future, and investing in their well-being leads to positive long-term outcomes. Early childhood interventions improve educational attainment, job prospects, and overall health, benefiting society as a whole. This includes supporting our child care system, which is facing a loss of nearly $600 million in federal support this year.

- Promoting equality: Programs for children often target low-income families and disadvantaged communities, narrowing the gap in opportunities and promoting a fairer society. Access to quality education, healthcare, and essential services can break the cycle of poverty, creating an even playing field for every child.

- Stimulating the economy: A healthy, educated population contributes to a stronger economy. Investments in children's programs create a ripple effect, boosting productivity, encouraging innovation, and fostering economic growth in the long run.

We need to hit pause on tax cuts and instead acknowledge that investing in children is the better path to follow. It will lead to a stronger and more prosperous Utah, and those benefits will far outweigh any tax cut currently being considered.

When the pandemic hit, child care was one of the first sectors in crisis. But action in the form of federal aid and swift state program implementation prevented widespread program closures. The nearly $600 million Utah received in federal child care funds helped stabilize the historically struggling sector and defied national trends by expanding the number of child care slots available. This substantial funding is estimated to have supported child care services for over 85,200 children in Utah.

As federal COVID-era funds begin to wind down, child care providers and the parents they serve are looking to elected officials to ensure that the sector doesn’t immediately fall back into total crisis. Child Care Stabilization Grants, a key program of the funding, are currently playing a vital role in enabling child care providers to stay open, keep costs down for families, and raise wages in an industry that has been long plagued by inadequate compensation. Unfortunately, the lack of commitment from federal, state, or local governments to sustain these successful programs with new funding means most COVID-era programs will end, ultimately leaving parents with ballooning child care costs, and abandoning child care providers to navigate a broken system.

Starting in October, Utah families will begin to experience the impact of the child care funding cliff.

What change is happening this fall?

As federal funding runs out, Utah’s Office of Child Care (OCC) will reduce monthly Child Care Stabilization grant amounts by 75% in October. By June 2024, the grants will end entirely.

How will this change impact Utah providers and families?

Providers are preparing now for the impending grant reductions. For example, PC Tots, a program in Park City, already announced tuition increases due to a funding gap of $620,000 from the loss of ARPA money. One family reported a $1,000 monthly tuition increase for their two children enrolled in PC Tots, highlighting the financial strain this poses for many families.

The wind-down and ultimate end of stabilization grants also presents additional concerns for providers. When surveyed, 36.7% providers anticipate being unable to sustain wage increases for their child care staff or, in some cases, will have to cut wages. Without intervention, this will likely to lead to higher turnover rates among child care staff, resulting in more disruptions in care for families and a further reduction in available child care slots, statewide, due to understaffing.

How will the end of stabilization grants impact Utah's child care sector?

A recent report from The Century Foundation identified Utah as one of six states where half or more of all licensed child care programs statewide could close, without new funding to replace the federal support.

Their analysis estimates that in Utah:

- 35,614 children will lose access to child care.

- 663 child care programs will be forced to close their doors.

- Parents will experience a collective loss of $101 million in earnings.

- 1,304 child care jobs will be lost.

Deep, structural problems within the child care system existed well before the COVID pandemic; those problems will persist and worsen when COVID-era funding runs out. With 77% of Utahns living in child care deserts, parents already allocating 14-25% of their income on care, and providers making less than animal caretakers, we can’t afford to reduce our investment in child care. The child care market faces new challenges too. The current robust job market has made it increasingly difficult for child care providers to compete for good employees. And inflation has caused the cost of normal expenses to skyrocket for families.

As we look towards the fall, parents and providers should prepare for these difficulties. But also, state and local policymakers need to pay attention and ask what they can do to mitigate a new child care crisis.

This blog post is part of a series of blog posts examining Utah's child care funding cliff. You can find the other posts here:

- Utah's Child Care Crisis is About to Hit a Whole New Level

- How Much Will Each Utah County Soon Lose in Child Care Funding?

- What Happened with Child Care During the Legislative Session?

To learn more about our initiative to invest in child care, go to UtahCareforKids.org.

Utah’s family demographics have changed. 53% of Utah families have all available parents in the workforce, making child care a necessity. These days, most Utah families need two incomes to maintain financial stability. But Utah’s licensed child care system struggles to meet the demand. Licensed child care program capacity is only sufficient to serve about 36% of all children under six whose parents are working.

To provide a comprehensive picture of Utah's current child care crisis, this report produced by Voices for Utah Children examines the availability of licensed child care across the state, and in each individual county. By conducting a detailed analysis of both the demand and supply of child care services, the report aims to provide policymakers and the public with a clear understanding of the urgent need for child care reform.

Download a copy of the report here.

County-Level Data

Child Care Access Data Fact Sheets by County are also available on our Utah Care for Kids website. Look up child care access in your county today!

Statewide Data

Children Potentially in Need of Care |

|

| All Children Under 6 Years Old | 289,240 |

| Children Under 6 Years Potentially in Need of Care | 154,229 |

| Rate of Children Under 6 with Potential Child Care Needs | 53% |

Licensed Child Care Programming |

|

| Home-based Child Care Programs | 940 |

| Center-based Child Care Programs | 427 |

| Total Licensed Slots | 54,804 |

| Percent of Child Care Need Met | 36% |

Cost of Care for Families |

|

| Average Annual Cost Home-based Child Care for Infant/Toddler | $8,267 |

| Average Annual Cost Center-based Child Care for Infant/Toddler | $11,232 |

| Average Annual Cost Home-based Child Care for Preschool-Aged Child | $7,311 |

| Average Annual Cost Center-based Child Care for Preschool-Aged Child | $8,487 |

| Number of Children Eligible for Subsidies | 81,805 |

| Number of Children Receiving Subsidies | 11,665 |

| Rate of Eligible Children Receiving Subsidies | 14% |

Child Care Workforce Compensation |

|

| Median Hourly Wage for Child Care Professionals | $12.87 |

| Median Annual Salary for Child Care Professionals | $26,770 |

Takeaways

There is insufficient licensed child care in Utah to meet the needs of working families.

There are more than 154,000 children under the age of six living in Utah with all available parents in the workforce. But, there are only 54,804 licensed child care spots in 1,367 programs statewide. Licensed child care program capacity is only sufficient to serve about 36% of all children under six whose parents are working. That means the working families of nearly two-thirds of Utah’s youngest children must rely on alternate arrangements (such as utilizing family members, hiring or sharing a nanny, alternating parent work schedules, using unlicensed child care providers, or some combination of these).

The high cost of child care makes it even less accessible to low- and middle-income families, and rural families struggle most.

Affordability remains a significant hurdle with child care costs often consuming a substantial portion of a family’s income. The U.S. Department of Health and Human Services defines affordable child care as care that costs no more than 7% of a family's income. In Utah, the average annual cost of care for two children under the age of six (one infant, one preschool-aged child is $16,890, taking up about 17% of family’s income. For a family in rural Grand County, the cost of that care is actually higher at $17,339, consuming 41% of their income. The lack of dramatic differences in child care prices from county to county is an illustration of how little flexibility providers have to reduce tuition costs for parents, even in areas of the state where family incomes clearly can’t keep up.

How costs play out for a typical four-person family with one infant/toddler and one preschool-aged child |

|

| Median Four-Person Family Household Income | $100,752 |

| Average Annual Cost of Toddler/Infant Care | $9,193 |

| Average Annual Cost of Preschool-Aged Care | $7,678 |

| Considered "Affordable" Child Care for this Family | $7,053 |

| Average Amount this Family Will Spend on Child Care | $16,871 |

| Percent of Income this Family Will Spend on Child Care | 17% |

Licensed child care is insufficient in every county in Utah, though the level of unmet need varies from place to place.

Summit County emerges as the county with the highest percentage of child care need met (54%), followed by Carbon, (48%) Sevier (45%), Grand (45%), Salt Lake (45%), and Iron Counties (41%). All other counties have less than 40% of child care need met with licensed program capacity, and multiple rural counties (Daggett, Piute, Rich, and Wayne) have no licensed child care available at all.

With substantial public investment, Utah’s child care system has grown 31% since the start of the COVID pandemic.

Through various federal funding streams, nearly $600 million has worked to grow Utah’s child care capacity from approximately 42,000 licensed slots in March 2020 to over 54,000 in August 2023. In contrast to many other states, Utah has managed to increase its licensed child care capacity - despite substantial pandemic disruptions - through stabilization grants paid directly to existing providers for wage supplementation, startup support for new programs, and a one-time worker bonus of $2,000 per child care professional. These financial investments both expanded the enrollment capacities of existing programs as well as recruited new providers into the sector. However, with the ending of this funding in October 2023, Utah risks jeopardizing this incredible progress.

Recommendations

1. Commit to Public Investment in Child Care

Utah’s child care crisis requires public investment. Funding is needed to bridge the gap between what families can afford and the true cost of care. While businesses can contribute, their capacity to address this crisis is limited. There is no sufficient source of investment to address child care’s market failure aside from public funding. Child care should be valued in the same ways as the public education system, ensuring equal access and opportunities for all children. Currently, the burden of expensive early education falls largely on Utah families, with minimal public support, even though most brain development occurs before age six.

2. Help Parents Afford the Care They Want

Utah’s current child care system doesn’t promote parent choice. Child care affordability and accessibility severely limit family choice when it comes to child care, forcing decisions based on cost or access, rather than preference. This also impacts family planning and career choices. Parents are forced to make difficult choices, such as changing jobs, adjusting school and work schedules, or choosing suboptimal child care situations. To address these issues, policymakers should consider improving the child care subsidy program, expanding the child tax credit, and finding ways to help alleviate the financial burden on Utah families.

3. Support the Critical Work of Child Care Professionals

Child care professionals face significant financial challenges. Low wages and a lack of benefits, including healthcare and retirement, have made the profession unsustainable, leading to high rates of turnover each year. Since Utah’s current child care system only meets 36% of the state's need, Utah must invest in the early child care profession to attract and retain a robust workforce. To support child care providers, policymakers should consider measures including state funding of Child Care Stabilization Grants, wage supplement programs, eliminating barriers to licensure, and increasing access to employment benefits.

For questions or inquiries regarding this report, please contact Voices staff members:

It’s Official: Access to Licensed Child Care Statewide is Really Bad (and Getting Worse)

We know that Utah’s child care crisis is bad, and is going to get worse. New data helps illustrate exactly how bad the situation is, in each county across the state.

Next week Voices for Utah Children will release a report titled, “Mapping Care for Kids: A County-Level Look at Utah’s Crisis in Licensed Child Care.” The report includes more detailed county-level analysis and data highlighting the inaccessibility of care and financial challenges faced by families and child care professionals. In addition, the report includes policy recommendations for Utah leaders to help resolve this crisis.

The full report will be available the week of October 23rd, but as a teaser, this blog highlights some key findings from the report.

There is insufficient licensed child care in Utah to meet the needs of working families.

Licensed child care program capacity is only sufficient to serve about 36% of all children under six whose parents are working. Parents face shortages in every county statewide, with rural families struggling most.

The high cost of child care makes it even less accessible to low- and middle-income families, and rural families struggle most.

The average annual cost of care for two children under the age of six (one infant/toddler, one preschool-aged child) for a Utah family costs about 17% of a 4-person family’s income. Cost varies little between rural and urban counties, but on average household median incomes are lower in rural areas. In Grand County, with the state’s lowest median annual income at $42,654, the cost of care for a family of four would comprise about 41% of a family’s income.

Child care providers receive insufficient compensation, and have few incentives to stay in the field.

Child care providers typically earn low wages and very limited benefits. The median hourly wage for child care professionals in Utah is just $12.87 per hour ($26,770/year), less than they could make as professional dog walkers. The poverty rate among child care providers in Utah is 23.1%, more than 8 times higher than that of K-8 teachers.

With substantial public investment, Utah’s licensed child care capacity has grown significantly since the start of the COVID-19 pandemic.

Thanks to federal funding streams totaling nearly $600 million, licensed child care capacity in Utah has grown by approximately 31% since March 2020. This growth is due primarily to child care stabilization grants made directly to licensed child care providers; those grants recently were reduced by 75%. Utah has been identified as one of six states that could see half or more of all licensed child care programs statewide close with the end of the stabilization grants.

Licensed child care is insufficient in every county in Utah, though the level of unmet need varies from place to place.

How does child care access and affordability compare in each county?

Our full report, “Mapping Care for Kids: A County-Level Look at Utah’s Crisis in Licensed Child Care” will be released the week of October 23rd. For questions about the report, this blog, or sources and methodology, please contact Jenna Williams at . For more information on efforts to improve Utah’s child care system or learn about the child care advocacy network, visit utahchildren.org/issues/early-childhood-education and utahcareforkids.org.

The best holiday gift for Utah kids this year: An improved federal Child Tax Credit

Every December Congress meets to try to pass all the urgent items they didn't manage to get done the rest of the year. Usually the list includes tax policy changes demanded by one well-heeled special interest or another. This year is no different. At the top of the lobbyists' wish list is reportedly "extending soon-to-expire business tax breaks... affecting research and development costs, investment deductions and debt write-offs."

But what about the tax policy issues directly impacting Congress's youngest constituents? It's true that children don't have fancy lawyers and lobbyists and PACs making big campaign contributions. But they do have a few scrappy nonprofits speaking up for their interests and backed by millions of parents. And at the top of the children's wish list this month is improvements to the federal Child Tax Credit.

The federal CTC does a world of good every year for families all over Utah and across the nation. Well over a third of Utahns qualify for the CTC every year when they file their taxes. That's over half a million households! And the amount of the CTC received by these Utah families exceeds $1.6 billion -- that's billion with a b. Wow!

But there is a problem with the Child Tax Credit. Tens of thousands of Utah families fail to qualify every year for the full credit of $2,000 per child for a simple reason: The parents work low-wage jobs -- often working long hours -- but their low hourly wages still leave their incomes below the minimum level required under current tax law to qualify for the full credit -- over $29,000 of income for a single parent with two kids, for example. In other words, a single mom working full-time at $12/hour makes too little to qualify for the full CTC under its current rules.

That means over 150,000 Utah kids every year are left out and left behind -- and these are the very kids who would benefit most from the proven positive impacts of refundable tax credits like the CTC -- including better educational outcomes and higher labor force participation rates years later when they become adults.

And it gets worse: While most of the kids excluded from the CTC are white, disproportionate numbers of them are from Utah's communities of color, including an estimated 50,000 Latino children, comprising 29% of Utah’s Latino child population, as well as 6,000 Native American children, comprising 75% of Utah’s Native American children. This means that a tax credit that has incredible potential to reduce societal disparities is instead making them worse.

That's a real shame, because the CTC does a lot to reduce child poverty already. National data from the Census Bureau's Supplemental Poverty Measure has found that refundable tax credits, including both the Child Tax Credit and Earned Income Tax Credit, reduced child poverty from where it would have been -- 18% or one-in-six children -- to 12.5% or one-in-eight children in 2019. That's over 4 million children lifted out of poverty. And if we could make the full CTC available to all the lower-income kids now being left out, that would help an additional 19 million children who need the help most.

Even if Congress lacks the political consensus to restore the temporary 2021 CTC boost that cut child poverty last year by 36%, there are several more incremental ideas that would help a lot of kids:

- Implement a more rapid phase-in of the refundable credit, as proposed by Sen. Mitt Romney in his Family Security Act 2.0 proposal from earlier this year.

- Make the full credit available without a phase-in for families with children under the age of 6.

- Exempt from the phase-in grandparents acting as custodial parents and parents whose disabilities impact their ability to work.

- Institute a look-back policy that counts previous years' earned income in determining whether a work requirement has been met.

- Restore the pre-2017 status quo where all children in immigrant families could receive the CTC.

The role of Utah's Congressional delegation in any Child Tax Credit improvements passed this month is expected to be one of the keys to success. After all, it was Utah Senator Mike Lee who demanded that Congress include improvements to the CTC in the 2017 TCJA legislation (though that law also cut off an estimated 1 million immigrant children without Social Security numbers from the credit). And it is Senator Romney who has put far-reaching additional improvements on the table with his Family Security Act proposals.

If you agree that Congress should act this month to improve the Child Tax Credit, let your Representative and our two Senators hear from you! Lifting more kids out of poverty would truly be a wonderful holiday gift for Utah's children this year.

Digital Media Policies & Kids: The need for more thoughtful approaches to solutions

2021 Utah Kids Count Data Book Release

Kids Count Utah: A Data Book on the Measures of Child Well-Being in Utah, 2021 is the first glance at the effects of the COVID-19 pandemic on Utah’s children. Please click on the button below for the full report.

2021 UTAH KIDS COUNT DATA BOOK

Children under the age of 18 make up a third of the state’s population. Not surprisingly, Utah children and their families faced additional challenges as a result of living through a global pandemic.

Unfortunately, over 10 percent of Utah children are experiencing poverty. Additionally, since 2019 Utah saw an increase of over 4,000 additional children considered to be in Intergenerational Poverty (IGP). More children caught in a cycle of IGP is concerning as it could mean that their own children may continue that same cycle if their economic situation does not improve.

Providing a quality education to children during the pandemic continues to be a challenge. The most recent data shows that student proficiency assessment results decreased over the past year. And data also shows that many children are not receiving the mental health treatment they need. A new data indicator shared in the 2021 data book looked at access to mental health. The data collected from the National Survey of Children’s Health shows that approximately 60% of three- to 17-year-olds struggling with mental health are not receiving treatment.

Voices for Utah Children hopes that the yearly KIDS COUNT data book project and the publication of Measuring of Child Well-Being in Utah continues to be a valuable resource that can provide guidance to both policymakers and the general public on how to improve the lives and futures of Utah children.